Airlines (SIA, Southwest)

advertisement

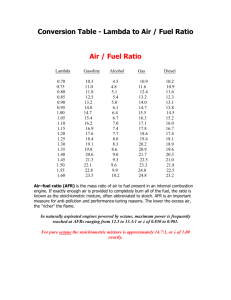

AIRLINE INDUSTRY Stan Li, Jessica Liu, Ben Mui, Edison Pei, Tony Yeung Airlines • Provide air transport services for passengers or freight’ • Categories of airline services include: • International • National • Regional • Domestic Major Issues • Weather • Fuel Cost -14-16% of an airline's total costs • Labor - 40% of an airline's expenses • Other • Airport capacity, route structures, technology, and costs to lease or buy the physical aircraft Pressures from External Forces • Threat of new entrants • Power of suppliers • Power of buyers • Availability of substitutes • Competitive rivalry Key Success Factor • Attracting customers • Managing its fleet • Managing its people • Managing its finances Industry Profit Pattern • Cyclical industry • Four or five years of poor performance precede five or six years of improved performance. • Mature industry consolidation trend Government Regulations • Government has extensive regulation for economic, political, and safety concerns • Some countries (e.g. US and Australia) have "deregulated" their airlines. • The entry barriers for new airlines are lower in a deregulated market, • far greater competition • average fares tend to drop 20% or more. International Regulation • Groups (e.g. International Civil Aviation Organization) establish worldwide standards for safety and other vital concerns. • Most international air traffic is regulated by bilateral agreements between countries. • Bilateral agreements are based on the "freedoms of the air“ • In the 1990s, "open skies" agreements became more common Major Risks Faced by Airlines • Strategic risk • Business design choices • Financial risk • Variability of revenue and costs • Operational risk • Tactical aspects of running the business • Hazard risk • Safety of physical assets Risk Events Causing Stock Drops 1991-2001 Source: Mercer analysis Singapore Airline Background • Public company since 1972 in Singapore Stock Exchange • Wholly-owned subsidiary of the Singapore government through Temasek Hldgs (Pte) • Its expanding route network covers 110 cities in 42 countries now. • Having the fastest and youngest growing fleets. Coverage Competitive Advantage - Fleet Age Comparison Decreased but Strong Profitability Singapore Airline Company Structure • Subsidiaries: SilkAir, Tradewinds Tour and Travel, SIA Engineering Company, SIA Cargo, and SATS • All the companies are in closely related business • SIA accounts for about 75% of the total revenue The Group 2005-06 2004-05 ROA 6.55% 7.38% ROE 9.29% 10.42% 101.7 111 EPS (cents) Consolidated Income Statement Stock Information 5-year Stock Price Trend List of Major Shareholders Employee Stock Option (cont) At the end of the financial year, options to take up 79,196,566 unissued shares in the Company were outstanding, which is 6% of the total share outstanding. Financial Risk • Market Risk • Jet fuel price risk • Foreign currency risk • Interest rate risk • Market price risk • Counterparty risk • Liquidity risk • Other possible risk Jet Fuel Price Risk Jet Fuel Price Risk (cont) • A change in price of US$0.01 per American gallon of jet fuel affects the Group’s annual fuel costs by US$14.7 million Jet fuel price risk management • Swaps and options contracts hedged up to 24 months forward • The group has a 55% jet fuel hedge ratio at $81 per barrel. Jet Fuel Price Risk (cont.) • FY2006 operating profit = $1.213B • FY2005 operating profit = $1.317B • Dropped $105 million (-7.9%) • Mainly due to rise in higher jet fuel price • From this, one can see the profitability of the group lies mainly on the hedge strategy Jet Fuel Price Risk (cont) • Hedge by Mean of Platts Singapore (MOPS) • As of March 31st 2006, the MOPS price USD $79.54 • Annualized volatility 2005-06 = 26.36% • Risk free rate = 2.4% Jet Fuel Price Risk (cont) • On 26 April 2006, the Company announced an increase of the fuel surcharge on tickets sold from 15 May 2006 • The adjustments will offer partial relief of higher operating costs arising from persistently high price of jet fuel hovering at US$90 per barrel, as compared to US$80 per barrel when the surcharge was last revised in September 2005. Jet Fuel Price Risk (cont) • Net fair value gain of $82.2m Foreign Currency Risk • Foreign currency accounts for 65% of total revenue (2004-05: 68%) and 69% of total operating expenses (2004-05: 64%) • The Group’s largest exposures are from USD, Euro, UK Sterling Pound, Swiss Franc, Australian Dollar, New Zealand Dollar, Japanese Yen, Indian Rupee, Hong Kong Dollar, Chinese Yuan, Korean Won and Malaysian Ringgit. • The Group generates a surplus in all of these currencies, with the exception of USD. • The deficit in USD is attributable to capital expenditure, fuel costs and aircraft leasing costs – all conventionally denominated and payable in USD. Foreign Currency