Student Resource 3.2

Reading: Regulatory Agencies/GAAP

This presentation examines regulatory agencies in the accounting industry and the need for and purpose

of regulation.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

Standardization helps investors make informed decisions about different companies. If financial

information were not standardized, it would be very difficult to compare across different investments.

Regulations promote honest behavior and help industry workers better understand what is expected of

them. It also creates confidence in the system, which encourages investment and allows companies to

grow.

Because so many different stakeholders rely on financial information for important decisions, there is a

need for accounting rules and regulations that are enforced by impartial third parties.

A good regulation is clear, concise, and enforceable. A bad one is difficult to follow and open to

interpretation.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

Governments tax their citizens to pay for certain services. In the United States, an income tax was first

imposed in the 1860s to pay for the Civil War. Then the income tax was deemed unconstitutional and

repealed. In 1913, the 16th amendment to the Constitution instituted a national income tax, which is still in

force.

The IRS is the agency that collects taxes and is one of the most powerful departments in the US

government. The IRS has powers of enforcement to collect taxes, levy fines, and confiscate property.

One big difference between the governmental regulatory agencies and other agencies discussed in this

lesson is that the relationship between the government and individuals or businesses is mandatory. All of

the other entities discussed in this lesson maintain voluntary relationships with individuals and

businesses.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

The SEC is responsible for protecting all investors and making sure the markets run smoothly. It works

closely with Congress to enact and enforce laws to achieve these ends. One way it protects the public is

by setting standards of disclosure for public companies (companies that trade securities on the stock

exchanges). By making all companies disclose the same financial information, the SEC makes it possible

for investors to become informed about whether they should buy, sell, or hold securities. The SEC relies

mostly on the Financial Accounting Standards Board (FASB) to generate accounting rules.

It’s one of two agencies of the ones we’re studying with powers of enforcement (the Internal Revenue

Service is the other one). Every year the SEC catches people guilty of insider trading, accounting fraud,

lying or misleading others about securities and issuing companies, manipulating stock prices, and

stealing customers’ assets, among other infractions.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

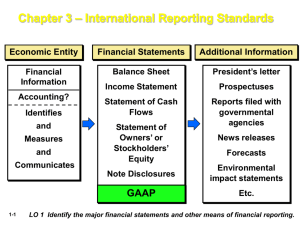

Although the Securities and Exchange Commission (SEC) has the legal authority to establish financial

accounting and reporting standards for publicly held companies, it has allowed the accounting profession

to develop its own accounting standards and guidelines. In 1973, the SEC gave the responsibility for

setting accounting standards for public companies to the Financial Accounting Standards Board (FASB).

The FASB isn’t part of the government, but it is a private nonprofit organization whose primary purpose is

to develop generally accepted accounting principles (GAAP) in the public’s interest. The rules FASB

makes affect how accountants record transactions, and these rules provide guidelines that allow investors

to compare companies with each other in a way that’s meaningful.

GAAP is a set of guidelines established for accountants to follow when recording transactions and

preparing financial statements of companies. One essential part of GAAP is that the guidelines are

general and broad. GAAP allows for different companies to present information differently, as long as the

presentation follows GAAP guidelines.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

The AICPA is a professional organization that tries to help its members succeed in the field of accounting

and to make government and the public in general have confidence in the accounting industry. The

AICPA creates and administers the Certified Public Accountant (CPA) exam to ensure that the industry is

represented by professionals with a high degree of competence and knowledge. In addition, the AICPA

creates standards for audits of private companies as well as ethical standards for CPAs to follow.

Created in 2002 by Congress, the PCAOB is a nonprofit corporation that oversees the audits of public

companies in order to protect investors and the general public. The PCAOB promotes informative,

accurate, and independent audit reports. The five members of the PCAOB are appointed by the SEC.

The difference between the AICPA, PCAOB, and the FASB is that the FASB creates generally accepted

accounting principles (GAAP) guidelines that focus on the information reported on financial statements.

Both the AICPA and PCAOB create wide ranges of behavioral (ethical and professional) guidelines,

which focus on how CPAs and auditors actually do their jobs. The AICPA and the PCAOB both support

the FASB by providing technical support for how to follow the principles made by the FASB and the rules

made by the IRS.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

Financial reports must be prepared objectively, without bias or inconsistency. The following are the seven

principles that guide all other rules that accountants follow:

Principle of regularity or principle of consistency: The same accounting principles must be followed at

all times.

Principle of sincerity: Statements must be presented honestly and accurately.

Principle of the permanence of methods: The same accounting methods and format of statements

should be used over time so they can be compared.

Principle of noncompensation: Companies should completely disclose the truth, and not add fake

positive items to balance out negative items on the financial statements.

Principle of prudence: Accountants should not make the statements look better than they are and they

must use caution when recording transactions.

Principle of continuity: Accountants should record transactions assuming the business will be in

business for a long time and won’t be stopped or interrupted in the short run.

Principle of periodicity: Accounting should be split into periods of the same time length. Each

transaction should be accounted for in a given period and split across many periods if necessary.

By following these principles, accountants create an environment in which managers and investors can

trust the numbers they are given and make intelligent, informed decisions.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

Student Resource 3.3

Vignettes: Regulatory Agencies/GAAP

Student Name:_______________________________________________ Date:___________

Directions: Identify which agency, agencies, or GAAP is presented in each vignette. Write your answers

and your rationale in the space below each description.

Vignette 1

This agency is responsible for protecting all investors and making sure the markets run smoothly. It works

closely with Congress to enact and enforce laws to achieve these ends. One way it protects the public is

by setting standards of disclosure for public companies, or companies that trade shares on the market

exchanges. By making all public companies disclose the same financial information, investors can inform

themselves as to whether they should buy, sell, or hold securities.

This agency relies mostly on another to generate the ideas that become law. So, essentially, the

accounting profession gets to police itself to some extent.

Name the agency that protects investors and the agency it relies on to generate ideas that become laws.

Defend your answers.

Vignette 2

This agency isn’t part of the government. It’s a private nonprofit organization whose primary purpose is to

develop general accounting guidelines within the United States. The rules this agency make affect how

accountants record transactions, and these rules provide guidelines that allow many different

stakeholders such as investors and financial institutions to compare companies with each other in a way

that’s meaningful.

Name the agency and the guidelines it develops.

Defend your answer.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.

AOF Principles of Accounting

Lesson 3 The Regulatory Environment

Vignette 3

This agency creates and administers the CPA exam to set the standard for what you need to know if you

are going to practice as a certified public accountant. Also, it creates audit standards for private

companies and ethical standards for CPAs to follow in an attempt to provide the public with a sense of

confidence when they deal with CPAs. On the other hand, this corporation creates audit standards for

public companies.

Name these two entities.

Defend your answer.

Vignette 4

This agency is one of the most powerful departments in the US government with responsibility for

collecting taxes, levying fines, and confiscating property. The relationship between this agency and

individuals or businesses is mandatory.

Name this agency.

Defend your answer.

Copyright © 2008–2013 National Academy Foundation. All rights reserved.