Consumption of white cement

advertisement

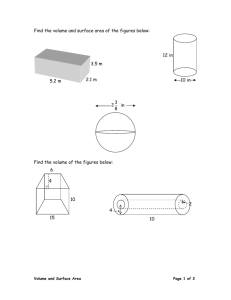

Understanding the White Cement Market in the U.S. Secondary Research Final Report Prepared for [Confidential Client] Submitted by: Mike Morgan, PhD September, 2010 1 Background and Objectives The client, headquartered in [confidential], is a leading producer in the global cement market. The company manufactures white, gray, and calcium aluminate cement and clinker, as well as ready-mix concrete for the construction industry. The client has more than 40 facilities and an annual production rate of about 4 million tons of cement, 3.5 million tons of clinker and 1.5 million cubic meters of concrete. Established in 1972, The client sells its products in nearly 50 countries on four continents. The client is currently considering strategic options for the white cement business in the U.S. Because of this, it would like to undertake an overview study of the U.S. market and of both buyers and sellers. Ideally, this would include, on the seller side, production capacity, volume and pricing, and channels of distribution and what governmental regulatory actions have or will have the largest impact on production. The client would also like to know about energy costs – these are available only for the cement industry as a whole. There have been no mergers or acquisitions currently impacting the U.S. white cement industry specifically, nor do there seem to be any on the horizon. The single most important change in domestic activity has been the closing of white production facilities by TXI, since TXI still sells white cement through outsourcing. On the buyer side, the client would like to understand each of the key buyer segments and drivers of demand within each segment. This would include not only buyer behavior but also buyer attitudes, including expectations about product quality and service. Segments are based on usage and, for white cement, include: architects, chemical additive companies, ready-mix suppliers, precasters and white masonry brick and mortar suppliers. 2 Methodology Much of the information the client seeks was available from secondary sources. This includes data primarily on the raw production side of the market – factories, production volume, prices and trends. Other information was more difficult to obtain from secondary sources alone, such as: secondary processing plants, wholesalers and end-users. Therefore, a combination of secondary data and primary survey research was necessary. This report summarizes the results of the secondary research efforts. Some of the distribution channels could be sized directly from available data in Dun & Bradstreet’s database of businesses and other secondary sources. Further information, however, required interviews of architects, chemical engineers, ready-mix suppliers, precasters, white mortar and brick suppliers and chemical additive companies. In order to obtain the needed information, in-depth interviews were conducted with architects, ready-mix suppliers, precasters, white mortar and brick suppliers and chemical additive companies. Besides basic requirements and business practice information, we collected customer expectations regarding availability of product by form, service, business relations and the types of marketing by different competitors for their business. We then combined the secondary source data and interview data to produce an overall, quantified description of the market opportunity for the client in the U.S. Secondary data sources. Concrete Products – a comprehensive trade publication Business Source Complete – online publications search engine Both of the above sources are used to compile information on trends in the industry, mergers & acquisitions, major players and their market positions, and legal/regulatory issues. USA Trade Online – Database of Import/Export statistics by commodity, industry, country, import district, etc. 3 The Datamyne database of bills-of-lading and census information on companies delivery to ports and generally prevailing prices for those deliveries. Portland Cement Association research groups – reports: o White cement production time series o 2009 Annual Yearbook o 2009 Plant Information Summary o Apparent Use reports United States Geological Survey agency o Monthly survey data o Annual yearbook publications The above four sources are used to compile data on cement production and consumption, white cement production and consumption, trends, and background information in preparation for the primary data collection phase of the project. CM Cemnet International Cement Review. ICR Quarterly: The Global White Cement Report 2003. This source has a number of integrated reports, a database of producers and other information that provide overall views of the industry and specialty areas such as white cement production, consumption and user groups. 4 Executive Summary Market Overview. White cement is largely imported. In 2009, for example, out of 896 thousand metric tons consumed (see table 4 below), 683 thousand, or more than 76%, were from imports (see Table 9). Reliance on imported white cement has increased in the past two years due to the closing of US manufacturing plant operations: 1. LeHigh has plants in York, PA and Waco, TX. 2. Texas Industries had a plant in Riverside, CA. However, they are no longer operating it and now only resell white cement purchased from other manufacturers. 