Small Business Management

advertisement

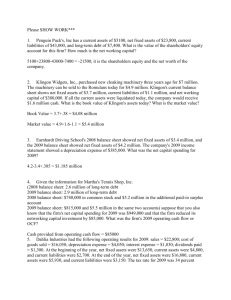

Understanding the Numbers: Essential for the Entrepreneur A Student Tutorial Ever thought or said: • “I did not do well in my accounting and finance classes . I just am not good with numbers” • “Finance scares me.” • “I try, but I just can’t get it.” If not, great, but if so, you may try to avoid accounting and finance. Why is that a mistake? Reasons to Learn Finance • There are things you cannot learn about a company any other way. • If you do not understand financial statements and what they tell you, you will be missing some critical information about the firm. • And hiring someone to do it for you, DOES NOT WORK!! Understanding Financial Statements • Goal: Understand the financial consequences of decisions • There are three basic financial (or accounting) statements: – Income Statement – Balance Sheet – Cash Flow Statement The Goal: Making Good Financial Decisions 3 types of financial statements Income Statement (1) • Indicates the firm’s profits over a period of time – Usually monthly, quarterly or annually • Basic form: Sales (Revenues) Expenses Profits Basic purpose and format of an income statement Income Statement (2) • The Income Statement starts with sales (revenues). Sales (Revenue) = # of units sold X sales price per unit minus Cost of Goods Sold equals Gross Profit From Sales, subtract the Cost of Goods Sold to obtain the Gross Profit Can you compute gross profits? Income Statement (3) What is cost of goods sold? Cost of goods sold is determined by: • The cost of producing or acquiring a single unit of the firm’s products or services • The number of units sold Cost of goods sold = cost per unit X number of units sold Computing cost of goods sold Income Statement (4) • Next compute operating income (earnings before interest & taxes) Sales Revenue minus Cost of Goods Sold equals Gross Profit minus Operating Expenses equals Operating Income From Gross Profits subtract Operating Expenses to obtain Operating Income Can you compute operating income; also called earnings before interest and taxes (EBIT)? Income Statement (5) What are operating expenses? In addition to the cost of goods sold, you need to convince someone to buy what you are selling. So, you will have; Marketing expenses • And you have operating overhead—the light bill must be paid. So, you will have: General & administrative expenses • And if you have equipment and buildings. You will have: Depreciation expense (More will be said about depreciation later.) Operating expenses include marketing expenses, G&A, and depreciation Income Statement (6) A Comment on Operating Income • Operating Income is the total profit a firm makes from running the business before paying creditors (interest expense) for the use of debt, and paying income taxes to the government. • Operating income is the best profit indicator of how well a company is doing in its business. Income Statement (7) • Next we compute earnings before taxes (EBT) From Operating Income, subtract Interest Expense to obtain Earnings Before Taxes Operating Income minus Interest Expense equals Earnings Before Taxes Can you compute earnings before taxes? Income Statement (8) Interest Expense: The Cost of Borrowing Money • A lender charges interest to loan money, which is shown as interest expense in the income statement of the borrower. • Interest expense is the result of the interest rate and the amount borrowed. Interest Rate x Amount Borrowed Interest Expense You have to pay the banker to use the bank’s money!! Income Statement Earnings Before Taxes: (9) Computing Earning Before Taxes: = Operating Income – Interest Expense An Illustration = $15,000 - ($50,000 X .06) = $15,000 - $3,000 = $12,000 If a firm has: $15,000 in operating income and $50,000 in debt at a 6% interest rate, then: Operating Income $ 15,000 Interest Expense $ 3,000 The Earnings before taxes is: $ 12,000 Computing a firm’s earnings before taxes Income Statement (10) • Finally, we calculate net income From Earnings Before Taxes subtract Income Taxes to obtain the Net Income Operating Income minus Interest Expense equals Earnings Before