Ehebeferuntil vil virmilicae quonum hos, nortil ut Catis popos hebata

advertisement

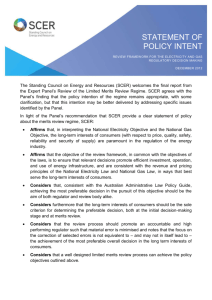

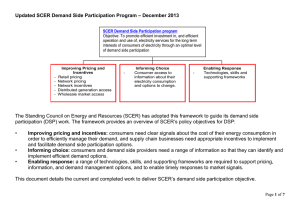

BULLETIN SCER Response to AEMC Advice: Consideration of Differences in Actual Compared to Forecast Demand in Network Regulation BULLETIN FOUR / 31 MAY 2013 THIS DOCUMENT PRESENTS THE STANDING COUNCIL ON ENERGY AND RESOURCES (SCER) RESPONSE TO THE AUSTRALIAN ENERGY MARKET COMMISSION’S (AEMC) ADVICE OF 26 ARIL 2013 TITLED ADVICE TO SCER: CONSIDERATION OF DIFFERENCES IN ACTUAL COMPARED TO FORECAST DEMAND IN NETWORK REGULATION. SCER welcomes the AEMC’s advice on the implications of differences between actual and forecast demand within the regulation of transmission and distribution electricity networks, the impact on consumers and how the Australian Energy Regulator (AER) manages those implications. SCER recognises the AEMC’s advice builds on a substantive body of work relating to energy markets, including: the AEMC’s Rule Determination National Electricity Amendment (Economic Regulation of Network Service Providers) Rule 2012 and National Gas Amendment (Price and Revenue Regulation of Gas Services) Rule 2012 made on 29 November 2012; the AEMC’s Rule Determination National Electricity Amendment (Optimisation of Regulatory Asset Base and the Continued Use of Fully Depreciated Assets) Rule 2012 and National Gas Amendment (Optimisation of Regulatory Asset Base and the Continued Use of Fully Depreciated Assets) Rule 2012 made on 13 September 2012; the AEMC’s Rule Determination National Electricity Amendment (Distribution Network Planning and Expansion Framework) Rule 2012 made on 11 October 2012; the AEMC’s Power of Choice review; the AEMC’s reviews into transmission and distribution reliability standards and requirements; the AER’s Better Regulation Program; the Australian Energy Market Operator’s (AEMO) National Electricity Forecasting Report 2012; and the Productivity Commission’s draft report on its inquiry into Electricity Network Regulatory Frameworks. Background Recent observations on demand suggest that, for the first time in the National Electricity Market (NEM), there may be a sustained slowing of growth in peak demand and a decline in average demand. This reduced demand has implications for the costs of providing networks for consumers as network revenues are set, in part, on the basis of the provision of capacity to meet forecast peak demand levels. On 7 December 2012, the Council of Australian Governments (COAG) agreed that SCER task the AEMC with providing advice on the merits of the AER considering the difference between actual and forecast demand in the prior determination period when undertaking the current determination. While recognising that this may be a complex area, COAG requested that this advice be provided by March 2013, to provide sufficient time for it to be considered and responded to in the mid-2013 SCER meeting. In the context of this task, the AEMC was also requested to provide analysis around which party bears the risk when forecasts are not realised and the difference of impact depending on whether the regulatory control mechanism sets prices or revenue, and to provide advice on whether any changes to the National Electricity Rules (NER) are needed to ensure consumers receive the benefits of sustained reductions in demand. In identifying options to address these matters, the AEMC was requested to have regard to the need for actions to be proportionate, including the value of maintaining stability and predictability in the regulatory regime, including ensuring sufficient investment certainty. AEMC’s findings The AEMC does not recommend any changes to the NER in light of the network regulation rule changes made recently. The AEMC considers the incentive based regulatory regimes for transmission and distribution network businesses are now flexible enough to manage the impacts of differences between actual and forecast demand. The AEMC notes the NER allows the AER to put financial measures in place that encourage network businesses to adjust their capital programs in response to variations between actual and forecast demand within the regulatory control period. These adjustments will be reflected in prices during the subsequent regulatory control period. How consumer prices are affected during the current regulatory control period depends on whether the control mechanism is a revenue cap or a weighted average price cap (WAPC). The NER provides the AER with the option to determine the form of control mechanism to apply to distribution businesses. This allows the AER to consider factors such as the predictability of demand forecasts and the appropriate risk sharing between consumers and the network business when deciding the form of control mechanism. Under the NER, transmission businesses are subject to a revenue cap. As transmission charges are generally recovered by distribution businesses, the AEMC considers potential benefits of a WAPC control mechanism for transmission businesses are more limited. Consequently, the AEMC did not propose to change the requirement for revenue caps for transmission businesses. The AEMC noted that there are barriers to efficient pricing in the network tariff structures. However, the AEMC considers that these are best addressed through its recommendations in the Power of Choice review. 2 SCER’s response SCER agrees with the AEMC’s conclusion that changes to the NER are not required at this time. SCER recognises that, given the substantive nature of the National Electricity Amendment (Economic Regulation of Network Service Providers) Rule 2012 and National Gas Amendment (Price and Revenue Regulation of Gas Services) Rule 2012 made on 29 November 2012 and that these only take full effect towards the end of 2013, to progress further changes to the economic regulatory frameworks at this stage would be inappropriate. Further, SCER considers that any already identified limitations in network tariff structures are best addressed through the rule changes currently being progressed in light of the recommendations in the Power of Choice review. In addition, SCER notes the advice from the AEMC that other factors, such as planning and security standards, may contribute to the impact of demand driven investments on consumer outcomes. Consequently, SCER considers it essential to ensure that these requirements are set in a transparent and economically robust process that takes into account consumer expectations around the cost, quality, reliability and security of supply. SCER notes that this principle is the basis for the work currently being progressed via the AEMC's reviews of the national frameworks for transmission and distribution and AEMO's Value of Customer Reliability work. However, SCER considers that the responsiveness of network tariffs to sustained changes in demand may be an issue requiring further consideration in the future, with the changing patterns of electricity use. While the AEMC identified that demand related capital expenditure is a small contributor to network tariffs applied to consumers as it is recovered over the life of the asset, SCER recognises that there is the potential for consumers to face higher than necessary prices over the long term if there is no incentive for network service providers to both continuously adjust their capital works programs to reflect the evolving demand outlook and share the benefits of sustained reductions in demand, where it is due to consumer actions in addition to their own business decisions. SCER considers that it is important that the NER are appropriately responsive to sustained changes in demand to ensure that they are delivering the long term interests of consumers, as set out in the National Electricity Objective. Consequently, SCER will monitor the effectiveness of the Rules, as recently amended, to ensure that capital expenditure is appropriately responsive to changes in demand. 3 4