Class 6 - Financial Management - Budget-57-508-201

advertisement

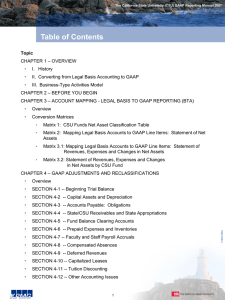

Financial Management 57.508-201 The Budget as a Policy, Planning and Information Tool Week 6 - Spring 2011 Accounting and Controls • • • • • • • • • Recording all financial transactions Accrual or modified accrual basis accounting GAAP & GASB (Governmental Accounting Standards Board) Budget oversight and expenditure monitoring Revenue monitoring Program or outcome monitoring Purchasing controls Staffing changes Supplemental appropriations GAAP The Governmental Accounting Standards Board (GASB) is the source of the generally accepted accounting principles (GAAP) used by state and local governments, publicly-traded and privately-held companies and not-for-profit organizations GAAP Principles • • • • • • • • • Regularity: Conformity to enforced rules and laws Consistency: All entries in exactly the same way Sincerity: Done in good faith Permanence of methods: Allow for comparison Non-compensation: Not seek to compensate a debt with an asset or a revenue with an expense Prudence: Not make things look better than they are. Continuity: Assume that the business will not be interrupted Periodicity: Each entry should be allocated to a given period Full Disclosure/Materiality: All information must be disclosed Fund Accounting Governments & NGOs practice fund accounting Rule: All revenues are designated to be deposited in a particular fund and every item of expenditure comes from some particular fund Principle: An obligation for reporting to financial statements users to show how money is spent Fund Structure • General Fund • Special Revenue Fund • Capital Projects Fund • Debt Service Fund • Enterprise Fund • Internal Service Fund • Special Assessment • Trust and Agency (3rd party) Budgeting Interrelationship • Both budgeting and accounting are fiscal systems or processes that involve the allocating, and disbursing of resources • This results in an interrelationship and a need for coordination between these two fiscal disciplines • Budgeting is regarded more in terms of planning, preparing and executing a fiscal plan for a period of time • Budgeting processes are dependent upon the accounting of past-year and current-year expenditures/revenues • Accounting focuses on the recording, classifying, and interpreting of financial transactions Financial Statements GAAP requires the following 4 financial statements • • • • Balance Sheet - statement of financial position at a given point in time Income Statement - revenues minus expenses for a given time period ending at a specified date Statement of Owner’s Equity - also known as Statement of Retained Earnings or Equity Statement Statement of Cash Flows - summarizes sources and uses of cash; indicates whether enough cash is available to carry on routine operations Balance Sheet Based on the fundamental accounting model: Assets = Liabilities + Fund Balance (Note for-profit: Assets = Liabilities + Equity) Balance Sheet Assets Assets can be classed as current or fixed • Current assets are assets that easily can be converted into cash including cash on hand, accounts receivable, marketable securities, notes receivable, inventory, and prepaid assets like insurance • Fixed assets include land, buildings, and equipment and are recorded at historical cost (which can be higher or lower than the current market value) Liabilities That portion of the assets that are owed • Current liabilities include accounts payable, notes payable, debt service, wages owed, etc. • Long-term liabilities include outstanding mortgages and bonds Fund Balance A fund balance is created from excess revenues over expenditures (some combination of revenues being higher than budgeted and expenditures being lower than budgeted) Fund balance two different categories • Reserved Fund Balance – • Capital reserve or special projects Unreserved Fund Balance – Emergency or contingency or “rainy day” Income Statement The income statement presents the results of the organization’s operations over a period of time Net Income = Revenue - Expenses Income from operations can be separated from other forms of income like grants, gifts, interest earned, sales, etc. And if there are investments or property: Net Income = Revenue - Expenses + Gains - Losses Income Statement Statement of Cash Flows • Shows how changes in balance sheet affect cash on hand • Useful in the organization’s ability to pay its bills on time • Represents an analysis of all of the transactions of the period showing where the organization obtained its cash and what it did with it and breaks the sources and uses of cash into : – Operating activities – Investing activities – Financing activities – Grant receipts Statement of Cash Flows Financial Statements McNamara’s Basic Guide to Non-Profit Financial Management “NONPROFIT FINANCIAL STATEMENTS” “Financial Statements of Not-for-Profit Organizations” http://www.1800net.com/nprc/fasb117.html Alliance for Nonprofit Management http://www.allianceonline.org/ Auditing Government Auditing Standards Generally Accepted Government Auditing Standards (GAGAS) Standards for audits of “government organizations, programs, activities, and functions, and of government assistance received by contractors, nonprofit organizations, and other nongovernment organizations.” http://gaqc.aicpa.org/ Internal Controls A process, effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of objectives in the following three categories: 1. Effectiveness and efficiency of operations 2. Reliability of financial reporting 3. Compliance with applicable laws and regulations Internal Controls Five Components Control Environment 1. – Tone set at the top Risk Assessment 2. – Risks to achieving the objectives Control Activities 3. – Written policies and procedures Information and Communication 4. – Communicate, communicate , communicate… Monitoring 5. – Performance measurement Internal Controls “As important as an internal control structure is to an organization, an effective system is not a guarantee that the organization will be successful. An effective internal control structure will keep the right people informed about the organization’s progress (or lack of progress) in achieving its objectives, but it cannot turn a poor manager into a good one.” Guiding Principles • Planning • Fundraising • Governance • • Human Resources Public Policy & Advocacy • Information and Technology • Strategic Alliances • Evaluation • Financial Management • Transparency and Accountability Planning • Clearly defined written mission statement • Periodic review of mission statement • Formal risk management plan • Solicit input from staff, board & clients • Consults with counterpart agencies • Written strategic plan with objectives & tasks Governance • Determine the organization’s mission and purpose • Select & evaluate the chief executive • Provide proper financial oversight • Ensure legal and ethical integrity • Recruit and orient new board members • Enhance the organization’s public standing • Monitor the organization’s programs and services • Review & adopt the organization’s annual budgets Human Resources • Comply with all state and federal employment laws • Adopt written personnel policies and procedures • Employ personnel who reflect the community (EEO) • Support the education and development of staff • Provide opportunities for growth and advancement • Provide clear and current job descriptions Financial Management • Generate accurate and relevant financial reports • Should understand how to read financial statements • Have specific financial checks and balances process • Have annual audits prepared by outside auditor • Auditor should meet with the board separately • Establish and maintain a financial reserve • System that allows reports of financial misconduct Transparency & Accountability • Comply with all required reporting procedures • Regularly measure levels of performance • Clients provided with opportunities for input • Hold public meetings regularly to gather input • Produce an annual report on activities and performance • Full information on services and fee structure • Ensure confidentiality and non-discriminatory service Fundraising • Board owns responsibility for fundraising • Seek only the funds needed to achieve mission • Comply with code of ethics and standards • Professional fundraiser must be licensed • Expend funds according to funders’ wishes • Regularly communicate with donors Public Policy & Advocacy • Advocate on behalf of its clients and mission • Participate in public policy formation • Maintain understanding of current policies • Assist its client groups in public and civic engagement • File accurate reports on all lobbying activities • Ensure that the activities are nonpartisan Information and Technology • Have information systems in place with back-up • Have technology use and security policies • Train board, employees and volunteers on system • Should maintain a catastrophic data recovery plan Strategic Alliances • Foster relationships with similar organizations & state, regional and national associations • Alliances should be in line with the strategic goals • Be aware of services provided by other organizations • Promote other organizations’ services for choice • Collaborate to ensure effective use of resources • Larger nonprofits should assist smaller nonprofits Evaluation • Procedures for evaluating programs and procedures • Regularly monitor the satisfaction of clients • Results should be used to effect operational plan • Performance measures should be specific • Evaluation should be ongoing with broad input • Results should be communicated broadly • Share lessons learned with other agencies & funders Upcoming Schedule • • Spring Break – No class 3/9 Midterm Presentations 3/16 – No more than 15 minutes – • 3/23 – Comparative Public Budgeting (US & others) – • Tom Moses - Lowell 3/30 – Strategic Management – • Send me presentations in advance (by 4:00 pm) Donnalee Lozeau - Nashua 4/6 – The Strategic Agenda – Paul Cohen - Chelmsford