Taxes minus Income Taxes equals Net Income Can you compute net income? Net Income: Income Statement (11) (Earnings before taxes)-(Tax rate)*(Earnings Computing before taxes)Net Income Illustrated $12,000 - (25%)*($12,000) = $12,000 - $3,000 = $9,000 If a firm has: Operating Income of $15,000 Earnings before taxes of $12,000 And pays 25% on income taxes. The Net income is: $ 9,000 Computing income taxes to find net income Income Statement (12) Operating Activities Sales Revenue minus Cost of Goods Sold equals Gross Profit minus Operating Expenses equals Operating Income Financing Activities What have we learned about the income statement? Operating Income minus Interest Expense equals Earnings Bef Taxes minus Income Taxes equals Net Income DO NOT continue until you know and understand the format and content of an income statement. Income Statement (13) An Example The Income Statement for Trimble & Associates: Cost of borrowing Income from operating the business Income after \paying interest Sales Cost of Goods Sold Gross Profit on Sales Operating Expenses: Marketing Expenses 90 General & Admin Expenses 80 Depreciation 30 Total Operating. Expenses Operating Income Interest Expense Earnings Before Tax Income Tax (25%) Net Income $850 550 $300 $200 100 20 80 20 60 Income Statement (14) Summary • The Income Statement answers the question: “How profitable is the business?” • The Income Statement reports on five broad areas: – Sales (Revenue) – Costs of producing or acquiring the firm’s goods or services – Operating Expenses – Financing costs (interest expense) – Tax payments Income Statement (15) Can You Put It Together? Organize this Income statement Gross Profit on Sales Operating Expenses: Total Op. Exp. Operating Income $ Admin. &Sales Exp. $ 18 $ $ Earnings Before Taxes $ Net Income Cost of Goods Sold $250 $ Depreciation $ 8 Interest Expense $ 6 Sales $290 Income Taxes(25%) $ 2 Put the pieces where they go!! 4. Good judgment Here You Go! Gross Profit on Sales Operating Expenses: Total Op. Exp. Operating Income $ 40 Cost of Goods Sold $250 Admin. &Sales Exp. $ 18 $ 26 $ 14 Earnings Before Taxes $ 8 Net Income 6 $ Depreciation $ 8 Interest Expense $ 6 Sales $290 Income Taxes(25%) $ 2 Income Statement (16) A Concluding Thought • Congratulations!! You should be able to understand the income statement and what it is telling you. • We are now ready to examine the balance sheet, which measures the firm’s current financial position. • Let’s continue. Balance Sheet (1) • A Snapshot of a company’s financial position at a specific point in time – The Income Statement covers a period in time (Jan 1 – Dec 31, 2007) – The Balance Sheet represents a specific moment (December 31, 2007) • In its simplest form, the Balance Sheet is: Total Assets Outstanding Debt Owner’s Equity Debt & Equity Total assets always equal debt plus equity. Balance Sheet (2) Three main parts • Assets – What the company owns • Liabilities (Debt) – What the company owes Basic pieces of the balance sheet • Owner’s Equity (Net Worth) – The amount invested by the owners (stockholders) – The difference between Assets and Liabilities Continue Balance Sheet (3) Three main parts • Total Assets, the sum of: • Current Assets (Cash, A/R, Inventory) • Fixed Assets (Machinery and equipment, Buildings, Land) • Other Assets (Long-term investments, Patents) • Debt and Equity, the sum of: – Total Debt, including: • Current debt (Accounts payable, Accrued expenses, Short-term notes) • Long-term debt (Long-term notes, Mortgages) – Owner’s equity: owner’s investment in the company A look inside the balance sheet -Cash Flow 2. Forecast 3. Determine and evaluate 4. Good judgment Balance Sheet (4) Assets: Current Assets • Current assets are also called gross working capital • Current assets comprise the assets that are relatively liquid – – – – Cash Accounts Receivable Inventories Other current assets (e.g., prepaid expenses) Current assets: the firm’s “liquid” assets; includes cash and assets that can soon be converted into cash Balance Sheet (5) Assets: Fixed Assets • Fixed assets include: – Machinery and Equipment – Buildings and Land • The cost of a fixed asset is recorded