Test 1 Reading Materials

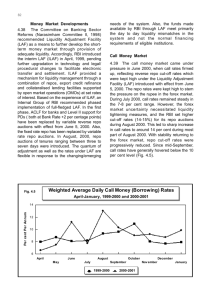

advertisement