0538467924_250100

advertisement

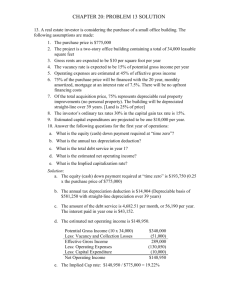

Concepts in Federal Taxation Hiring Incentives to Restore Employment Act The Hiring Incentives to Restore Employment Act (HIRE) increases the Section 179 deduction for 2010. This update explains the change and updates textbook problems that illustrate the change. Chapter 10 Section 179 Limits Increased The Hiring Incentives to Restore Employment Act (HIRE) increases the Section 179 Election to Expense deduction for qualifying property placed in service during tax years that begin after December 1, 2007 and before January 1, 2011. Property placed in service in tax years beginning after 2010 are not eligible for the increased Section 179 deductions. The Section 179 Election to Expense is increased to $250,000 (from $134,000). In addition, the phase-out of the deduction for excess investment is increased from $530,000 to $800,000. Thus, taxpayers who place less than $800,000 of qualifying property in service during a tax year beginning in 2010 will be able to expense up to $250,000 of the cost of the property. Section 179 Election to Expense Section 179 allows an annual current expense deduction for the cost of qualifying depreciable property purchased for use in a trade or business. The deduction for expensed assets is treated as a depreciation deduction. This election allows many small businesses to expense assets as they are purchased instead of depreciating them over several years. The immediate deduction promotes administrative convenience by eliminating the need for extensive depreciation schedules for small purchases. Qualified Taxpayers In 2010, individuals, corporations, S corporations, and partnerships may elect to deduct as an expense up to $250,000 in investment in qualified property to be used in an active trade or business. A husband and wife are considered one entity for purposes of the election to expense. Although the phrase ‘‘active trade or business’’ is not defined in the tax law, it appears to have the same meaning as the phrase ‘‘trade or business’’ (Chapter 5). The elements of profit motivation, regularity, and continuity of the taxpayer’s involvement in the activity and the absence of hobby, amusement, and similar motivations are important factors to consider when determining whether an activity qualifies for the Section 179 election. This interpretation is supported by the fact that the deduction is not allowed for assets purchased for use in an activity related to the production of income (an investment activity). However, the portion of a mixed-use asset that is used in a trade or business does qualify for immediate deduction under Section 179. Estates and trusts cannot use the Section 179 election to expense assets. The election is not available to these entities because they are formed to protect and conserve the entity’s assets for the benefit of the beneficiaries and not to operate an active trade or business. 2 Qualified Property The Section 179 expense deduction is allowed only on depreciable, tangible, personal property used in a trade or business. Examples of eligible property are trucks, machinery, furniture, computers, and store shelving. Real property, such as buildings and their structural components, does not qualify for the special election to expense. Also excluded from the deduction are land and improvements made directly to the land, such as a parking lot, sidewalks, or a swimming pool. In addition, qualifying property does not include intangible assets such as patents, copyrights, and goodwill. EXAMPLE 3 Kelly purchases a new computer and a new telephone system and installs a new roof and an air-conditioning system in her office building. Which of the expenditures qualify for the election to expense? Discussion: The computer and the telephone system are depreciable, tangible, personal property and therefore qualify under Section 179. The roof and the airconditioning system are integral parts of the office building. Therefore, they are real property and do not qualify for immediate expensing. Limitations on Deduction The Section 179 election-to-expense deduction is subject to three limitations: ■ A taxpayer’s annual Section 179 deduction cannot exceed the maximum annual limitation ($250,000 for 2010). ■ If the taxpayer’s investment in Section 179 property exceeds $800,000 for the tax year, the annual deduction limit is reduced by one dollar for each dollar of investment over $800,000 in 2010. For 2010, a taxpayer who purchases more than $1,050,000 of qualifying property may not take any election-to-expense deduction for any of the purchases. ■ The Section 179 deduction allowed for a tax year cannot exceed the taxable income from the active conduct of all the taxpayer’s trade or business activities. Annual Deduction Limit The annual deduction limit does not have to be prorated according to the length of time an asset is used during the year. The annual deduction limit applies to all tax entities entitled to use Section 179. Thus, the annual limit applies separately to a partnership and to its individual partners. The annual limit also applies separately to an S corporation and to its shareholders. Because the partnership and S corporation are conduit entities, a portion of the entity’s total deduction is allocated to each owner, who subtracts it as an expense on the owner’s personal tax return. However, the Section 179 deduction allocated to the taxpayer from the conduit entity plus the taxpayer’s Section 179 deduction from all other sources cannot exceed the annual limit. Any excess Section 179 election resulting from allocations from several entities must be carried forward to be used in subsequent years. 