Principles of Macroeconomics Econ 202

advertisement

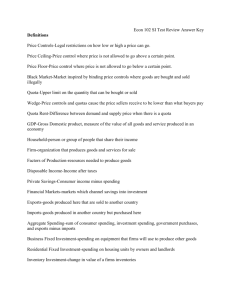

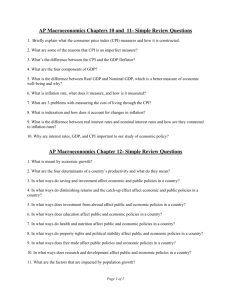

Principles of Macroeconomics Econ 202 D.W. Hedrick Housekeeping • Syllabus – – – – – – Textbook Course outcomes and outline Evaluations: quizzes,Aplia, midterms and final Grades Positive and civil learning environment Recommended study habits • Web page http://www.cwu.edu/~dhedrick • Supplemental Instruction Overview of the Course • Macroeconomics vs. Microeconomics – The big picture – Circular Flow – Determination of aggregate production, income, prices, and employment • Setting the stage with a Brief Review of Microeconomics – Demand and supply in product and resource markets – Determinants of demand and supply: Micro vs. Macro and the fallacy of composition – Market equilibrium in product and resource markets • Macroeconomic Variables – Output and income: real and nominal gross domestic product (GDP) – Aggregate Prices • Cost of living • Inflation – Employment and Unemployment – Interest Rates and Exchange rates • Determination of Macroeconomic Performance in the Long-run – – – – – – Economic growth Saving, Investment and the Financial System Employment, unemployment Monetary System Money and Inflation The Macroeconomics of Open-economies • Determination of Macroeconomic Performance in the Short-run – Aggregate demand and supply – Effects of fiscal and monetary policy – Short-run tradeoffs between inflation and unemployment • Major Issues in Macroeconomics – – – – – Stabilization policy Rules vs. Discretionary monetary policy Optimal inflation Budget deficits vs. surpluses Tax laws and savings and investment The Measurement of Aggregate Output and Income • By definition, aggregate output is equal to aggregate income. The value of output is equal to the income (wages, interest, rents and profits) received by the factors. • Various measures of aggregate output: – Gross domestic product (GDP) – Gross national product (GNP) Gross Domestic Product • GDP is the market value of all final goods and services produced within a country in a given period of time. – Market value – prices, illegal, household – All – imputed values for rent – Final goods and services– intermediate goods are not double counted – Produced (newly) - products resold, inventory – Within the country – Excludes US production abroad includes ROW production within the US – Given period of time (generally yearly or quarterly) Gross National Product and Other Measures of Income • GNP is the total income earned by a nation’s permanent residents, includes US earning in ROW and excludes ROW’s earnings in US • Net National Product (NNP) = GNP-Depreciation • National Income (NI) = NNP – indirect business taxes + subsidies to businesses • Personal Income (PI) = NI – corporate profits taxes – retained earnings – social security taxes + interest from government debt + transfer payments • Disposable Income = PI – personal taxes – nontax payments Which Measure Should be Used? • It depends, we are interested in understanding the total domestic production of goods and services, so we will use GDP. • If you are interested in incomes earned by permanent residents and citizens, GNP is the one to use. NNP gives net production. NI the income earned by residents by producing goods and services. PI is the income by resident households and noncorporate businesses. DI is the income household and noncorporate businesses have after taxes. Components of GDP • Since aggregate production equals aggregate income, let’s call GDP = Y • Y can be broken up into the following parts – – – – Consumption – HH spending on G&S (except housing) Investment – HH spending on K including HH of new housing Government Purchases of G&S Net Exports (= Exports – Imports) Net addition (subtraction) attributable to purchases by ROW. • Y = C + I + G + NX • Economic theory will be used to explain the determination of the above components of aggregate demand=aggregate output=aggregate income. GDP Data • The US Department of Commerce’s Bureau of Economic Analysis has data on line: – http://bea.gov/ • Economic Report of the President – http://www.gpoaccess.gov/eop/index.html • Graphs and Data – http://www.economagic.com/ – FRED Real Versus Nominal GDP • Remember from micro: – Expenditures or Revenue = PxQ – Total Expenditures or Revenue = Σ PxQ • Total can increase either because prices go up or quantities increase • Nominal GDP is measured in current dollars • Real GDP corrects for increases in prices and tries to measure the total quantity of goods • Nominal GDP= Σ PCY x QCY • Real GDP= Σ PBY x QCY • GDP Deflator = (Nominal GDP/Real GDP) X 100 Real and Nominal GDP 1947-2004 Real GDP with Pct. Changes 1947-2004 Table 2 Real and Nominal GDP Copyright©2004 South-Western The GDP Deflator • The GDP deflator is a measure of the price level calculated as the ratio of nominal GDP to real GDP times 100. • It tells us the rise in nominal GDP that is attributable to a rise in prices rather than a rise in the quantities produced. The GDP Deflator • Remember The GDP deflator is calculated as follows: Nominal GDP GDP deflator = 100 Real GDP The GDP Deflator • Converting Nominal GDP to Real GDP – Nominal GDP is converted to real GDP as follows: Real GDP20XX Nominal GDP20XX 100 GDP deflator20XX Real and Nominal GDP Year Nominal GDP GDP Deflator Real GDP 2001 200 100 (200/100)X100=200 2002 600 171 (600/171)X100=351 (350)* 2003 1,200 241 (1,200/241)X100=498 (500)* *errors due to rounding deflator Copyright©2004 South-Western Macro Variable GDP 2006 II III 13197.3 %chg RGP 11388.1 %chg C 3.798% 11443.5 0.486% 115.886759 Sum 13322.6 0.949% %chg GDP Def Annualized 1.946% 116.4206755 0.461% 1.843% 3.789% 9346.7 70.2% I 2235.5 16.8% G 2542.1 19.1% X -801.7 -6.0% 100.0% Percentage Changes and GDP • GDP is most often reported as the percentage change in real GDP on annual basis. • For example, from the BEA website Latest news release -- 8/30/07 Real GDP increased at an annual rate of 4.0 percent in Q2 2007, according to final estimates. • Nominal GDP = GDP Deflator x Real GDP Y = P x Q • When multiplying amounts one adds growth rates: %ΔY approx. = %ΔP + %ΔQ 7.8% approx = 3.8% + 4.0% Percentage Changes in Nominal GDP, Real GDP and the GDP Deflator Nominal GDP Pct.Chg RGDP Pct. Chg 8703.50 GDP Deflator Inflation 1997 8304.3 95.4 1998 8747.0 5.3% 9066.90 4.2% 96.5 1.1% 1999 9268.4 6.0% 9470.30 4.4% 97.9 1.4% 2000 9817.0 5.9% 9817.00 3.7% 100.0 2.2% 2001 10100.8 2.9% 10083.00 2.7% 100.2 0.2% 2002 10469.6 3.7% 10048.8 -0.3% 104.2 4.0% 2003 10971.2 4.8% 10320.6 2.7% 106.3 2.0% 2004 11734.3 7.0% 10755.7 4.2% 109.1 2.6% 2005 12394.17 5.6% 11096.93 3.2% 111.7 2.4% Quarterly Percent Change in Real GDP 2000.1-2004.3 GDP AND ECONOMIC WELLBEING • GDP is probably a good measure of the economic well-being of a society. • GDP per capita (or person) tells us the income and expenditure of the average person in the economy. GDP AND ECONOMIC WELLBEING • Higher GDP per person indicates a higher standard of living. • GDP is not a perfect measure of the happiness or quality of life, however. • Some things that contribute to well-being are not included in GDP. – The value of leisure. – The value of a clean environment. – The value of almost all activity that takes place outside of markets, such as the value of the time parents spend with their children and the value of volunteer work. Table 3 GDP, Life Expectancy, and Literacy Copyright©2004 South-Western Summary • Because every transaction has a buyer and a seller, the total expenditure in the economy must equal the total income in the economy. • Gross Domestic Product (GDP) measures an economy’s total expenditure on newly produced goods and services and the total income earned from the production of these goods and services. • Changes in the overall level of prices from year to year can be corrected using the GDP Deflator. Measuring the Cost of Living • Inflation refers to a situation in which the economy’s overall price level is rising. • The inflation rate is the percentage change in the price level from the previous period. THE CONSUMER PRICE INDEX • The consumer price index (CPI) is a measure of the overall cost of the goods and services bought by a typical consumer. • The Bureau of Labor Statistics reports the CPI each month. • It is used to monitor changes in the cost of living over time. • When the CPI rises, the typical family has to spend more dollars to maintain the same standard of living Calculating the Consumer Price Index • Fix the Basket: Determine what prices are most important to the typical consumer. – The Bureau of Labor Statistics (BLS) identifies a market basket of goods and services the typical consumer buys. – The BLS conducts monthly consumer surveys to set the weights for the prices of those goods and services. • Find the Prices: Find the prices of each of the goods and services in the basket for each point in time. • Compute the Basket’s Cost: Use the data on prices to calculate the cost of the basket of goods and services at different times. • Choose a Base Year and Compute the Index: – Designate one year as the base year, making it the benchmark against which other years are compared. – Compute the index by dividing the price of the basket in one year by the price in the base year and multiplying by 100. • Compute the inflation rate: The inflation rate is the percentage change in the price index from the preceding period • The Inflation Rate – The inflation rate is calculated as follows: Table 1 Calculating the Consumer Price Index and the Inflation Rate: An Example Copyright©2004 South-Western Table 1 Calculating the Consumer Price Index and the Inflation Rate: An Example Copyright©2004 South-Western • Calculating the Consumer Price Index and the Inflation Rate: Another Example – – – – – Base Year is 2002. Basket of goods in 2002 costs $1,200. The same basket in 2004 costs $1,236. CPI = ($1,236/$1,200) 100 = 103. Prices increased 3 percent between 2002 and 2004. FYI: What’s in the CPI’s Basket? 