FresnoGMS - Orcutt Mineral Society

advertisement

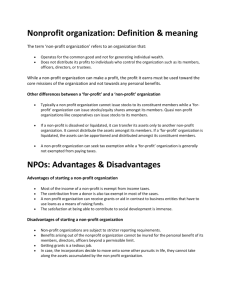

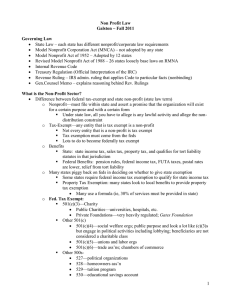

FRESNO GMS BRIEFING - 3 FEBRUARY 2011 BY WES LINGERFELT Requested by good friend and Digging Partner Gerry Wells To the FGMS Board of Directors Subjects to be covered: State and Federal Taxes The Internet Website Considerations Raffles First, who am I? Current Treasurer - Orcutt Mineral Society, Inc. Former Treasurer – CFMS 1997 – 98 CFMS Director Since 1986 Former CFMS Endowment Fund Chair Former CFMS Internet & PLAC Committee Member Current Dealer Chair for OMS Gem Show Webmaster for 2 websites ( www.omsinc.org & www.sphereheaven.com) Current Judge for AFMS Annual Website Contest Member National Rockhound Hall of Fame - 2002 Staying abreast of Federal & State Non-profit rules is imperative Annual Electronic Filing Requirement for Small Exempt Organizations — IRS Form 990-N (e-Postcard) Exempt Organizations - Public Disclosure Requirements in General Exempt Organizations - Disclosures Required Exempt Organizations Public Disclosure - Penalties for Noncompliance Exempt Organizations Public Disclosure - Charitable Contribution Disclosures Exemption Requirements - Section 501(c)(3) Organizations (See Attached Text) Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in accordance with IRS Code section 170. Section 501(c)(3) organizations are restricted in how much political and legislative (lobbying) activities they may conduct. 501(c)(4) see also: Citizens United v. Federal Election Commission 501(c)(4) organizations are generally civic leagues and other corporations operated exclusively for the promotion of social welfare, or local associations of employees with membership limited to a designated company or people in a particular municipality or neighborhood, and with net earnings devoted exclusively to charitable, educational, or recreational purposes. Unlike 501(c)(3) organizations, 501(c)(4) organizations may lobby for legislation; they may also participate in political campaigns and elections, as long as campaigning is not the organization's primary purpose. Substantiating Charitable Contributions A charitable organization must provide a written disclosure statement to donors of a quid pro quo contribution in excess of $75. A quid pro quo contribution is a payment made to a charity by a donor partly as a contribution and partly for goods or services provided to the donor by the charity. A penalty is imposed on a charity that does not make the required disclosure in connection with a quid pro quo contribution of more than $75. The penalty is $10 per contribution, not to exceed $5,000 per fund-raising event or mailing. The charity can avoid the penalty if it can show that the failure was due to reasonable cause. Written Record of Charitable Contribution A donor may not claim a deduction for any contribution of cash, a check or other monetary gift made on or after January 1, 2007, unless the donor maintains a record of the contribution in the form of either a bank record (such as a cancelled check) or a written communication from the charity (such as a receipt or a letter) showing the name of the charity, the date of the contribution, and the amount of the contribution. Any correspondence generated concerning this topic should be approved and released by the Board of Directors only. CALIFORNIA STATE TAX REQUIREMENTS 199N California e-Postcard This new requirement applies to account periods beginning on or after January 1, 2010. Tax-exempt organizations that normally have annual gross receipts of $25,000 or less must electronically submit information annually. For more information, see 199N filing requirements. Organizations not eligible to submit an ePostcard must complete and file a paper Form 199. Filing Requirements - FTB 199N, Annual Electronic Filing Requirement for Small TaxExempt Organizations (California e-Postcard) (See Attached Text) ACTIVITIES IN YEARLY ACCOUNTING CYCLE: Financial Statements and Analysis Financial Statements (See Attached Text) Monthly Reports Statement of Position (Balance Sheet) What is our financial health? Can we pay our bills? Statement of Activities (consolidated) showing budget to actual information What has been our overall financial performance this month and to date? Departmental Income and Expense Statement showing budget to actual information How does actual financial experience compare with the budget? Is specific action called for, such as limiting expenses in certain areas? Does experience indicate a change in the budget is appropriate? Narrative report including tax and financial highlights, important grants received, recommendations for short term loans, or other means of managing cash flow An executive summary of financial highlights, analysis, and concerns. SAMPLE TREASURER’S REPORT An accounting software program is a must to maintain appropriate records for an organization. There are several available such as Quicken, Microsoft Money and Microsoft Excel spread sheet. Data must be accurately and frequently entered and then backed up for archiving. Special training may be required to keep accounts current and accessible. Do not allocate only one person to have access to the computer system and files. A Club owned computer system under adequate security should be considered as a useful tool for maintaining the organizations books and records. Annual Reports Annual Federal forms, including 990 and Schedule A; State Reports MUST BE FILED WITH 5 MONTHS OF CLOSURE OF ACCOUNTING CYCLE ANALYSIS OF FASB 117 (Financial Accounting Standards Board) "FINANCIAL STATEMENTS OF NOT-FOR-PROFIT ORGANIZATIONS" (SEE ATTACHED TEXT) Non-Profit Audit Requirements | An audit reviews and verifies the financial books of an organization. Audits are most often associated with the IRS and taxes, but nonprofits often conduct audits through a