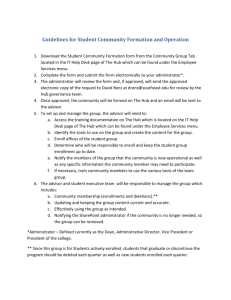

underwriting

advertisement

QCTO Roadshow July/August 2010 Definition of Qualification • Qualified in: the field of Insurance (Long Term, Short Term, Health Benefits, Pension Funds) • Qualified to: sell, underwrite, negotiate claims, manage risk • Qualified as: Financial Planner, Underwriter, Risk Manager, Loss Adjuster, Claims Manager, Insurance Administrator Different Functions in the Industry SALES ADMIN UNDERWRITING RISK MNGT CLAIMS ) Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Financial Planner Alternative Title: Para Planner (Financial Planner – 222301) Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning Financial Services Advisor Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) Professional Bodies / Associations – FPI, IISA, FIA, SAIA, IHRM Sales Call Centre Agent Alternative Titles: Sales Advisor Sales Agent (541101 Admin Inquiry Clerk Skills Level 2) Different Functions in the Industry SALES ADMIN UNDERWRITING RISK MNGT CLAIMS ) Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Insurance Admin Manager Alternative titles: Insurance Product Quality Manager (New Title -139911) Financial Planner Insurance Administrator Alternative Title: Para Planner (Financial Planner – 222301) Alternative Titles: Commercial Administrator Commercial Internal Broker Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning (Insurance Administrator 552302) Financial Services Advisor Servicing Broker Assistant Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Sales Call Centre Agent Alternative Titles: Sales Advisor Sales Agent (541101 Admin Inquiry Clerk Skills Level 2) Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Different Functions in the Industry SALES ADMIN UNDERWRITING RISK MNGT CLAIMS ) Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Insurance Admin Manager Underwriter Alternative titles: Alternative Title Risk Analyst Insurance Product Quality Manager (New Title -139911) (Underwriter – 611201 Alternative title) Financial Planner Insurance Administrator Assistant Underwriter Alternative Title: Para Planner (Financial Planner – 222301) Alternative Titles: Commercial Administrator Commercial Internal Broker Alternative Titles: Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning (Insurance Administrator 552302) (611201 – Alternative Title to Underwriter) Financial Services Advisor Servicing Broker Assistant Underwriting Clerk Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Sales Call Centre Agent Alternative Titles: Sales Advisor Sales Agent (541101 Admin Inquiry Clerk Skills Level 2) Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Internal Broker (Insurance Administrator 552302 – added as an alternative title) Different Functions in the Industry SALES ADMIN UNDERWRITING RISK MNGT CLAIMS ) Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Insurance Admin Manager Underwriter Risk Manager Alternative titles: Alternative Title Risk Analyst Alternative Title: Portfolio Manager (Underwriter – 611201 Alternative title) (Risk Manager 139906 – Risk and Quality Manager) Risk Surveyor Insurance Product Quality Manager (New Title -139911) Financial Planner Insurance Administrator Assistant Underwriter Alternative Title: Para Planner (Financial Planner – 222301) Alternative Titles: Commercial Administrator Commercial Internal Broker Alternative Titles: Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning (Insurance Administrator 552302) (611201 – Alternative Title to Underwriter) Financial Services Advisor Servicing Broker Assistant Underwriting Clerk Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Sales Call Centre Agent Alternative Titles: Sales Advisor Sales Agent (541101 Admin Inquiry Clerk ) Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Internal Broker (Insurance Administrator 552302 – added as an alternative title) (Risk Surveyor 599603 – Admin Skills Level 3) Different Functions in the Industry SALES ADMIN UNDERWRITING CLAIMS RISK MNGT ) Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Insurance Admin Manager Alternative titles: Insurance Product Quality Manager (New Title -139911) Risk Manager Claims Manager Alternative Title Risk Analyst Alternative Title: Portfolio Manager (Claims Manager 139912) (Underwriter – 611201 Alternative title) (Risk Manager 139906 – Risk and Quality Manager) Underwriter Insurance Administrator Assistant Underwriter Alternative Title: Para Planner (Financial Planner – 222301) Alternative Titles: Commercial Administrator Commercial Internal Broker Alternative Titles: Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning (Insurance Administrator 552302) (611201 – Alternative Title to Underwriter) Financial Services Advisor Servicing Broker Assistant Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Alternative Titles: Sales Advisor Sales Agent (541101 Admin Inquiry Clerk ) (Loss Adjuster 599602 ) Claims Assistant Manager Financial Planner Sales Call Centre Agent Loss Adjuster Risk Surveyor Alternative Title Claims Supervisor (added as alt title to Claims Manager) (Claims Assessor 599602) Internal Broker (Risk Surveyor 599603 – Admin Skills Level 3) Recovery Clerk Alternative Title: Recovery Agent Legal Advisor Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Claims Assessor Underwriting Clerk Claims Negotiator (Insurance Administrator 552302 – added as an alternative title) Alternative Titles: Claims Consultant Claims Advisor Claims Handler (Claims Negotiator – 552305 NEW TITLE) Claims Clerk Alternative Title: Claims Administrator (Claims Co-Ordinator 611201) Link with Labour • Department of Labour – Organising Framework for Occupations (OFO) – List of job functions with alternative titles • An occupation must exist on the framework for a qualification to be developed • Considerations for additional occupations: – Tasks of the function – Similarity with other occupations – Function versus Discipline Levels of Qualifications SALES ADMIN UNDERWRITING CLAIMS RISK MNGT ) ST LT RF HB Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Financial Planner Alternative Title: Para Planner (Financial Planner – 222301) Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning LT RF HB RF HB ST LT RF HB ) ) ) ) Risk Manager Claims Manager Alternative titles: Alternative Title Risk Analyst Alternative Title: Portfolio Manager (Claims Manager 139912) (Underwriter – 611201 Alternative title) (Risk Manager 139906 – Risk and Quality Manager) Insurance Product Quality Manager (New Title -139911) Loss Adjuster (Loss Adjuster 599602 ) Claims Assistant Manager Insurance Administrator Assistant Underwriter Alternative Titles: Commercial Administrator Commercial Internal Broker Alternative Titles: (Insurance Administrator 552302) (611201 – Alternative Title to Underwriter) Risk Surveyor Alternative Title Claims Supervisor (added as alt title to Claims Manager) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Claims Assessor (Claims Assessor 599602) Internal Broker (Risk Surveyor 599603 – Admin Skills Level 3) Recovery Clerk Alternative Title: Recovery Agent Legal Advisor Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) (541101 Admin Inquiry Clerk ) LT Underwriter Servicing Broker Assistant Alternative Titles: Sales Advisor Sales Agent ST Insurance Admin Manager Financial Services Advisor Sales Call Centre Agent GENERAL ST Underwriting Clerk Claims Negotiator (Insurance Administrator 552302 – added as an alternative title) Alternative Titles: Claims Consultant Claims Advisor Claims Handler (Claims Negotiator – 552305 NEW TITLE) Claims Clerk Alternative Title: Claims Administrator (Claims Co-Ordinator 611201) Levels of Qualifications SALES ADMIN UNDERWRITING CLAIMS RISK MNGT ) ST LT RF HB Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) Financial Planner Alternative Title: Para Planner (Financial Planner – 222301) CORE Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning LT RF HB RF HB ST LT RF HB ) ) ) ) Risk Manager Claims Manager Alternative titles: Alternative Title Risk Analyst Alternative Title: Portfolio Manager (Claims Manager 139912) (Underwriter – 611201 Alternative title) (Risk Manager 139906 – Risk and Quality Manager) Insurance Product Quality Manager (New Title -139911) Loss Adjuster (Loss Adjuster 599602 ) Claims Assistant Manager Insurance Administrator Assistant Underwriter Alternative Titles: Commercial Administrator Commercial Internal Broker Alternative Titles: (Insurance Administrator 552302) (611201 – Alternative Title to Underwriter) Risk Surveyor Alternative Title Claims Supervisor (added as alt title to Claims Manager) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Claims Assessor (Claims Assessor 599602) Internal Broker (Risk Surveyor 599603 – Admin Skills Level 3) Recovery Clerk Alternative Title: Recovery Agent Legal Advisor Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) (541101 Admin Inquiry Clerk ) LT Underwriter Servicing Broker Assistant Alternative Titles: Sales Advisor Sales Agent ST Insurance Admin Manager Financial Services Advisor Sales Call Centre Agent GENERAL ST Underwriting Clerk Claims Negotiator (Insurance Administrator 552302 – added as an alternative title) Alternative Titles: Claims Consultant Claims Advisor Claims Handler (Claims Negotiator – 552305 NEW TITLE) Claims Clerk Alternative Title: Claims Administrator (Claims Co-Ordinator 611201) Levels of Qualifications SALES ADMIN UNDERWRITING CLAIMS RISK MNGT ) PROFESSIONAL ST LT RF HB Business Development Manager Alternative Title: New Business Manager (Business Development Manager – 131102, OR Sales and Marketing Manager 131101) CORE ADVANCED Financial Planner Alternative Title: Para Planner (Financial Planner – 222301) Professional Body – FPI Professional Qualification – Post Grad Diploma in Financial