Risk Management • The Group manages its foreign exchange exposure by a policy of matching, as far as possible, receipts and payments in each individual currency. • The Group also uses forward foreign currency contracts to hedge a portion of its future foreign exchange exposure. • Such contracts provide for the group to sell currencies at predetermined forward rates, with settlement dates that range from one month up to one year. • The Group uses forward contracts purely as a hedging tool. Interest Rate Risk • Interest rate risk • Changes in interest rates impact interest income and expense from short-term deposits and other interest-bearing financial assets and liabilities Interest Rate Risk (cont) • Long-Term liabilities • The company’s finance lease commitments are charged at a margin above the LIBOR. These ranged from 3.19% to 5.18% (2004-05: 1.56% to 2.31%) per annum. • SIA Cargo’s finance lease commitments are charged at a margin above the LIBOR. These ranged from 2.88% to 4.74% (2004-05: 1.15% to 2.65%) per annum. Interest Rate Risk (cont) • Long-Term Assets • Non-equity investments of $382.4 million (2005: $389.8 million) for the Group and the Company relate to interest-bearing investments with an effective annual interest rate of 3.97% (2004-05: 1.71%). • During the financial year, the Group and the Company recorded an impairment loss in the profit and loss account of$1.0 million (2004-05: $0.1 million) pertaining to unquoted equity investments. • The Group’s loan receivable within one year of $42.0 million is unsecured and bears interest between 3.19% to 5.05% (2004-05: 1.56% to 3.19%) per annum. Interest Rate Risk (cont) • As at 31 March 2006, the composition of cash and bank balances held in foreign currencies by the Group is as follows: USD – 21.8% (2005: 21.7%), EUR – 13.6% (2005: 21.1%) and JPY – 13.2% (2005: 13.3%). • Cash at bank earns interest at floating rates based on daily bank deposit rates ranging from 1.38% to 4.71% (2004-05: 0.28% to 2.20%) per annum. • Short-term deposits are made for varying periods of between one day and three months depending on the immediate cash requirements of the Group, • earn interests at the short-term deposit rates. The weighted average effective interest rate of short-term deposits is 3.6% (2004-05: 2.5%) per annum. Market Price Risk • Potential loss resulting from a decrease in market prices • Such as lower airfares • The Group owned $412.2 million (2005: $41.6 million) in quoted equity and non-equity investments at 31 March 2006. Counterparty Risk • Surplus funds are invested in interestbearing bank deposits and other high quality short-term liquid investments. • Counterparty risks are managed by limiting aggregated exposure on all outstanding financial instruments to any counterparty, taking into account its credit rating. Such counterparty exposures are regularly reviewed, and adjusted necessary. • This mitigates the risk of material loss arising in the event of non-performance by counterparties. Liquidity Risk • At 31 March 2006, the Group had cash and shortterm deposits amounting to $3,151.6 million (2005: $2,840.2 million). In addition, the Group had available short-term credit facilities of about $1,449.1 million (2005: $1,417.1 million). • The Group also has Medium Term Note Programmes under which it may issue notes up to $1,500 million (2005: $1,500 million). • Under these Programmes, notes issued by the Company may have maturities as may be agreed with the relevant financial institutions, and notes issued by one of its subsidiary companies may have maturities between one month and ten years. Liquidity Risk Management • The Group’s holdings of cash and short-term deposits are expected to be sufficient to cover the cost of all firm aircraft deliveries due in the next financial year. • any shortfall would be met by bank borrowings or public market funding. • Due to the necessity to plan aircraft orders well in advance of delivery • it is not economical for the Group to have committed funding in place at present for all outstanding orders. • The Group’s policies in this regard are in line with the funding policies of other major airlines. Other Possible Risks • Risk management committee’s of the different subsidiaries and associated companies create the ability to react to unforeseen events such as • 9-11 • SARS • Iraq war • Bali bombing Risk Management Governance SIA Board of Directors Board Audit and Risk Committee SIA Group Risk Management Committee SIA SIAEC RMC RMC SATS Group RMC SilkAir RMC SIA Cargo RMC Other Subsidiary RMC Statement on Risk Management • 1) Enhancement to Risk Framework • Intro of strategic risks framework • Identify and report strategic risks and other long-term issues for senior management attention. • Review of Risks to Singapore Airlines Reputation • Review of Regulatory Compliance Statement on Risk Management • 2) Simulations and Tests