Watts and Associates Inc.

advertisement

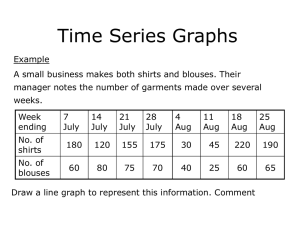

Watts and Associates Inc. Crop Insurance Division Michigan White Wheat Quality Adjustment Update Presented to: Michigan Wheat Program Presented by: Alex Offerdahl Watts and Associates March 11, 2015 Confidentiality Notice Watts and Associates, Inc. has developed this material in cooperation with its clients for the sole use of its recipients for use in developing progressive agricultural policy and has exclusive ownership rights in part or all of its format and content. The content of this material, regardless of the format in which it is presented, including orally, in print, or electronically, may not be further disseminated. This material is protected by law. Watts and Associates Inc. Crop Insurance Division Introduction • Watts and Associates is an Agricultural Economics consulting firm based in Billings, MT • We are the leading developer of new crop insurance products, including both Federal Crop insurance and private products. • In Michigan growers have felt the coverage offered by the Federal Crop Insurance Program does not offer adequate or appropriate protection, particularly for quality loss • We were engaged by the Michigan Wheat Program to develop a study on the relationship between price discount and falling number scores. • We were also asked to work with the program to assist in working with the agency to change the way quality adjustment is handled for falling numbers. Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 1 Watts and Associates Inc. Crop Insurance Division Michigan Wheat and Crop Insurance Wheat Planted Acres 100,000,000 1,400,000 90,000,000 1,200,000 80,000,000 70,000,000 1,000,000 60,000,000 800,000 50,000,000 600,000 40,000,000 30,000,000 400,000 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 US MI Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 2 Michigan Wheat and Crop Insurance Watts and Associates Inc. Crop Insurance Division Wheat Production (Bu) 3,000,000,000 60,000,000 2,500,000,000 50,000,000 2,000,000,000 40,000,000 1,500,000,000 30,000,000 1,000,000,000 20,000,000 500,000,000 10,000,000 0 0 1979 1984 1989 1994 1999 US 2004 2009 2014 MI Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 3 Michigan Wheat and Crop Insurance Watts and Associates Inc. Crop Insurance Division Wheat Yield (bu/ac) 80 Trend: 0.9 bu/yr 70 60 50 40 Trend: 0.25 bu/yr 30 20 10 0 1979 1981 1983 1985 1987 1989 1991 1993 1995 US 1997 1999 2001 2003 2005 2007 2009 2011 2013 MI Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 4 Michigan Wheat and Crop Insurance Watts and Associates Inc. Crop Insurance Division MI Wheat Insurance Participation 800,000 100% 90% 700,000 80% 600,000 70% 500,000 60% 400,000 50% 40% 300,000 30% 200,000 20% 100,000 10% 0 0% 1997 1998 1999 2000 2001 2002 2003 Planted Acres 2004 2005 2006 Insured Acres 2007 2008 2009 2010 2011 2012 2013 2014 Participation Rate Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 5 Watts and Associates Inc. Crop Insurance Division Michigan Wheat and Crop Insurance MI Wheat Insurance Experience $35,000,000 $30,000,000 $25,000,000 $20,000,000 Total Premium Grower Premium Indemnity $15,000,000 $10,000,000 $5,000,000 $0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 6 Michigan Wheat and Crop Insurance Watts and Associates Inc. Crop Insurance Division MI Wheat Loss and Payback Ratios 16 8 4 2 1 0.5 0.25 0.125 1995 1997 1999 2001 2003 Loss Ratio (%) 2005 2007 2009 2011 2013 Payback Ratio Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 7 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat • Falling Numbers – A test for cereal chemical effects of sprout damage – Technically a test for the effects of an enzyme “Alpha Amylase”, which breaks down starch – Industry standard value is 300, with lower values subject to (often variable) discounts Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 8 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat 2011 SPOI: Soft White Wheat will be discounted for falling numbers, regardless of U.S. grade designation as follows: 299-200 0.055 199-0 0.183 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 9 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat 2012 SPOI: Soft White Wheat will be discounted for falling numbers, regardless of U.S. grade designation as follows: 299-200 0.054 199-0 0.181 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 10 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat 2013 SPOI: Soft White Wheat will be discounted for falling numbers, regardless of U.S. grade designation as follows: 299-200 0.054 199-0 0.179 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 11 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat 2014 SPOI: Soft White Wheat will be discounted for falling numbers, regardless of U.S. grade designation as follows: 299-275 0.053 274-250 0.071 249-225 0.089 224-200 0.107 199-0 0.196 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 12 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat Discount Translation: Cash price for soft white wheat in Breckenridge, MI on 3/04 (Michigan Ag Commodities online posted bid price): $5.31/bu FN Value 299-275 274-250 249-225 224-200 199-0 RMA Discount 0.053 0.071 0.089 0.107 0.196 Implied Discount $0.28 $0.38 $0.47 $0.56 $1.04 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 13 Watts and Associates Inc. Crop Insurance Division Quality Adjustment Example • Quality Adjustment in MI White Wheat – A grower has an APH of 80 bu/ac and selects a 75% coverage level. RMA reports a projected price of $5.00/bu. – Guarantee = 80 bu/ac x $5.00 x 75% = $300/ac – Grower harvests 50 bu/ac and has a Falling Number score of 245 (Reduction in Value factor of 0.071). Yield is adjusted • 50 bu/ac x (1.00 - 0.071) = 46.45 bu/ac – Revenue to Count Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 14 Watts and Associates Inc. Crop Insurance Division Quality Adjustment Example • Quality Adjustment in MI White Wheat – Harvest price is also $5.00/bu. – Revenue to Count • 46.45 bu/ac x $5.00/bu = $232.25/ac – Indemnity • $300 – 232.25 = $67.75/ac – Without Quality Adjustment, indemnity would have been $50.00/ac. Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 15 Watts and Associates Inc. Crop Insurance Division Our Study Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 16 Watts and Associates Inc. Crop Insurance Division Our Study Falling Number Implied Empirical Discount Factor Above 300 0.000 299-275 0.000 0.053 274-250 0.000 0.071 249-225 0.035 0.089 224-200 0.111 0.107 199-0 0.306 0.196 SPOI Discount Factor Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 17 Watts and Associates Inc. Crop Insurance Division Quality Adjustment in MI White Wheat RMA’s Proposed Approach: RMA is working to implement an alternative approach to severe falling number situations FN Value 299-275 274-250 249-225 224-200 199-0 2014 Discount 0.053 0.071 0.089 0.107 0.196 2015 (and future) 0.053 0.071 0.089 0.107 RIV Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 18 Watts and Associates Inc. Crop Insurance Division Reduction in Value • Reduction in Value (RIV) is used in place of discount factors in certain crop insurance situations. It is a term used in the Special Provisions and Loss Adjustment Stand Handbooks (LASH). Typically it is used for discounts for which there are no discount schedule to account for it, i.e. discounts that “fall off the chart”. To establish an RIV a “Local Market Price” (LMP) must be established. Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 19 Watts and Associates Inc. Crop Insurance Division Example: RIV Vs. Current Discount Schedule approach • A grower has an APH of 60 bu/ac and purchased a 75 % coverage Level for Revenue Protection. The Projected Price was $6.00/bu. His Guarantee is $270/ac • A grower harvests 50 bu/ac with a falling number score of 185. The product is subject to quality adjustment, which will reduce the grower’s production to count based on its reduced value. • The two approaches both calculate Quality Adjustment Factors, which are then applied to determine production to count, and then indemnities Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 21 Watts and Associates Inc. Crop Insurance Division Discount Schedule Approach • The SPOI display a schedule of falling numbers values and attendant discount factors. Based on a score of 185, the grower’s production to count is discounted by a factor 0.196. – 1.000 – Discount Factor = Quality Adjustment Factor 1.000 - 0.196 = 0.804 – Gross Production x Quality Adjustment Factor = Production to Count 50 bu x 0.804 = 40.2 bu Falling Number SPOI Discount Factor Above 300 299-275 0.053 274-250 0.071 249-225 0.089 224-200 0.107 199-0 0.196 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 22 Watts and Associates Inc. Crop Insurance Division Reduction in Value Approach • The SPOI still display discount factors for values of 200 or above, but for lower values, specify a Reduction in Value approach. At 185, RIV is applied. The grower is discounted $2.00/bu by the local elevator for his/her damaged production.1.000 – Discount Factor = Quality Adjustment Factor – Determine Local Market Price. Based on calls to local elevators, a LMP of $5.00/bu is established by the Approved Insurance Provider (the loss adjuster). – Reduction in Value / Local Market Price = Discount Factor $2.00/bu RIV ÷ $5.00 = 0.400 – 1.000 – Discount Factor = Quality Adjustment Factor 1.000 – 0.4000 = 0.600 – Gross Production x Quality Adjustment Factor = Production to Count 50 bu/ac X 0.600 = 30 bu/ac Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 23 Watts and Associates Inc. Crop Insurance Division Comparison Discount Factor Guarantee $270/ac Gross Production 50 bu/ac Discount Factor 0.196 Production to Count 40.2 bu/ac Revenue to Count $201/ac Indemnity $69/ac RIV $270/ac 50 bu/ac 0.400 30.0 bu/ac $150/ac $120/ac Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 24 Watts and Associates Inc. Crop Insurance Division Questions? Alex Offerdahl Watts and Associates 4331 Hillcrest Rd Billings, MT 59870 406-252-7776 aofferdahl@wattsandassociates.com Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 25 Watts and Associates Inc. Innocuous Statistics Crop Insurance Division Insured Acres 350 300 Millions of Acres 250 200 150 100 50 0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 2011 2013 26 Watts and Associates Inc. Innocuous Statistics Crop Insurance Division Liability $140,000 $120,000 Millionsof Dollars $100,000 $80,000 $60,000 $40,000 $20,000 $0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 2011 2013 27 Watts and Associates Inc. Innocuous Statistics Crop Insurance Division Total Premium $14,000.00 $12,000.00 Millions of Dollars $10,000.00 $8,000.00 $6,000.00 $4,000.00 $2,000.00 $0.00 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 2009 2011 2013 28 Watts and Associates Inc. Innocuous Statistics Crop Insurance Division U.S. Premium Totals $14,000.00 $12,000.00 Millions of Dollars $10,000.00 $8,000.00 $6,000.00 $4,000.00 $2,000.00 $0.00 1989 1991 1993 1995 1997 1999 2001 Premium Subsidy 2003 2005 2007 2009 2011 2013 Producer Premium Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 29 Watts and Associates Inc. Innocuous Statistics Crop Insurance Division Aggregate Crop Insurance Loss History $20,000.00 $18,000.00 $16,000.00 Millions of Dollars $14,000.00 $12,000.00 $10,000.00 $8,000.00 Total Premium $6,000.00 Indemnity Producer Premium $4,000.00 $2,000.00 $0.00 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 Use or disclosure of information or data contained on this sheet is subject to the restrictions on the title page. 2011 2013 30