here - The Thurlows

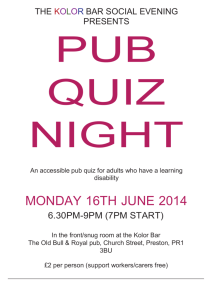

advertisement

The Thurlow Cock Business Plan January 2016 Executive Summary The Thurlow Cock was registered as a Community Asset in July 2015 by Little Thurlow Parish Council which effectively means the community (or any local community interest group) has a right to bid on the pub before it is sold. On the 27th August 2015 the Parish council was formally notified that the pub was on the market for £300,000 which gives any interested community group six weeks to lodge a non-binding expression of interest. This expression of interest was actioned on the 29th September 2015 following support and approval at a meeting of over 21 villagers in Thurlow Village Hall. It was agreed at this meeting that a steering committee be formed to investigate how the pub may be purchased by the community interest group. If funding was then deemed achievable, and the business viable, the committee would then formally propose a bid for the pub. Under the Community Asset rules any community group has a right to bid on the pub before the deadline of the 27th February 2016. During this moratorium period the owner can continue to market the pub as they see fit but may not exchange contracts other than with a community interest group. However, there is no first right of refusal for a community interest group and, after the 27th February 2016, the owner can sell to who they wish. Loss of the pub would be seen as a disaster for many residents of the village and could have a negative effect on house prices and the attractiveness to people considering renting or buying in the area. This is particularly felt after the recent loss of the post office and village shop. The steering committee have consulted with local experts and believe that the pub business could be profitable with the right offering as outlined in this document. The steering committee have considered the options with a view to meeting the objectives of: o o o Financial viability Retaining The Cock as a village pub Improved sustainability A good food offering will be key to the sustainability of The Cock to bring in custom from outside of the village so that is seen as a destination pub as well as a pub serving the local community. According to the British Beer and Pub Associations annual guide to costs, the highest levels of Gross Profit are achieved by rural destination pubs and food-led pubs. The steering group have agreed that the best way to purchase The Cock is to set up a Limited Liability Company. The company would appoint a manager who would run the day to day operation of the pub while embracing the mission objectives and values at its core. The manager would report to a small board of directors nominated by shareholders. Tax paying investors would qualify for a 30% return on their investment through the Enterprise Investment Scheme (EIS). To achieve the purchase of the pub and upgrade the facilities the company would issue shares at a price of £250 per share to local residents of the surrounding villages and friends of The Cock. No one person would be allowed to buy more than 30% of the shares sold in order to avoid loss of control and to conform to the rules of the EIS. The total sum to be achieved by the share offer is £400,000. This would cover the purchase of the freehold of building, some light decoration of facilities and the initial working capital required to run the business. The financial structure suggested would comply with the Enterprise Initiative Scheme (EIS). This scheme enables personal tax relief of 30% on the investment made provided the asset is held for a period of three years, as well as Capital Gains and Inheritance tax benefits. The following pages set out the proposal in more detail and the document will be circulated to interested parties in order to raise the necessary funds. IT SHOULD BE STRESSED THAT THIS DOCUMENT IS NOT AN OFFER FOR SHARES. IF A BID IS ACCEPTED A SEPARATE DOCUMENT WILL BE ISSUED TO ALL INTERESTED PARTIES. Contents 1. The Opportunity 2. The Market 3. The Cock Inn property 4. Ownership 5. Management 6. Financial estimates 7. Development 8. Risks 1. The Opportunity The current owner of The Cock is retiring and wishes to sell the pub. Being listed as a Community Asset gives Community Investment Groups like ours the right to bid on the pub before it can be sold to anyone else. This moratorium runs out on the 27th Feb 2016. Although the pub’s turnover has dipped over the last year or so we have spoken to local existing pub and restaurant experts who believe that the pub can be turned into a profitable business. More and more pubs are now being purchased by the community and run successfully. Examples in our locality are The Star at Lidgate, The Green Man at Thriplow, The Dykes End at Reach, The Green Man at Toppesfield and The Brook Inn at Washbrook. Apart from the garage in the high street there are no longer any community-based businesses left in Thurlow or the Bradleys. To lose The Cock Inn would leave a gap in community life and