of Risk Control • Conducted throughout the year to test the effectiveness of risk controls and handling of business continuity • The exercise tested recall responses, communications systems, functional preparedness and management decisionmaking under simulated “crisis scenarios”. Statement on Risk Management • 3) Other Risk Process and Program • Annual Risk Management Review • Whistle Blowing Program • All “wrong-doings” can be reported and investigate to an independent investigation unit • “Wrong-doings” can include fraud, theft, abuse of authority, breach of regulations or non-compliance with corporate policy such as improper banking or financial transactions. • Banking Transaction Procedures • Lenders to Singapore Airlines must be properly authorized • All group companies/divisions has its own approved limits and procedures that must be followed Statement on Risk Management • Board of directors after reviewing the risk management practices and activities of Singapore Airlines has not found anything to suggest that risks are not being satisfactory managed. Southwest Airline Company profile • Southwest Airlines was founded in 1967 and is headquartered in Dallas, Texas. • Southwest Airlines Co. provides scheduled air transportation services in the United States. • As of December 31, 2006, the company operated 481 Boeing 737 aircrafts and provided service to 63 cities in 32 states. • It also sells credit to business partners, including credit card companies, hotels, telecommunication companies, and car rental agencies. Executives • Chairman – HERBERT D. KELLEHER • CEO – GARY C. KELLY • President and director – COLLEEN C. BARRETT • CFO – LAURA WRIGHT Routes Map Competitors • AMR corporation • Continental Airline, Inc. • JetBlue Airways Corporation South West Airline Market Share Market Share South West 47% Other Carriers 63% Competitive Strength Low Cost Leadership • Productivity is the key • High asset utilization • Point-to-point system • More direct nonstop routings • Employee Proficiency • 71 employees per aircraft • Lowest ratio since 1972 Stock Performance Stock Performance • • • • • • • • • • Last Trade:15.00 Change: 0.02 (0.13%) Prev Close:14.98 Open:14.96 Day's Range:14.96 - 15.1052wk Range:14.56 - 18.20 Volume:6,448,400 Avg Vol (3m):7,768,670 Market Cap:11.83B P/E (ttm):24.75 EPS (ttm):0.61Div & Yield:0.02 (0.10%) Income Statements Cash Flow Statements Cash Flow Statements Risk Factor • From company’s Annual Report: • Southwest's business is labor-intensive • Southwest relies on technology to operate its business and any failure of these system could harm the Company’s business • Insurance cost increases or reductions in insurance coverage may adversely impact the Company’s operation and financial results. • Disruptions to operations due to factors beyond Southwest’s control could adversely affect the Company. • Southwest’s low cost structure is one of its primary competitive advantages and many factors could affect the Company’s ability to control its costs. Risk Factor • Jet Fuel • Unpredictable price movement • Unable to increase fares when fuel price rise • Changes in hedging strategy and the effectiveness of hedging arrangement have significant impact on operating results Risk Factor: Jet Fuel • Anticipating higher jet fuel prices • Not as strong hedge position and higher market price in 2006 • Lower hedge ratio and prices of hedges in place are higher Purpose of Hedging • Airline operators are inherently dependent upon jet fuel to operate, and therefore, impacted by change in jet fuel prices • Jet fuel and oil consumed in 2005, 2004, and 2003 represented approximately 19.8%, 16.7%, and 15.2% of operating expenses respectively • The company endeavours to acquire jet fuel at the lowest possible cost Hedging Strategy - Jet Fuel • Hedging Commodities: • Primarily crude oil • Heating oil • Unleaded gas • Components of hedging positions: • Call options • Collar structures • Fixed price swap agreements Hedging Strategy: Jet Fuel • Hedge ratio: • 70% • 60% • 35% • 30% for for for for 2006 2007 2008 2009 at at at at $36/barrel $39/barrel $38/barrel $39/barrel • Near term hedge positions are in the form of option contracts • Limit the cost of rising fuel price and benefit the company of declining fuel price Value of Hedge Contracts • As of December 31, 2005, the company has $1.1 billion derivative instruments • $640 million of that was classified as “Fuel hedge contracts” • Fair value was determined by the use of present value methods or standard option value model with assumptions about the commodity prices based on those observed in underlying markets Balance Sheet - Assets Performance of Hedging • Gains from hedging: • $890 million unrealized gain, as of December 31, 2005 • Of that amount, $327 million are expected to be realized in 2006 Balance Sheet – Liability & SW’s Equity Cost Structure Operating Cost per Available