3. Federal White still has their one plant in Woodstock, Ontario, but that's the only one. This means that, currently, there are only two white cement manufacturing plants in the US and one in Canada. There are four white cement plants in Mexico, according to the 2010 North American Cement Directory. Lafarge, through its Cemento Portland Blanco subsidiary, has one and Cemex has three. U.S. demand for Portland Cement fell heavily when the real estate market collapsed, beginning in the second half of 2007 and continuing through the first half of 2010. White cement’s import drop between 2008 and 2009 of 31% (Table 3) was considerably less than that of all cement imports in the same annual period, about 40% (USGS Mineral Industry Survey, December 2009). This suggests a “cushion” in the downside demand for white cement. This may confirm a general industry perception that white cement is a kind of “luxury product” within the cement line and that construction projects involving white cement-based products are high-budget, luxury projects, relatively immune to economic cycles. We suspect that white cement also enjoys favorability among concrete additives suppliers, and that somehow the demand for concrete additives, which has grown at a remarkably, seemingly-recession-proof rate for the past five years, has bolstered the demand for white cement indirectly. 5 o While white cement may be a key component in the final cement and concrete additives products, there is no direct evidence that white cement demand per se will change unless the additives industry growth rate increases substantially. o One element in this judgment is that concrete and cement additives may or may not involve, in the future, more white cement than gray cement than the amount of white currently used. o A recent report issued by Fredonia, for example, covers the entire concrete additives industry and includes market projections for both additives and cement. Nowhere in the report, however, is white cement mentioned specifically. Market demand. There are a small number of highly proprietary producers in the U.S. Even these regularly resell imported white cement. This is mainly because of the small percentage that white cement represents of the total market. The market outlook projects a return to 2008 levels (about 30% below the peak levels of 2007) by the year 2013. This bodes well for a well-planned, slow but deliberate rollout of The client to the market over the next three years. Year 2008 2009 2010 2011 2012 2013 Projected Consumption Total US Texas California 1,284 192 130 896 125 86 917 127 88 979 136 94 1,061 147 102 1,261 175 121 See Table 5 for market projections by state. Texas and California represent the two biggest opportunities for both existing and new market entrants. Focus on imports. As noted above, 76% of white cement consumed is imported. Thus, evidence points to imports as the major source of competition and the area to focus on competitively. 6 The top producers of white cement are each situated in a different country. Thus, comparison of country data on import quantities helps to produce a picture of the potential competitive positioning for The client. In addition, manufacturers tend to use only one or at most two ports for the vast majority of their imports. Thus, The client’s best strategy is to (initially) utilize a single port for delivery, build a terminal near that port and market heavily to resellers and processers within the state for that port. An exception is in waterway passage, such as along major rivers, to states also easily accessible from the port. The main candidate for this type of market entry is New Orleans, Louisiana. The port selected should not already be “saturated” in the sense of major imports from competitors such as Federal White, Hanwen, Cemex, Aalborg, etc., in the southern coast ports that The client is considering. The above chart shows that the ports of Houston and Miami may already be saturated. Based on country by import district data, along with demand patterns within states, it appears that New Orleans, Louisiana is the best candidate. (Savannah, Georgia, is also a candidate, but the latest projections of construction outlook for the part of the country that port would serve are significantly less than projections for the rest of the country.) Brand choice process and players. There are, in effect, only four main types of companies who make a selection of a manufacturer’s brand of white cement from among the competing set of brands. All of these are, in effect, resellers of the white cement after combining it with other substances or products and, in some cases, molding the cement into precasted forms of concrete for delivery to the end-user. (In addition, architects may 7 specify a cement brand, but this is rare – usually they rely on product standards to ensure a quality brand choice.) These brand decision makers include: 1. Ready-mix suppliers who mix the cement with aggregates on the way to a construction site and then pour it into casting molds upon arrival. 