trained accountant or CPA. An audit verifies deposits with checks and deposit slips, verifies receipts and expense reimbursements, and reconciles bank statements. The audit provides a way for a nonprofit to maintain transparency in its spending methods and use of donations. Although there are few laws or regulations that directly state how nonprofit organizations must operate their finances internally, there are many that have a strong indirect impact. These indirect influences include IRS reporting requirements and the accounting standards most funding agencies require supported organizations to follow. In practical terms, these "recommended" standards all but demand certain accounting and other financial practices be followed by nearly all nonprofit organizations. Non-Profit Audit Requirements Non-profit organizations that expend $500,000 or more in a year in Federal awards must have an audit conducted for that year in accordance with the provisions of OMB Circular A-133. A-133 audits are performed by independent public accounting firms engaged by the Non-profit organizations. Costs for A-133 audits are borne by the Non-profit organizations but are allowable as charges to grant projects; they may be considered either direct costs or allocated indirect costs as determined by the Federal cost principles. Non-profit organizations that expend less than $500,000 in a year in Federal awards are not required to have an A-133 audit for that year. There are three major bodies that issue standards for nonprofit organization financial accounting, and some supplementary guidelines that are commonly referenced, which regulators typically relay on for determining if an NPO is conducting its finances responsibly. The standards bodies are the Financial Accounting Standards Board (FASB), the American Institute of Certified Public Accountants (AICPA), and the U.S. Federal Office of Management and Budget (OMB). THE INTERNET Is a very useful tool (As the CFMS has discovered) Allows a club to present itself to the world. Has many inherent dangers especially for kids. A Internet policy should be established & published. The club should own the domain name. (Do not use a personal account for hosting your site) The Internet Service Provider (ISP) should be well known, reliable and reasonably priced. A web site will become more necessary over time so protect it just as you would your bank account. Don’t rely on just one person to build/run it as he/she may become unavailable for all sorts of reasons. WEB SITE CONSIDERATIONS The club Web site serves several functions. Three of the major functions of the Web site are: (1) Attract new members (2) Provide member information (3) Public advertising of club activities such as shows. This item is a subset of the higher and more important question of "Does the Web site assist in fulfilling the mission of the club?" Advertising is only one of the many functional capabilities to be assigned to the Web site. Most clubs have the mission of educating the public, and they find that providing educational materials and links to educational sites for geologic and Earth Science information is a good use for the Web site. (See attached Web site Contest guidelines) Search engines don't just find your site by accident-they need to know you exist. At the very least, submit your site to the "big three": Google, Yahoo! and Bing (owned by Microsoft). Key links:· www.google.com/addurl/ · http://search.yahoo.com/info/submit.html - www.bing.com/webmaster/Submit SitePage.aspx Another key place to submit your site is www.dmoz.org/help/submit.html. This is an independent, nonprofit Web-monitoring project that links to Goggle's directory. When you submit your site to dmoz, it will be checked by a real human being-now there's a novelty. The downside is that human beings, especially volunteers, take their time, so it may be a while before you reap the rewards. Does your site have a sitemap? It's an often-neglected file that gives search engines a list of your website's contents. The good news is that you don't even have to know how to make a map. Several sites, such as www.xmlsitemaps.com, will generate one for you. Again, you'll need to submit your sitemap to search engines. Keywords are hidden within the code of your website, but they should cover any search terms that your visitors might use. It is worth getting them right. Goggle's search-based keyword tool (search "keyword tool" at www.google.com). can help. Ironically, Google doesn't take any account of keywords. Other search engines do, though. Meta tags are optional HTML coding elements that provide information about a Web page. Your description meta tag is hidden from view, but it's a vital smoke signal for search engines. It's your chance to describe succinctly what your website is about. So keep it short and sweet, but remember that each page of your website can-and should-have a separate description. · In contrast, a more visible device is the headings you use on your website. These are essential reading for search-engine robots. Make them relevant. Better still, make them feature your site's keywords. No matter how good your site looks, it's wasted if your online audience is too small. RAFFLES A Comprehensive Study of California Non-Profit Raffle Rules is provided in a separate presentation titled Raffles Rules Defined consisting of 50 Power Point slides. References: http://www.muridae.com/nporegulation/accounting.html#state_reporting http://oag.ca.gov/charities http://www.ftb.ca.gov/ http://www.boe.ca.gov/ http://www.irs.gov/ The internet is a vast reservoir of information and most questions concerning almost any topic can be found by diligent search of the net. Should anyone have question or need more information I can be contacted as noted below. Cell = 805-710-1983 Home = 805-929-3788 FAX = 805-929-3768 E-mail = Rocks4u@prodigy.net