Word - Standing Council on Energy and Resources

advertisement

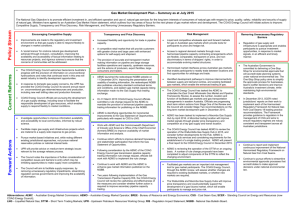

Gas Market Development Plan – Summary as at December 2015 Policy Stream The National Gas Objective is to promote efficient investment in, and efficient operation and use of, natural gas services for the long term interests of consumers of natural gas with respect to price, quality, safety, reliability and security of supply of natural gas. Ministers have agreed to an Australian Gas Market Vision statement, which outlines four key areas of focus for the next phase of gas market reform and development. The COAG Energy Council will initiate actions to improve: Competitive Supply, Transparency and Price Discovery, Risk Management, and Removing Unnecessary Regulatory Barriers. Encouraging Competitive Supply Current Reforms Underway Forward Actions Improvements are made to the regulatory and investment environment so that gas supply is able to respond flexibly to changes in market conditions. A ‘social licence’ for onshore natural gas development achieved through inclusion, consultation, improving the availability and accessibility of factual information relating to resources projects, and rigorous science to ensure that the concerns of communities will be addressed. On 4 December 2015, the COAG Energy Council agreed to a gas supply strategy to maximise the benefit to the Australian community from the responsible development of all gas resources. Increased flexibility and opportunity for trade in pipeline capacity. A competitive retail market that will provide customers with greater choice and large users with enhanced options for self-supply and shipment. The provision of accurate and transparent market making information on pipeline and large storage facilities operations and capacity, upstream resources, and the actions of producers, export facilities, large consumers and traders. Implementation of the AEMC’s Stage One recommendations is underway: o The AEMC is working closely with the Australian Bureau of Statistics to develop a wholesale gas price index with industry consultation in early 2016. In response to domestic gas supply concerns, the Upstream Petroleum Resources Working Group’s fourth annual report on unconventional gas reserves/resources and production, including new well drilling rates and production forecasts, was released on 30 November 2015. The report has been renamed Coal Seam, Shale and Tight Gas in Australia: Resources Assessment and Operation Overview 2015. o On 26 November 2015, COAG Energy Council officials submitted a rule change request to the AEMC to harmonise gas day start times across eastern Australian gas markets. Investigate opportunities to improve information availability and accessibility to local communities, informed by robust science. Facilitate major gas supply and infrastructure projects which are material to a supply side response to gas prices. Consider the Australian Competition and Consumer Commission’s findings from the East Coast Gas Inquiry. The Final Report is due April 2016. Pursue market based initiatives and, while noting different existing jurisdictional approaches, not pursue national reservation policies or national interest tests. The Upstream Petroleum Resources Working Group will provide advice on medium-term strategic issues relevant to the acreage release process. Work with AEMO and the Commonwealth Department of Industry, Innovation and Science’s Office of the Chief Economist (formerly BREE) to improve availability of market information and analysis. Continue reform efforts to improve demand forecasting and stakeholder participation that inform the Gas Statement of Opportunities. The Council notes the importance of further consideration of competition issues and barriers to entry which may be inhibiting opportunities to make supply more competitive. Following the release of the AEMC’s final determination concerning the gas transmission pipeline capacity trading information rule change request, officials will work with AEMO to implement the rule change. The Council will aim to facilitate supply responses, by removing unnecessary regulatory impediments, streamlining regulation across governments and improving the availability of information. o On 31 March 2015, COAG Energy Council officials submitted a rule change request to the AEMC to mandate the provision of enhanced pipeline capacity information for publishing on the NGBB. The AEMC is due to release the final determination in mid-December 2015. Risk Management Transparency and Price Discovery AEMO is identifying opportunities for incremental improvements to the Gas Statement of Opportunities, particularly with respect to CSG to LNG. Continue to work with AEMO and the AEMC to enhance gas market information