2. Precasters who mix the cement with aggregates, pour it and set it in prepared molds, then deliver the hardened casts to the job site. 3. Masonry block and mortar manufacturers who mix the cement with aggregates and use them to create blocks of white cement as well as white cement-based mortar. The main differences between masonry block and precast is that the latter is specifically made-to-order and involves very strict standards for reflectance, etc., while blocks and mortar can vary to some extent in color and cement content and are more of a standardized production line item. 4. Chemical engineers who choose brands of white cement to combine with their additives – such as plasticizers. (As noted above, while the cement additives industry may be growing rapidly, that is no guarantee that it holds the keys to white cement’s future in the U.S.) Strategic considerations. Leaving aside the chemical additives channel for a moment, the marketing strategist must grasp and address some key elements in the process of creation of and delivery of white cement that tend to drive most, if not all, decisions made by both brand choosers and end-users: Because of weight and bulk, cement, concrete, and accompanying products are relatively expensive to transport. This is true for all constituents in the supply chain – manufacturers (domestic or import), ready-mix suppliers, precasters and masonry block and mortar suppliers. Some portions of the product mix, such as the finished concrete prior to mixing, have a relatively short shelf life, especially under adverse weather conditions. In-transit mixing times (typically about one hour) tend to restrict the size of the trading area for ready-mix suppliers to those available within a short driving distance from the end-user’s job site. For example, if too many ready-mix trucks arrive at a 8 job site at the same time it may be impossible to complete all mixing and pouring within the one-hour window. The above three points support that The client should enter one state market at a time, each associated with one port. This will help guarantee on-time rail or truck delivery to the customer. Along with the short shelf life of cement, the short in-transit mixing times for ready-mix suppliers mean that these customers will buy for the short term and sell within a geographically limited (i.e. within-state) area. The compression strength of the concrete is tested at 7 and 28 days after setting. If it does not hold up, the supplier must remove and replace all concrete from the given delivery, a very expensive proposition. Thus, suppliers tend to minimize risk by: o Ensuring that their choices of cement (with or without additives), aggregate and the concrete mixture are actually above compression strength standards before pouring. o Adding more cement to the mixture than the architectural specs per-concreteyard call for. Suppliers are thus in a dilemma of whether to reduce risk by increasing their own costs. Feedback from respondents indicates that it is becoming more difficult to live up to whiteness, consistency and compression standards and still make money on a given bid. Although he can cheaply accommodate the additional cement by using cheaper suppliers, such as those in China, the supplier runs a risk of inconsistency in the whiteness of the final product, another reason they may ask him to remove and replace an entire placement. The concrete supplier faces intense price competition in the bidding process. For any concrete construction project worth more than a million dollars, for example, the supplier bid pool may easily consist of a dozen or more competing companies. Despite the price competition in the bidding process, a company such as a precaster has set up his own set of “recipes” for blending in colors and additives to produce the delivered product. These recipes are not easy to change. 9 o To avoid having a change in the consistency of the whiteness of the base product, before coloring, a precaster may order from the same manufacturer all the time, even though manufacturers’ prices fluctuate. o One important selling point for The client would be to emphasize that its white cement is consistently the same color from batch to batch, so that precasters and ready-mix suppliers can be assured their own recipes will consistently work. o Another opportunity for The client would be to form a partnership with a concrete additives company, who may then recommend that the customer use The client for all of their additives. The client, in turn, could communicate its partnership to customers and help assure them that the additives can increase its shelf life and tensile and compression strength. Where else do concrete additives fit into the scenario? Here are some more general observations: It is unlikely that concrete additives companies will deploy their own brands of cement – that is, resell existing supplier cement after mixing in selected chemicals. It is more likely that these companies will supply independently to the customer. Additives companies are unlikely to provide even repackaging, instead relying on the distributor to handle the product after mixing in the additive chemicals. These considerations suggest that white cement producers should partner with the concrete additives companies in order to provide