Q - Learning

advertisement

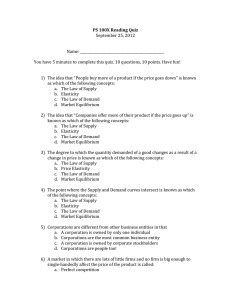

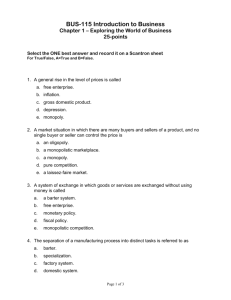

Market Structures The Degree of Competition • Classifying markets – – – – number of firms freedom of entry to industry nature of product nature of demand curve • The four market structures – – – – perfect competition monopoly monopolistic competition oligopoly Features of the four market structures Type of market Number of firms Freedom of entry Nature of product Examples Implications for demand curve faced by firm Perfect competition Very many Unrestricted Homogeneous (undifferentiated) Cabbages, carrots (approximately) Horizontal: firm is a price taker Monopolistic competition Many / several Unrestricted Differentiated Builders, restaurants Downward sloping, but relatively elastic Undifferentiated Cement or differentiated cars, electrical appliances Downward sloping. Relatively inelastic (shape depends on reactions of rivals) Oligopoly Monopoly Few One Restricted Restricted or completely blocked Unique Local water company, train operators (over particular routes) Downward sloping: more inelastic than oligopoly. Firm has considerable control over price Features of the four market structures Type of market Number of firms Freedom of entry Nature of product Examples Implications for demand curve faced by firm Perfect competition Very many Unrestricted Homogeneous (undifferentiated) Cabbages, carrots (approximately) Horizontal: firm is a price taker Monopolistic competition Many / several Unrestricted Differentiated Builders, restaurants Downward sloping, but relatively elastic Undifferentiated Cement or differentiated cars, electrical appliances Downward sloping. Relatively inelastic (shape depends on reactions of rivals) Oligopoly Monopoly Few One Restricted Restricted or completely blocked Unique Local water company, train operators (over particular routes) Downward sloping: more inelastic than oligopoly. Firm has considerable control over price Features of the four market structures Type of market Number of firms Freedom of entry Nature of product Examples Implications for demand curve faced by firm Perfect competition Very many Unrestricted Homogeneous (undifferentiated) Cabbages, carrots (approximately) Horizontal: firm is a price taker Monopolistic competition Many / several Unrestricted Differentiated Builders, restaurants Downward sloping, but relatively elastic Undifferentiated Cement or differentiated cars, electrical appliances Downward sloping. Relatively inelastic (shape depends on reactions of rivals) Oligopoly Monopoly Few One Restricted Restricted or completely blocked Unique Local water company, train operators (over particular routes) Downward sloping: more inelastic than oligopoly. Firm has considerable control over price Features of the four market structures Type of market Number of firms Freedom of entry Nature of product Examples Implications for demand curve faced by firm Perfect competition Very many Unrestricted Homogeneous (undifferentiated) Cabbages, carrots (approximately) Horizontal: firm is a price taker Monopolistic competition Many / several Unrestricted Differentiated Builders, restaurants Downward sloping, but relatively elastic Undifferentiated Cement or differentiated cars, electrical appliances Downward sloping. Relatively inelastic (shape depends on reactions of rivals) Oligopoly Monopoly Few One Restricted Restricted or completely blocked Unique Local water company, train operators (over particular routes) Downward sloping: more inelastic than oligopoly. Firm has considerable control over price Features of the four market structures Type of market Number of firms Freedom of entry Nature of product Examples Implications for demand curve faced by firm Perfect competition Very many Unrestricted Homogeneous (undifferentiated) Cabbages, carrots (approximately) Horizontal: firm is a price taker Monopolistic competition Many / several Unrestricted Differentiated Builders, restaurants Downward sloping, but relatively elastic Undifferentiated Cement or differentiated cars, electrical appliances Downward sloping. Relatively inelastic (shape depends on reactions of rivals) Oligopoly Monopoly Few One Restricted Restricted or completely blocked Unique Local water company, train operators (over particular routes) Downward sloping: more inelastic than oligopoly. Firm has considerable control over price Features of the four market structures Type of market Number of firms Freedom of entry Nature of product Examples Implications for demand curve faced by firm Perfect competition Very many Unrestricted Homogeneous (undifferentiated) Cabbages, carrots (approximately) Horizontal: firm is a price taker Monopolistic competition Many / several Unrestricted Differentiated Builders, restaurants Downward sloping, but relatively elastic Undifferentiated Cement or differentiated cars, electrical appliances Downward sloping. Relatively inelastic (shape depends on reactions of rivals) Oligopoly Monopoly Few One Restricted Restricted or completely blocked Unique Local water company, train operators (over particular routes) Downward sloping: more inelastic than oligopoly. Firm has considerable control over price The Degree of Competition • Classifying markets – – – – number of firms freedom of entry to industry nature of product nature of demand curve • The four market structures – – – – perfect competition monopoly monopolistic competition oligopoly • Structure conduct performance Perfect Competition • Assumptions – firms are price takers – freedom of entry – identical products – perfect knowledge • Short-run equilibrium of the firm – price, output and profit Short-run equilibrium of industry and firm under perfect competition P R MC S Pe D = AR = MR AR AC D O O Q (millions) (a) Industry AC Qe Q (thousands) (b) Firm Loss minimising under perfect competition P R AC P1 AC MC S D1 = AR1 AR1 = MR1 D O O Q (millions) (a) Industry Qe Q (thousands) (b) Firm Perfect Competition • Assumptions – firms are price takers – freedom of entry – identical products – perfect knowledge • Short-run equilibrium of the firm – price, output and profit • The short-run supply curve of the firm Deriving the short-run supply curve P R S MC = S a P1 P2 b c P3 D1 = MR1 D2 = MR2 D3 = MR3 D1 D3 O D2 O Q (millions) (a) Industry Q (thousands) (b) Firm Perfect Competition • Long-run equilibrium of the firm – all supernormal profits competed away – LRAC = AC = MC = MR = AR Long-run equilibrium under perfect competition Profits return Supernormal New firms enter to normalprofits P R S1 Se LRAC P1 AR1 D1 PL ARL DL D O O Q (millions) (a) Industry QL Q (thousands) (b) Firm Long-run equilibrium of the firm under perfect competition R (SR)MC (SR)AC LRAC DL AR = MR LRAC = (SR)AC = (SR)MC = MR = AR O Q Perfect Competition • Incompatibility of economies of scale with perfect competition • Benefits of perfect competition – price equals marginal cost – prices kept low – firms must be efficient to survive Monopoly • Defining monopoly • Barriers to entry – economies of scale – economies of scope – product differentiation and brand loyalty – lower costs for an established firm – ownership/control of key factors – ownership/control over outlets – legal protection – mergers and takeovers – aggressive tactics Monopoly • The monopolist’s demand curve – downward sloping – MR below AR • Equilibrium price and output – Equilibrium output, where MC = MR Profit maximising under monopoly R MC MR O Qm Q Monopoly • The monopolist’s demand curve – downward sloping – MR below AR • Equilibrium price and output – Equilibrium output, where MC = MR – Equilibrium price, found from demand curve Profit maximising under monopoly R MC AC AR AC AR MR O Qm Q Monopoly • The monopolist’s demand curve – downward sloping – MR below AR • Equilibrium price and output – Equilibrium output, where MC = MR – Equilibrium price, found from demand curve • Profit – Measuring profit Profit maximising under monopoly R MC Total profit AC AR AC AR MR O Qm Q Monopoly • The monopolist’s demand curve – downward sloping – MR below AR • Equilibrium price and output – Equilibrium output, where MC = MR – Equilibrium price, found from demand curve • Profit – Measuring profit Monopoly • Disadvantages of monopoly – high prices / low output: short run Equilibrium of industry under perfect competition and monopoly: with the same MC curve R MC Monopoly P1 AR = D MR O Q1 Q Equilibrium of industry under perfect competition and monopoly: with the same MC curve R MC ( = supply under perfect competition) Comparison with Perfect competition P1 P2 AR = D MR O Q1 Q2 Q Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate – X-inefficiency Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate – X-inefficiency • Advantages of monopoly Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate – X-inefficiency • Advantages of monopoly – economies of scale Equilibrium of industry under perfect competition and monopoly: with different MC curves R MCmonopoly P1 AR = D MR O Q1 Q Equilibrium of industry under perfect competition and monopoly: with different MC curves R MC ( = supply)perfect competition MCmonopoly P2 P1 x P3 AR = D MR O Q2 Q1 Q3 Q Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate – X-inefficiency • Advantages of monopoly – economies of scale – profits can be used for investment Monopoly • Disadvantages of monopoly – high prices / low output: short run – high prices / low output: long run – lack of incentive to innovate – X-inefficiency • Advantages of monopoly – economies of scale – profits can be used for investment Monopoly • Contestable markets – importance of potential competition – a perfectly contestable market – contestable markets and natural monopolies – importance of costless exit • Contestable markets and the public interest Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run Short-run equilibrium of the firm under monopolistic competition R MC AC Ps ACs AR = D MR O Qs Q Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run – long run Long-run equilibrium of the firm under monopolistic competition R LRMC LRAC PL ARL = DL MRL O QL Q Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run – long run – underutilisation of capacity in the long run Long run equilibrium of the firm under perfect and monopolistic competition R LRAC P1 P2 DL under perfect competition DL under monopolistic competition O Q1 Q2 Q Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run – long run – underutilisation of capacity in the long run • Non-price competition Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run – long run – underutilisation of capacity in the long run • Non-price competition • The public interest Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run – long run – underutilisation of capacity in the long run • Non-price competition • The public interest – comparison with perfect competition Monopolistic Competition • Assumptions of monopolistic competition • Equilibrium of the firm – short run – long run – underutilisation of capacity in the long run • Non-price competition • The public interest – comparison with perfect competition – comparison with monopoly Oligopoly • Key features of oligopoly – barriers to entry – interdependence of firms • Competition versus collusion • Collusive oligopoly: cartels – equilibrium of the industry Profit-maximising cartel R Industry D = AR O Q Profit-maximising cartel R Industry MC P1 Industry D = AR Industry MR O Q1 Q Oligopoly • Key features of oligopoly – barriers to entry – interdependence of firms • Competition versus collusion • Collusive oligopoly: cartels – equilibrium of the industry Oil prices $ per barrel Actual price 35 Iraq invades Iran OPEC’s first quotas 30 Iraq invades Kuwait Revolution in Iran 25 20 Impending war with Iraq World-wide recovery First oil from North Sea World-wide slowdown 15 10 Cease-fire in Iran-Iraq war New OPEC quotas 86 92 Recession in Far East Yom Kippur War: Arab oil embargo 5 0 70 72 74 76 78 80 82 84 88 90 94 96 98 00 02 Oil prices $ per barrel Actual price Cost in 1973 prices 35 Iraq invades Iran OPEC’s first quotas 30 Iraq invades Kuwait Revolution in Iran 25 20 Impending war with Iraq World-wide recovery First oil from North Sea World-wide slowdown 15 10 Cease-fire in Iran-Iraq war New OPEC quotas 86 92 Recession in Far East Yom Kippur War: Arab oil embargo 5 0 70 72 74 76 78 80 82 84 88 90 94 96 98 00 02 Oligopoly • Tacit collusion – price leadership: dominant firm Price leader aiming to maximise profits for a given market share R Assume constant market share for leader AR = D market AR = D leader MR leader O Q Price leader aiming to maximise profits for a given market share R MC PL l t AR = D market AR = D leader MR leader O QL QT Q Oligopoly • Tacit collusion – price leadership: dominant firm – price leadership: barometric Oligopoly • Tacit collusion – price leadership: dominant firm – price leadership: barometric – rules of thumb Oligopoly • Factors favouring collusion – Few firms – Open with each other – Similar production methods and average costs – Similar products – Dominant firm – Significant entry barriers – Stable market – No government measures to curb collusion Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games Profits for firms A and B at different prices X’s price R2.00 B A R2.00 Y’s price R1.80 R1.80 R5m for Y R12m for X R10m each D C R12m for Y R5m for X R8m each Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games • Nash equilibrium Profits for firms A and B at different prices X’s price R2.00 B A R2.00 Y’s price R1.80 R1.80 R5m for Y R12m for X R10m each D C R12m for Y R5m for X R8m each Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games • Nash equilibrium • the prisoners’ dilemma The prisoners' dilemma Amanda's alternatives Not confess Not confess B A Each gets 1 year Nigel's alternatives C Nigel gets Confess