Monopoly

advertisement

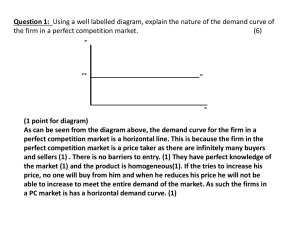

Lecture Notes Monopoly Market environment where there is only one firm in the market Firm faces ALL of demand So monopoly profit = p(y)y – c(y) Where p(y) = inverse market demand let p(y)y = r(y) revenue function Monopolistic problem: Choose y to Max r(y) – c(y) First order conditions are given by: MR = MC The same condition we got with perfect competition But now MR does not equal P (i.e. firms not price takers) Two effects of changing y (say increase y) on revenues 1-sell more so revenue increases 2-price decreases so revenue decreases ∆ r (y) = p ∆y + y ∆p ∆ r(y)/ ∆ y = MR = p + y ∆p/ ∆y or: For price takers ∆p=0 => ∆r = p ∆y But now P decreases as y increases so the second term matters. Now both 1 and 2 measure Marginal Revenue (MR) MR= ∆r/ ∆y = p + y ∆p/ ∆y = p(1 + (y/p)(∆p/ ∆y) = p(y) (1 + 1/ε) Since ε = price elasticity of demand = (p/y)(∆y/∆p) => can re-write optimal condition, MR = MC as: p(y) (1 + 1/ ε(y)) = mc (y) Or p(y) (1- 1/| ε(y)|) = mc (y) Since ε < 0 Also recall that | ε | > 0 elastic | ε | < 1 inelastic So that if demand elastic regions | ε | > 1 MR > 0 but if demand inelastic MR < 0 The above implies that the Monopolist only operates in elastic portion of Demand since MR < 0 when demand inelastic and profit max. requires MR = MC but MC < 0 is unlikely (impossible). Now with linear demand… P(y) = a –b y So R (y) = ay –by2 => MR= a – 2by Notice 3 things: 1. MR = D at y=0 2. slope of MR = 2 times the slope of demand (i.e., twice as steep). 3. MR = 0 where | ε | = 1 (this is always true not just for linear Demand) MC AC Pm D MR Ym y Look at tax example: suppose c(y) = cy => mc = c P(y) = a-by so MR = a -2by Now suppose a tax on the monopolist = t (quantity tax) so pc = ps + t So mc w/ tax is c + t or c(y) = (c+ t)y => before profit max where c = a -2by Or y* = a-c/2b Now MC = c + t = a – 2by = MR So y* = (a-c-t)/2b => Δy/ Δ t = -1/(2b) (why?) What is the impact of the tax on price, p? Recall slope of demand function = Δp/ Δy = -b, so The tax is imposed => y changes by -1/(2b) then The price changes by – b, the overall impact is both of these together, Or – b times -1/(2b) = -1/2 Interpretation: if t increases by $1 => price increases by $.50 pt P* C+t MC = C MR Yt D y* But note that p may actually increase more than by the amount of tax. See book for example Now look at efficiency and compare to perfect competition Again assume MC = C (constant returns) in the long run Produce at (pm, ym) Deadweight loss to society Pm MC=LRAC Pc=c MR Ym D yc But competitive firms would produce at MC = D Or (pc, yc) which is the point that maximizes net surplus to society. Or if upward sloping LRMC Deadweight loss to society Pm MC Pc MR Ym D yc => appears that monopolist is inefficient (i.e. does not max society’s net surplus) Public policy: may be to get rid of monopolies (1) contestable markets i.e. free entry => if profit > 0 more firms enter so profit = o even with one firm. (2) economies of scale and scope Consider natural monopoly (economies of scale) Pm Pt LRMC LRAC MR Ym D Only one firm can cheaply produce given demand but (1) if p=mc=Pso(socially optimum price) Firms makes a loss and leaves (2) if p=pm => deadweight loss (3) if p=AC=pf (fair price) still a loss in profit but firm can operate But if break up of monopoly: Pc > Pm > Pf >Pso => competition is not more efficient due to economies of scale. Same may to be true due to economies of scope. Price Discrimination 3 different types A. Perfect price discrimination—price the monopolists sells is