reduce the amenities in the villages. The pub is located in the heart of the village surrounded by residences in an area of outstanding countryside complete with Stour Valley walks popular with ramblers. The village is on the route to Newmarket and Bury St Edmunds as well as being just four miles from West Suffolk’s biggest and growing town: Haverhill. It is proposed that the pub should be bought by a newly-formed company (name to be confirmed) which will be funded by a share issue to local people and others. This will enable it to be run on a commercial basis to ensure financial viability whilst being under community control. Mission statement: To run a profitable pub with the appeal of a large town business at the heart of a Suffolk village. to continue The Thurlow Cock as a family friendly English pub to become a destination pub for dining to operate a community focussed pub which is actively involved in hosting or participating in local events to maintain and improve the property provide a financial return to investors incentivise shareholders through a discount scheme longer term goals are to look at reinstating a post office service from the pub, to offer an essentials shopping service (e.g. bread, milk, tea), to offer a café style environment during week days Proposed Values: The company would be part of the Thurlow and Bradleys community and would be accountable to the community through the appointed board and shareholders. It aims to be an active centre for the community. The company will be run in a way which listens to the wishes and concerns of local people irrespective of whether they are shareholders. Major decisions on investment and development will be widely consulted on. 2. The Market The UK has lost 21,000 pubs since 1980. Half of these closures have taken place since 2006 with analysts expecting thousands more to close before the decade is out. The peak in pub closures came in 2009, with 52 pubs shutting down each week, but pubs were still closing at a rate of 31 a week in mid-2014, according to the Campaign for Real Ale (Smithers, 2014). Going to the pub is not the national pastime it used to be. Price competition from supermarkets, tax rises and the smoking ban has helped drive sales away from pubs. But it is not all gloom and doom! A recent review of the industry identified five positive themes: • Customers are starting to take notice of the loss of pubs, are recognising the sense of community, and are prepared to act on it. • There is a sense of cautious optimism amongst the surviving pubs; closure rate is slowing, the weak have gone and there are even a few new openings. • Those that have made it through the recession and credit crunch may be well placed for the recovery and growth. • Pub food has really improved and there is significant potential for growth with 60% of people ordering food when they visit pubs. • Customers are looking for a wider mix of products with a revival of cask ales and craft beers, greater attention to wines, interest in premium soft drinks, popularity of speciality coffees; all of this creates less dependency on lager and the potential for a higher margin. Other recent market research has indicated these strengths and opportunities for pubs: Eating out remains a top consumer spending priority with the UK’s pub catering market expected to grow in value from £6.57bn to £7.7bn by 2017, according to Mintel. Innovating, for example, by offering restaurant-style food, can support a perception of pubs as a place to go for special occasions. Meanwhile, ensuring their coffee offer is good quality and in step with current trends should enable operators to tap into the lucrative out-of-home coffee market. Growth opportunities still exist in, for example, breakfast/café culture sector or takeaways. Food festivals and themed evenings offer a way to boost eating out frequency. The community population of Thurlow (Great and Little) is approximately 430 and Bradley (Great and Little) is around 460. The Cock is the last pub in these villages. In addition it is close to the local village of Withersfield (450) which is served by the White Horse pub (now named 'Bradmans') and the growing town of Haverhill (27,000). The food offering for this population is quite poor with very few well regarded restaurants in the area (The Black Bull Inn at Balsham being the nearest pub/restaurant with an AA rosette). With more and more profit being generated through food this is an area key to our pub’s sustainability. 