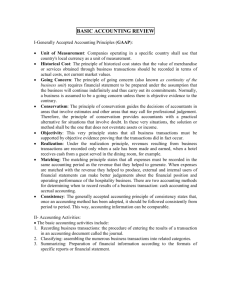

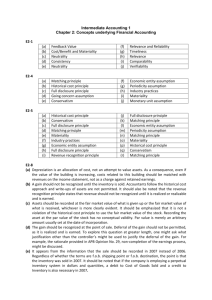

What Is Accounting Theory? It’s essential for accountants and business owners alike to understand basic accounting concepts. The principles behind these theories have given rise over time to the actual practices employed by accountants to ensure finances are properly managed and tracked. There are several principles considered part of basic accounting theory, including cost principle, matching principle, materiality, conservatism and monetary unit assumption. Cost principle: This principle requires recording assets as soon as they are acquired. These can range from things as simple as office supplies and factory equipment to new franchises. Depending on the sorts of assets you are recording, it’s possible that they will depreciate over time. However, they should still be documented when you acquire them. Matching principle: This principle requires that all transactions associated with a particular type of revenue be kept together and reported as a unit. Under the matching principle theory, expenses are always reported in the same period, such as a month, quarter or year, and the associated income is recorded. This theory exists only in the accrual method of accounting. For instance, if your company has a salesperson who earns $2,000 in commissions for work done in January, the expense for this should be recorded in January, even if you do not pay the employee until the next month. This principle requires accountants to be careful and always consistent in their documentation. Materiality: The notion of materiality states that a standard of accounting can be ignored, as long as the net result of doing so will have a small enough impact on the books that no one reviewing them would be misled. Careful judgment must be exercised when determining whether a specific transaction is important enough since materiality does not outline specifically which transactions are deemed most impactful. For instance, if you have a minor expense that will be spread out over a period of a year, such as your wireless internet charge, it might not matter whether that $240 is accounted for when you first sign the contract versus split into $20 increments over the 12 months it will impact. Materiality changes depending on the size of the company in question, too, since smaller budgets require that more attention is paid to each amount spent, as it represents a larger portion of the whole. The Securities and Exchange Commission suggests that a line item that represents less than 5 percent of a budget need not be accounted for, but that anything over that amount should be. Conservatism: This principle deals with liabilities. To ensure that your business holds on to enough of its money for the bills it has on the horizon, conservatism requires that all liabilities and potential liabilities be recorded as soon as they are anticipated. In this way, companies can plan for expenses that crop up in the future. Monetary unit assumption: This high-level accounting principle is appropriate for large or global companies. It considers the value of the dollar and whether this value might remain consistent or change over time. By anticipating the potential fluctuations of currency, it can help businesses plan for future ramping up of business, expansion of production facilities or investment opportunities.