in the balance sheet and depreciated over its useful life. – The Income Statement reports the depreciation expense for each year. – The Balance Sheet reports the accumulated depreciation—depreciation taken on an asset over all its life. Fixed assets may also be called plant & equipment Balance Sheet (6) Depreciating Fixed Assets • Remember that – When a fixed asset is purchased, the firm pays cash, and so: • Fixed assets increase in the balance sheet. • Cash decreases in the balance sheet. – But the depreciation expense is NOT a cash event. • Depreciation expense is recorded in the income statement • Accumulated depreciation increases in the balance sheet • There is NO cash involved!! Depreciation expense is NOT a cash expense!!! Balance Sheet (7) Gross Versus Net Fixed Assets • Gross Fixed Assets is the original amount paid for a firm’s fixed assets. • Net Fixed Assets is the gross fixed assets minus the total depreciation (accumulated depreciation) taken on the fixed assets. That is, Gross fixed assets accumulated depreciation net fixed = assets So: net fixed assets = gross fixed assets – accumulated depreciation Balance Sheet (8) An Example of Depreciation • You purchase equipment for $10,000 with an expected life of 5 years. How much will the depreciation expense be each year, as reported in the income statement? $2,000 ($10,000 ÷ 5 years = $2,000) • What will the balance sheet look like over the 5 years? End of Year 1 2 3 4 5 Gross fixed assets $10K $10K $10K $10K $10K Accumulated depre 2K 4K 6K 8K 10K Net fixed assets $8K $6K $4K $2K $0K Balance Sheet (9) Assets: Other Assets • Other assets includes intangibles, such as: – Patents – Copyrights – Goodwill And for a start-up company: – Organizational costs The firm’s other assets Balance Sheet (10) Debt And Equity • Remember Total Assets Outstanding Debt Owner’s Equity Debt & Equity Total assets MUST equal total debt plus owner’s equity Balance Sheet (11) Debt or Liabilities • Debt is financing provided by a creditor • Debt is divided in two parts: – Current debt or short-term liabilities – Long-term debt Where does debt come from? Balance Sheet (12) Short-term Liabilities • Liabilities due within 12 months – Accounts Payable or Trade Credit: • Credit extended by suppliers for the purchase of inventories • Usually given 30-60 days to pay – Accrued Expenses: • Operating expenses that are owed but not yet paid – Short-term Notes: • Short-term loans from banks or other financial institutions Short-term liabilities is debt that must be repaid within 12 months -Cash Flow 2. Forecast 3. Determine 4. Good judgment Balance Sheet (13) Long-term Liabilities • Loans from banks or other sources that that come due after 12 months • Usually loans to finance long-term capital investments, such as machinery and equipment. Long-term liabilities (debt) Loans that come due after 12 months Balance Sheet (14) Owners’ Equity • Owner’s Equity is the money invested by the owners Note: They are residual owners, because in a liquidation, stockholders are paid last • Equity consists of: – Amount invested when purchasing ownership in the business – Retained Earnings: All the profits retained in the company (profits not paid out in dividends to the owners) Owners have 2 ways to invest in a business: • Buy stock • Reinvest all or part of the firm’s profits Balance Sheet (15) Owners’ Equity • Retained Earnings is the accumulated profits (gains-losses) of the business, less the dividends paid to stockholders since the firm was created Owners’ Equity Owners’ Equity Owners’ Investment Owners’ Investment Cumulative Profits Cumulative Dividends Retained Earnings Retained earnings: A concept that many students fail to understand. Do you? Balance Sheet (16) An Example The Balance Sheet for Trimble & Associates: ASSETS DEBT AND EQUITY Current Assets Cash Accounts receiv Inventories Total current assets Fixed assets: Gross fixed assets Accum depreciation Net fixed assets TOTAL ASSETS Current Liabilities: $50 Accounts payable 80 Short-term notes 220 Total current debt $350 Long-term debt Total debt: $960 Common stock -390 Retained earnings $570 Total common equity $920 TOTAL DEBT AND EQUITY $20 80 $100 200 $300 $300 320 $620 $920 Balance Sheet (17) Putting it together Given the information below, can you ASSETS arrange theFIRST: balance sheet? Remember: ASSETS = LIABILITIES + EQUITY Assets: Current Assets Fixed Assets TOTAL ASSETS Gross Fixed Assets $2,500 Inventories $ 310 Net Fixed Assets $2,200 Cash $ 70 Accumulated Depreciation $(300) $ 2,800 Total Current Assets $ 600 Accounts Receivable $ 220 Balance Sheet (18) Putting it together NEXT: DEBT & EQUITY Liabilities: Current Liabilities: Owners’ Equity: TOTAL DEBT&EQUITY $ 2,800 Total Current Liabilities $ 250 Total Owners’ Equity $1,750 Accounts Payable $ 230 Common Stock $ 900 Short-term Notes $ Total Debt $1,050 Long-term debt $ 800 Retained Earnings $ 850 20 Balance Sheet (19) All Together The complete balance sheet is as follows Assets: Current Assets Liabilities: Current Liabilities: Cash $ Accounts Receivable 70 Accounts Payable $ 230 $ 220 Short-term Notes $ Inventories $ 310 Total Current Liabilities $ 250 Total Current Assets $ 600 Long-term debt $ 800 Total Debt $1,050 Fixed Assets Gross Fixed Assets $2,500 20 Owners’ Equity: Accumulated Depreciation $ 300 Common Stock $ 900 Net Fixed Assets $2,200 TOTAL ASSETS $ 2,800 Retained Earnings Total Owners’ Equity $ 850 $1,750 TOTAL DEBT&EQUITY $ 2,800 Balance Sheet (20) Income Statement and Balance Sheet Income Statement for 2007 December 31 January 1 The Income Statement and Balance Sheet complement each other YEAR 2007 Balance Sheet on December 31, 2006 Balance Sheet on December 31, 2007 Balance Sheet (21) Concluding Thought • A balance sheet indicates a firm’s financial position in terms of the assets owned and how these assets have been financed by debt and owner’s equity. • With an understanding of the income statement and the balance sheet, we can now look at the Cash Flow Statement. DON’T CONTINUE if you do not fully understand the balance sheet!! Go back until you have grasped all the parts of the balance sheet. Cash Flow Statement (1) “Cash is King!! Cash flow problems is a major reason for small firms failing—even at times when the business is profitable. Run out of cash and your business will fail! CASH IS KING is not some cliché, but a principle you cannot afford to violate! Cash Flow Statement (2) Accrual versus Cash Accounting • You must understand the difference between accrual-basis accounting and cash-basis accounting. • With the exception of very small businesses, the income statement and the balance sheet are based on accrual accounting. • When accrual accounting is used, profits and cash flows will not be equal. Cash Flow Statement (3) Accrual and Cash Accounting Again • Recording income and expenses: – Accrual-basis: When there is a commitment – Cash-basis: When money changes hands Income earned Cash received Expense incurred Expense paid Accrual-basis accounting Cash-basis accounting Cash Flow Statement (4) Why Profits and Cash Flow are NOT the Same • The differences between profits and cash flows can result from: – Sales reported on the Income Statement include cash and credit sales – Some purchases are financed by credit—so no cash is involved – Depreciation expense is a non-cash expense. – Income tax on the income statement may be accrued and paid in later periods. Profits will never tell you how much cash you generated!! Cash Flow Statement (5) Accrual vs. Cash Again Which type of accounting would record the following? Accrual Income tax expense that has not been paid Insurance premium paid in advance Customer pays for a good to be delivered Equipment is sold, with a 30 day note Customer pays and takes equipment sold Customer receives a service estimate Payment of last month’s utility bill Cash Cash Flow Statement (6) The Cash Flow Statement answers a very important question: “Where did the cash come from and where did the cash go?” Cash Flow Statement (7) Data Needed to Compute Cash Flows • From the income statement: – – – – Depreciation expense Operating income Interest expense Income tax expense • Changes in the balance sheet at the beginning of the year (end of last year) and the balance sheet for the current year end. Cash Flow Statement (8) Changes in the