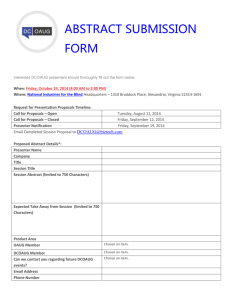

Gas Distribution Price Control Review

advertisement

Gas Distribution Price Control Review Summary of Initial Proposals Gas Customer Forum 9 July 2007 Presentation content • • • • • • • Introduction Context Initial proposals Financial issues Key policy proposals Outstanding issues Next steps 2 Introduction (1) • The price control that has applied to the Gas Distribution Networks (GDNs) since 1 April 2002 expired on 31 March 2007. • We extended the price control for one year from 1 April 2007 to 31 March 2008. This was completed in December 2006 and addressed a number of big issues from previous period. • The Gas Distribution Price Control Review (GDPCR) will reset the price control, which specifies the maximum revenue that a network can recover from its customers from 1 April 2008 to 31 March 2013. 3 Introduction (2) • This presentation discusses our initial proposals document which was published in May 2007. • The document set out our view on: – appropriate operating, capital and replacement expenditure allowances for the period 2008-13; and – a range of incentives and outputs that together with the allowances protect customers’ interests. 4 Context • GDPCR is first distribution price control review since the sale by National Grid Gas plc (NGG) of 4 of its 8 GDNs to 3 new owners on 1 June 2005. • Benefits to consumers identified from sale: generated mainly from comparing relative GDN performance. • The benefits from this comparative competition will be build up over time and passed back to consumers at future reviews (majority expected post 2013). Scotia Gas Networks Northern Gas Networks National Grid Gas Wales & West Utilities Scotia Gas Networks 5 Initial proposals – Key themes • Despite short period in independent ownership benefits to customers through comparative competition (mainly reductions in operating expenditure) • Increased allowances for investment and for replacement of old iron gas mains • Obligations to offer good quality customer service to be strengthened • Initiatives on sustainable development, such as network extensions and incentives on GDNs to reduce gas shrinkage 6 Initial proposals – Overall impact • Impact of proposals on revenue negligible: operating cost reductions broadly offset by increasing cost of mains replacement programme Allowances by GDN (£m, 2005-06 prices) GDN NGG NGN SGN WWU East of England London North West West Midlands Northern Scotland Southern Wales and West Total Allowed revenue 2007-08 427.2 245.1 285.5 217.8 273.5 194.3 432.4 252.0 2,327.7 Average annual allowed revenue 2008-13 416.8 261.2 286.7 218.3 281.0 192.7 450.4 261.7 2,368.7 Average X 0.8% -2.2% -0.1% -0.1% -0.9% 0.3% -1.4% -1.3% -0.6% 7 Headline cost allowances £m in 2005-06 prices Average annual actual 2002 to 2007 2007-08 Allowances Average annual GDN forecast over 2008-13 Average annual Ofgem allowance over 2008-13 Difference GDN forecast to allowance Opex 662.4 652.5 722.1 598.0 -17% Capex 260.5 358.4 393.1 328.2 -17% Repex 493.9 588.0 797.5 654.0 -18% Note: - Large reductions against forecasts - Data based on average GDN, some significant outliers - Actuals vs allowances 8 Cost allowances • Operating expenditure – Propose a reduction in operating expenditure of 3.3 per cent a year from forecast actual levels for 2006-07 • Capital expenditure – Increased allowances mainly driven by lumpy LTS investment • Replacement expenditure (mandated by HSE) – Required to fund cast iron mains replacement volume – Unit costs gap 9 Initial proposals – opex allowances (1) • To assess opex, we have focussed on benchmarking at individual activity level and used top-down analysis as a sense check. • We have proposed benchmarking at an upper quartile level. • We have taken into account regional labour rates in our benchmarking. • Other regional price costs will be considered as part of the updated proposals work. • We have taken account of real price effects • We have proposed an on-going efficiency target of 2.5% p.a. 10 Initial proposals – opex allowances (2) GDN Average annual GDN forecast 2008-09 to 201213 (excluding shrinkage) (£m, 2005-06 prices) Average annual allowance 2008-09 to 2012-13 (excluding shrinkage) (£m, 2005-06 prices) Difference forecast to allowance East of England 123.0 95.7 -22% London 86.4 67.0 -22% North West 93.8 74.0 -21% West Midlands 67.3 54.0 -20% NGN Northern 81.8 73.0 -11% SGN Scotland 68.1 57.0 -16% Southern 117.7 105.4 -10% Wales & West 84.0 71.9 -14% Total 722.1 598.0 -17% NGG WWU 11 Initial proposals – capex and repex allowances • • To assess capex and repex, we have adopted a similar approach to opex The scope for benchmarking capex is more limited resulting in extensive use of recommendations made by technical consultants. • In some cases, there are large differences between us and the GDNs on their capex and repex requirements. • We are proposing an Information Quality Incentive designed to bridge this gap. 12 Initial proposals – capex allowances (pre-IQI) GDN Average annual GDN forecast 2008-09 to 2012-13 (£m, 2005-06 prices) Average annual allowance 2008-09 to 2012-13 (£m, 2005-06 prices) Difference forecast to allowance East of England 41.9 37.5 -10% London 39.0 32.6 -17% North West 35.2 32.1 -9% West Midlands 18.4 17.5 -5% NGN Northern 52.1 43.7 -16% SGN Scotland 50.2 41.3 -18% Southern 95.0 74.9 -21% Wales & West 61.4 48.7 -21% Total 393.1 328.2 -17% NGG WWU 13 Initial proposals – repex allowances (pre-IQI) GDN Average annual GDN forecast 2008-09 to 2012-13 (£m, 2005-06 prices) Average annual allowance 2008-09 to 2012-13 (£m, 2005-06 prices) Difference forecast to allowance East of England 103.6 94.8 -8% London 95.8 77.4 -19% North West 100.2 85.0 -15% West Midlands 68.9 62.9 -9% NGN Northern 83.8 78.0 -7% SGN Scotland 71.3 49.0 -31% Southern 187.8 132.4 -29% Wales & West 86.2 74.5 -14% Total 797.5 654.0 -18% NGG WWU 14 Financial issues • • Cost of capital: – TPCR most recent reference point – Modelling assumption for initial proposals: • Cost of debt continuing to fall on a trailing average basis – adjusted by 20b.p. • Cost of equity will be informed by our comparative risk analysis to be carried out between now and updated proposals - unchanged at mid-point of total equity returns • Gearing 62.5% - consistent with previous review for now – This provides a point estimate WACC of 4.84% (post-tax 4.2%) Assessing financeability: – Ratios arising from our notional assumptions consistent with a comfortable investment grade credit rating for majority of GDNs – Will be considered further at updated and final proposals to establish whether any adjustments are required. 15 Outputs and Quality of Service (1) • We are proposing a number of changes to the outputs and quality of service arrangements for GDNs to: – simplify the arrangements; – improve protection for consumers; – improve the accuracy and reliability of the data recorded and reported by GDNs; – enhance comparative competition between the GDNs; and – enable us to better monitor how performance is improving both over time and between different GDNs. • We have undertaken a programme of consumer research to inform these changes and to comply with our statutory duty. 16 Outputs and Quality of Service (2) • Removal of the Overall Standards of Performance – Propose to revoke the Overall Standards and migrate these obligations to licence conditions or guaranteed standards. – Improved ability to take appropriate enforcement action; – Consistent with DPCR4. • Changes to the Guaranteed Standards – Complaint handling and the timing and quality of reinstatement works were identified in the consumer research as areas where GDNs performance could be improved. – Improved protection for consumers connected to IGTs & smaller non-domestic consumers regarding supply restoration. 