Chapter 3 Instructor

advertisement

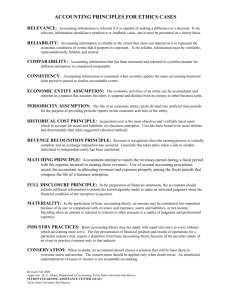

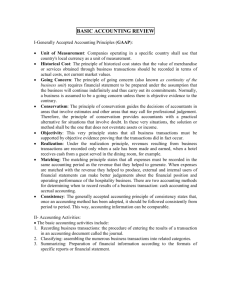

Chapter 3: The Measurement Fundamentals of Financial Accounting 1 Basic Assumptions Basic assumptions are foundations of financial accounting measurements The basic assumptions are – Economic entity – Fiscal period – Going concern – Stable dollar 2 Economic Entity A company is assumed to be a separate economic entity that can be identified and measured. This concept helps determine the scope of financial statements. Examples — Disney and ABC, General Electric and NBC. 3 Fiscal Period (Periodicity) It is assumed that the life of an economic entity can be broken down into accounting periods. The result is a trade-off between objectivity and timeliness. Alternative accounting periods include the calendar or fiscal year. 4 Going Concern The life of an economic entity is assumed to be indefinite. Assets, defined as having future economic benefit, require this assumption. Allocation of costs to future periods is supported by the going concern assumption. 5 Stable Dollar (Monetary Unit) The value of the monetary unit used to measure an economic entity’s performance and position is assumed stable. If true, the monetary unit must maintain constant purchasing power. Inflation, however, changes the monetary unit’s purchasing power. If inflation is material, the stable dollar assumption is invalid. 6 Valuations on the Balance Sheet There are a number of ways to value assets and liabilities on the balance sheet: – Input market: cost to purchase materials, labor, overhead – Output market: value received from sales of services or inventories Alternative valuation bases – – – – Present value Fair market value Replacement cost Original (historical) cost 7 Present Value as a Valuation Base Discounted future cash inflows and outflows For example, the present value of a notes receivable is calculated by determining the amount and timing of its future cash inflows and adjusting the dollar amounts for the time value of money. 8 Fair Market Value as a Valuation Base Fair market value is measured by the sales price or the value of goods and services in the output market. For example, accounts receivable are valued at net realizable value which approximates fair market value. 9 Replacement Cost as a Valuation Base Replacement cost is the current cost or the current price paid in the input market. For example, inventories are valued at original cost or replacement cost, whichever is lower. 10 Historical Cost as a Valuation Base Historical cost is the input price paid when asset originally purchased. For example, land and property used in a company’s operations are all valued at original cost. “Cash equivalent price” is used to calculate historical cost when cash is not paid (as in the issue of a liability to purchase the asset) 11 Principles of Financial Accounting Measurement When transactions occur, we must decide when to recognize the transactions in the financial statements, and how to measure the transactions. The principles of recognition and measurement are: – Objectivity – Revenue recognition – Matching – Consistency 12 The Objectivity Principle This principle requires that the values of transactions and the assets and liabilities created by them be verifiable and backed by documentation. For example, present value is only used when future cash flows can be reasonably determined. 13 The Revenue Recognition Principle This principle determines when revenues can be recognized. This principle triggers the matching principle, which is necessary for determining the measure of performance. The most common point of revenue recognition is when goods or services are transferred or provided to the buyer (at delivery). 14 The Matching Principle Matching focuses on the timing of recognition of expenses after revenue recognition has been determined. This principle states that the efforts of a given period (expenses) should be matched against the benefits (revenues) they generate. For example, the cost of inventory is initially capitalized as an asset on the balance sheet; it is not recorded in Cost of Goods Sold (expense) until the sale is recognized. 15 The Consistency Principle Generally accepted accounting principles allow a number of different, acceptable methods of accounting. This principle states that companies should choose a set of methods and use them from one period to the next. For example, a change in the method of accounting for inventory would violate the consistency principle. However, certain changes are permitted with sufficient disclosure regarding the change. 16 Exceptions (Constraints) to the Basic Principles These exceptions contradict the basic principles, in certain circumstances. They are: – Materiality – Conservatism 17 Materiality Materiality (the immateriality constraint) – Only transactions with amounts large enough to make a difference are considered material. – Nonmaterial transactions can be given alternative treatments For example, a trash can might have a five year life, but the materiality constraint allows a company to expense the item in the year purchased. 18 Conservatism The conservatism constraint permits the choice of the more conservative alternative in certain situations where two alternatives exist regarding the valuation of a transaction. Conservatism - When in doubt: – Understate assets – Overstate liabilities – Accelerate recognition of losses – Delay recognition of gains For example, :lower of cost or market” is used to value inventory. Problem: Some managers have abused the conservatism constraint in earnings management. 19 International Perspective Conservatism is pervasive in foreign financial statements. In Japan and most of western Europe, where creditors provide large amounts of capital, companies prepare reports that contain intentional understatement of assets and overstatement of liabilities. In Switzerland, federal law encourages management to set up “hidden reserves,” through excessive depreciation or liability write-ups, to permit income smoothing. 20 Brief Exercise 3-1 1. Reporting period ends on Saturday closest to Jan. 31. 2. Consolidated financials include subsidiaries. 3. Inventory valued at lower of cost or market. 4. Reclassifications made to conform with this year’s presentation. 5. Revenues recognized when motion pictures exhibited. Brief Exercise 3-1(continued) 6. Management believes lawsuit will not have a material impact on Company’s financial position. 7. Equipment depreciated over 20 years. 8. Intangible assets carried on B/S at cost. 9. Property and equipment recorded at cost. 10.Inflation rates have no effect on the company’s financials.