Course Plan

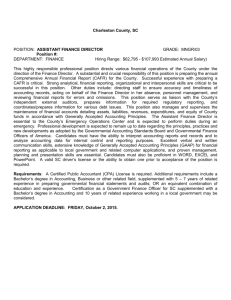

advertisement

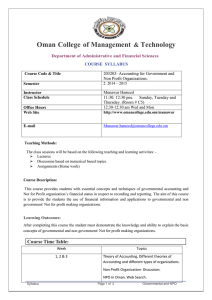

The Islamic University – Gaza Faculty of Commerce Department of Accounting Academic Year 2013/2014 First Semester Mr. Mahmood Ashoor Course’s Name: Government Accounting (ACTE 3302) Instructor’s E-mail: maashour@iugaza.edu.ps Place & Time of Lecture: Section 101: Saturday, Monday, & Wednesday from 9:00 a.m. till 10:00 a.m., Hall K203. Section 201: Saturday, Monday, & Wednesday from 10:00 a.m. till 11:00 a.m., Hall L207. Instructor’s Office Hours: Saturday, Monday, & Wednesday from 12:00 p.m. till 01:00 p.m. Sunday & Tuesday from 11:00 a.m. till 12:00 p.m. Course’s Description: This course helps students understand the differences and similarities between government and business accounting. It emphasizes on different concepts and practices used to account for governmental institutions. In addition, the Palestinian Fiscal System in effect is discussed and evaluated. Course’s Learning Goals: After finishing this course, the student should be able to: 1) Understand the differences between government and business accounting and their implications on the accounting information system. 2) Understand the concept of fund accounting and how it is utilized in governmental institutions. 3) Understand the different bases of accounting. 4) Understand the budgeting process within governmental institutions and how it enhances control and accountability. 5) Understand how governmental institutions account and report revenues and expenditures. 6) Understand the different laws and regulations applied by Palestinian governmental institutions. Course’s Topics: Week 1-2 3-4 5-6 7 - 10 11 - 14 15 - 16 Topic Introduction Fund Accounting Budgeting Revenue Recognition Expenditure Recognition Palestinian Fiscal System Page 1 of 2 References: Main Reference Granof Michael, Government & Not-for-Profit Accounting, Concepts & Practices, Fourth edition, John Wiley & Sons, USA : 2007. Additional References - Palestinian Fiscal and Budget Law - Ruppel Warren, Governmental Accounting Made Easy, John Wiley & Sons, USA : 2005. (Library Code: 657.835) - Freeman Robert, Shoulders Craig, & Allison Gregory, Governmental & NonProfit Accounting, Theory & Practice, Eighth edition, Pearson, USA : 2006. (Library Code: 657.835) - Ives Martin, Razek Joseph, & Hosch Gordon, Introduction to Governmental & Not-for-Profit Accounting, Fifth edition, Pearson, USA : 2003. (Library Code: 657.835) - Oakey Francis, Principles of Government Accounting & Reporting, General Books, USA : 2010. (Library Code: 657.835) Evaluation: Method Assignments Presentation Report Mid-term Examination Final Examination Percentage from Total Mark 10 % 10 % 10 % 20 % 50 % Notes: Assignments and Reports submission, management, and grading will be through the Moodle learning system. Please be aware that late submissions of Assignments and Reports will be penalized. Please be aware that missing the mid-term exam will be penalized by the deduction of 10 marks unless an acceptable justification is submitted with supporting documents. Page 2 of 2