published on the NGBB. Following implementation of the Gas Transmission Pipeline Capacity RIS, the COAG Energy Council will review the effectiveness of the measures and consider further actions on secondary pipeline capacity trading. Liquid and competitive wholesale spot and forward markets for gas in Australian gas markets which provide tools for participants to price and hedge risk. Access to regional demand markets through more harmonised pipeline capacity contracting arrangements which are flexible, comparable, transparent on price, and nondiscriminatory in terms of shippers’ rights, in order to accommodate evolving market structures. Harmonised market interfaces across Australian gas markets that enable participants to readily trade between locations and find opportunities for arbitrage and trade. Identified development pathways to improve interconnectivity between supply and demand centres, and existing facilitated gas markets, which enable the enhanced trading of gas. The COAG Energy Council tasked the AEMC to undertake the East Coast Wholesale Gas Market and Pipeline Frameworks Review, to assess the number, location and function of facilitated gas markets and gas transportation arrangements in eastern Australia. Officials are progressing short-term reform actions recommended in the AEMC’s Stage One Report. The COAG Energy Council is currently considering the AEMC’s draft Stage Two Report and will assess whether changes are required to existing facilitated markets and transportation arrangements, or whether new markets are required. AEMO is undertaking detailed design to implement a Moomba Gas Supply Hub by June 2016. A Moomba trading location will improve market signals via greater price transparency and competition at a key gas supply and transit location. The COAG Energy Council tasked AEMO to review the operation of the Wallumbilla Gas Supply Hub. In December 2015, the COAG Energy Council agreed to AEMO’s recommendation to implement the introduction of a voluntary single market via its ‘Optional Hub Services’ model. This is expected to improve liquidity at Wallumbilla by pooling buyers and sellers at a single location and providing participants with a mechanism to trade supporting services. The COAG Energy Council will consider the Australian Competition and Consumer Commission’s findings and final report from the East Coast Gas Inquiry which is due to be delivered in April 2016. Facilitated gas markets are an important risk management tool for gas market participants. The COAG Energy Council will progress agreed reforms from the AEMC Review for a long-term market development path toward achieving the Council’s Gas Market Vision. The Wallumbilla and Moomba Gas Supply Hubs will improve price transparency and could potentially support the development of a gas futures market, which will enable participants to manage and price risk. Removing Unnecessary Regulatory Barriers Regulation of gas supply and infrastructure is appropriate and enables participants to pursue investment opportunities, in response to market signals, in an efficient and timely manner. The Australian Government is committed to delivering a One-Stop Shop for environmental approvals that will accredit state planning systems under national environmental law. The One-Stop Shop policy aims to simplify the approvals process for businesses, lead to swifter decisions and improve Australia's investment climate, while maintaining high environmental standards. The Industry Growth Centres Initiative will boost the competitiveness and productivity by identifying opportunities to reduce regulatory burden as well as improve collaboration, engaging markets, and skills. The Oil, Gas and Energy Resources Growth Centre is due to start in early 2016. The COAG Energy Council’s National Harmonised Regulatory Framework for Natural Gas from Coal Seams provides guidance to regulators in the management of CSG and aims to ensure regulatory regimes are robust, consistent and transparent across all Australian jurisdictions. The third annual report was published in December 2015. Work with Growth Centres to continue to improve competitiveness and productivity. Continue to report and continuously improve the National Harmonised Regulatory Framework for Natural Gas from Coal Seams. Continue to pursue efforts to streamline environmental approvals processes that accredit states to make approval decisions under national environmental law. Abbreviations: AEMC – Australian Energy Market Commission; AEMO – Australian Energy Market Operator; BREE – Bureau of Resource and Energy Economics; CSG – coal seam gas; NGBB – National Gas Bulletin Board; LNG – liquefied natural gas; RIS - regulation impact statement; SCER – Standing Council on Energy and Resources (now COAG Energy Council)