Imran Presentation

advertisement

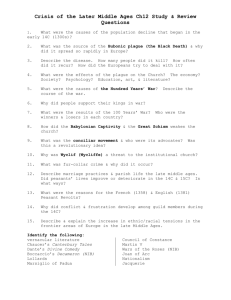

“Starting with the name of ALLAH most Beneficent, most Merciful” Presentation of Business Communication ON NIB Bank Ltd. Dedication I want to dedicate this to My Grandparents. My MOM and DAD, because the helped me a lot. And last but not least to my respected teachers my best friends and my fellow beings. I am very thankful to Shah Mahmood my friend who helped me a lot in making this presentation. Submitted To:Mr. Muhammad Imran Hanif Submitted By:Muhammad Imran Khan BS(IT)2nd Roll No# 07-37 Computer Science Department Bahauddin Zakariya University Multan. Board Of Directors Francis Andrew Thoms P. Sodano Mahmud ul Haq Syed Wali Tan Soo Nan Willi Wali Kong Chan Khawaja Iqbal Hassan Director Director Director Director Director Director President/CEO Legal Advisor's of NIB Bank. Rizvi. Isa. Afridi. & Angell. Advocate & Corporate Consellors Vision Statement • To become a leading provider of investment banking and wealth management services. • To be a top-3 choice of employers, a premier developer of human talent, and an organization that understand and hours its social responsibilities. Mission Statement • The values that will desire the bank mission, vision and culture. • NIB Bank ltd mission is to provide a banking experience so unique that it completes each of NIB Bank customer to want a long term, multi-product relationship with NIB bank. Brief History of NIB Bank Ltd. • NIB Bank Limited commenced banking operations in October 2003 following the merger of the former National Development Leasing Corporation ("NDLC") and the Pakistan operations of IFIC Bank Limited of Bangladesh with and into NIB Bank Limited. NIB Bank Limited was introduced in April 2004, Our current network of 27 branches strategically located in all the major cities. • Financing product menu of NIB Bank Limited comprised of Auto & Corporate Lease until May 2006 when the first unsecured consumer product, Personal Installment Loan was launched. With the launch of Personal Loans, NIB Bank has entered into the already growing consumer industry in Pakistan. It's an unsecured Personal Installment Loan facility for individuals to fulfill their personal cash deficiencies. An individual may require this facility to cater to a variety of personal needs. Nature of the Organization NIB Bank has following two sections. General Banking:Following four department in NIB general Banking Abdali Road Multan. Customer Service Department:- The Customer Service department deal with the each and every problem of there customers. Structure of the customer service center Branch Manager Relationship manager Customer relation officer Customer relation officer Customer relation officer Customer relation officer What is customer Service Department? Customer service department open the customer account. There are two types of accounts. Current account Saving account A customer can open the current account with Rs. 5000/rupees without any reference. Departments of NIB Bank Ltd. • Customer Service Department. • Sales Department. • Operation Department. • Consumer Banking. There are further four departments of Consumer Banking Section. • Sales Department. • CIU Department. • Verification Department. • Collection Department. Business Volume Three years program from 2004-07 Years 2004 2005 Capital & Reserves 1,219 1,389 1515 3002 Deposits 51,124 55,897 63430 76541 Advances 29,552 32,436 36231 42719 Investment 15,610 15,574 20193 25606 2006 2007 Income 6,102 7,056 8397 8984 Expenditure 5,571 6,822 8368 8814 531 234 29 170 58,480 63,439 72404 89358 Pre-tax Profit Total Assets (Less contra Account) Graph of Business Volume From year 2004-2007 for 3 years. Capital & Reserves Deposits 4,000 80,000 3,000 60,000 2,000 40,000 1,000 20,000 0 0 2004 2005 2006 2007 2004 2005 2006 2007 Investment Advances 30,000 50,000 40,000 20,000 30,000 20,000 10,000 10,000 0 0 2004 2005 2006 2007 2004 Income 10,000 8,000 8,000 6,000 6,000 4,000 4,000 2,000 2,000 0 0 2005 2006 2007 2006 2007 Income 10,000 2004 2005 2006 2007 2004 2005 Profile of Employees in Multan Main Branch of NIB Bank Ltd. Managing Director Branch Manager Operations Manager Relationship Manager Commercial Manager Sales Manager Group Leader MIS Coordinator Processor Relationship Officer Total 1 1 1 1 1 8 3 3 2 80 101 Products available from NIB Bank Ltd. NIB Bank has introduce three products only in Multan. NIB Auto-Finance. NIB SBL (Small Business Loan). NIB ATM. SBL(Small Business Loan) • NIB Bank Ltd offers the able to the business man with out any mortgage and plunging and without any guaranty. In monthly equally in statement basic for one year to five year. RS introduce the product to customer through the data calling and bank visit. DUTIES AND RESPONSIBILITIES OF SALES DEPARTMENT. • There are three teams in Multan for SBL each team consist of fifteen relationship officer and one group leader. (EACH RO REPORT TO GL AND EACH GL REPORT TO SM) What Relationship Officer do? • Relationship officers deal with customer through telemarketing and bank visit. They introduce the product to customer. • If any customer is villain to get the loan then ROs take the signature on documents and take the one years business proof in the shape of sole proprietorship letter and or NTN (National Tax No.). Relationship officer complete the customer file and report to group leader What do Group leader do? • After taking the report from RO Group Leader will submit that report to the SM (Sales Manager). What do Sales Manager (SM) do? • Sales Manager will take the report from the GL and will thoroughly go through that report and after that he will send that report to CIU Department for configuration. Requirements for SBL. • Customer should have one year business proof. If the customer have business name and bank statement, then bank requires the one year old sole proprietorship letter. If the customer have personal names statement then bank requires one year old NTN number. • NIC copy. • PTCL should be installed in office. • Last 7 days markup rate 16% premium IRR 26% to 29%. • Compound intrust. Product Features • Without any guaranty. • No post dated cheques. • Built in insurance. • Fastest processing 7 days. • NIB current account. • NIB ATM card. • Credit limit upto 75000/Bank divided the customer in two categories:- Establish NIB (New to Bank) Establish Customer • Establish customer is a such customer. Which Bank relation is more than 1 year or using the products of other Bank more then 1 year. Products like:• Credit card • Running finance • Auto finance • Mortgage loan There is no need of PTCL number. And there is no need office verification for the establish customer. New to Bank • Any customer wide has no relation with any bank or such customer which is applying first time for loan from NIB bank Ltd. INSTALLMENT SCHEDULE OF SMALL BUSINESS PLAN Amount Years Years Years Years Years 1 2 3 4 5 50000 4782 2700 2021 1692 1504 100,000 9656 4500 4042 3385 3008 200,000 19130 10800 8084 6771 6017 300,000 28695 16200 12127 10157 9026 400,000 38260 21600 16196 13543 12035 500,000 47826 27000 20212 16929 15044 600,000 57390 32400 24254 20314 18052 700,000 66955 37800 28294 23695 21056 750,000 71738 40500 30315 25387 22560 References and Sources used: • NIB Bank websites www.nib.com.pk • Annual reports • Mr. Ahmad Kaleem Zaffar (TSM) (SBL) • Mr. Adnan (TSM) Car Financing Manager) • Mr. Shahid Malik (Collection Management) • Mr. Shahzad Aslam (CIU Manager)