Diapositiva 1

advertisement

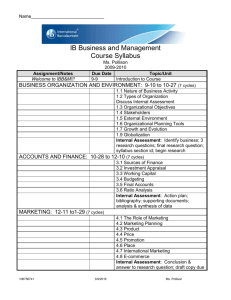

Innovation technology and long cycles of economy: Kontratiev Theory Lesson 5 Innovation Innovation can be defined in many different ways and can be synonymous with many concepts: change changing the selection mechanism everything that enables organizations surviving and growing Technology The complex of knowledge, skills, procedures, equipment and technical solutions that are applicable to any functional activity which takes place in the organization at the end of the production / distribution. (Porter M., 1985; Rispoli M., 1991) Schumpeter (1912) 5 types of innovation: 1. product innovation (the production of new goods); 2. innovation of production (new production method); 3. commercial innovation (new methods of marketing); 4. innovation in supply (the conquest of a new source of raw material); 5. market innovations (reorganization of the supply of an industrial sector); L’INNOVAION TO 360°: INNOVATION’S ICEBERG Resource & Technology Organization Human capital Internazionalization Public and Private Investment in R&S Education, spin-off etc. Efficient use of technology Total quality Innovation leadership Social and Environmental development Sustainability Law and Regulation Competition and markets and public policies Source: Confindustria. Our revisitation GAP ITALY-EUROPE (UE4*=100) propensity to innovation of enterprises innovation of process innovation in marketing innovation of product innovation in management * The first four countries for the share of innovative companies are Germany, Belgium, Austria and Sweden. Source: CSC on Eurostat, CIS-3. us jp 4, 27 % 4, 98 % 4, 75 4, % 71 % 6, 93 % 7, 32 % 6, 05 % 7, 61 % 6, 87 % 6, 54 % 6, 44 % 6, 54 % 6, 31 % 6, 07 % 5, 94 % 5, 59 % 7, 79 % 9,00% 8,00% 7,00% 6,00% 5,00% eu 15 un it o s v pa e es zia ib po ass rto i ga f in llo l da and ni ia m ar ca be lg au io s ge tria rm an i fra a nc ia it a lia gr ec s p ia ag n irl a an da re gn o Benchmarking internazionale degli investimenti in ICT Spesa ICT in % PIL (dati eurostat 01/2005) 4,00% 3,00% 2,00% 1,00% 0,00% 2003 2004 Kondratiev Cycles • Focus on price system • Cyclic emerging clusters of innovations, among them related directly or indirectly, able to systematically change the whole system of prices • The "clusters" (techno-economic paradigms) are not simply collections of scientific discoveries, but it is essential that they are applied to the production and organizational innovations are also The clusters (techno-economic paradigms) 1. 2. 3. 4. 5. New energy sources or significant changes in energy production; New materials used in the production of strategic products; New sectors of production or otherwise taken off than the previous stage; New organizational forms of production cycles and labor markets; New procedures for the movement of goods and information. Kondratiev Cycles The advent of a new techno-economic paradigm produces overheating of prices that can last for two decades, since it requires the system to fully renew its industrial structure (factories and machines), as Schumpeter called "creative destruction storms." This produces huge investments, as the sum of a countless number of individual investments that naturally move on prices. Kondratiev Cycles • Time differentials • Geographical differentials Kondratiev Cycles The depreciation of investments in replacement of production cycles, faster for the pioneers and innovators in places, requires a longer time at a global scale before the system has full (or at least significantly) converted, can spend a relatively long period, after which, the future depreciation (accounting and real) along with the maturation of the technology (economies of scale) tend to cool prices, until the advent techno-economic paradigm of the next, pushing prices to rise again (phase A + phase B = 50/55 years). Kondratiev Cycles • Stage A “expansion”: rising prices, investment demand growth, confidence and optimism virtuous circle of investment / demand – Stage A “recession” : • Stage B “expansion”: – Stage B “recession” : rising prices, overestimation of demand, lack of market direction, increased competition, heavy cost structure failures, job loss, decline in demand decreasing prices fewer producers, completion of technological substitution, standardized technologies, reducing production costs, lower prices, increased demand overestimation of demand and technological obsolescence of the bunch. Kondratiev cycle …not just the “accumulation regime” but also “ways of setting”… Kondratiev Cycles • Stage A “expansion”: organization of production, question, Investment distribution