Chapter 11

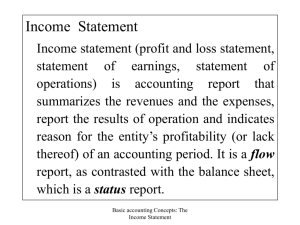

advertisement

Chapter 11: The Income Statement Evolving definitions Future events Comprehensive income Earnings Per Share Earnings management New proposals Definitions: Income Income and profit...results from the deduction from revenues, or from operating revenues, of COGS, other expenses, and losses Net income...the excess (deficit) of revenue over expenses for an accounting period Comprehensive income... Definitions: Revenues Results from the sale of goods and rendering of services... Gross increases in assets and gross decreases in liabilities measured in conformity with GAAP... Inflows or other enhancements of assets of an entity or settlements of its liabilities... Revenues versus Gains Typically have been displayed separately on financial statements Gains are . . . revenues . . . from other than sales of products, merchandise, or services. . . . Gains are increases in equity (net assets) from peripheral or incidental transactions . . . except those that result from revenues or investments by owners. Definitions: Revenue Recognition Revenue should be identified during the period during which the major economic activities necessary to the creation and disposition of goods and services has been accomplished Alternative points in time During production At completion of production At time of sale When the cash is collected Definitions: Expenses and Losses Includes all expired costs which are deductible from revenues Gross decreases in assets or gross increases in liabilities recognized and measured in conformity with GAAP... Are outflows or other using up of assets or incurrence of liabilities... Cost Classifications Costs directly associated with the revenue of the period Costs associated with the period on some basis other than a direct relationship with revenue Costs that cannot, as a practical matter, be associated with any other period Future Events Reporting process is grounded in recording events that have occurred, but these past events and their recording are very dependent upon our interpretation of future events either happening or not happening Every accrual and deferral is dependent upon future events Treatment of future events in asset, liability, expense, and revenue recognition has not been well systematized Future Events Trade-off of qualitative characteristics such as relevance and reliability? Answer may be largely qualitative in nature, which may add to the ever-burgeoning role of disclosure What is the future of accounting? Comprehensive Income Comprehensive income pushes the allinclusive approach toward its logical conclusion In addition to net income as presently defined, comprehensive income includes those elements of profit and loss that bypassed the income statement Reporting Comprehensive Income 1. in a combined statement of financial performance (income in which the comprehensive income elements and total would appear below net income) 2. in a separate statement of comprehensive income which would begin with net income 3. reported within a statement of changes in equity Nonoperating Items Nonoperating section of the income statement discontinued operations extraordinary items accounting principle changes Retained earnings statement reports prior period adjustments Earnings Per Share (EPS) SFAS No. 128 , an improvement over APB Opinion No. 15 increases EPS comparability with other nations simplifies the computational aspects of EPS revises disclosure requirements Calculations have to be shown right on the income statement itself for both basic and diluted earnings per share Specialized Topics Development Stage Enterprises Any enterprise devoting substantially all of its efforts to establishing a new business Question as to what should be expensed or deferred Troubled Debt Restructuring When the creditor for economic or legal reasons related to the debtor’s financial problems grants a concession to the debtor Present value concept does not apply Specialized Topics Early Extinguishment of Debt Gains and Losses, if material, are reported as extraordinary items net of the tax effects FASB conceded to the single-line financial statement item Stock Options Intent is to align management and stockholder interests Frequently lead to dysfunctional management behavior Specialized Topics Stock Options Debate as to whether they are an expense Nonqualified stock options Incentive stock options Stock options and equity theories Entity theory Proprietary theory Reformat the Income Statement Entity Income Maintain the bottom line, but do not deduct interest expense Result is “entity income,” income to the firm itself Proprietary Income From entity income deduct interest costs and stock option costs Result is “proprietary income, income to the shareholder Earnings Management ....purposeful intervention in the external financial reporting process, with the intent of obtaining some private gain (Schipper) Earnings Management Managing income to affect management compensation Income might be managed by manipulating discretionary accruals Studies find that managers manage income when bonus plans are dependent on earnings levels Income smoothing Managers smooth income to facilitate better predictions of future cash flows on which firm value is based Studies’ tests confirm income-smoothing behavior Developments Pre-FASB more time and effort was placed on refining the income statement to the detriment of the balance sheet Since FASB, a shift toward cleaning up the balance sheet a movement toward more of an asset-liability approach to the financial statements consistent with the conceptual framework project Developments Cash earnings Pro forma earnings Retrospective reports Quality of earnings Increasing emphasis on earnings sustainability and an absence of earnings management Accounting scandals Chapter 11: The Income Statement Evolving definitions Future events Comprehensive income Earnings Per Share Earnings management