16% Food and beverages 17% Transportation Education and communication 41% Housing 6% 6% 6% 4% 4% Medical care Recreation Apparel Other goods and services Copyright©2004 South-Western Consumer Price Index Data • U.S. Department of Labor’s Bureau of Labor Statistics (BLS) – www.bls.gov • Commercial website to compare cost of living geographically – http://www.homefair.com/homefair/calc/salcalc.html – http://www.bestplaces.net/html/cost_of_living.html Problems in Measuring the Cost of Living • The CPI is an accurate measure of the selected goods that make up the typical bundle, but it is not a perfect measure of the cost of living. Problems in Measuring the Cost of Living • Substitution bias • Introduction of new goods • Unmeasured quality changes Problems in Measuring the Cost of Living • Substitution Bias – The basket does not change to reflect consumer reaction to changes in relative prices. • Consumers substitute toward goods that have become relatively less expensive. • The index overstates the increase in cost of living by not considering consumer substitution. Problems in Measuring the Cost of Living • Introduction of New Goods – The basket does not reflect the change in purchasing power brought on by the introduction of new products. • New products result in greater variety, which in turn makes each dollar more valuable. • Consumers need fewer dollars to maintain any given standard of living. Problems in Measuring the Cost of Living • Unmeasured Quality Changes – If the quality of a good rises from one year to the next, the value of a dollar rises, even if the price of the good stays the same. – If the quality of a good falls from one year to the next, the value of a dollar falls, even if the price of the good stays the same. – The BLS tries to adjust the price for constant quality, but such differences are hard to measure. Problems in Measuring the Cost of Living • The substitution bias, introduction of new goods, and unmeasured quality changes cause the CPI to overstate the true cost of living. – The issue is important because many government programs use the CPI to adjust for changes in the overall level of prices. – The CPI overstates inflation by about 1 percentage point per year. The GDP Deflator versus the Consumer Price Index • The BLS calculates other prices indexes: – The index for different regions within the country. – The producer price index, which measures the cost of a basket of goods and services bought by firms rather than consumers. The GDP Deflator versus the Consumer Price Index • Economists and policymakers monitor both the GDP deflator and the consumer price index to gauge how quickly prices are rising. • There are two important differences between the indexes that can cause them to diverge. The GDP Deflator versus the Consumer Price Index • The GDP deflator reflects the prices of all goods and services produced domestically, whereas... • …the consumer price index reflects the prices of all goods and services bought by consumers. The GDP Deflator versus the Consumer Price Index • The consumer price index compares the price of a fixed basket of goods and services to the price of the basket in the base year (only occasionally does the BLS change the basket)... • …whereas the GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base year. Figure 2 Two Measures of Inflation Percent per Year 15 CPI 10 5 0 GDP deflator 1965 1970 1975 1980 1985 1990 1995 2000 Copyright©2004 South-Western CORRECTING ECONOMIC VARIABLES FOR THE EFFECTS OF INFLATION • Price indexes are used to correct for the effects of inflation when comparing dollar figures from different times. Dollar Figures from Different Times • Do the following to convert (inflate) Babe Ruth’s wages in 1931 to dollars in 2001: Salary2001 Price level in 2001 Salary1931 Price level in 1931 177 $80,000 15.2 $931,579 Table 2 The Most Popular Movies of All Times, Inflation Adjusted http://www.movieweb.com/movies/boxoffice/alltime.php http://www.filmsite.org/boxoffice.html Copyright©2004 South-Western Indexation • When some dollar amount is automatically corrected for inflation by law or contract, the amount is said to be indexed for inflation. Real and Nominal Interest Rates • Interest represents a payment in the future for a transfer of money in the past. • The nominal interest rate is the interest rate usually reported and not corrected for inflation. – It is the interest rate that a bank pays. • The real interest rate is the nominal interest rate that is corrected for the effects of inflation. • If you borrow $1,000 for one year, and – Nominal interest rate was 15%. – During the year inflation was 10%. • Then, Real interest rate = Nominal interest rate – Inflation = 15% - 10% = 5% Compound Interest • Simple formula: – Pt=P0 (1 + i)t • Complex Formula: – Pnt=P0 (1 + i/n)nt Figure 3 Real and Nominal Interest Rates Interest Rates (percent per year) 15 10 Nominal interest rate 5 0 Real interest rate –5 1965 1970 1975 1980 1985 1990 1995 2000 Copyright©2004 South-Western Summary • The consumer price index shows the cost of a basket of goods and services relative to the cost of the same basket in the base year. • The index is used to measure the overall level of prices in the economy. • The percentage change in the CPI measures the inflation rate. Summary • The consumer price index is an imperfect measure of the cost of living for the following three reasons: substitution bias, the introduction of new goods, and unmeasured changes in quality. • Because of measurement problems, the CPI overstates annual inflation by about 1 percentage point. Summary • The GDP deflator differs from the CPI because it includes goods and services produced rather than goods and services consumed. • In addition, the CPI uses a fixed basket of goods, while the GDP deflator automatically changes the group of goods and services over time as the composition of GDP changes. Summary • Dollar figures from different points in time do not represent a valid comparison of purchasing power. • Various laws and private contracts use price indexes to correct for the effects of inflation. • The real interest rate equals the nominal interest rate minus the rate of inflation.