Planning LT RF HB RF HB ST LT RF HB ) ) ) ) Risk Manager Claims Manager Alternative titles: Alternative Title Risk Analyst Alternative Title: Portfolio Manager (Claims Manager 139912) (Underwriter – 611201 Alternative title) (Risk Manager 139906 – Risk and Quality Manager) Insurance Product Quality Manager (New Title -139911) Loss Adjuster (Loss Adjuster 599602 ) Claims Assistant Manager Insurance Administrator Assistant Underwriter Alternative Titles: Commercial Administrator Commercial Internal Broker Alternative Titles: (Insurance Administrator 552302) (611201 – Alternative Title to Underwriter) Risk Surveyor Alternative Title Claims Supervisor (added as alt title to Claims Manager) Alternative titles: Financial Planning Assistant Sales Assistant Sales Administrator New Business Admin (Added as alt title to Insurance Admin) Client Service Call Centre Agent Alternative Titles: Client Services Advisor Service Agent (541101 Admin Inquiry Clerk) Claims Assessor (Claims Assessor 599602) Internal Broker (Risk Surveyor 599603 – Admin Skills Level 3) Recovery Clerk Alternative Title: Recovery Agent Legal Advisor Alternative Title: Broker Consultant Commercial Advisor Short Term Advisor Insurance Sales Consultant (Insurance Sales Consultant – 611201) (541101 Admin Inquiry Clerk ) LT Underwriter Servicing Broker Assistant Alternative Titles: Sales Advisor Sales Agent ST Insurance Admin Manager Financial Services Advisor Sales Call Centre Agent GENERAL ST Underwriting Clerk Claims Negotiator (Insurance Administrator 552302 – added as an alternative title) Alternative Titles: Claims Consultant Claims Advisor Claims Handler (Claims Negotiator – 552305 NEW TITLE) Claims Clerk Alternative Title: Claims Administrator (Claims Co-Ordinator 611201) International Benchmark - CII The qualifications framework offered by the CII has been designed to provide a clear path for those looking to develop their career in today’s insurance market. The framework gives candidates the following options: Fellowship The highest qualification on offer from the CII This requires the completion of a personalised, structured advanced professional development programme Advanced Diploma in Insurance This is the ‘professional’ qualification awarded to experienced and expert market practitioners. It requires candidates to pass a 290 credit threshold. Diploma in Insurance This qualification recognises ‘technical’ development achieved by those with a growing understanding of the industry. It requires candidates to pass a 110 credit threshold. Certificate in Insurance This is the ‘core’ level qualification, suitable for those entering the industry and seeking to gain essential basic knowledge of the market, key disciplines and products. It requires candidates to pass a 40 credit threshold. Award in Insurance An introductory-level study programme, the Foundation Insurance Test, developing fundamental knowledge on key topics. Candidates pass one test, gaining credits which they can use towards study for a CII qualification Note: Candidates obtaining the Certificate, Diploma, Advanced Diploma or Fellowship, who are already or subsequently become CII members, are entitled to use the designations ‘Cert CII®’, ‘Dip CII®’, ‘ACII®’ and ‘FCII®’, respectively. Designation holders are required to comply with CII membership and Continuing Professional Development requirements. International Benchmark - CII Unit credit rating 15 credits Certificate in Insurance (Designations: Cert CII® /Cert CII (Claims)/Cert CII (London Market)) (IF1) Insurance, legal and regulatory -- - - - - - - - - - - - - - - - - - - - - - COMPULSORY UNIT (IF2) General insurance business (IF3) Insurance underwriting process (IF4) Insurance claims handling process (IF5) Motor insurance products (IF6) Household insurance products (IF7) Healthcare insurance products (IF8) Packaged commercial insurances Award in Insurance 6 credits (FITTM) Foundation Insurance Test® International Benchmark - CII Unit credit rating 30 credits 25 credits Diploma in Insurance (Designation: Dip CII ®, Dip CII (Claims)) NEW NEW (P91) Aviation and space insurance (P97) Reinsurance NEW (P05) Insurance law* -- - - - - - - - - - - - - - - - - - - - - - COMPULSORY UNIT (P10) Commercial insurance practice (p92) Insurance business and finance* -- - - - - - - - - - - - - - - - - - - - - - COMPULSORY UNIT (P93) Commercial property and business interruption (P94) Motor insurance Certificate in IT for insurance professionals (CITIP) (P04) Business practice * (P21) Commercial insurance contract wording Certificate in IT for insurance professionals (CITIP) (P81) Insurance broking practice (P85) Claims practice (P90) Cargo and goods in transit insurances (P96) Liability insurances 20 credits Certificate in IT for insurance professionals (CITIP) * To satisfy the Diploma compulsory unit requirements you can either pass units P92 and P05 or