Balance Sheet that Affect Cash Flows • Cash increases if: – Reduce assets – Borrow more money (increase debt) – Owners invest more in the business • Cash decreases if: – Increase assets – Repay (decrease) debt – Owners withdraw money from the company Changes in the balance sheet affect cash flows. Cash Flow Statement (9) • Cash inflows and outflows result from three activities: – Operating Activities: Cash flow from normal operations – Investment Activities: Cash flow related to the investment in or sale of assets – Financing activities: Cash flow related to financing the firm Three activities cause cash to increase or decrease Cash Flow Statement (10) Operating Activities • Cash flow from operations consists of the net flow of cash from day-today business activities • Start with • Add back Operating income Depreciation expense (a non-cash expense) • Subtract income taxes (to work on an after-tax basis) • Subtract capital increase in net working Which consists of: – Increase in A/R (a use of cash) – Increase in inventories (a use of cash) – Decrease in A/P (a source of cash) What is cash flow from operations? Cash Flow Statement (11) Investment Activities • Investment activities consist of – The purchase or sale of fixed assets (change in gross fixed assets) – The purchase or sale of other long-term assets (changes in goodwill, patents, etc.) What is cash flow from investment activities? Cash Flow Statement (12) Financing Activities Financing activities include: – Paying dividends and interest expense – Increasing or decreasing short-term and long-term debt • Increase: borrowing more money • Decrease: paying off debt – Owners invest more or less in business • Buy more stock • Company buys owner’s stock back What is cash flow from financing activities? Cash Flow Statement (13) Change in net working capital Cash Flow Statement for Trimble Associates Operating Activities Operating income $ 100 Plus depreciation 30 Less income taxes (20) $ 110 Change in net working capital: Less increases in A/R $ (5) Less increases in inventories (40) Plus increases in A/P 5 (40) Cash flows from operations $ 100 Investment Activities Less increase in gross fixed assets $ (100) Financing Activities Less interest expenses $ (20) Less dividends paid (15) Plus incr in short-term notes 20 Plus incr in long-term notes 50 Total Financing Activities $ 35 Increase (Decrease) in cash $ 5 Cash Flow Statement (14) Can You Arrange this Cash Flow Statement? Operating activities: Plus Less Less Less Plus Cash flows from operations: Investment activities Less Financing activities Less Less Plus Plus Total financing activities Increase (Decrease) in cash Interest expenses $(30) Operating Income $120 Taxes $(30) Increase in gross fixed assets $(90) $100 Increases in long-term notes $ 30 Depreciation $ 40 Increases in short-term $ 100 notes $ 15 $ receivable (90) Increases in accts $(20) $ 5payable $ 5 Increases in accounts $ 5 $ 15 Increases in inventories $(10) Dividends paid $(10) Cash Flow Statement (15) Interpreting the Cash Flow Statement • To understand what the cash flow statement is saying, look at the signs (+ or -) of the three cash flow activities: – Is cash flow from operations positive or negative? – Is cash flow from investment activities positive or negative? – Is cash flow from financing activates positive or negative? Want to understand the cash flow statement? Look at the three cash flow activities. Cash Flow Statement (16) Examples of Cash Flow Patterns Some of the more important cash flow patterns are: Using cash flows from operations and financing to invest in long-term assets (fixed assets) Using cash flows from operations to expand the business and repay creditors and/or owners Negative cash flow from operations funded by selling long-term assets and additional financing Sustaining negative cash flows and investment to expand the business through financing (Could be a start-up that has yet to break even) CONGRATULATIONS!! Go Celebrate! You have completed the task! Hopefully, your persistence has paid off and you understand financial statements much more fully and any fear of financial statements has been reduced. Way to go!!!