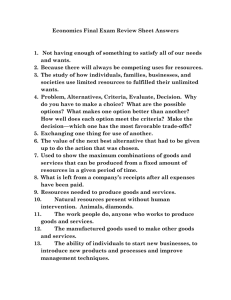

Money management class - Financial Coaching Volunteer Resources

advertisement

WELCOME TO: MONEY MANAGEMENT CLASS REACHING YOUR FINANCIAL GOALS Section One Intake Forms Please fill out your intake paperwork via page 7-15 or via https://www.surveymonkey.com/r/CFCIntake Bring completed forms, or complete the forms online before our next class. Foundation Communities uses this information for reporting purposes only. Can you make through the month? Let’s play The Spent Game! http://playspent.org/ Or: Let’s play The Bean Game! (20 min) In these games you will be faced with various financial decisions, and hardships. Your goal is to make it through the month successfully. What is a Budget? Helps you track your monthly income and expenses Helps you actively choose how to use your money The most effective financial management tool available to all of us There are various types of budgets find the one that suits you best and stay with it Remember a budget is a living document – revisit periodically and adjust as needed How to make your goals SMART: S Specific M Measurable A Aggressive yet achievable R Realistic T Time-sensitive Making Behavior Changes to Reach Your SMART Goals: Real change takes a little planning On Your Own: take your SMART goals and answer the questions on this sheet for each goal. This will help you to come up with a defined plan on how to change your behavior to reach your goals. Needs Vs. Wants Activity A Need is something you have to have, something you can not do with out. A Want is something you would like to have. These vary by household, lets work in groups to complete this activity and then talk about it a little more! (10 min) Reducing Expenses & Saving Green Where can you cut back? Everyone has a few black holes where money seems to disappear. If you can pin point these black holes you can plug them up! Saving Green Video: Part 1 (10 min) Overview of Saving Green Materials (10 min) Part 2 (10 min) 4 Simple Steps to Creating a Budget : Do an honest assessment of your monthly expenses. Write it down. Determine if your living expenses are compatible with your income. Put your budget to work Remember your budget is a living document update it frequently! Create Your Own Budget Use the budget template that suits you best and own your own create your budget at home! Why Do You Need a Bank Account? Having a bank account can be cheaper, and more convenient than not having one. Savings Accounts can help you reach your financial goals Choose the one that suits you best. Be Sure to check out the Resources for Reaching Your Financial Goals Don’t Forget to complete your Intake Forms Join us next class for more on Money Management! FREEDOM FROM DEBT & GIVING YOURSELF CREDIT Section Two Why Do We Spend Money? What is Debt and How Do You Deal With It? Debt is something, typically money, that is owed or due. Let’s take a look at a few ways to deal with debt . Bankruptcy To file or not to file…that is the question What is Credit & How do you get it? Credit is the ability of a customer to obtain goods or services before payment, based on the trust that payment will be made in the future We are going to discuss some important aspects of credit and how to handle it. Credit Profile Activity What should Henry do? For a Safety Net Savings Account be sure to bring all necessary documents with you to our next class. Join us next class for more on Money Management! GIVING YOURSELF CREDIT Continued… Section Three Money Habitudes By: Syble Solomon Target some of your habits and attitudes that are affecting your relationship with money. Discussion Question: Who’s habitude is right? There are no right habitudes. The most important thing is to “know thyself”. Recognize your own habitudes and use that knowledge to your advantage when managing your money. Have You Ever Been Affected by Identity Theft? Identity Theft is the fraudulent acquisition and use of a person's private identifying information, usually for financial gain. What is a Consumer Report? A consumer report is a specialty report that contains information about you beyond your credit history. What is a Credit Report? A credit report is a detailed report of an individual's credit history prepared by a credit bureau and used by a lender to in determining a loan applicant's creditworthiness. CONGRATULATIONS YOU HAVE COMPLETED FC’s MONEY MANAGEMENT CLASS! Please complete the Post-Test and Course Evaluation and turn them in on your way out! Time for Credit Counseling & Safety Net Savings Accounts Thank You again for joining us!