alternatively P04 or 530 and P05 ** P05 is also a compulsory unit within the Advanced Diploma in Insurance International Benchmark - CII Fellowship (Designation: FCII®) Unit credit rating 30 credits MSc in Insurance and Risk Management Advanced Diploma in Insurance (Designation: ACII®) (510) Risk, regulation and capital adequacy -- - - - - - - - - - - - - - - - - - - - - - COMPULSORY UNIT (530) Business and economics -- - - - - - - - - - - - - - - - - - - - - - COMPULSORY UNIT (555) Life and disability underwriting (556) Life and disability claims (590) Principles of Takaful (655) Risk management (735) Life assurance (745) Principles of property insurances (770) Principles of marine insurance (785) Principles of reinsurance (790) Private medical insurance (815) Underwriting management (820) Claims management (non-life) (930) Insurance broking (945) Marketing NEW (990) Insurance corporate management Certificate in IT for insurance professionals (CITIP) International Benchmark - FPSB “Education and training programs for financial services qualifications and professional certifications increasingly rely on a competency-based approach, whereby a curriculum’s learning outcomes and theoretical knowledge connect to appropriate practice outcomes or competencies for a given job function. In developing a global education standard for financial planning, FPSB developed learning outcomes and content for its Financial Planning Curriculum Framework that relate to the abilities, skills and knowledge needed to practice financial planning (as defined by FPSB’s Financial Planner Competency Profile). By linking the Financial Planning Curriculum Framework directly to its Financial Planner Competency Profile, FPSB encourages educators to be directed by the actual practice of financial planning when developing financial planning curricula, so that students develop thinking and capabilities that prepare them to practice as competent financial planning professionals.” Qualification Process • Purpose of Qualification • Key Performance Areas • Knowledge and Skills per key performance area • Context of assessment • Context of key performance area Proposed Insurance Sales Advisor Curriculum • Purpose: To advise clients on insurance solutions that address their identified insurance needs • TASK Summary: (Key Performance Areas) 1. 2. 3. 4. 5. 6. Establish and maintain an Insurance client base Review and determine insurance solutions to meet the client’s insurance need Propose insurance solutions to a client Implement insurance solutions for a client Keep accurate records of insurance documents Advise on the insurance claims process Proposed Insurance Sales Advisor Curriculum Task 1: Establish and maintain an Insurance client base • What does this entail? Establish, prospect and qualify an insurance client base Make contact with prospective clients Make disclosures to client as per the FAIS Requirement Clarify your role in the insurance process to the client Update client’s insurance records and information • Underpinning knowledge: 1. 2. 3. 4. 5. 6. 7. • Basic marketing principles of Insurance policies (including relationship marketing), FAIS Legislation relating to disclosure, Knowledge of insurance industry role players Own role and responsibility in insurance industry with regard to FAIS Steps in the insurance needs identification and review process Replacement of insurance products/policies and their rules Basic economic terminology and concepts as relevant to insurance Practical applied skill: 1. 2. 3. 4. 5. Make disclosures as per the FAIS Requirement Qualify insurance clients correctly Segment an insurance client base Review the suitability of an existing insurance policy Prospect new insurance business • Context in which this happens: any situation in which the insurance representative and client (prospective or existing) meet • Exposure to determine if skill has been acquired: Observe 5 client visits and 5 client calls performed by an experienced insurance representative • Contextual exposure: – – – – Own insurance company’s approach to relationship marketing and insurance marketing standards Own insurance company’s rating criteria Company organogram, Values, Vision and Mission Company’s code of conduct for insurance employees including dress code Proposed Insurance Sales Advisor Curriculum Task 2: Review and determine insurance solutions to meet the client’s insurance need • What does this entail? Gather information from client relating to insurance need Identify and analyse insurance risk Calculate the extent of the insurance risk Interpret existing insurance policy Educate the client on his immediate insurance situation and risk exposure • Underpinning knowledge: 1. 2. 3. 4. 5. • Basic insurance concepts and terminology Risks that can cause financial loss Types of cover and lines of insurance Law of contract as it applies to insurance products and contracts Legislation that covers short term insurance Practical applied skill: 1. 