Seat Mile (ASM) Other 18% Depreciation and amrt 7% Salaries 40% Landing fees 7% Aircraft rentals 2% Maintenance 6% Fuel and oil 20% Cost Control • To absorb the increasing in Jet Fuel cost, Southwest maintain its low cost characteristic through reduction in other operating expenses. • Reduction in non-fuel unit costs of 1.5% • Downsized work force and renegotiated collective bargaining and vendor agreements • Headcount per aircraft decreased from 74 at Dec 2004 to 71 at Dec 2005 Risk Factor 2 – Employment cost Employee Stock Option ESO subject to bargaining agreements Other Employee plans • Options granted at or above the FMV of the common stock • 6-12 years terms • Neither Executive officers nor members of the company’s board of directors are eligible to participate • Options granted at the money • 10 years terms • Fully exercisable over 3, 5, or 10 years of continued employment Employee Stock Option • The Company accounts for stock-based compensation utilizing the intrinsic value method in accordance with the provisions of Accounting Principles Board Opinion No. 25 (APB 25) • No compensation expense is recognized for fixed option plans because the exercise prices of Employee stock options equal or exceed the market prices of the underlying stock on the dates of grant. Compensation expense for other stock options is not material. • Under the new accounting regulation SFAS 123R : Expected 2006 salary increase is approximately $20 million Employee Stock Option Employee Stock Option Employee Stock Option An option’s exercise price may be paid (i) in cash, (ii) in shares of Common Stock, (iii) through a cashless exercise, or (iv) in any other manner permitted by the committee. Executive Stock Option • Option Exercises in Last Fiscal Year The following table provides information regarding stock options exercised, and the value realized upon exercise, by the named executive officers during 2006. Interest Rate risk Other Purchase long term debt Aircraft Purchase Interest Commitmen ts Operating Lease Capital Lease Interest Rate Hedging • Interest rate swap • Take advantage of short term rate significantly lower than fixed long term rate • Objective is to reduce the volatility of net interest income by better matching the reprising of assets and liabilities • “A hypothetical ten percent change in market interest rates as of December 31, 2005, would not have a material effect on the fair value of the Company's fixed rate debt instruments.” Interest Rate Swap Security Pay Floating rate Receive Fixed rate $385 million (LIBOR) plus a margin every six months Estimated to be 6.5% (LIBOR) plus a margin every six months Estimated to be 5.496 % (LIBOR) plus a margin every six months average floating rate 5.25% 6.5% senior unsecured notes due 2012 $375 million 5.496% Class A-2 due 2006 $350 million 5.25% senior unsecured notes due 2014. 6.46% 6.73% In 2005 is 3.82% Interest Rate Hedging • Investments • The Company also has some risk associated with changing interest rates due to the short-term nature of its invested cash • ST invested cash $2.3 billion • ST investment $251 million • “a hypothetical ten percent change in those rates would correspondingly change the Company's net earnings and cash flows less than $2 million” The returns earned parallel closely with short-term floating interest rates • Net effect on interest rate • Increase in interest rate: net +tv effect on earnings and CF • Decrease in interest rate: net –tv effect on earnings and CF • FV of interest rate swap as of Dec 31, 05 is: • was a liability of approximately $31 million Credit risk • The Company does not expect any of the counterparties to fail to meet their obligations • To manage credit risk: • selects and periodically reviews counterparties based on credit ratings • limits its exposure to a single counterparty • and monitors the market position of the program and its relative market position with each counterparty • The Company had agreements with seven counterparties containing early termination rights and/or bilateral collateral provisions whereby security is required if market risk exposure exceeds a specified threshold amount or credit ratings fall below certain levels. • held $950 million in fuel hedge related cash collateral deposits under these bilateral collateral provisions • decrease, but not totally eliminate, the credit risk associated with the Company's hedging program Insurance • Purpose of Insurance: • protect the Company and its property • comply both with federal regulations and the Company’s credit and lease agreements. • General Coverage: • public and passenger liability, property damage, cargo and baggage liability, loss or damage to aircraft, engines, and spare parts, and workers’ compensation. • Increasing insurance cost after 9-11 Conclusion It is important to hedge and hedge appropriately THE END Any questions or comments are welcomed!