a standard, wide product selection for their buyers. The general idea is that the cement manufacturers/importers must support the concrete supplier in a number of ways. Below are some general rules for The client as a new market entrant to consider. The cement importer must select the ports, and therefore states, where most of its marketing and sales efforts are to be concentrated. Ultimately, these should be states in which 10 o Private and public construction activity is healthy and/or expected to grow over the strategic planning timeline. o Strong, consistent relationships can be formed with the larger ready-mix, precast and masonry block suppliers. This means ranking the relative size of these customers in terms of annual revenues and number of employees, and targeting those companies in the upper echelons of size. o The ports of entry are convenient to The client in that the cost of the rail and truck shipments from the ports can be minimized. This supports the current desired focus of The client on Texas, Louisana, Mississippi, Alabama, Georgia, Arkansas and Florida. However, multiple terminal construction should not be planned yet. Instead, The client should choose only one port/state to operate in and then expand as consumption of white cement expands based on the forecast noted above. We need to consider the current pattern of delivery of white cement by port in these states as a strategic factor in The client’s market entry. Pricing. It seems clear from the import data that price is a key element in determining which countries and companies suffered the greatest recent downturn. The relatively low cost of shipments from Turkey, over time, is likely to be the reason that it has had less of a drop in imports than other countries during the economic downturn beginning in 2008. Thus, The client should maintain its current pricing throughout the upcoming launch of its products in the target U.S. Markets. Sales force. The most important factor in The client’s market entry is the building and deployment of its sales force in the target U.S. Markets. This involves: Acquiring sales force staff and setting up a compensation system for them that depends not only on completed orders but on the number of new customers (readymix suppliers, precasters and masonry block/mortar suppliers) they obtain during their sales calls. 11 Obtaining new customers defined as securing a place on the vendor lists used when bids are sent out. As noted above, many concrete suppliers buy from the same manufacturer in order to maintain the consistency of the whiteness (or base whiteness before coloring) in their final products. Thus, obtaining the first buyer trial or sale is a major breakthrough, and should be rewarded more richly than resales. Ensuring that the top potential customers are reached by appropriately sizing them based on Dun & Bradstreet data – annual sales, number of employees, etc. Continually following up with the prospects to ensure that The client’s white cement is considered in all new bids. Developing of the The client sales force accompanied by marketing support – mailing brochures, including architects and chemical engineers in the mailings, on a regular basis. Web site. As part of its market entry strategy, The client needs to construct a customerfocused Web site with the following functionalities: The ability for the customer to view all available products, including those with chemical additives that increase the favorability of a product. These would include both white cement per se and masonry white cement when that becomes available. A system in which the potential buyer can obtain a bid quickly and easily by submitting information online. The online bids can be couched with caveats, for example, to be pending a final signed contract, but obtaining the bids online would boost the buyer’s ability to turn around his own bids quickly and efficiently. The ability for buyers to track their shipments online and to be notified by email of key events – shipments from Turkey, mid-Atlantic transfers of merchandise, arrival at the port, passage by customs and shipment from the port by rail or truck to the buyer’s location. This will also allow The client to begin building a customer database that lends itself to true customer relationship and value management, since orders can be tracked, sorted, and customer value can be prioritized accordingly. 12 13 Detailed Findings Clinker and cement Production by Volume and by growth trends Table 1 shows the white cement and clinker production in U.S.A. and in Canada. There were two companies that manufactured white cement in U.S.A. – Texas Industries and Lehigh1 White cement. Texas Industries has closed its white cement plant in early 2009 and only Lehigh White Cement remains. Thus, at this time there are only two white cement production plants in USA, both belonging to Lehigh White Cement. With the shutting down of Texas Industries white cement plant, the total U.S. clinker capacity is 213,000 tons per annum and the finish grinding capacity is 260,000 tons. Federal White Cement in Canada invested heavily in new plants in 2000-2001 and has steadily increased their capacity to 998,000 tons. Table 1: U.S. and Canada White cement and Clinker Capacity by Volume Plant Location Texas Industries Lehigh Cement Lehigh Cement Federal White Cement Total US and Canada Riverside, CA York, PA Waco, TX Woodstock, ON Kilns 2 1 1 2 6 Finish Grinding capacity (000 tons) 113 127 133 477 850 (Source: PCA Plant Information Summary 2008) *Note: Texas Industries closed its white cement plant in early 2009. 