St Louis Money Spinners Investment Club

advertisement

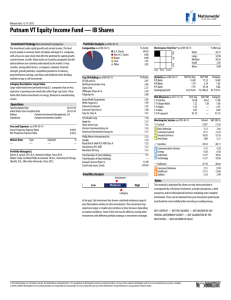

St Louis Money Spinners Investment Club Investing Guidelines Goals Learing the art of investing Having fun Creating wealth Not a “get rich quick” scheme Responsibility Understand and be committed to SLIC investment philosophy. Commit to active participation in the club. Contribution of time and talent Serve on operational committees as necessary Participate in the research and investment activities Participate in educational activities Attend meetings Contribute your monthly investment and yearly administrative fees on time. Understand that all contributions are RISK capital Abide by the Partnership Agreement and By-Laws. Philosophy of the club Believe in Diversification Doing Homework Reinvestment of earnings, dividends and capital gains Growth Stocks Criteria for Buying Stocks 3-Yr. Sales Growth (%) > 20 3-Yr. Earnings Growth (%) > 20 Proj. Long-Term EPS Growth (%) > 15 Price Chg. - 52 Wks. (%) Range_Per from 50.0 to 100.0 for Industry Avg. Surprise, Last 4 Qtrs (%) > 0 1-Yr. Sales Growth (%) > 3-Yr. Sales Growth (%) Avg. Daily Trading Volume > 200000 Average Analyst Rating <= 2 Price Chg. – YTD (%) > 0 Criteria for Selling Stocks Although no single factor will determine a criteria for selling a stock but the following criteria would be considered Adverse change in management Declining profit margin Deteriorating financial condition Competition affecting profits Dependence on a single product To balance the portfolio or to purchase a better stock Stock price drops 10% Diversification Philosophy In order to lower the risk of portfolio, club will maintain diversity by Industry and company size No stock should account for more than 20% of the total value of the portfolio No sector should account for more than 20% of the total value of the portfolio Scaling In We do not enter into a position all at once in a single buy We scale in by buying 50% of the proposed value to be spent on an equity first Should the stock decline by more than 5% then we buy the remainder of the position Scaling Out We do not leave a position all at once in a single sell if we met our profit criteria. We scale out by selling 50% of the equity should the profit exceed 20%. Remaining position of the same stock is sold if it decline by more than 15%. Stocks in our criteria Stock Ticker Company Name RIG Transocean Inc. NE Rating Sector Curr. Price S&P Ranking 2 Basic Materials 100.06 Buy Noble Corp. 1.6 Basic Materials 97.27 Strong Buy SII Smith International Inc. 1.9 Basic Materials 56.91 Hold CAM Cameron International Corp. 1.5 Basic Materials 76.5 Hold CELG Celgene Corp. 1.7 Healthcare 59.46 Buy HOLX Hologic Inc. 1.6 Healthcare 51.82 Strong Buy RS Reliance Steel & Aluminum Co. 1.6 Industrial Goods GME GameStop Corp. Cl A 1.6 LTM Life Time Fitness Inc. LKQX 50.2 Hold Services 39.55 Hold 1.5 Services 52.75 NR LKQ CORP 1.4 Services 28.76 NR ZUMZ ZUMIEZ INC 1.6 Services 36.48 NR RIMM RESEARCH IN MOTION LTD 1.8 Technology 218.5 Hold CTSH Cognizant Technology Solutions Corp. 1.6 Technology 82.85 Buy APH Amphenol Inc. 1.7 Technology 34.81 Buy VSEA Varian Semiconductor Equipment Associates Inc 2 Technology 48.4 Hold CTV Commscope Inc. 1.3 Technology 53.23 NR DIOD DIODES INC 1 Technology 27.83 NR Stock Analyst LKQX & RS – Ganesh NE – Rajesh HOLX – Elango CTSH - Raj Buy Decisions CTSH NE HOLX LKQX *Subjective to through analysis