3 EXAMPLE 4 Roberto is a 50% shareholder and full-time employee of an S corporation. During 2010, the S corporation invests $324,000 in equipment qualifying for the Section 179 deduction. Roberto also owns a sole proprietorship that constructs kitchen cabinets. The cabinet business qualifies as an active business for Roberto. During 2010, he purchases $200,000 worth of equipment to use in his cabinet business. What is the maximum amount that Roberto can deduct as a Section 179 expense for 2010? Discussion: Roberto’s deductible Section 179 expenditures are limited to $250,000. The S corporation can elect to deduct $250,000 of its $324,000 in capital expenditures. The remaining $74,000 is subject to regular depreciation. The S corporation allocates $125,000 (50% × $250,000) of its Section 179 deduction to Roberto. Thus, Roberto’s qualified Section 179 expenditures total $325,000 ($125,000 from the S corporation + $200,000 from the cabinet business). However, the $250,000 annual deduction limit applies at the shareholder level as well as at the S corporation level. Therefore, Roberto may elect to deduct only $250,000 as a Section 179 expense. A taxpayer may choose to use all, part, or none of the annual deduction. By electing to expense less than the limit for a tax year, the taxpayer can avoid a Section 179 deduction carryforward resulting from either the annual limitation or the trade or business income limitation. EXAMPLE 5 Based on the information in example 4, how should Roberto allocate his Section 179 deduction in 2010? Discussion: Roberto should claim as a Section 179 deduction the $125,000 allocated to him from the S corporation plus $125,000 of the cost of the equipment purchased for use in the cabinet business. The remaining $75,000 cost of the equipment used in his cabinet business is depreciated using regular depreciation methods. If Roberto expenses the $200,000 worth of equipment he purchased for the cabinet business, he will lose $75,000 of the deduction allocated to him from the S corporation by exceeding the $250,000 annual limitation by $75,000 ($200,000 + $50,000 = $250,000) this year. The $75,000 carries forward to be used in subsequent years. Any amounts that flow to a taxpayer from a conduit entity should always be expensed under Section 179 before any amount is elected from another trade or business of the taxpayer. After an asset’s basis is reduced by the amount expensed under Section 179, the remaining basis is subject to regular depreciation under any valid method. EXAMPLE 6 Devra Corporation purchases a machine costing $300,000 for use in its business. Devra wants to expense $250,000 of the asset’s cost under Section 179. If Devra makes the Section 179 election to expense $250,000 of the asset’s cost, what is its depreciable basis in the machine? Discussion: Devra’s depreciable basis for regular depreciation is $50,000. The depreciable basis of the machine is its $300,000 cost, less the $250,000 it elects to expense under Section 179. The reduction of depreciable basis by amounts expensed under Section 179 is necessary to ensure that the total capital recovery on the machine does not exceed the $300,000 invested. 4 The Section 179 deduction can be allocated to reduce the basis of qualifying assets in any manner the taxpayer chooses. This allows the deduction to be allocated equally to all assets acquired during the year or to specific assets. This option is important. Two general rules apply to choosing assets to expense. First, do not use the Section 179 election to expense automobiles. As discussed later, automobiles are subject to annual depreciation deduction limits. For purposes of this annual limitation, the Section 179 expense is treated as a depreciation deduction. Because MACRS depreciation on most automobiles exceeds the firstyear annual limitation amount, using the election to expense on an automobile does not result in additional tax savings. Second, based on time value of money concepts, taxpayers should take the depreciation deduction as early as possible. This is accomplished by expensing the assets with the longest life and using regular depreciation methods to depreciate assets with the shortest life. EXAMPLE 7 Gwendolyn purchases equipment costing $250,000 and a computer system that also costs $250,000 for use in her business in 2009. Under MACRS, the equipment is 7-year property, and the computer system is 5-year property. How should Gwendolyn allocate her $250,000 Section 179 expense deduction? Discussion: If Gwendolyn wants to deduct the $250,000 maximum election to expense, she should elect to expense the $250,000 cost of the equipment (7-year property). The $250,000 cost of the computer system will be deducted over its 5-year life, resulting in greater deductions sooner than if she elected to expense the computer. Gwendolyn could elect to deduct less than the full $250,000 Section 179 limit. Because Section 179 is elective, Gwendolyn can decide how much to deduct and the specific assets to expense. This allows taxpayers who do not want or need the extra deductions in the current year to spread the deductions out through depreciation charges. Annual Investment Limit The annual deduction limit is reduced dollar for dollar by