1 LeHigh includes LeHigh, Hanson, and, worldwide, Heidelberg cement companies. 14 Clinker capacity (000 tons) 86 * 112 101 998 1297 As seen from Table 2, the U.S. capacity for the production of white cement has remained steady around 300,000 tons for a long period before declining in 2009. The 2009 consumption of white cement in U.S.A. is estimated to be around 896,400 metric tons. Table 2: White cement production trends Total White Cement Clinker Capacity (000 metric tons) U.S. 1994 264 1995 269 1996 267 1997 264 1998 274 1999 291 2000 305 2001 305 2002 311 2003 298 2004 311 2005 311 2006 310 2007 310 2008 299 2009 213 (Source: PCA Plant Information Summary 2008) 15 Canada 179 182 184 184 184 230 820 929 929 998 998 998 998 998 998 998 Shipment Volume, Price and Trends In Table 3, we report the shipments of white cement from U.S. producers, and imports of white cement during the period 1994-2009. These figures are taken from the U.S. Geological Survey data. Note that the quantity shipped by U.S. producers is far in excess of the installed capacity, which suggests that the producers imported white cement and sold it in the U.S. There are other distributors who also sold imported white cement in the U.S. market. In addition, the table reports the customs value of the imports and the C.I.F. value of imports. The customs value is the value declared to US Customs while the C.I.F. value refers to the customs value of the imports after adding freight, insurance and transportation costs. Figure 1 graphically depicts the trend in shipments and imports over time. From Table 3 and Figure 1, one can see that the demand for white cement both in terms of shipments from producers and from imports has increased steadily from 1994 to 2006 and then declined significantly in the last three years since the peak demand in 2005-2006. This is in line with the decline in construction since the collapse of the mortgage industry in 2008. Table 3: U.S. Producer Shipments; Imports and Prices 1994-2009 Shipments from Cement Custom Producers Imports value of (tons) (tons) imports ($) Custom value per ton ($) C.I.F. value of imports ($) a C.I.F. value per ton ($) Mill value per ton ($) 1994 519000 458862 34242511 74.62 177.04 1995 549000 435776 34853624 79.98 174.66 1996 615000 389661 35406301 90.86 183.08 1997 634000 519980 45707111 87.90 177.05 1998 790000 845984 66027780 78.05 161.40 1999 848000 825183 84769103 102.73 166.04 2000 894000 923136 87872077 95.19 16 102177665 110.68 159.45 2001 870000 936408 86485724 92.36 97641078 104.27 155.00 2002 952000 866478 82784064 95.54 93360577 107.75 157.00 2003 985000 847767 83914452 98.98 97909244 115.49 159.00 2004 1130000 1197294 113903964 95.13 140691460 117.51 164.00 2005 1190000 1484702 134747062 90.76 168365748 113.40 176.00 2006 1180000 1477607 149140539 100.93 181641711 122.93 191.00 2007 1020000 1641591 156499511 95.33 205950666 125.46 197.00 2008 823000 985160 119194129 120.99 147205830 149.42 221.50 2009 581430 683038 86008185 125.92 100715129 147.45 N.A. (Source: Shipments (USGS AY T15), I mports (IM145) a C.I.F. value includes insurance/freight/transportation costs Figure 1: Shipments and Imports of white cement 1994-2009 1800000 1600000 1400000 1200000 Shipments from Cement Producers 1000000 800000 Imports 600000 400000 200000 0 1990 1995 2000 2005 2010 Shipments from producers declined 13.6%, 19.4% and 29.4% in 2007, 2008 and 2009 respectively and current shipments are about half of the shipments in 2006. More drastically, imports declined 40% and 30.7% in 2008 and 2009 respectively. 17 The trend in prices can be analyzed from the customs value of imported white cement using three different reported prices – customs value per ton, C.I.F. (customs value including insurance, freight and transportation) per ton and mill value per ton. The average price of white cement has gone up in the past three years. Customs value per ton of white cement went up from $95.33 per ton in 2007 to $125.92 per ton in 2009. Similar increases can be seen for the C.I.F. value per ton and the mill value per ton of white cement. The graph in Figure 2 clearly shows this trend. Figure 2: Trends in prices of white cement 250 200 150 Custom value per ton C.I.F. value per ton 100 Mill value per ton 50 0 1990 1995 2000 2005 2010 Special notes on pricing.2 Mill net (or terminal net) is an average price to final customer, inclusive of any bagging or palletizing charges, but excluding any onward delivery charges or transportation charges to terminals. For a cement plant and its terminals, it is thus, in effect, an FOB plant price. For an independent terminal, it does not include any further transportation charges. For an import terminal, it would thus represent the CIF price, plus all port charges (stevadoring/storage/any bagging charges) + terminal markup. But no further transportation costs. CIF = Cost, Insurance, and Freight. "Cost" is usually equated to Customs Value which should equate (if the ownership has not changed) to the FOB ship value at the originating port. If the ownership has changed "mid-Ocean" however, Customs Value could exceed 2 From special communication with Hendrik Van Oss, who is responsible for compilation of tracking numbers and statistics on cement from other countries. 