Slide 1

advertisement

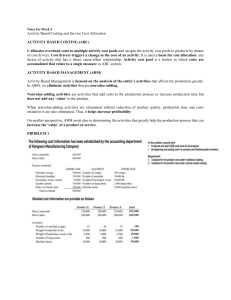

CHAPTER 5 Activity-Based Costing and Activity-Based Management Problems with One Overhead Pool • In the last chapter, the author indicated that one overhead pool can lead to less accurate cost allocation if the overhead is actually incurred in a non-uniform fashion by each product. • This is known as Peanut-Butter costing. You are spreading cost evenly across all products when in fact some products create greater or lesser amounts of overhead. Product Cross-Subsidization • Undercosting – product consumes a lot of resources but has little MOH allocated to it. Set price too low – may actually lose money on these. • Overcosting – consumes fewer resources than the allocation of MOH would suggest. Set price too high – you may lose market share as competitors enter the market with a lower selling price. Refinements in Overhead Costing • Want to tie costs incurred to cost objects more accurately • 3 Improvements Increase direct cost tracing - pull costs out of overhead and trace to products Increase number of indirect cost pools - so that all costs in a pool have the same relationship with the cost allocation base Identify appropriate cost-allocation bases for each indirect cost pool (cause and effect) Why is this so important? • Refinements in our cost systems are needed more now than ever. Increases in diversity of product lines and mass customization Increase in indirect costs as a % of the total product cost Price competition • Advances in computer technology allow us to create better cost systems. Activity-Based Costing • A system that deals more effectively with allocation of overhead • Utilizes more cost pools/ allocation bases • Cost pools reflect activities taking place Purchasing all raw materials, set-up costs, design costs • Allocation bases are units of the activity # of parts purchases, # of different parts # of setups Cost Hierarchy • We gather costs into pools based on the following hierarchy of costs. Unit-level costs Batch-level costs Product or Service sustaining costs Facility sustaining costs Unit Level Costs • Some costs vary as the # of units completed vary. Direct costs are examples of unit-level costs Machine operating costs increase as the number of products worked on increases machine hours might the appropriate driver to use. Batch-level Costs • Some costs are increased not by the # of units but by the # of batches. Machine set-up, recalibration, tool and dies, reprogramming CAD/CAM computers for each custom order, etc. • These costs don’t vary by direct labor hour, but they vary as the # of batches vary. We want a cost allocation base that reflects the batches. Product Sustaining Costs • We incur costs to sustain a particular product or service. Manufacturing: design costs of new product College: costs incurred to bring a new program on line Accounting: costs incurred to provide a new service (Web Trust) • Allocation base must reflect the # or complexity of products or services Facility Sustaining Costs • These represent broad-based costs of running a particular facility utilities, rent of space, depreciation of the building • It doesn’t make sense to allocate these costs on the basis of a unit-level driver, so we might use floor space per department as the initial allocation method. Activity-Based Costing • What kinds of companies would benefit from ABC? Those with multiple products consuming different amounts of indirect costs Those with complex, varied operations Those in highly competitive environments where cost control is critical Those with access to accounting and information systems expertise How to Implement ABC • Understand the activities in your facility • Categorize the activities into different cost hierarchy • Select the allocation base which explains the cost of the various activities identified • Compute allocation rates • Allocate costs to products • Used revised data in the decision process Activity-Based Costing • Disadvantages Availability of reliable data - we may need to redesign the information system to get what we need Cost to design and implement are higher Some costs may feed into multiple activities. Shared costs must be allocated to activities first then to products ABC and ABM • ABC improves product costing. ABM uses ABC data to improve customer satisfaction and profitability. • ABM allows us to make better pricing and product mix decisions reduce costs and improve processes now that we understand our costs • design changes that might lower costs without affecting product quality and performance more effectively plan and manage activities • more effective evaluation of performance Keep on rollin’…