Chapter 8: Reporting and Interpreting Long

advertisement

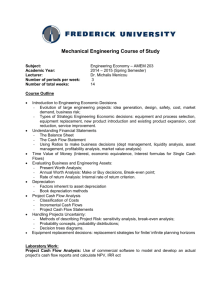

8-1 ©2006 Prentice Hall, Inc. REPORTING & INTERPRETING L-T OPERATIONAL ASSETS (1 of 2) Learning objectives Acquiring plant assets Using long-term tangible assets— depreciation and depletion Using intangible assets—amortization Changes after the purchase of an asset 8-2 ©2006 Prentice Hall, Inc. REPORTING & INTERPRETING L-T OPERATIONAL ASSETS (2 of 2) Selling long-term assets Long-term asset presentation on financial statements Financial statement analysis Business risk, control, and ethics 8-3 ©2006 Prentice Hall, Inc. Learning Objectives (1 of 3) Explain how long-term assets are classified, how their cost is computed, and how they are reported Explain and compute how tangible assets are written off over their useful lives and reported on the financial 8-4 statements ©2006 Prentice Hall, Inc. Learning Objectives (2 of 3) Explain how decreases in value, repairs, changes in productive capacity, and changes in estimates of useful life and salvage value of assets are reported on the financial statements Describe how long-term assets are reported on the financial statements 8-5 ©2006 Prentice Hall, Inc. Learning Objectives (3 of 3) Describe how long-term assets are reported on the financial statements Use return-on-assets (ROA) and the asset turnover ratio to help evaluate the firm’s performance Recognize the risks associated with long-term assets and the controls that 8-6 can minimize those risks ©2006 Prentice Hall, Inc. Acquiring Plant Assets (1 of 2) Long-term operational assets Assets that last for more than one accounting period Used to help a business generate revenue Does purchase of a plant asset affect the income statement? 8-7 ©2006 Prentice Hall, Inc. Acquiring Plant Assets (2 of 2) Types of long-lived assets Tangible assets Property, Intangible plant, and equipment assets Trademarks, patents, copyrights, etc. Acquisition costs Basket purchase allocation ©2006 Prentice Hall, Inc. 8-8 Acquisition Costs (1 of 2) Historical cost principle requires assets to be recorded at their cost Plus cost of getting asset in place and ready for use Why aren’t most long-term assets reported at their current market value? Why aren’t long-term assets immediately expensed when purchased? 8-9 ©2006 Prentice Hall, Inc. Acquisition Costs (2 of 2) Which of the following are acquisition costs for a building and why? Real estate commissions Cost of tearing down an existing building Consultant’s fee to decide whether to lease or purchase the building Installation fees Cost of land where building will be built 8-10 ©2006 Prentice Hall, Inc. Basket Purchase Allocation Purchase of two or more assets for one price Cost allocated to each asset based on their relative fair market values Percent of total FMV of the assets How do firm’s determine an asset’s current fair market value? Basket ©2006 Prentice Hall, Inc. purchase example 8-11 Basket Purchase Example (1 of 2) On July 1, Valdez Environmental purchased a tug boat and oil cleaning equipment for $7M FMV of tug boat is $4M FMV of oil cleaning equipment is $6M How much of the $7M will be allocated to the tug boat and to the oil cleaning equipment? 8-12 ©2006 Prentice Hall, Inc. Basket Purchase Example (2 of 2) Relative FMV Tug Boat Cleaning Equip Total Allocation Tug Boat Cleaning Equip ©2006 Prentice Hall, Inc. FMV _ X X _ $7M = $7M = 8-13 Using L-T Tangible Assets: Depreciation and Depletion (1 of 3) Purchase of long-term tangible assets are capitalized (recorded as assets) L-T tangible assets expensed by depreciating (or depleting) them Depreciation allocates the COST of an asset to the periods that benefit from the use of the asset What ©2006 Prentice Hall, Inc. accounting principle requires this (ch 2)? 