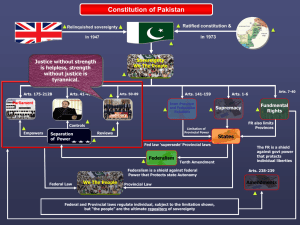

Making Federalism Work – The 18 th Constitutional Amendment

advertisement