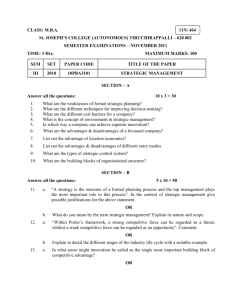

Enhancing Competitiveness : Process Capabilities

advertisement

Auto Component Industry in India: Enhancing the Capabilities of the Industry Presentation by: Mr. Amit Mukherjee Dy. Executive Director 17th October, 2013 About ACMA • Established in 1959 • Apex body of Auto Component Industry in India • Over 700+ members from the Organized sector • Represents 85% of the Industry by turnover • Represented on all Government and Industry bodies – Strategic to the Auto Sector • Offices across all Regions in the Country • An ISO 9001-2008 Institution ACMA – Excellence in Service Delivery Agenda • India: A Vibrant Economy • Automotive Industry in India • Auto Component Industry in India • Cluster Initiatives • Policy Environment 3 India: A Vibrant Economy 1. Largest Democracy – 1.2 billion people, Growing Middle Class 2. 4th largest GDP (PPP) and 10th largest GDP (Nominal, USD 1.8 trillion) 3. One of the fastest growing economies - Estimates for 2013-14: ~ 5% • India’s average GDP growth rate: 8.4% over past 5 years • Expected to outpace China in the next decade 4. 3rd Largest Investor base in the World 5. Robust Legal and Banking Infrastructure 6. Demographics Advantage – Youth driven economy 7. Suburbanization & Rural to Urban Migration – 140 million by 2020; 700 million by 2050 8. 2nd largest pool of Certified Professionals and highest number of Qualified Engineers in the world 9. Investment in Infrastructure 4 Automotive Clusters in India Eicher Escorts Hero Moto Corp Honda Motorcycle Honda SIELCars ICML JCB Maruti Suzuki New Holland Mahindra Suzuki Motorcycles Swaraj Mazda Tata Motors Yamaha North *New Hub: Sanand Tata Motors, Maruti, Ford India, Hindustan Motors Tata Motors East West Bajaj Auto Fiat Force Motors GM John Deere Mahindra Man Force Mercedes Benz PSA Skoda Tata Hitachi Tata Motors Volkswagen Volvo Eicher Ashok Leyland BMW Caterpillar South Daimler Ford Hindustan Motors Hyundai Nissan Renault Royal Enfield Same Deutz TAFE Tata Motors Toyota Kirloskar TVS Volvo Buses (Illustrative List) Significant Manufacturing base of OEMs – Indian & Global 5 Passenger Vehicles Production (’000 units) 10,000 * 10,000 CAGR 2008-12: 14% 7,500 CAGR 2012-21: 13%* 5100 * 5,000 2,500 1,838 2,357 2,987 3,146 3234 2010-11 2011-12 2012-13 2008-09 2009-10 2015-16 2020-21 Figures for financial year – April to March (* Estimates) Source: SIAM 6 Other Vehicles Production Commercial Vehicles Tractors ( ’000 units) CAGR 2008-12: 22% CAGR 2012-21: 11%* 1200 ( ’000 units) CAGR 2011-21: 5%* 1,000 1000 800 600 545 640 641 710 420 400 200 0 2009-10 2010-11 2011-12 2012-13 2015-16 2020-21 Commercial Vehicles include: • Small Commercial Vehicles (SCV) • Light Commercial Vehicles (LCV) • < 1 ton > 1 ton but < 7.5 tons • Medium Commercial Vehicles (MCV) Heavy Commercial Vehicles (HCV) > 7.5 tons but <16 tons > 16 tons (In ’000 units) Two & Three Wheelers CAGR 2008-12: 16% CAGR 2012-21: 7%* Construction Vehicles( ’000 units) CAGR 2011-21: 14%* 7 Source: SIAM Figures for financial year – April to March (* Estimates) 7 Auto Component Industry Profile - Turnover CAGR – 15% USD billion 120 115 * 90 66 * 60 30 27.2 24.1 2007-08 2008-09 41.3 42.2 39.7 2010-11 2011-12 2012-13 30.8 0 2009-10 Comprehensive Product Range 2015-16 2020-21 Figures for financial year – April to March (* Estimates) 8 Auto Component Industry Profile – Exports & Imports 40 35 35 Export CAGR – 17% 30 Import CAGR – 14% * 30 * USD billion 25 19 * 20 13.8 15 10.9 10 5 8.2 7.1 8 4.5 5.1 4.2 2007-08 2008-09 2009-10 13.7 8.8 9.7 2011-12 2012-13 12 * 6.6 0 Figures for financial year – April to March 2010-11 Export North America, 24.0% 2020-21 Imports (* Estimates) Sources of Imports Export Destinations Latin America Oceania, 0.9% and the Caribbean, 6.6% 2015-16 Africa, 8.6% Asia, 24.3% Latin America and the North America, Caribbean, 7.16% 1.17% Oceania, 0.18% Africa, 0.36% Europe , 32.48% Europe, 35.6% OEM/Tier 1 account for 80%; Aftermarket for 20% Asia, 58.65% Indian Suppliers’ Focus – Global Best Practices Industry fast embracing modern shop-floor practices: Focus on Quality Deming Award - 12 Japan Quality Medal - 2 TPM Award - 15 5-S; 7-W Kaizen TQM TPM 6 Sigma Lean Manufacturing Shingo Silver