Types of Organizational Customers

advertisement

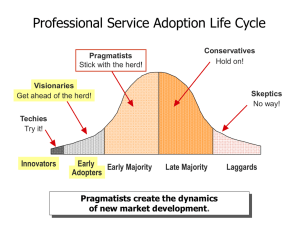

Chapter 2 Classifying Customers, Organizations, and Markets Prepared by John T. Drea, Western Illinois University 1 Types of Organizational Customers Commercial Enterprises Industrial Distributors Value-Added Resellers Government Units 85,000 local, state, and federal government units Original Equipment Manufacturers Users or End Users Nonprofit and Not-for-Profit Organizations Churches, hospitals, colleges, nursing homes, etc. 2 • Industrial Distributors Commercial Enterprises Industrial Distributors Value-Added Resellers Original Equipment Manufacturers Users or End Users – Provide economic utilities of form, time, place, and possession to manufacturers – Creates assortments of products from many manufacturers – Particularly useful for reaching customers too small to justify direct sales efforts 3 • Value-Added Resellers Commercial Enterprises Industrial Distributors Value-Added Resellers Original Equipment Manufacturers Users or End Users – More than just a distributor or wholesaler. – Provides unique offering enhancements tailored to a customer’s needs by combining products/services from other manufacturers. – Creates a value network at the user level. 4 Commercial Enterprises Industrial Distributors Value-Added Resellers Original Equipment Manufacturers Users or End Users • Original Equipment Manufacturers (OEMs) – Purchase products and incorporate those products into their products. – Usually the largest-volume users of goods and services. – Ex: Intel is an OEM supplier to many computer manufacturers, Firestone was an OEM supplier to 5 Ford for many years. Commercial Enterprises Industrial Distributors Value-Added Resellers Original Equipment Manufacturers Users or End Users • Users or End Users (E/U) – A manufacturer that purchases goods or services for consumption/ incorporation into their products in such a way that the identity of the purchased product is lost. – When Goodyear purchases steel for fabrication into steel belts for tires, Goodyear is the steel manufacturer’s E/U. 6 Producer Types Raw Materials Producers Component Parts and Manufactured Materials Producers Accessory Equipment Suppliers Capital Goods Manufacturers 7 Producer Types Raw Materials Producers Often compete in price sensitive markets Raw Materials Producers Seek value added positions Products lose identity once incorporated into the customer’s product Raw materials markets are often dominated by a few very large producers 8 Producer Types Components Parts and Manufactured Materials Producers Parts retain their same form when incorporated. Component Parts and Manufactured Materials Producers Usually retain identity even when incorporated into the customer’s product. More differentiated from direct competition by the value added to the customer’s product. Seagate computer drives are an example. 9 Producer Types Capital Goods Manufacturers Capital goods involve large purchases with considerable risk for the customer. Capital Goods Manufacturers Involves the development of specifications to ensure that organizational needs are met. Adherence to specifications reduces opportunities for differentiation. Customers expect an offering that includes installation, equipment, and 10 accessories. Producer Types Accessory Equipment Suppliers Accessory equipment is equipment that works with some other offering. Accessory Equipment Suppliers Accessories can be added to a bundled offering by a channel intermediary. Accessory equipment is usually produced by an independent supplier. The key to providing value is to be compatible with industry standards for the primary offering. 11 Financial Publics Public Interest Groups Communities of interested parties who are not direct participants in a market as customers, channel members, suppliers, or competitors. Publics Independent Press Internal Publics 12 The Macroenvironment Demographic influences Environment value creation. Competitive Environment Economic Environment Technological Environment Sociocultural Environment Natural Environment 13 Forms of Competition in B2B Markets • Pure Competition – No single entity dominates the market or has much of an influence on price. – Most common in commodity industries. – Little product differentiation – price is a major component of the marketing mix. 14 Forms of Competition in B2B Markets • Monopolistic Competition – Many buyers, many sellers. – Product is differentiable – can vary in quality, features, and style – A range of prices is possible. – Promotion and branding are important to product differentiation. 15 Forms of Competition in B2B Markets • Oligoplistic Competition – Market consists of a few sellers that are sensitive of each others’ strategy. – Barriers limit entry of new competitors. – Prices are aimed at maintaining market stability. – Key is building relationships with large volume customers. 16 Forms of Competition in B2B Markets • Pure Monopoly – Only one primary seller. – Competitors that do exist are small niche players. 17 An Adaptation An Adaptation of the Value Chain of the Value Chain 18 Multinational Value Network 19 The Product Life Cycle 20 The Technology Adoption Life Cycle 21 PLC and TALC • Product Life Cycle (PLC) – – – – Introduction Growth Maturity Decline • Technology Adoption Life Cycle (TALC) – Technophiles – Visionaries (aim for “quantum leaps”) – Pragmatists (want proven solutions) – Conservatives – Laggards 22 TALC and How Technology Markets Evolve • Chasm – A break in the sales growth curve for a new technology. – A chasm occurs between visionaries and pragmatists. • Tornado – The chaos that occurs during a period of rapid growth. – A dominant supplier usually emerges from a tornado. 23 Using the Technology Adoption Life Cycle • The vendor of an innovation passes through technophiles and visionaries before establishing a foothold among pragmatists. • Crossing the chasm (called the “market development gap”) between visionaries and pragmatists is related to a change in the entire marketing mix. – There are changes in type of customer and what the customers perceives as being of value. 24 Using the Technology Adoption Life Cycle • Tornado – Corresponds to the late introduction/early growth stage of the PLC – The market wants to support the market leader – it reduces uncertainty for pragmatists. – The market leader has the chance to become the “gorilla” – the gorilla can do what it wants as long as it stays close to what pragmatists desire. 25