Chapter7

advertisement

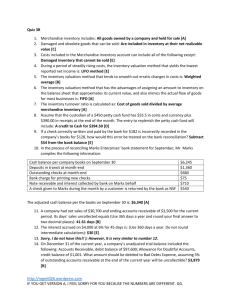

Accounting Fundamentals Dr. Yan Xiong Department of Accountancy CSU Sacramento The lecture notes are primarily based on Reimers (2003). 7/11/03 Chapter 7: Sales and Collection Cycle Agenda Control Procedures for Cash Bank Reconciliations Accounts Receivables and Bad Debts Other Accounting Issues Agenda Control Procedures for Cash Controlling CASH Cash has universal appeal and ownership is difficult to prove. Both cash receipts and cash payments should be recorded immediately when received and made. Checks should be prenumbered and kept secure. Safeguarding Cash Separation of duties Different people receive and disburse the cash. Procedures for the record keeping of cash receipts and disbursements are separate. Handling the cash and record keeping are completely separate. Procedures To Have In Place Both cash receipts and cash payments should be recorded immediately when received and made. Keep cash under strict physical control, and deposit cash receipts daily. Have separate approvals for purchases and the payment for those purchases. Procedures Use pre-numbered checks, and keep a log of electronic transfers. Payment approval, check signing, and electronic funds transfer should be assigned to different individuals. Bank accounts and cash balances should be reconciled monthly. Accounting For Cash: Reconciling The Bank Statement An important part of internal control Need for calculating a true cash balance Two “sides” to be reconciled balance per bank balance per books If there are any mistakes or transactions that have not been recorded in the company’s books, the company’s records should be updated. Agenda Bank Reconciliations Terminology Bank statement Monthly report prepared by bank that contains details of a company’s deposits, disbursements, and bank charges. Bank reconciliation Report prepared by the company after receiving the bank statement that compares the bank statement with the company’s records to verify the accuracy of both. More Terminology Outstanding check A check written by the company that has been recorded on the company’s records but has not yet cleared the bank Deposit in transit A deposit that the company has made and recorded, but it has not reached the bank’s record keeping system yet. More Terminology NSF check A “bad” check written by a customer that must be deducted from the company’s records. The company recorded the check as a cash receipt (and then deposited it), but the check writer didn’t have the money in his or her account to cover it. The bank will have already deducted it from the company’s balance (in the bank’s records), but the company will have to make an adjustment to their records. More Terminology Credit memo An addition to the company’s balance in the bank’s records for a reason such as the bank having collected a note for the company (from a third party who owed the company). Debit memo A deduction from the company’s balance in the bank’s records for a reason such as a bank service charge. An Example Of A Reconciliation Given the following information: Balance per bank at 4/30 Balance per books at 4/30 Outstanding checks at 4/30 Bank service charge for April Deposit in transit at 4/30 Customer’s NSF check (returned with bank statement) Bank collected note receivable company $8,750 6,900 1,380 30 400 100 1,000 for Balance Per Bank Section Of The Reconciliation Balance per bank Plus: Deposit in transit Less: Outstanding checks Cash Balance at 4/30 $8,750 400 (1,380) $7,770 Balance Per Books Section Of The Reconciliation Balance per books $6,900 Plus: Note collected by bank 1,000 Less: NSF check returned (100) Service charge ( 30) Cash balance at 4/30 $7,770 Bank Reconciliation: Necessary Entries to Correct Account Balances How would the collection of the note receivable be recorded in the journal? Date Transaction Apr 30 Cash Note receivable Debit Credit 1,000 1,000 Bank Reconciliation: Necessary Entries to Correct Account Balances How would the NSF check and the bank service charge be recorded in the journal? Date Transaction Apr 30 Accounts receivable Operating expenses Cash Debit Credit 100 30 130 There Is One True Cash Balance Bank balance per statement is reconciled to the TRUE cash balance Book balance (company’s records) is reconciled to the TRUE cash balance Cash (Bank) Reconciliation Has Two “Independent” Parts Balance per bank ++ deposits in transit ++ -- outstanding checks -True cash balance Balance per books ++ collections for us made by the bank ++ -- NSF checks (from customers) -- Service charges True cash balance Agenda Accounts Receivables and Bad Debts Accounts And Notes Receivable A/R are the expected future cash receipts of a company. They are typically small and are expected to be received within 30 days. N/R are used when longer credit terms are necessary. The note specifies the maturity date, the rate of interest, and other credit terms. Value Of Receivables Receivables are reported at their face value less an allowance for accounts which are likely to be uncollectible. The amount which is actually expected to be collected is called the net realizable value (NRV). GAAP requires that A/R be reported at NRV. Two Methods GAAP Not GAAP Allowance Method Direct Write-Off Method A/R Method Sales Method Used only when bad debts are a very small item or when