the amount of the investment in qualifying property in excess of $800,000. As a result of this limitation, a taxpayer who purchases $1,050,000 or more of qualified property during 2010 cannot expense any amount under Section 179. Because of the $800,000 annual investment limitation, only relatively small businesses can use the election to expense. EXAMPLE 8 During 2010, the Allen Partnership places $828,000 of Section 179 property in service for use in its business. What is Allen’s maximum Section 179 deduction? Discussion: Allen’s election to expense is reduced to $222,000 by the $800,000 annual investment limit. Because the partnership invested $28,000 more than the $800,000 annual investment limitation ($828,000 - $800,000), it must reduce the annual deduction limit dollar for dollar by the excess ($250,000 - $28,000 = $222,000). NOTE: The $28,000 lost through the annual investment limit is not carried forward to future years. It is lost forever. EXAMPLE 13 Bomhoff Inc. purchases office equipment costing $400,000 on April 1, 2010. What is Bomhoff’s depreciable basis in the office equipment? 5 Discussion: To maximize the 2010 cost recovery deduction, Bomhoff should elect to expense $250,000 of the cost of the office equipment. This reduces the adjusted basis (and depreciable basis) of the equipment to $150,000 ($400,000 - $250,000). Basis Subject to Cost Recovery Depreciable basis is the asset’s original basis for depreciation less any amounts deducted under the Section 179 election to expense assets. Therefore, the basis rules discussed in Chapter 9 provide the starting point for computing the capital recovery deduction. An asset’s basis for depreciation does not have to be reduced by its salvage value. The depreciable basis of an asset is the amount of basis that is subject to depreciation and is the amount used to determine the annual depreciation deduction. The depreciable basis does not change during an asset’s tax life unless additional capital expenditures are made for the asset. The total capital recovered as a depreciation deduction over an asset’s useful life may never be more than its depreciable basis. Do not confuse the term depreciable basis with adjusted basis. Adjusted basis refers to the unrecovered capital of an asset at any point in time. An asset’s adjusted basis decreases as cost recovery deductions are taken. The capital recovery under MACRS does not necessarily relate to the true remaining useful life and salvage value of the asset. That is, an asset’s depreciable basis can be fully recovered, even though the asset remains in service and salvage value exists. EXAMPLE 14 In 2010, Estelle Corporation purchases office equipment costing $280,000 for use in its repair business. Because equipment is eligible to be expensed under Section 179, Estelle elects to expense $250,000 of the cost of the equipment. What is Estelle Corporation’s depreciable basis in the equipment? Discussion: Estelle’s initial basis in the equipment is $280,000. The election to expense reduces the depreciable basis to $30,000 ($280,000 - $250,000). The corporation recovers its $280,000 investment in the equipment through expensing $250,000 in the year of purchase and $30,000 in depreciation charges over the life of the equipment. If the office equipment had cost only $100,000 and Estelle elected to expense the entire $100,000 cost under Section 179, the corporation would fully recover its capital investment in 2010. The depreciable basis in the equipment then is zero, and the corporation is allowed no further capital recovery deductions on its initial $100,000 investment. However, the equipment remains in service and may provide several years of quality use. Depreciation Method Alternatives Under current tax law, taxpayers have three alternatives for calculating depreciation: ■ Regular MACRS ■ Straight-line over the MACRS recovery period ■ Straight-line over the Alternative Depreciation System (ADS) recovery period 6 Figure 10–2 illustrates these choices for depreciating personal property. A taxpayer decides which to use by first choosing whether to maximize or minimize the depreciation deduction in the year of acquisition. The taxpayer would maximize by using the Section 179 election, claiming the additional first-year depreciation, and using regular MACRS for the remaining depreciable basis. Regular MACRS depreciates property in the 3-, 5-, 7-, and 10-year classes using the 200-percent declining balance method with an optimal, automatic switch to straightline in the IRS percentage tables. Assets in the 15- and 20-year classes are depreciated using the 150-percent declining balance method. The taxpayer who needs a slower depreciation rate can minimize the deduction by using straight-line (S-L) MACRS or ADS. Because of the longer recovery period, ADS produces the smallest depreciation deduction. Taxpayers will need to elect not to claim additional first-year depreciation to secure the smallest depreciation deduction. EXAMPLE 22 On March 14, 2010, Lorange Mining company purchases a bus costing $400,000 to transport its employees from the parking area to the mines. What should Lorange do if it wants to recover its $400,000 cost as quickly as possible (i.e., maximize the cost recovery)? Discussion: To maximize cost recovery, Lorange should elect to expense $250,000 of cost under Section 179, leaving a depreciable basis of $150,000 ($400,000 − $250,000), which would be recovered using the regular MACRS 