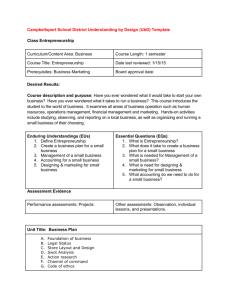

Entrepreneurship Journal Report

advertisement