17 Outputs and Quality of Service (3) • Other changes to the arrangements – Introducing targets for the accuracy and completeness of GDNs interruptions data; – Expanding the existing quarterly consumer satisfaction survey to include GDNs performance in connections, emergencies and providing information during unplanned interruptions; – Introducing a reporting regime to strengthen incentives on GDNs to maintain accurate pipeline records; and – Developing a balanced score card to better compare GDNs performance across a number of key areas. 18 Incentives (1) • Information Quality Incentive: – Proposing to implement an information quality incentive (IQI) similar to DPCR4 – GDNs rewarded for forecasting their capital and replacement expenditure close to our consultant’s view (conversely penalty if long way from our view). Also rewarded for forecasting accurately. – Intention to close “gap” between GDN forecasts and our proposed allowances – Re-bids due this summer (13 July) 19 Incentives (2) Comparison of post IQI allowances to forecasts 2008-13 (£m, 2005-06 prices) Total 5Yr capex + repex forecast East of England London North West West Midlands Northern Scotland Southern Wales and West Total £m 727.2 674.1 676.7 436.6 679.3 607.4 1,414.1 737.7 5,953.1 Total 5Yr capex + repex allowance (pre IQI) £m 661.8 549.8 585.7 402.0 608.4 451.3 1,036.4 615.6 4,910.9 IQI Ratio (post adjustment) 114 114 114 114 108 135 135 116 Allowance (post IQI) £m 683.1 566.6 604.2 415.6 618.9 485.1 1,114.0 637.0 5,124.5 Incentive 33% 33% 33% 33% 36% 23% 23% 32% Additional income £m 5.4 4.2 4.6 3.4 9.3 -9.6 -22.1 3.0 -1.8 20 Sustainable development • Sustainable development – Extending the network to fuel poor communities – Reducing levels of gas shrinkage – Responding to concerns about CO poisoning – Proposals • Discretionary reward scheme (£4m pa) • Change to structure of charges for fuel poor communities • Roll forward shrinkage incentive but consider whether it should be strengthened for cost of carbon 21 Outstanding issues • These are initial proposals; there are still a number of areas to be considered further including: – Resubmission by GDNs of actual 2006-07 data plus resubmission of forecast expenditure this summer – Some cost issues still to be concluded, e.g. regional factors – Detailed analysis for cost of capital and further assessment of financeability to be undertaken – Number of policy areas still need to be concluded, e.g. opex rolling incentive • This may mean that changes for our September updated proposals could be more substantive 22 Next steps Milestones Dates Resubmission of BPQ (forecast) 13 July 2007 Responses to Initial Proposals document 13 July 2007 Consultation on cost reporting* 20 July 2007 Consultation on licence drafting Early September 2007 Updated Proposals 24 September 2007 Publish final proposals Early December 2007 New price control implemented 1 April 2008 * We propose to introduce a cost reporting framework to apply from 2008-09 onwards similar to electricity distribution and transmission. 23 24 Key policy proposals • Proposed IQI matrix GDN:Ofgem ratio Efficiency incentive Additional income Allowed expenditure Actual expenditure 70 80 90 100 105 110 115 120 125 130 135 140 100 105 40.0% 37.5% 2.50 1.97 100 101.25 110 115 120 125 35.0% 32.5% 30.0% 27.5% 1.38 0.72 0.00 -0.78 102.5 103.75 105 106.25 14.50 10.50 6.50 2.50 0.50 -1.50 -3.50 -5.50 -7.50 -9.50 -11.50 -13.50 12.75 9.25 5.75 2.25 0.50 -1.25 -3.00 -4.75 -6.50 -8.25 -10.00 -11.75 13.69 9.94 6.19 2.44 0.56 -1.31 -3.19 -5.06 -6.94 -8.81 -10.69 -12.56 11.69 10.50 8.44 7.50 5.19 4.50 1.94 1.50 0.31 0.00 -1.31 -1.50 -2.94 -3.00 -4.56 -4.50 -6.19 -6.00 -7.81 -7.50 -9.44 -9.00 -11.06 -10.50 9.19 6.44 3.69 0.94 -0.44 -1.81 -3.19 -4.56 -5.94 -7.31 -8.69 -10.06 130 135 25.0% 22.5% -1.63 -2.53 107.5 108.75 7.75 5.25 2.75 0.25 -1.00 -2.25 -3.50 -4.75 -6.00 -7.25 -8.50 -9.75 6.19 3.94 1.69 -0.56 -1.69 -2.81 -3.94 -5.06 -6.19 -7.31 -8.44 -9.56 140 20.0% -3.50 110 4.50 2.50 0.50 -1.50 -2.50 -3.50 -4.50 -5.50 -6.50 -7.50 -8.50 -9.50 25