just equal to your willingness to pay => With no price discrimination produce at (pm, ym) but this assumes no ability to discriminate Pm Pe MC D MR Ym Ye Now perfectly discriminate => D=MR and produce at Yc which is efficient (assuming $1 to producer is the same as $1 to consumer since CS=0) 2nd degree Price Discrimination Pi= f(yi) i.e. how much you pay depends on your consumption Examples: utilities, bulk discounts for large purchases 3rd degree price discrimination-different groups get different prices but individuals within a group get the same price Most common type: Examples 1. movie theatre discounts (kids v. adults) 2. local ski discounts (locals v. non-locals) More formally suppose 2 groups with different demand => max P1 (Y1) Y1 + P2 (Y2) Y2 – C(Y1 + Y2) by: MR1 – MC(Y1 + Y2) = 0 MR2 – MC(Y1 + Y2) = 0 Combine to get MR1 = MC(Y1 + Y2) = MR2 or P1 [1- 1/| ε1 |] = MC (Y1 +Y2) = P2 [1-1/| ε 2|] If P1 > P2 => [1-1/| ε 1|] < 1 – 1/| ε 2| or 1/| ε 1| > 1/| ε 2| or | ε 2| > | ε 1| i.e. for P1 > P2 demand for group 1 must be more inelastic Graphically, assume C= MC Group 1 Group 2 P1 D1 C P2 C MR1 Y1 MR2 Y2 D2 Innovation—monopolies have more incentive to innovate (at least this is the argument) Define innovation Just a decrease in MC to MC2 assuming constant returns P MC1 MC2 Q What are the incentives to innovate for monopoly? I.e. increase profit due to innovation = shaded area. Why? P MC1 MC2 MR D Y What are incentives to innovate for perfectly competitive industry? None unless (1) innovative technology is secret or (2) a patent system exists Under a patent system what is the incentive? What are increased profits to patent holder? 1st what does patent holders MR curve look like? As long y < y* MR = C ; i.e. he’s a price taker. P MC1 C MC2 C1 D Y* Q P C C1 C* MR Y* D Y But if y > y* the firm becomes sole supplier R= p(y)y so MR is downward sloping and determined by D when y > y*. Note: as long as C > C* ; y = y* in the market. This is a small innovation. But if C < C* so y > y* then this is a large innovation. Now just look at a small innovation (i.e. y = y* before and after innovation) P Incentive to innovate to competitive industry C C2 MR D Y Notice that the incentive to innovate for a competitive industry is greater than for a monopoly because output is larger for the competitive firm. Q: What if economies of scale in innovation (i.e. small firms in competitive industry don’t have resources to innovate) A: Firms specialize in innovating, gain patents and license to small competitive firms Example: agriculture where innovating is done by Universities Seed companies Etc. Monopolistic Competition Characteristics Large numbe r of potential sellers All small relative to market Differentiated product Easy entry and exit The short-run looks like a monoply Profit MC Pm MR Ym ATC D Profit can also be negative or zero in the short-run. If negative => firms exit if p< avc. Long-run equilibrium is just like for competition: If profit > 0 => entry which drives profit down. If profit < 0 => exit which drives profit up. Therefore, long-run equilibrium is where profit equals zero, where no exit or entry. MC ATC Po Pc MR Qo Qc D Notice that at Equilibrium but P > MC Resource Allocation & Efficiency Since MSC does not equal MSB or MSB > MSC => inefficient p.c. firm would produce the efficient amount. Might be efficient if benefit from different products > Cost of producing different products => in long run (1) each firm is on its demand curve (2) each firm chooses y to max profit (3) entry forces profit = 0 (4) P > MC => inefficient