8-14 Using L-T Tangible Assets: Depreciation and Depletion (2 of 3) Depreciation terminology Acquisition cost (cost) Estimated useful life Salvage value (residual value) Estimated value of an asset at the end of its useful life Depreciable base = cost - salvage value 8-15 Book value (carrying value) ©2006 Prentice Hall, Inc. Using L-T Tangible Assets: Depreciation and Depletion (3 of 3) Depreciation methods Straight-line Activity (units of production) Declining balance Depreciation example Depletion 8-16 ©2006 Prentice Hall, Inc. Estimated Useful Life How long a company expects an asset to be productive May be expressed in years or units of activity (e.g., miles, hours, # of units produced) 8-17 ©2006 Prentice Hall, Inc. Book Value Book value equals cost less accumulated depreciation The unexpensed portion of an asset Book value bears NO relationship to FMV 8-18 ©2006 Prentice Hall, Inc. Straight line Depreciation Equal amount of an asset are expensed each year Depreciable base is constant (cost-SV) Depreciation rate is constant (1/UL) Depreciable cost (cost - SV) Useful life (in years) 8-19 ©2006 Prentice Hall, Inc. Activity (Units of Production) Depreciation Amount of asset expensed each year depends on asset’s usage Depreciable base is constant (cost-SV) Depreciation rate is constant (1/UL) Depreciable cost (cost SV) Depr Rate = Useful life in units Annual depreciation expense depr rate x actual level of activity for year8-20 ©2006 Prentice Hall, Inc. Declining Balance Depreciation (1 of 2) Accelerated depreciation method Annual depreciation expense declines over asset’s useful life Depreciable base changes (beg book value) Depreciation rate is constant (X/UL) X = Depreciation rate Most common rate is 200% Also called double-declining balance (DDB) Never ©2006 Prentice Hall, Inc. depreciate below salvage value 8-21 Declining Balance Depreciation (2 of 2) 2_ DDB Exp = x Book value (cost – A/D) UL 8-22 ©2006 Prentice Hall, Inc. Depreciation Example (1 of 5) Photocopier purchased on 1/1/08 Acquisition cost $14,000 Useful life 5 years or 300,000 copies Estimated salvage value $2,000 8-23 ©2006 Prentice Hall, Inc. Depreciation Example (2 of 5) Straight-line method =$2,400/year $14,000 - $2,000 5 years Activity method Assume 40,000 copies were made $14,000 - $2,000 x 40,000 =$1,600 8-24 300,000 copies ©2006 Prentice Hall, Inc. Depreciation Example (3 of 5) Double-declining Year balance method 1 2 _ x $14,000 = $5,600 5 yrs Year 2 2 _ x ($14,000 - $5,600) = $3,360 5 yrs 8-25 ©2006 Prentice Hall, Inc. Depreciation Example (4 of 5) SL Yr 1 2 3 4 5 Exp 2,400 2,400 2,400 2,400 2,400 ©2006 Prentice Hall, Inc. A/D 2,400 4,800 7,200 9,600 12,000 DDB Exp A/D 5,600 5,600 3,360 8,960 2,016 10,976 1,024 12,000 - 12,000 8-26 Depreciation Example (5 of 5) Which method (SL or DDB) produces the highest income in the earliest years? Which method has the highest book value throughout the asset’s life? Which method is best for income smoothing? Which method produces the best asset turnover ratio over the asset’s life? 8-27 ©2006 Prentice Hall, Inc. Depletion Used to expense natural resources as they are used up Same computation to activity depreciation with zero salvage value Cost _ Depl rate = Useful life in units Annual depletion expense depl ©2006 Prentice Hall, Inc. rate x actual level of activity for year 8-28 Using Intangible Assets: Amortization (1 of 3) Rights, privileges, or benefits that have long-term value to the firm Recorded at cost Amortization Same method of expensing as straightline depreciation with zero salvage value Accumulated amortization calculated for 8-29 each intangible asset ©2006 Prentice Hall, Inc. Using Intangible Assets: Amortization (2 of 3) Copyright Provides U.S. legal protection for authors of original work Amortized over shorter of legal or useful life Patent A property right on inventions Amortized over shorter of legal life (20 years) or useful life (often around 10 years) 8-30 ©2006 Prentice Hall, Inc. Using Intangible Assets: Amortization (3 of 3) Trademarks 10 years of protection; renewable Franchise Agreement that authorizes someone to sell or distribute a company’s goods or services in a certain