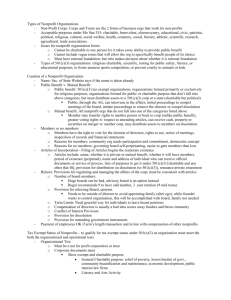

Non Profit Law – Galston – Fall 2011

advertisement