Strong Revenue Growth Driving Momentum

advertisement

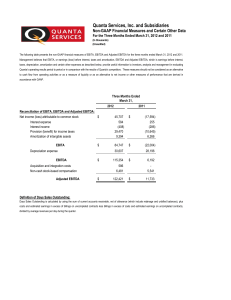

Express-1 Expedited Solutions, Inc. AMEX: XPO Investor Presentation Safe Harbor This presentation contains forward-looking statements that may be subject to various risks and uncertainties. Such forward-looking statements are made pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 and are made based on management's current expectations or beliefs as well as assumptions made by, and information currently available to, management. These forward-looking statements are subject to various risks and uncertainties. You can find information concerning risks and uncertainties that could cause actual results to differ materially from those projected or suggested in the reports that we have filed with the Securities and Exchange Commission. The forward-looking statements contained in this presentation represent our judgment as of the date of this presentation and you should not unduly rely on such statements. Unless otherwise required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this presentation. Use of GAAP and Non-GAAP Measures In addition to results presented in accordance with generally accepted accounting principles (GAAP), the Company has included "EBITDA", a non-GAAP financial measure. A reconciliation of EBITDA to the most directly comparable GAAP financial measure is available on our company website, www.express-1.com. Management believes the use of non-GAAP financial measures provides useful information to investors to assist them in understanding the underlying operational performance of the Company. Specifically, management believes EBITDA is a useful measure of operating performance before the impact of investing and financing transactions, making comparisons between companies' earnings power more meaningful and providing consistent period-over-period comparisons of the Company's performance. The Company uses these non-GAAP financial measures internally to measure its ongoing business performance . XPO Organizational Structure Express-1, Inc. • • • • • • • Non-Asset Based Expedited Transportation Exclusive Use, Independent Contractor Fleet High Value, Time Critical and Priority Shipments Same Day Service Team of 70 Employees Buchanan, MI and Toledo, OH 2007 Revenue - $48 Million Expedites Created by: Supply Chain Interruptions Special Handling Needs Manufacturing Constraints JIT Inventory Demands Absolute Dependability Needs Bounce Logistics • • • • • • • Non-Asset Based Brokerage Operation High Growth Market Niche Focused on Premium Transportation Solutions Shares Customer Overlap with Express-1 and CGL Team of 5 Employees South Bend, IN Start-Up, 2008 Revenues $5 Million Targeted Customers: Freight Forwarders (Domestic and International) Integrated Carriers Airlines 3PL’s and 4PL’s Freight Brokers Express-1 Dedicated • • • • • • • Asset Light, Dedicated Fulfillment Operation Supports One Primary Account – FORD Became Highly Profitable of Late Low Growth, High Returns Team of 55 Employees Evansville, IN 2007 Revenue - $5 Million Operational Overview: 18 Trucks with 200 Dedicated Stops Daily Service to FORD Dealerships within 250 Radius of Evansville Cross-Dock Operation for Other Accounts Concert Group Logistics (CGL) • • • • • • Non-Asset Based Network of 24 Stations Each Station Independently Owned Not Restricted by Size, Weight, Mode or Location Approximately 20 Employees Downers Grove, IL 2007 Revenue - $47 Million Common Services (Domestic and International): Time Critical (Immediate, Air Charter, Expedite) Time Sensitive (Next Day, 2nd Day, 3rd Day) Staged Deliveries Cost Sensitive (Deferred, Full Load) Value Added (Documentation, Customs Clearance, Banking Support) Historical Highlights of XPO • Formed Express-1 Dedicated in 2003. Dedicated Contract Services for Ford Motor Company • Acquired Express-1, Inc. in 2004. Founded in 1989 by Mike Welch and Keith Avery. 19 Year History of Profitability and Growth. • Formed Bounce Logistics in 2008. Headed by Seasoned Management Team High Growth Market Niche • Acquired Concert Group Logistics (CGL) in 2008. Founded in 2002 by Dan Para and Gerry Post. History of Strong Growth and Profitability Acquired Express-1, Inc. Formed Express-1 Dedicated Acquired Concert Group Logistics (CGL) Formed Bounce Logistics XPO Strategy • Focus on Non-Asset Based Transportation • Provide Premium Services Resulting in Premium Rates • Committed to High Rate of Organic Growth • Compliment Organic Growth with Select Acquisitions and Start-ups Strong Revenue Growth * CAGR Includes CGL on Proforma Basis Year End 2007 Highlights • Consolidated Revenue Growth > 25% • Proforma Revenue Growth > 27% • Consolidated Operating Income Up > 30% • Proforma Operating Income Up > 28% • EBITDA $4.4 Million or 8.2% • Proforma EBITDA $6.0 Million or 6.0% Proforma results include CGL Strong Revenue Growth $30 $27 $26 $26 $27 $24 $22 $21 $20 $20 $21 $18 $18 $18 $17 $14.1 $13.8 $15 $11.1 $12 $9.5 $9.7 $10.9 $10.7 $13.4 $11.5 $9.6 $9 $6 $3 $- Q3 2005 Q4 2005 Q1 2006 Q2 2006 Q3 2006 Q4 2006 ($ In Millions) Revenue Growth 18% CAGR Q1 2007 Q2 2007 Q3 2007 Q4 2007 Proforma results include CGL XPO Revenue High Margins and Shrinking SG&A 50% 45% 40% 35% 30% 25% 20% 20% 18% 19% 16% 15% 14% 15% 14% 18% 18% 14% 14% 13% 18% 17% 16% 14% 12% 11% 11% 11% 10% 5% 0% Q3 2005 Q4 2005 Q1 2006 Q2 2006 Q3 2006 Gross Margin Q4 2006 Q1 2007 Q2 2007 Q3 2007 SG & A Q4 2007 Taking it to the Bottom Line 1,891 1,940 Not Adjusted for Tax Fully Tax Adjusted 1,595 1,440 1,141 1,049 920 1,046 905 839 848 940 729 597 807 754 651 557 499 461 457 440 (551) (60) Tax Benefit Of $1.1 Million (378) (560) Q3 2005 (In Thousands) Q4 2005 Q1 2006 Q2 2006 Net Income Q3 2006 Q4 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Proforma Net Income Why Invest in XPO • Experienced Management Team Comparative P/E Ratios 44 • Low P/E Compared to Peers • History of Strong EBITDA Growth 38 • Low Annual CapEx Requirements 31 28 • Strong Free-Cash Flow • Significant ROI 18 • Annual Guidance 13 7 XPO Company A Company B Company C Company D Company E Company F Revenues > $120 Million (+20%) Gross Margin > 17% SG&A < 11% Net Income > $3.7 Million EPS $0.11 to $0.12, Fully Diluted Questions XPO XPO XPO XPO XPO Investor Relations Contact: Mark Patterson Chief Financial Officer Express-1, Inc. 429 Post Road Buchanan, MI 49107 (269) 695-2700 www.express-1.com XPO XPO XPO