Wk 4 Quiz

advertisement

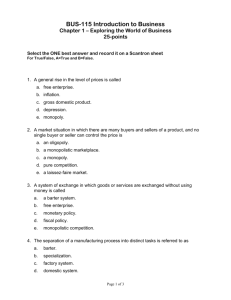

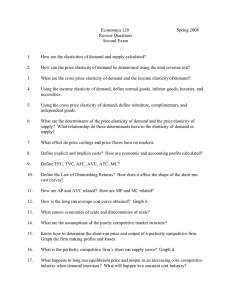

PS 100X Reading Quiz September 25, 2012 Name: __________________________________________________ You have 5 minutes to complete this quiz. 10 questions, 10 points. Have fun! 1) The idea that “People buy more of a product if the price goes down” is known as which of the following concepts: a. The Law of Supply b. Elasticity c. The Law of Demand d. Market Equilibrium 2) The idea that “Companies offer more of their product if the price goes up” is known as which of the following concepts: a. The Law of Supply b. Elasticity c. The Law of Demand d. Market Equilibrium 3) The degree to which the quantity demanded of a good changes as a result of a change in price is known as which of the following concepts: a. The Law of Supply b. Price Elasticity c. The Law of Demand d. Market Equilibrium 4) The point where the Supply and Demand curves intersect is known as which of the following concepts: a. The Law of Supply b. Elasticity c. The Law of Demand d. Market Equilibrium 5) Corporations are different from other business entities in that a. A corporation is owned by only one individual b. Corporations are the most common business entity c. A corporation is owned by corporate stockholders d. Corporations are people too! 6) A market in which there are lots of little firms and no firm is big enough to single-handedly affect the price of the product is called: a. Perfect competition b. Monopolistic competition c. Oligopoly d. Monopoly 7) A market in which there is only one firm is called: a. Perfect competition b. Monopolistic competition c. Oligopoly d. Monopoly 8) A market in which there are a few big firms is called : a. Perfect competition b. Monopolistic competition c. Oligopoly d. Monopoly 9) The authors of “Sex, Booze, and Drugs” argue that the prohibition of alcohol had which of the following effects on the alcohol market: a. Increased the production of stronger liquors b. Encouraged criminals to enter the market as producers c. Increased the number of deaths from alcohol poisoning d. All of the above 10) The authors of “The (Dis)Incentives of Higher Taxes” argue that raising taxes often does not increase revenues as expected because: a. Workers decide to work less b. More people try to cheat the tax system c. Individuals/companies will move their money and operations to other countries with lower tax rates d. All of the above