Confess 3 months Amanda gets 10 years Nigel gets 10 years Amanda gets 3 months D Each gets 3 years Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games • the prisoners’ dilemma • Nash equilibrium – more complex non-dominant strategy games Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games • the prisoners’ dilemma • Nash equilibrium – more complex non-dominant strategy games – the importance of threats and promises Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games • the prisoners’ dilemma • Nash equilibrium – more complex non-dominant strategy games – the importance of threats and promises – the importance of timing of decisions Oligopoly • The breakdown of collusion • Non-collusive oligopoly: game theory – alternative strategies • maximax and maximin – simple dominant strategy games • the prisoners’ dilemma • Nash equilibrium – more complex non-dominant strategy games – the importance of threats and promises – the importance of timing of decisions • decision trees A decision tree Airbus decides Boeing –R10m (1) Airbus –R10m B1 Boeing +R30m (2) Airbus +R50m Boeing decides A Boeing +R50m (3) Airbus +R30m B2 Airbus decides Boeing –R10m (4) Airbus –R10m Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model Kinked demand for a firm under oligopoly R Current price and quantity give one point on demand curve P1 O Q1 Q Kinked demand for a firm under oligopoly R D P1 D O Q1 Q Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model – stable prices Stable price under conditions of a kinked demand curve R MC2 MC1 P1 a D = AR b O Q Q1 MR Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model – stable prices – limitations of the model Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model – stable prices – limitations of the model • Oligopoly and the public interest Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model – stable prices – limitations of the model • Oligopoly and the public interest – advantages Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model – stable prices – limitations of the model • Oligopoly and the public interest – advantages – disadvantages Oligopoly • Non-collusive oligopoly: the kinked demand curve theory – assumptions of the model – stable prices – limitations of the model • Oligopoly and the public interest – advantages – disadvantages Price Discrimination • Meaning of price discrimination – First degree – Second degree – Third degree (the most common form) Third-degree price discrimination P Revenue from a single price P1 D O 200 Q Third-degree price discrimination P Increased revenue from price discrimination A higher discriminatory price is now introduced P2 P1 D O 150 200 Q Price Discrimination • Meaning of price discrimination – First degree – Second degree – Third degree (the most common form) • Conditions necessary for price discrimination Price Discrimination • Meaning of price discrimination – First degree – Second degree – Third degree (the most common form) • Conditions necessary for price discrimination • Advantages to the firm Price Discrimination • Profit maximising prices and output under price discrimination Profit-maximising output under third degree price discrimination DX O O MRX (a) Market X O Profit-maximising output under third degree price discrimination DY DX O MRY O O MRX (a) Market X (b) Market Y Profit-maximising output under third degree price discrimination DY DX O MRY O MRT O MRX (a) Market X (b) Market Y (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC DY DX O MRY O MRT O MRX (a) Market X (b) Market Y (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC DY DX O MRY O O MRX (a) Market X MRT (b) Market Y 3000 (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC 5 DY DX O MRY O O MRX (a) Market X MRT (b) Market Y 3000 (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC 5 DY DX O 1000 MRY O O MRX (a) Market X MRT (b) Market Y 3000 (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC 5 DY DX O 1000 MRY O MRX (a) Market X 2000 (b) Market Y MRT O 3000 (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC 9 5 DY DX O 1000 MRY O MRX (a) Market X 2000 (b) Market Y MRT O 3000 (c) Total (markets X + Y) Profit-maximising output under third degree price discrimination MC 9 7 5 DY DX O 1000 MRY O MRX (a) Market X 2000 (b) Market Y MRT O 3000 (c) Total (markets X + Y) Price Discrimination • Profit maximising prices and output under price discrimination • Price discrimination and the public interest – competition Price Discrimination • Profit maximising prices and output under price discrimination • Price discrimination and the public interest – competition – profits