18 the Cost or FOB ship value, as the new owner may include a markup. Generally, CIF minus the Customs Value = insurance + freight. Our independent research established that a contractor in a competitive market will pay about $235 per metric ton for white cement. Please note that this should not be interpreted as the final, current price, however, since it is subject to daily changes. Special note on bag versus bulk purchasing Through various sources on the Web we established that the larger ready-mix suppliers (20 or more trucks) do buy in bulk or in large bag, while the smaller ready-mix suppliers buy in small bags. Both types, however, buy small bags to make up shortfalls when necessary. Consumption of white cement The consumption of white cement has been calculated in the following way. By taking the total shipments of white cement from U.S. producers and deducting the installed capacity of white cement at these plants, one can obtain the amount of white cement imported and sold by these producers. By deducting the above quantity of white cement resold by producers from the total imports of white cement to the U.S., one can obtain the amount of imports that were sold by other agents and dealers not associated with production. The amount of white cement sold by others plus the amount of white cement shipments made by producers provides the total consumption of white cement in a given year. This calculation assumes that there is no inventory buildup in a given year. The consumption of white cement is given in Table 4 and the trend over time is depicted in Figure 3. The data indicates that the consumption peaked in 2007 and since then has seen declines of 34% and 30% in 2008 and 2009 respectively. There is no secondary data available on the trends in consumption by product type of white cement. 19 Table 4: Consumption of white cement in U.S.A. Year Total Consumption Year over Year %Change 1994 722.862 1995 704.776 -2.502 1996 656.661 -6.827 1997 783.98 19.39 1998 1119.984 42.86 1999 1116.183 -0.34 2000 1228.136 10.03 2001 1241.408 1.08 2002 1177.478 -5.15 2003 1145.767 -2.69 2004 1508.294 31.64 2005 1795.702 19.05 2006 1787.607 -0.45 2007 1951.591 9.17 2008 1284.16 -34.20 2009 896.038 -30.22 (Source: PCA Plant Information Summary 2008) 20 Figure 3: Consumption of white cement in the U.S. (000 tons) Total Consumption of white cement in US 2500 2000 1500 1000 500 0 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 Consumption volume by state There is no secondary data available on the consumption patterns of white cement by state. We estimate the state-wise breakup in consumption of white cement using data on Portland Cement usage by state and making some simple assumptions. We estimate the demand for white cement by state using two different approaches. a. First, we estimate the ratio of white cement consumption to Portland cement consumption using aggregate U.S. data on consumption of these two types of Cement in 2009. We then applied this percentage to each state’s consumption of Portland grey cement to arrive at the estimated consumption of white cement. The data on grey cement is taken from USGS Mineral Industry Survey in December, 2009. b. In the second approach, we estimate the per capita consumption of white cement in 2009 and apply this number to estimate the white cement consumption based on each state’s latest population numbers. 21 Table 5: Estimated consumption of white cement by state 2008-2013 Destination Texas California Florida Illinois New York Ohio Pennsylvania Louisiana Georgia Arizona Missouri North Carolina Virginia Indiana Washington Colorado Wisconsin Michigan Iowa Oklahoma Tennessee New Jersey Minnesota Kansas Alabama Utah Nevada Puerto Rico Maryland Kentucky Nebraska South Carolina Mississippi Arkansas Massachusetts Oregon New Mexico Connecticut South Dakota West Virginia North Dakota Idaho Wyoming Hawaii Montana New Hampshire 2008 192.37 129.70 78.15 45.15 40.71 39.01 38.26 32.41 42.91 38.24 26.78 31.70 27.83 23.74 27.74 29.01 22.96 24.89 19.50 20.03 22.73 21.97 18.58 18.98 21.26 17.35 22.31 19.27 16.89 14.70 13.23 15.91 14.26 11.96 12.41 12.73 9.78 8.78 6.21 6.91 5.36 7.02 6.78 5.50 4.77 2009 124.50 86.09 47.77 33.67 31.68 29.36 28.30 26.51 24.41 22.62 21.94 20.75 20.04 19.05 18.45 18.03 18.00 17.85 16.74 16.23 15.94 15.12 14.66 14.57 14.43 13.42 12.82 12.65 11.79 11.18 10.71 10.24 10.18 9.30 8.98 8.62 7.04 6.23 5.94 5.26 4.89 4.84 4.59 4.04 3.32 2010 127.49 88.16 48.91 34.47 32.44 30.06 28.98 27.15 24.99 23.16 22.47 21.25 20.53 19.51 18.89 18.46 18.44 18.28 17.14 16.62 16.32 15.48 15.01 14.92 14.78 13.74 13.13 12.96 12.08 11.45 10.97 10.49 10.42 9.52 9.19 8.82 7.21 6.38 6.08 5.38 5.01 4.96 4.70 4.13 3.40 2011 136.05 94.07 52.20 36.79 34.62 32.08 30.92 28.97 26.67 24.71 23.98 22.68 21.90 20.82 20.16 19.70 19.67 19.51 18.29 17.73 17.41 16.52 16.02 15.92 15.77 14.67 14.01 13.82 12.89 12.22 11.70 11.19 11.12 10.16 9.81 9.42 7.69 6.81 6.49 5.74 