area Goodwill Research and Immediately ©2006 Prentice Hall, Inc. development costs expensed. Why? 8-31 Goodwill Excess of cost over FMV of net assets when one company purchases another company Why would a company pay more than the FMV of the net assets for a company? Goodwill Loss is not amortized recorded for decrease in value Reported in the notes to the financial statements ©2006 Prentice Hall, Inc. 8-32 Changes After an Asset Purchase (1 of 2) Asset impairment Permanent reduction in market value below book value Similar to LCM method for inventory Capital expenditures to improve or extend an asset’s useful life Capitalize and depreciate 8-33 ©2006 Prentice Hall, Inc. Changes After an Asset Purchase (2 of 2) At what point does a roof repair become a capital expenditure? Revising estimates of useful life and salvage value Depreciate remaining depreciable cost over remaining useful life Revising estimate example 8-34 ©2006 Prentice Hall, Inc. Revising an Estimate Example (1 of 2) Facts Asset cost: $30,000 Original useful life: 5 years Original salvage value: $8,000 In the beginning of year 3, the asset is determined to have 4 years of useful life remaining and a salvage value of $6,000 ©2006 Prentice Hall, Inc. 8-35 Revising an Estimate Example (2 of 2) Depreciation ($30,000 Book - $8,000)/5 = $4,400/yr value at beginning of year 3 ($30,000 - $8,800) = $21,200 Depreciation ($21,200 4 ©2006 Prentice Hall, Inc. expense for yr 1 & 2 expense yr 3-6 - $6000)/4 = $3,800/yr =remaining years of useful life 8-36 Selling Long-term Assets (1 of 2) Cash proceeds > BV = gain Cash proceeds < BV = loss Cash proceeds = BV = no gain/loss Journal entry Increase cash (debit) Remove asset (credit) Remove A/D (debit) Record gain (credit) or loss (debit) ©2006 Prentice Hall, Inc. 8-37 Selling Long-term Assets (2 of 2) Sold asset for $20,000 cash Cost $35,000; A/D $18,000 Assets = Liab. Date Transaction + Cont. Cap. + Debit R/E Credit 8-38 ©2006 Prentice Hall, Inc. Long-term Asset Presentation on Financial Statements PP&E may be reported on the financial statements at book value or showing cost and A/D How can you calculate the average age of depreciable assets when all you have is cost, A/D and depr exp? Could A/D? ©2006 Prentice Hall, Inc. you do this if you did not know 8-39 Financial Statement Analysis (1 of 3) Return on assets (ROA) Measures how well a company is using its assets to generate revenue Answers Did the following the company invest wisely in its assets? Net Income + Interest Expense Average Total Assets Avg ©2006 Prentice Hall, Inc. total assets = (Beg TA + End TA)/2 8-40 Financial Statement Analysis (2 of 3) Interest expense results from financing with debt instead of equity Why is interest expense added back to net income to compute ROA? How can a company increase its ROA without increasing its net income? Compare the ROA of a CPA firm to 8-41 the ROA of an auto manufacturer ©2006 Prentice Hall, Inc. Financial Statement Analysis (3 of 3) Asset Turnover Ratio Measures how efficiently a company uses its assets to generate sales Net Sales _ Average Total Assets Explain how a company can have a high asset turnover and a low ROA 8-42 ©2006 Prentice Hall, Inc. Business Risk, Control, and Ethics (1 of 2) Risks associated with long-term assets Theft, vandalism, natural disasters, terrorist attacks, etc. Controls used to safeguard assets Physical controls Complete and reliable record keeping 8-43 ©2006 Prentice Hall, Inc. Business Risk, Control, and Ethics (2 of 2) Controls used to safeguard assets (continued) Monitoring Make sure that physical controls, separation of duties, and other policies and procedures related to protecting assets are operating properly Who is responsible for monitoring function? 8-44 ©2006 Prentice Hall, Inc. Comments or questions about PowerPoint Slides? Contact Dr. Richard Newmark at University of Northern Colorado’s Kenneth W. Monfort College of Business richard.newmark@PhDuh.com ©2006 Prentice Hall, Inc. 8-45