Drifting on the IFRS highway

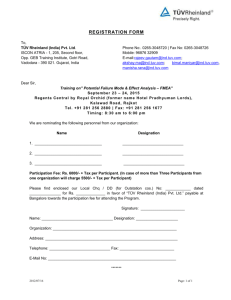

advertisement