5.34 5.29 5.01 4.41 3.63 2012 147.47 101.98 56.58 39.88 37.53 34.77 33.52 31.40 28.91 26.79 25.99 24.58 23.74 22.57 21.85 21.36 21.33 21.15 19.83 19.22 18.88 17.91 17.37 17.25 17.10 15.90 15.19 14.99 13.97 13.24 12.69 12.13 12.06 11.01 10.63 10.21 8.34 7.38 7.03 6.23 5.79 5.74 5.43 4.78 3.94 2013 175.20 121.15 67.22 47.37 44.58 41.31 39.82 37.30 34.35 31.83 30.88 29.20 28.21 26.81 25.96 25.37 25.33 25.12 23.55 22.84 22.43 21.28 20.63 20.50 20.31 18.89 18.04 17.80 16.59 15.73 15.07 14.41 14.32 13.09 12.63 12.13 9.90 8.77 8.36 7.40 6.88 6.81 6.45 5.68 4.67 3.65 2.55 2.61 2.78 3.02 3.59 22 Maine Alaska DC Delaware Rhode Island Vermont Total shipments 3.31 2.03 2.33 2.56 1.93 1.58 2.44 2.14 1.71 1.63 1.39 1.23 2.50 2.19 1.75 1.67 1.43 1.25 2.67 2.34 1.86 1.78 1.52 1.34 2.90 2.53 2.02 1.93 1.65 1.45 3.44 3.01 2.40 2.29 1.96 1.72 1284.16 895.83 917.33 978.89 1061.11 1260.60 Table 5 shows the estimates of white cement consumption in each state using the first method which is based on applying a ratio of white cement to grey cement consumption. We sorted the states in decreasing order of consumption. The total white cement consumption adds up to 1284,160 tons in 2008 and 895,830 tons in 2009 consistent with the annual consumption numbers reported in Table 4. The small differences between the numbers are due to rounding off errors. We then project the anticipated demand for white cement using forecasts made by the industry expert Mr. Ed Sullivan from Portland Cement Association who projected that the annual demand for grey cement would increase each year by 2.4%, 6.71%, 8.4% and 18.8% during the 2010-2013 period. These forecasts were made after taking into account potential growth in construction of residential, non-residential and public construction projects. We apply these percentages to white cement assuming that the ratio of white cement to grey cement consumption will not change during this period. From Table 5, we see that the white cement consumption will increase steadily in the next four years to 1,260,000 metric tons in 2013. About 50% of the total demand for white cement will be concentrated in the top ten states – Texas, California, Florida, Illinois, New York, Ohio, Pennsylvania, Louisiana, Georgia and Arizona. The top two states account for about 23.5% of the total demand. To verify our statewide estimates, we used a second approach based on per capita consumption of white cement to arrive at another set of estimates for white cement consumption. Table 6 and Figure 4 present the trend in per capita consumption of white cement from 2000 to 2009. We notice that the per capita consumption was 4.35 Kg in 2000 and it increased to 6.47 Kg during the construction boom in 2007 and then declined to 2.92 Kg in 2009. We apply this number (2.92 Kg per person) to each state’s population numbers to arrive at estimates for state wide consumption of white cement. 23 Table 6: Per capita consumption of white cement in the U.S. Year Per capita consumption of White cement (Kg) 2009 2.92 2008 4.22 2007 6.47 2006 5.98 2005 6.07 2004 5.15 2003 3.95 2002 4.09 2001 4.35 2000 4.35 Figure 4: Trend in per capita consumption of white cement in the U.S. Per capita consumption of white cement 7.00 6.00 5.00 4.00 3.00 2.00 1.00 0.00 1998 2000 2002 2004 2006 2008 2010 Table 7 presents estimates from this calculation and we see that Texas and California are the top two states. There is some variation in numbers between this table and those estimated using the first method. The top five states accounting for 37% of white cement consumption in 2009 are California, Texas, New York, Florida and Illinois. The consistency between the estimates obtained from the two approaches provides a measure of robustness of the estimation. 24 Table 7: Population and per capita consumption based estimates State Consumption of white cement Population (millions) % of total white cement .California 36.96 107.93 0.12 .Texas 24.78 72.36 0.20 .New York 19.54 57.06 0.26 .Florida 18.54 54.13 0.33 .Illinois 12.91 37.70 0.37 .Pennsylvania 12.60 36.81 0.41 .Ohio 11.54 33.70 0.45 .Michigan 9.97 29.11 0.48 .Georgia 9.83 28.70 0.51 .North Carolina 9.38 27.39 0.54 New Jersey 8.71 25.43 0.57 .Virginia 7.88 23.02 0.59 .Washington 6.66 19.46 0.62 .Arizona 6.60 19.26 0.64 .Massachusetts 6.59 19.25 0.66 .Indiana 6.42 18.76 0.68 .Tennessee 6.30 18.39 0.70 .Missouri 5.99 17.48 0.72 .Maryland 5.70 16.64 0.74 .Wisconsin 5.65 16.51 0.76 .Minnesota 5.27 15.38 0.77 .Colorado 5.02 14.67 0.79 .Alabama 4.71 13.75 0.81 .South Carolina 4.56 13.32 0.82 .Louisiana 4.49 13.12 0.84 .Kentucky 4.31 12.60 0.85 .Oregon 3.83 11.17 0.86 .Oklahoma 3.69 10.77 0.87 .Connecticut 3.52 10.27 0.89 .Iowa 3.01 8.78 0.90 .Mississippi 2.95 8.62 0.91 .Arkansas 2.89 8.44 0.91 .Kansas 2.82 8.23 0.92 .Utah 2.78 8.13 0.93 .Nevada 2.64 7.72 0.94 .New Mexico 2.01 5.87 0.95 .West Virginia 1.82 5.31 0.95 .Nebraska 1.80 5.25 0.96 25 .Idaho 1.55 4.51 0.96 .New Hampshire 1.32 3.87 0.97 .Maine 1.32 3.85 0.97 .Hawaii 1.30 3.78 0.98 .Rhode Island 1.05 3.08 0.98 .Montana 0.97 2.85 0.98 .Delaware 0.89 2.58 0.99 .South Dakota 0.81 2.37 0.99 .Alaska 0.70 2.04 0.99 .North Dakota 0.65 1.89 0.99 .Vermont 0.62 1.82 1.00 .District of Columbia 0.60 1.75 1.00 .Wyoming 0.54 1.59 1.00 307.01 896.46 Imports In Table 8, we