Slides - Amine Ouazad

advertisement

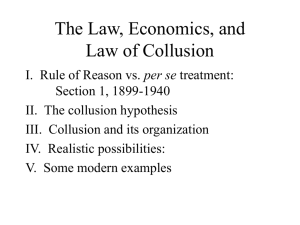

Prof. Amine Ouazad LLM in International Business Law, March 28 2014 Microeconomics/Industry Analysis Session #2: Collusion Outline for Session #2 1. Price & Quantity Wars: Strategic thinking 2. Sustaining Collusion 3. Deterring Collusion Price wars Interactions between markets Epson & HP 1989 Epson producing cheap inkjet printer HP producing high-priced laser printers Epson introduces cheap laser printer… Inkjet printer anyone? Put yourself in your competitor’s shoes: Chile’s shampoo war 1993: Unilever largest seller of shampoo (Sedal brand) 1993: Procter and Gamble introduces Pantene brand and capture market share equal to Sedal’s. P&G cuts prices to capture Sedal’s market shares. Outcome?? Strategic thinking in daily life The prisoners’ dilemma: Solutions? •Price wars •Quantity wars • OPEC •Lance Armstrong? • Anti-doping regulations •Nuclear Arms Race • START Treaty •Bank runs • Bank deposit insurance ➭Outcome? ➭Common issue? Why are Price Wars Dangerous? Example 1: Electronic phonebooks • 1986: Nynex charged $10,000 per disk for NY directory • ProCD and Digital Directory Assistance • Chinese workers at $3.50 daily wage • Bertrand or Price Competition → Free Example 2: Encyclopedia Britannica vs. Encarta 1991: EB sold @ $1,600 1992: Microsoft introduced Encarta, sold @ $49.95 1995: EB’s sales have halved 1995: EB offers online subscription for $120 p.a. or CD for $200 1996: EB lowers cost of subscription to $85 1999: EB offers FREE on-line service (www.britannica.com) Today: <$20 for DVD; $100 for online subscription Outline for Session #2 1. Price & Quantity Wars: Strategic thinking 2. Sustaining Collusion 3. Deterring Collusion A few players • Archer Daniels Midland United States • Ajinomoto Japan • Sewon South Korea • Kyowa Hakko Kogyo Japan ☞ January 1992: Face lowest prices in the history of lysine. Price Wars: Putting Numbers Dominant Strategy Ajinomoto High price Low price ADM 781.25 703.125 High price 586 Dominant Strategy 703.125 625 586 Low price 781.25 625 High prices lead to higher profits, but each firm has an incentive to deviate. The Cartel’s Implicit Contract • Agree on a higher price than the competitive price. • Agree on a lower production than the competitive productive. • Split the revenues among the cartel members. • Why did they start the collusion in the Spring?? Setting up a cartel • Participants in the cartel cannot enforce the terms of their implicit contract in a court of law. • Hence, they set up a punishment mechanism for cartel members who deviate. • Observe deviations from: • Trade statistics. • Customers’ reports. • Creation of a lysine trade association. Trigger Strategies to Enforce Collusive Outcome Begin by cooperating. I assume equal split of the production in the collusive agreement. Cooperate as long as the rivals do. Upon observing a defection: immediately revert to a period of punishment of specified length in which everyone plays non-cooperatively • Example • Grim Trigger Strategy (GTS) • Start off setting production at the low production level and continue to do so until the other firm cheats by producing more. • If the other firm cheats, set high output per year forever. Payoff Stream from Grim Trigger Strategy PV (collude) = 1 1 703.125 703.125+ 703.125+... = 703.125+ 1+ r (1+ r)2 r 1 1 625 781.25+ 625+ 625+... = 781.25+ 1+ r (1+ r)2 r 703.125+ PV (cheat) = Profit $781.25M $703.125M collude cheat $625M t t+1 t+2 t+3 Time “Monthly scorecards were prepared and discussed at quarterly meetings, based on reported sales volumes of each firm. To verify reported sales volumes, international trade statistics were available.” Collusion: Weighing Costs and Benefits • For punishment mechanism to work: • Gains from cooperation must exceed net gain from cheating and being punished • That is: • You would collude if PV of colluding > PV of cheating 703.125+703.125/r > 781.25+625/r → r < 1 (100%) • This condition always holds. • Key take-away point: If detection is certain and punishment is quick… • “Grim Trigger Strategy” can effectively deter cheating and ensure collusion • AND: Conditions on the Lysine market (e.g. only a few major players, frequent meetings, international trade statistics) were very conducive to trigger strategies working! Cheating or not Cheating? How many punishment periods? • The Grim Trigger Strategy is unforgiving. • Tit-for-Tat Strategy • Start off by cooperating (its nice!) • Cooperate if your rival cooperated in the previous period • Cheat for X periods if your rival cheated in the previous period • Back to collusion after X periods. • Tit for tat cooperates with cooperative opponents; punishes uncooperative opponents. • It is forgiving & easy to understand. Ajinomoto CEO: “cheating was frequent but the range of cheating was not too big ... they kept their promise about 90 percent. Something like that.” How long do you need to punish your partner to make him or her cooperate all the time?? Very impatient partner ?? Outline for Session #2 1. Price & Quantity Wars: Strategic thinking 2. Sustaining Collusion 3. Deterring Collusion How Did This All End? 1992 • Collusion between ADM and Ajinomoto. • Mark Whitacre (Matt Damon) is the Informant. 1995 • FBI raid at ADM’s offices. Price declines to the competitive price. U.S. Attorney General Janet Reno: "This $100 million criminal fine should send a message to the entire world.” Really?? 1996 • December : ADM & Ajinomoto executives indicted. Lost consumer surplus? Incentives to collude? • ADM Fined $100M. Additional legal costs of $640M. Extra Profit of collusion ?? 78.125+78.125/0.05 > $1b if done forever !! “The indictment and information further charge that the defendants and coconspirators: •Agreed to charge lysine prices at agreed-upon levels and to increase those prices accordingly. •Agreed to allocate among the corporate conspirators the volume of lysine to be sold by each. •Issued price announcements and price quotations in accordance with the agreements. •Participated in meetings and conversations for the purpose of monitoring and enforcing adherence to the agreed upon prices and sales volumes.” Fines […] “The defendants are charged with violating Section 1 of the Sherman Act, which carries a maximum fine of $10 million for corporations and a maximum penalty of three years imprisonment and a $350,000 fine for individuals. The fines for both corporations and individuals may be increased to twice the gain derived from the crime by the defendant or twice the loss suffered by the victims of the crime, if either of those amounts is greater than the statutory maximum fine of $10 million for corporations and $350,000 for individuals.” Collusion Profits & Cost for Consumers Lost consumer surplus? Cartel profits? P ($/lb) Total Cartel Profits Profit with competition Pm=$1.25 Supply P*=$1 Market Demand Qm =1875 Q* =2500 Q (lbs) Recent Cartels • ADM was involved in two other cartels: the citric acid cartel & the high-fructose corn syrup cartel. • Vitamin conspiracy. • Current investigations: • SIM card providers in Europe. • Elevators & Escalators in Europe: Schindler Holding. • Construction companies in South Africa. US/EU Leniency policy?