2. 3. 4. 5. 6. Gather relevant information relating to insurance needs Analyse information and establish insurable interest Record insurance information gathered Identify areas of insurance risk Interpret the client’s current financial situation and existing insurance policies Explain basic insurance concepts to the client • Context in which this happens: can be electronic or manual review, and can be an internal or external insurance client • Exposure to determine if skill has been acquired: identify client insurance needs under supervision for all applicable types of needs the company provides insurance solutions for • Contextual exposure: Company specific procedures and forms for insurance needs identification (all company insurance products involved in the case of a broker) Proposed Insurance Sales Advisor Curriculum Task 3: Propose insurance solutions to a client • What does this entail? Match the client’s insurance need to a relevant insurance product Prioritise the client’s insurance needs List all possible insurance products Apply underwriting criteria for each insurance product Draw insurance quotes for each insurance product Structure an insurance solution for the client’s needs Draft a report for the client on insurance options with disclosures as per FAIS Requirement Advise and educate the client on best suitable insurance product • Underpinning knowledge: 1. 2. 3. 4. 5. 6. 7. • Product knowledge in the selected field of insurance Legislation that impacts on insurance products considered Underwriting criteria that applies to each insurance product Legislation that impacts in presenting insurance solutions (FAIS, FICA, Money Laundering, Code of Conduct) Premium patterns and factors impacting insurance premium Insurance quote structures and terminology Hierarchy of needs as a basis for prioritization of client insurance needs Practical applied skill: 1. 2. 3. 4. 5. 6. 7. 8. Select and list all possible insurance product solutions Apply underwriting criteria to each insurance product selected Interpret insurance quotes and requirements Perform calculations relating to insurance premiums / Generate an insurance quote Draft a report (covering letter) and client advice record (terms and conditions) for relevant insurance offering to be presented Explain insurance product features and benefits Prioritise insurance needs on the basis of affordability Make disclosures as required by FAIS Legislation Proposed Insurance Sales Advisor Curriculum • Context in which this happens: Long term or Short Term (Personal or Commercial), knowledge of products and their context • Exposure to determine if skill has been acquired: observed 5 client presentations with insight into the entire process that preceded that presentation; draft 10 insurance plans under supervision which includes at least 1 insurance plan per type of insurance need and at least 2 insurance quotations per plan • Contextual exposure: – – – – Insurance company specific products Insurance quotes packages used by Company/ies OR Generate an insurance quote from the Company Insurance company specific procedures and processes Under the supervision of an experienced insurance representative Proposed Insurance Sales Advisor Curriculum Task 4: Implement insurance solutions for a client • What does this entail? • Underpinning knowledge: 1. 2. 3. • Facilitate agreement of an insurance policy Complete relevant insurance forms Identify and follow up on requirements for an insurance policy Issue and submit insurance documents Legislation that impacts on implementation of insurance policies Underwriting requirements for the insurance policy selected Process for issuing insurance policies Practical applied skill: 1. 2. 3. Complete relevant forms for insurance policies selected Facilitate agreement on terms and conditions of insurance policy Verify insurance documents and information • Context in which this happens: interaction between client, insurance representative and insurer; within the framework of the insurance solution offered • Exposure to determine if skill has been acquired: observe 5 presentations where insurance solutions are implemented (would be ideal if learner could sit with an insurance underwriter to get full exposure to different situations regarding terms and conditions of policies) • Contextual exposure: – Company specific forms, procedures and processes for insurance implementation Proposed Insurance Sales Advisor Curriculum Task 5: Keep accurate records of insurance documents • What does this entail? • Underpinning knowledge: 1. • File, record, update, backup, store and retrieve client and insurance product information Legislative requirements for record keeping of insurance documentation Practical applied skill: 1. 2. 