between wages and profits rules governing the market-state relationship, behavior and individual and collective habits. Decoupling without conflict – Stage A “recession” : Social conflict and conflict of interest which may itself be due to the crisis. The recession eases the resistance that lead to an adjustment of the control mode and then make a new pair. • Stage B “expansion”: the new techno-economic paradigm brings maximum benefits – Stage B “recession” : overestimation of demand, technological obsolescence of the bunch. Kondratiev Cycles The timing of each cycle can not be fixed precisely During the transition between these two cycles coexist The cycles start differently in various economies Kondratiev Model is able to show how the economic Development of systemic reaction to the introduction of new technologies but does not explain the precise chronology of the various developments Conclusions • • • • There is a succession of periods long enough and internally consistent, in which the organizational forms of market and society (but also of politics and culture) are seriously affected by new clusters The change also involves the "rules of the game" to economic, social, political, must bear, put up a new framework of constraints and opportunities. Each geographical economy changes, even if it is at the heart of technological change Each geographical economy system (local, national) demand for change, but each will react in the measure and is permitted by his organization, specialization, quality and quantity of resources. The speed of adjustment resulting in economic benefits, especially where the new cluster was formed. If the new rules of the game is incompatible with the specific geographical economy, this could be "ordered" not to intercept the change It is not enough to be predisposed to the new techno-economic paradigm, it must also evolve positively and quickly adjust mode, otherwise the economic advantage may dissipate and the decline begins First Kondratiev cycle • Time: 1790 (Industrial Revolution) - 1840 (Hungry Forties) • Leading sectors : textile (cotton), ceramics and metallurgy • Power Sources : Hydraulic and Steam (Textiles, Pumps, Coal Mines) • Infrastructure development: river networks, channels, and toll roads • Economic Geography: regional markets (capital, inputs, labor and local market) • Business models: factories mechanized and modernized workshops (steam power) Second Kondratiev Cycle • • • • Time: 1840-1890 (economic dumps) Leading sectors : iron metallurgy (steel, copper), machine tools Power Sources : steam engines, coal Localization : Great Bretain, Prussia-Russia, Belgium, France, USA Japan • Infrastructure development : Railing and Shipping (transportation) • Economic Geography: oligopolistic markets (protectionism to the outside and the banking system, labor force, national market) • Business model : factory large precedence over modernized workshops (industrial districts in Sheffield, Lyon, Darmstadt, etc., where the industrial revolution is "imported") Third Kondratiev Cycle • Time: 1890-1945 (crisis in ’29) • Leading sectors : chemicals, plastics, automobiles, telegraph, radio, cinema, air (the first war bombing of Libya 1912) • Power Sources : internal combustion engine, electrical machinery, petroleum • Localization : transition from British to American industry further spread in Western Europe, continued growth in Japan • Infrastructure development : railways, roads, telecommunication networks • Economic Geography : urban-industrial development • Business model: Taylorist model of the assembly line by Henry Ford (Fordism, conflict management, mass consumption) Fourth Kondratiev Cycle • Time: 1945-1990 (crisi anni ’70) • Leading sectors : electromechanical (electrical goods), transport equipment, chemicals, aerospace, television, telephone, • Power Source: Oil, Nuclear • Localization : USA, Europa, Soviet Union. • Infrastructure development: information systems, highways, airports • Economic Geography : Fordist regions (Triangle MI-TO-GE), Manufacturing Belt, Tokyo-Yokohama, West Midlands, Ruhr, Ile de France) • Business model: Fordist model of globalization, cooperation between state, employers and trade unions (Welfare, afavore free resource consumption) Fifth Kondratiev Cycle …. • Time: 1990-? • Leading sectors : new economy, biotechnology, microelectronics, nanotechnology • Power Source: oil, nuclear • Localization : Increased competition new emerging countries like China and India • Economic Geography: the geographic scope of business is global optimum. Companies are organized in network. • Business Model: enterprise transnational network