3. The Thurlow Cock – Property The following details are taken from Everard Cole Estate Agent. Further details and photos can be found here… http://www.everardcole.co.uk/find-a-property/property.php?id=66 Built in the 16th century and former coaching inn, the Thurlow Cock is an attractive freehold pub in an unspoilt Suffolk village. Key Points 2,690 sq ft Gross External Area - (250 sq m) Character period property w/ garden and dedicated parking. Site area- 0.57 acres (approx) Refurbished dining area with c.50 covers and separate open plan bar Vacant Possession is available The Thurlow Cock is prominent detached property in the centre of the village of Thurlow. The trade area is generally open plan with exposed timbers, wooden and tiled flooring and has many period features, including 2 open fireplaces. The dining area comprises a central wooden bar servery with loose seating throughout as well as a rear snug area, and further office/storage area which is currently unused for trade purposes, as well as male and female WC's to the rear. The trade kitchen is situated to the rear as well as access to the basement cellar. The private accommodation consists of 2 double bedrooms, 1 single, living room, utility room and bathroom. All these rooms are situated at 1st floor level with separate access from the rear. Externally the building provides a dedicated tarmac car park (20+ spaces) as well as rear grassed trade garden, patio and timber outbuilding, which could provide further accommodation, or function room, subject to the necessary consents. The area of the site, as measured from digital mapping, is approximately 2,311m² or 0.57 acres and the ground floor footprint of the public house extends to 250m² or 2,690ft². There is adequate space in the extensive grounds to build letting rooms, subject to the necessary consents. Before a bid is put in to buy the property an independent valuation of the pub will be carried out to assess its value and identify any future problems. 4. Ownership The company will be owned by a broad range of investors with most expected to be living locally. Profits will initially be used to improve the operation of the business. Subsequently investors will be rewarded via dividends. The company will hold an AGM for all shareholders and will hold further meetings during the year to report on progress and discuss plans. Funding: The intention is to raise the £400,000 required to purchase the property and enable enhancements to take place and to also provide working capital. VAT and Stamp Duty can be claimed back from any purchase but will need to be paid upfront. In order to avoid too much influence by any one individual, no shareholder (including close family) will be able to buy more than 30% of the company. Should the company be unable to raise the full amount efforts will be made to find other options including obtaining community grants/ loans for the shortfall. Funds committed to the project will be held in a solicitors client account and would be returned in full in the event of the venture not proceeding. Assets: The Company will own the freehold of the pub and land as shown on the Land Registry map. Furnishings and fittings as well as trading stock will be purchased separately. Over time it is expected that a growing reputation and improving profitability will further enhance the value. Tax Benefits: The company is expected to qualify for the Enterprise Investment Scheme (EIS) which provides for income tax relief of 30% of the amount invested. In other words a tax payer investing £1000 would be able to claim back £300 in that tax year from HMRC. There are also capital gains and inheritance tax benefits using EIC as well as being able to reduce tax liability on bank interest. Potential investors should go to the HMRC website, http://www.hmrc.gov.uk/eis/ for further information as well as consulting a tax advisor on these aspects. The EIS scheme requires that approval is sought by the company from HMRC after four months of operation. There are no difficulties expected in obtaining approval. 5. Management It is proposed that the shareholders will elect a Board of Directors comprised of five members. Any shareholder will be eligible to become a board member. The directors will retire on a three year cycle agreed at the first General Meeting. A retiring Director may seek re-election. These aspects will be set out in the Memorandum and Articles of the Company. The Chairman of the Board will be elected by the directors. The role of the Board will be to oversee the operation of the business. The Board will appoint the manager who will have full operational responsibility for the pub and the delivery of the annual financial targets set by the Board. We will seek expert advice during this process to ensure the right person/couple are chosen who best meets the ambitions and goals of the mission statement. While it is the responsibility of the Board to establish the strategy for the business, as a community venture, the Board will work in a way which is consultative with both shareholders and the wider community. 