3. Prepare insurance records Develop a filing system for own insurance records Capture, save and retrieve electronic/manual insurance data • Context in which this happens: At place of business as per FAIS address; manual or electronic • Exposure to determine if skill has been acquired: Observation • Contextual exposure: – – Company policy on record keeping for insurance documents Company electronic/manual data capturing system for insurance records Proposed Insurance Sales Advisor Curriculum Task 6: Advise on claims process for short term claims • What does this entail? Gather relevant information relating to insurance claims Advise on insurance claims process Complete and submit relevant insurance claims documents Validate information relating to insurance claims Follow up on insurance claims • Underpinning knowledge: (NOTE High level knowledge) 1. 2. 3. 4. 5. 6. 7. • Policy wording of relevant insurance product Insurance claims process Role of relevant parties to an insurance claim Types of compulsory legislative insurance Applicable insurance formulas Salvage and recovery process for insurance claims Legal rights of recourse for insurance claims Practical applied skill: 1. 2. 3. 4. 5. 6. 7. Scrutinize policy wording to determine whether the event is covered by the insurance policy Gather relevant initial information relating to an insurance claim Validate the insurance claim Validate documentation relating to the insurance claim Advise on completion of relevant forms for insurance claims Apply formula to determine estimated loss (average) of an insurance claim Explain the basic process of recovery and mitigation to the client in an insurance claim • Context in which this happens: interaction between client, insurance representative and insurer; relating to short term insurance products • Exposure to determine if skill has been acquired: analyse 5 approved insurance claims and 5 repudiated insurance claims (would be ideal if learner could work with a claims manager or negotiator) • Contextual exposure: – Insurance company claims procedure SALES ADMIN UNDERWRITING CLAIMS RISK MNGT ) Financial Services Advisor Insurance Administrator •Establish/source new business •Maintain existing business •Identify clients insurance needs •Apply underwriting criteria •Advise on terms and conditions •Policy Administration relating to issuing of policy, change of details, follow up on RD payments (unmets), renewals, endorsements) Policy Renewals Endorsements Policy Administration, relating to change of details Follow up on RD payments (unmets) and credit control Services existing business Alternative Titles: Servicing Broker Commercial Assistant Administrator Commercial Internal Administration function Broker the sales which supports side (Insurance Services existing Administrator 552302) business only Assistant Underwriter Claims Negotiator Claims Assessor Pre-underwriting of risk Limited Underwriting Authority Refer some decisions to underwriter Policy Issuing Risk Analysis Provide support to Underwriter Analyse all aspect of a claim Determine cover, liability and validity of a claim Seek legal counsel to determine liability Establish amount/quantum Negotiate settlement May have limit on authorization or amount Handover 3rd party claims to a Recovery Clerk/Agent Deals with Regulatory Controls / Legislation Ascertains the circumstances of an incident Assesses the damage of a claim Advise claim findings to Claims Negotiator Make recommendations on settlement Underwriting Clerk Policy Issuing Risk Analysis Provide support to Underwriter Claims Clerk Sales Call Centre Agent Conversion of leads / proposer to client Identify clients insurance needs Apply underwriting criteria Advise on terms and conditions Issue policies Follow up on RD payments (unmets) and credit control Client Service Call Centre Agent Policy Renewals Endorsements System tracking Services existing business Follow up on RD payments (unmets) and credit control Up-selling of additional product offering Establishes contact with client regarding the claim Register claims Send out claim forms Process and finalise claims up to a determined amount or hand over to Claims Negotiator Makes payment to suppliers relating to claims Proposed Modules in Curriculum Specialist Marine Aviation Professional Indemnity Professional (Associate) Core (Licentiate) General (IISA Member) Construction Engineering Basics of Insurance Claims Regulatory Framework Level 1 (Representatives) Proposing Terms and Conditions of a Policy (Fellow) Advanced Reinsurance Management of a Sales Team Understanding Reinsurance and the application thereof Determine, propose and implement insurance solutions for a client Specialised risks Interpretation of Terms and Conditions of a Policy Basic Insurance Concepts, Principles and Classes of Insurance Basic Risk Management Principles Understanding Terms and Conditions of Policies Basic Insurance Admin