credit sales are insignificant. The Most Common Method Allowance method Estimate the bad debt expense as an adjustment when it is time to prepare the financial statements. Record the amount as a reduction in ACCOUNTS RECEIVABLE, even though you don’t know whose accounts will be “bad.” Allowance Method, continued We will base the estimate on: Sales, or Accounts Receivable This method attempts to match the expense (bad debt) with the revenue (sale) by recording the expense in the same period as the sale even though the company has not specifically identified which accounts will go unpaid. The Other Method Direct Write-Off No estimates of bad debts are made. Only when a specific account is known to be uncollectible (customer files bankruptcy, for example) is bad debt expense recorded. This doesn’t do a very good job of matching the revenue (sale) with the expense (bad debt), because a company often discovers an account is uncollectible in a period subsequent to the one in which the sale was made. How Do We Report A/R On The Balance Sheet? Net Realizable Value of AR = what we expect to collect On the balance sheet: Accounts Receivable less allowance for uncollectible accounts $3,000 Net AR $2,800 (200) 1. On April 1, provided $5,000 Services On Account. How would providing services on account be recorded in the journal? Date Transaction Apr 1 Accounts receivable Service revenue Debit Credit 5,000 5,000 2. On April 15, Collected $4,000 Cash From Accounts Receivable. How would the collection on account be recorded in the journal? Date Transaction Apr 15 Cash Accounts receivable Debit Credit 4,000 4,000 3. Adjusting Entry Booked To Reflect The Estimate Of 5% Of Ending A/R To Be Uncollectible. How would the adjusting entry be recorded in the journal? Date Transaction Debit Credit Dec 31 Bad debt expense 50 Allowance for uncollect. accts. 50 Financial Statements At The End Of Year 19X4: Income Statement For the year 19X4 Sales Bad debt expense Net Income $5,000 50 Statement of Cash Flows For the year 19X4 Cash from operations $4,000 Cash from investing -0Cash from financing -0- $4,950 Total change in cash $4,000 Balance Sheet At 12/31/X4 Assets: Cash AR 1,000 Allowance Net A/R Total Assets Liab. + Equity: $4000 (50) 950 $4,950 RE $4,950 $4,950 1-b. On Feb 5, wrote Off A $40 A/R That Was Determined To Be Uncollectible. How would the actual write-off of accounts receivable be recorded in the journal? Date Transaction Debit Credit Feb 5 Allowance for uncollect. accts. 40 Accounts receivable 40 1. On March 8, Provided $6,000 Services On Account. How would providing services on account be recorded in the journal? Date Transaction Mar 8 Accounts receivable Service revenue Debit Credit 6,000 6,000 2. On March 23, Collected $4,500 Cash From Accounts Receivable. How would the collection on account be recorded in the journal? Date Transaction Mar 23 Cash Accounts receivable Debit Credit 4,500 4,500 Where Do We Stand? We overestimated bad debts by $10--we estimated $50 but we only wrote off $40 in the subsequent year. This year our estimate is 5% of $2460 (BB 1,000 + 6,000 credit sales - $4,500 collections -$40 accounts written off)= $123. But since we overestimated last year, we only need to record $113 this year. 3. Adjusting Entry Booked To Reflect The Estimate Of 5% Of Ending A/R To Be Uncollectible. How would the adjusting entry be recorded in the journal? Date Transaction Debit Credit Dec 31 Bad debt expense 113 Allowance for uncollect. accts. 113 To summarize: Two methods: the allowance method the direct writeoff method Which one involves estimating future uncollectibles? Summary Of The Allowance Method Continued One way to estimate bad debt expense is to use a percentage of ending A/R (or an aging schedule) When an actual account is written off as uncollectible, it is credited out of A/R and debited out of the Allowance. THERE IS NO NET EFFECT ON ASSETS and NO EXPENSE at the time of the write-off. Agenda Other Accounting Issues Other Accounting Issues Related to Sales: Warranty Costs Why give warranties? When should expense be recognized? We will repair or replace this item... Warranty Warranties How is the warranty obligation met and subsequently removed from the balance sheet? How do all of the above affect financial statements? What other issues are similar to warranties? Transaction Analysis Assume the following selected events occurred at Cell-It. For each event: Determine how the accounting equation was affected. Determine the effect on the financial statements. Record the event in t-accounts. 1. On Jan 1, Sold Merchandise For $5,000 Cash That Had Originally Cost $4,000. These Goods Were Sold With A Two-year Warranty. How would the sale of merchandise be recorded in the journal? Date Transaction Jan 1 Cash Sales revenue Cost of goods sold Inventory Debit Credit 5,000 5,000 4,000 4,000 2. Estimated That $100 Of Warranty Cost Will Be Incurred Over The Next Two Years On The Goods Sold In Transaction 1. How would the adjusting entry be recorded in the journal? Date Transaction Debit Credit Dec 31 Warranty expense 100 Estimated warranty liability 100 3. On February 7, A Customer Returned Goods Under Warranty For Repair. The Cost Of The Repair Was $30 Cash. How would the cost of the repair be recorded in the journal? Date Transaction Feb 7 Estimated warranty liability Cash Debit Credit 30 30