6. Financial Estimates We have not been able to look at the books of The Cock but have seen recent turnover figures. Anyone who knows the pub or lives in the village will be aware that customers have stopped supporting the current owners. Buying the pub will effectively be like starting a new business so although disappointing, it is the committees belief that the lack of figures is an inconvenience rather than a problem. The following financial estimates have largely been taken from national averages for a rural pub based on a starting turnover position of £5k a week. We have compiled this in conjunction with expert advice and are seen as realistic by the steering committee. Yr1 Yr2 Yr3 Total Drink Sales £135,460 £142,233 £149,345 Total Food Sales £123,500 £135,850 £149,435 Total Sales Turnover (excluding VAT) £258,960 £278,083 £298,780 Cost of Drinks £63,180 £64,760 £66,378 Cost of Food £47,060 £48,942 £50,900 £110,240 £113,702 £117,279 £148,720 £164,381 £181,501 57% 59% 61% £86,234 £94,634 £103,034 £1,617 £2,000 £2,500 £14,144 £15,144 £15,644 Insurance £2,236 £2,236 £2,236 Waste Disposal/Cleaning £3,224 £3,524 £3,224 £936 £936 £936 Professional fees £3,536 £3,536 £3,536 Repairs and renewals £5,252 £5,252 £5,252 £468 £468 £468 Bank Charges £2,184 £2,184 £2,184 Marketing/ Promotion/Telephone £3,640 £4,640 £4,640 Other Costs £5,772 £5,772 £5,772 £129,243 £140,326 £149,426 £19,477 £24,055 £32,075 £3,895 £4,811 £6,415 £15,582 £19,244 £25,660 Total costs (excluding VAT) GROSS PROFIT (excluding VAT) GROSS Margin OVERHEADS (excluding VAT) Wages and Salaries Rates Utilities Consumables Equipment Hire NET PROFIT Taxation @ 20% Interest Payable to Investors/Dividends RETAINED PROFIT The figures above assume 50/50 split in sales between wet (drinks) and dry (food) in Year 1 with a 5% increase in Wet and 10% increase in Dry sales in Year 2 and Year 3. This is in line with an improved food offering as highlighted in the Mission Statement. This would have a positive impact on profits and give a realistic gross margin of 60.7% in Year 3. Dividend policy The company will pay dividends to shareholders from profits after payment of all costs & repayment of any debts due. It is currently proposed that a policy will be put in place to pay around half of the profits after taxation in dividends and retain half in the company. To comply with EIS no dividends will be taken until Year 4. The target for dividends is 20% in Year 4 rising to 25% in Year 5 and then to continue increasing in 5% chunks until 50% is achieved. It is proposed that all dividends will be subject to a minimum fund of £25,000 remaining in the bank to cover emergencies. This allows the company to build a significant fund for any improvements or emergencies whilst scaling the dividend up from Year 4 will incentivise share ownership over the longer term. Dividends will be proposed by the Board at the Annual General Meeting of the shareholders who will be asked to approve them. Further financial advice will be sought on dividends and will be included in any share offer. 7. Developments Today anyone walking into the Thurlow Cock will find a very attractive pub (see photos on the estate agent link). The committee do not initially expect to spend a significant amount of money on refurbishment but will want the new manager(s) to drive trade through embracing and delivering on the measures laid out in our Mission Statement. A full survey will be conducted on the pub before any purchase is made. However it is worth mentioning the following here as short and longer term requirements. Internal and External redecoration Improvement to toilet facilities Improvement to children’s play area Disabled friendly access from rear Improved beer offering Potential conversion of outbuilding to form restaurant Potential conversion of bedrooms into accommodation for guests Redevelopment work would be based on feedback from the management team, the board of directors and the performance of the pub with major decisions being discussed at an extraordinary shareholders meeting or the AGM. 8. Risks All investments carry an element of risk. This document has not been prepared by a qualified financial adviser and the figures have not been audited. Anyone considering investment may wish to discuss the risks with their own advisers. The following risks have been identified: The property could have structural faults or other defects. A professional surveyors report will be obtained prior to any investment being made. The title to the property. This will be checked and searches carried out by our solicitors. Failure to raise sufficient funds. In this event all funds will be returned in full. Key staff leave. We aim to ensure we employ a team whose goals closely match ours and work with us to turn The Cock into a thriving business. In the event of a key staff loss we will ensure that we bring in new people with the same ethos. Incentivising staff is fundamental to making the pub a success. The market risk. A large turnover decline could cause losses. Efforts will be made with the community to address the issues. The villagers do not support the pub. This has been an issue with the current owners. We believe that by offering a vibrant destination pub with a great food offering we will be less reliant on local ‘wet’ custom. We also believe from our market research in the village that there is overwhelming support for a pub in Thurlow and the local area and that by being community led it will help to drive business forward so that we can be proud together of what we have achieved.