200% declining balance method over the 5-year recovery period for buses. The recovery period is found in Table A10–1 under the column labeled General Depreciation System. The regular MACRS method (using Table 10–4) provides the fastest depreciation write-off for the property’s depreciable basis: Initial basis Section 179 election Adjusted basis $ 400,000 (250,000) $ 150,000 Depreciable basis MACRS% (Table 10–4) 2010 depreciation $ 150,000 × 20% $ 30,000 Maximum cost recovery $280,000 ($250,000 + $30,000) EXAMPLE 23 Assume that in example 22, Lorange wants to recover the $400,000 cost as slowly as possible (i.e., minimize the cost recovery). Which options should Lorange elect? Discussion: The slowest cost recovery is obtained by not using Section 179 and electing to use straight-line depreciation over the ADS life of the property. The ADS recovery period is always greater than or equal to the MACRS recovery period. Table A10–1 shows that the ADS recovery period is 9 years for buses. Remember that the MACRS recovery period is 5 years. Thus, the use of the ADS life generally stretches the depreciation deductions over a longer period, thereby diminishing the deduction amounts for each year in the recovery period: Depreciable basis $400,000 Full-year S-L deduction ($400,000 ÷ 9) $ 44,444 Mid-year convention × ½ First-year depreciation $ 22,222 7 Problems 25. Firefly, Inc., acquires business equipment in July 2010 for $815,000. a. What is Firefly's maximum Section 179 deduction for 2010? Explain. b. What happens to any portion of the annual limit not deducted in 2010? Explain. c. What is the depreciable basis of the equipment? Explain. 26. In 2010, Terrell, Inc., purchases machinery costing $820,000. Its 2010 taxable income before considering the Section 179 deduction is $240,000. a. What is Terrell's maximum Section 179 deduction in 2010? Explain. b. What is the depreciable basis of the equipment? 30. Jennifer owns a 40% interest in the Thomas Partnership. She also owns and operates an architectural consulting business. During the current year, the partnership purchases $260,000-worth of property qualifying under Section 179 and elects to expense $250,000. Jennifer purchases $180,000-worth of qualifying Section 179 property for use in her architectural consulting business. Write a letter to Jennifer explaining what she should do to maximize her cost recovery. 37. The United Express Company begins business in August 2010 by purchasing the assets listed in the table below. Calculate the maximum MACRS depreciation on the assets. Asset Trucks Tractor units Office equipment Cost $200,000 60,000 100,000 38. Assume that in problem 37, the United Express Company sells a truck that cost $30,000 in 2010 for $10,000 in June 2013. Assume that none of the truck was expensed in 2010. Compute the adjusted basis of the truck and the gain or loss from the sale. 43. Dikembe purchases 4,000 breeding hogs for $320,000 in April 2010. a. What is his maximum 2010 cost-recovery deduction for the hogs? b. Dikembe's farming operation incurs a net loss this year and probably will next year before taking the cost recovery into consideration. What should Dikembe do in regard to his cost-recovery deductions? 8 44. Rograin Corporation purchases turning lathes costing $670,000 and a bus costing $280,000 in June of the current year. The lathes are 7-year MACRS property, and the bus is 5-year MACRS property. a. What is Rograin's maximum Section 179 deduction? b. Assuming that Rograin deducts the maximum Section 179 expense, what are the depreciable basis of the lathes and the bus? c. If Rograin wants to maximize its cost recovery this year, how much firstyear depreciation may it deduct in addition to the Section 179 deduction? 45. Baker, Inc., purchases office furniture (7-year MACRS property) costing $280,000 and a computer system (5-year MACRS property) costing $280,000 in 2010. What is Baker's maximum cost-recovery deduction in 2010? (Hint: Maximize the Section 179 election effect.) 48. The Gladys Corporation buys office equipment costing $290,000 on May 12, 2010. In 2013, new and improved models of the equipment make it obsolete, and Gladys sells the old equipment for $34,000 on December 27, 2013. a. What is Gladys Corporation's gain or loss on the sale assuming that Gladys takes the maximum cost-recovery deduction allowable on the equipment? b. What is Gladys Corporation's gain or loss on the equipment assuming that Gladys takes the minimum cost-recovery deduction allowable on the equipment? From Chapter 11 61. The Gladys Corporation buys equipment (7-year MACRS property) costing $290,000 on May 12, 2010. In 2013, new and improved models of the equipment make it obsolete, and Gladys sells the old equipment for $34,000 on December 27, 2013. a. What is the character of Gladys corporation’s gain or loss on the sale assuming that it takes the maximum cost-recovery deductions allowable on the equipment? NOTE: The depreciation calculations for this problem were done for problem 48, Chapter 10. b. What is the character of Gladys Corporation’s gain or loss on the equipment assuming that it takes the minimum cost-recovery deduction allowable on the equipment? 9 49. In June 2010, Copper Kettle, Inc., purchases duplicating equipment for $350,000. a. Compare cost recovery deductions using maximum, minimum, and intermediate methods over the recovery period of the equipment. b. Explain why Copper Kettle, Inc., would elect to use each of these methods.