Medallion - 1 JIPM - 3 Largest no. of Deming Award winning companies outside Japan Enhancing Competitiveness : Process Capabilities ACT is a division of ACMA, called “ACMA Centre for Technology”. ACT focuses on providing technical services to ACMA members as well as improving capabilities of the Industry by organizing cluster programs on pan-India basis ACT Clusters for company level engagement - ACT SME Cluster - ACT Foundation Cluster - ACT UNIDO Partnership Program - ACT Advance Cluster - ACT SME Advance Cluster - ACT Engineering Excellence Cluster Roadmap for ACT Foundation Cluster Industry focus - Integrated Development & Manufacturing Leadership position in the Automotive World Manufacturing Vehicles and components manufactured in India are increasingly meeting global standards of Quality, Reliability and Durability Product & Process Development However, today there is limited end-to-end product development and process engineering capability across the supply chain Cost and quality (strong foundation) Innovation Significant work needs to be done in this area to improve India’s innovation quotient Enhancing Competitiveness: Product and Process Capabilities • Engaging with Global T2/ T3 suppliers for joint development , collaboration and partnership National Manufacturing Competitiveness Program • Partnering with Global institute like Fraunhofer, MIT and others for join development and product innovation as well as working with local institutes • Companies are setting up their Global footprint by leveraging Merger and Acquisition. 14 Favorable Policy Regime Auto Policy 2002 and Auto Mission Plan 2006-16 – framework for Automotive Manufacturing in India • Manufacturing and Imports Free from Licensing and Approvals • WTO compliant policies (no import restrictions and reduced tariff levels) • Robust Legal system and stable Foreign Exchange regime • Joined UN-ECE WP 29 for Global Standard in Technology • Increased budgets for R&D activities • 100% FDI permitted without prior Govt. approval Robust Indian Automotive Industry Government support / assistance for Small Enterprises • National Manufacturing Competitiveness Program • Design Clinic Scheme for design expertise for Manufacuring • Competitiveness Improvement -Lean Manufacturing / Cluster Development Program • Setting up Common facililites like Tool Room , Training centers at diferent auto component clusters • Purchase Preference Policy • Participation in overseas events/ Trade shows • Skill Development 16 India’s automotive R&D testing infrastructure: National Level NATRIP Centres Vehicle Research & Development Establishment (VRDE), Ahmednagar • Research, design, development & testing of vehicles • Centre of excellence (CoE) for photometry, electromagnetic compatibility & test tracks Indore: National Automotive Test Tracks (NATRAX) • Complete testing facilities for all vehicle categories • CoE for vehicle dynamics & development Automotive Research Association of India (ARAI), Pune • Service for all vehicle categories • CoE for power-train development & material Chennai Centre, Tamil Nadu • Complete homologation service for all vehicle categories • CoE for infotronics, EMC & passive safety Rae Bareilly Centre • Services to agri-tractors, off-road vehicles & a driver training centre • CoE for accident data analysis International Centre for Automotive Technology (iCAT), Manesar • Services to all vehicle categories • CoE for component development, noise vibration & harshness (NVH) testing Silchar Centre, Assam • Research, design, development & testing of vehicles • CoE for photometry, electromagnetic compatibility (EMC) & test tracks ACMA as an Association and its initiatives Promotes Indian Automotive Component Industry Trade Promotion Technology Up-gradation Quality Enhancement Vital Catalyst for Industrial Development Collection & Dissemination of Information Auto Expo 2014 PRAGATI MAIDAN NEW DELHI 6th – 9th February 2014 INDIA EXPO MART GREATER NOIDA, UP 7th – 11th February 2014 We look forward to Welcoming you! Thank You for any assistance contact ACMA The Capital Court, 6th Floor, Olof Palme Marg, Munirka, New Delhi – 110 067 Tel: 011-26160315, Fax: 011-26160317 E-mail: acma@acma.in, Website: www.acma.in