report the quantity of white cement imported into various customs ports in the United States. Detroit, Michigan and Miami, Florida are the top two import destinations for white cement accounting for about 43% of imports. In Texas, the main ports are Laredo, Houston and El Paso. New York is serviced by Buffalo and New York City. White cement for California comes into Los Angeles and San Francisco. The total quantity of imports was 683,038 tons with a customs value of $100.7 million or an average customs value of $147.45 per ton. Table 8 : Import Volume in 2009 by Customs port (metric tons) Customs Port Detroit State Cumulative Percentage Quantity MI 181322 0.27 Miami FL 112471 0.43 Laredo TX 85021 0.55 Buffalo NY 70120 0.66 Tampa FL 47493 0.73 Houston TX 42655 0.79 Los Angeles CA 32665 0.84 New York City NY 24685 0.87 El Paso TX 23089 0.91 New Orleans LA 20668 0.94 San Juan PR 19305 0.97 26 San Francisco CA 15217 0.99 Norfolk VA 3348 0.99 Savannah GA 2997 1.00 Anchorage AK 1519 1.00 Ogdensburg NY 205 1.00 Great Falls MT 100 1.00 Pembina ND 96 1.00 Nogales AZ 40 1.00 Portland ME 21 1.00 St. Albans VT 1 1.00 Total: Quantity 683038 Value $ 100,715,129 $ 147.45 per ton In Table 9, we report the quantity, customs value and C.I.F. value of white cement imported into the U.S. from each of the countries during the 2007 – 2009 period. Canada is the single largest supplier of white cement to U.S.A. mainly from Federal White Cement. They supplied 407,000 tons in 2007 but the volume declined to 251,000 tons by 2009, a decline of 38.3% in two years. Mexico is the second largest supplier and their volume has shrunk from 285,000 tons to 127,000 tons (a decline of 55%). China was a major supplier in 2007 but its share of the white cement market seems to have shrunk significantly by 2009 possibly due to its quality problems. Turkey, Denmark and Egypt are the next largest suppliers. Turkey and Egypt have been steady in their supply of white cement between 2007 and 2009 with Turkey seeing a slight increase in volume. Denmark saw a 70% decline in volume in this period. The decline in total imports between 2007 and 2009 is 58.4%. Table 9: Imports of white cement by country of origin 2007-2009 2007 Country Quantity (000 tons) Customs value ($ 000) 2008 CIF value ($ 000) Quantity Customs value 2009 CIF value Algeria Quantity Customs value 13 2123 Canada 407 45164 46399 296 40213 41086 251 34681 China 403 30284 50747 88 15869 19697 29 4125 Colombia 72 7393 9078 62 7020 8941 23 4277 Denmark 227 18211 27501 99 9747 14875 69 12299 27 Egypt 57 4539 7796 55 4724 7087 53 7628 285 35268 39771 254 31203 35679 127 19572 Spain 27 2865 4266 Taiwan 43 1735 3765 Thailand 41 4521 7191 29 3536 5530 18 3249 Turkey 79 6172 8947 96 5257 12201 95 12219 108 148 6 1526 1957 5 540 156260 205609 985 119095 147053 683 100713 Mexico Other 1641 In Table 10, we see the trend in prices of white cement per ton during the period 2007-2009. Canada has a customs value of $136 per ton but the C.I.F. value is $139 per ton possibly reflecting lower transportation costs. There is trend of increase in prices as seen in the C.I.F. value per ton between 2007 and 2009. For instance, there is a 10% increase in C.I.F. value per ton of white cement imported from Mexico and a 21% increase in C.I.F. value per ton of white cement imported from Canada. Table 10: Customs value per ton, C.I.F. value per ton of white cement by country 2007-2009 2007 Country Value per ton ($) 2008 CIF per ton ($) Value per ton 2009 CIF per ton CIF per ton Algeria Percentage increase in CIF per ton (2009 over 2007) 163.31 110.97 114.00 135.85 138.80 138.17 21.2% 75.15 125.92 180.33 223.83 142.24 12.9% Colombia 102.68 126.08 113.23 144.21 185.96 47.5% Denmark 80.22 121.15 98.45 150.25 178.25 47.1% Egypt 79.63 136.77 85.89 128.85 143.92 5.2% Mexico 123.75 139.55 122.85 140.47 154.11 10.4% Spain 106.11 158.00 Taiwan 40.35 87.56 Thailand 110.27 175.39 121.93 190.69 180.5 2.9% 78.13 113.25 54.76 * 127.09 128.62 13.6% 254.33 326.17 108.00 120.91 149.29 147.46 Canada China Turkey Other 95.22 125.29 *Seems to be low. There may be an error in the reported value. Distribution 28 17.68% There is very limited data on the distribution of white cement as it represents a small fraction of the overall cement distribution. Most companies that sell Portland grey cement from their terminals and sales offices are able to cater to the demand for white cement from these locations. Lehigh Cement which focuses on white cement production, has three white cement terminals located at Riverside, California, Waco, Texas and York, Pennsylvania. Federal White Cement, Canada has divided the U.S. into five zones (as shown in the map of U.S.A.) and serves these from Emmaus and Bellwood in Pennsylvania, Upland in California, Jefferson in Georgia, Boca Raton in Florida and Woodstock and Vancouver in Canada. Texas and Florida are serviced from Boca Raton, FL. All the red colored states come under the office in Upland, CA. The pink states are served from Bellwood, PA. The green states are served from Emmaus, PA. Jefferson, GA caters to the states marked in yellow. FEDERAL WHITE CEMENT DISTRUBUTION 29 Table 11 lists distribution centers and sales offices of other competitors. Other than Federal White Cement and Lehigh Cement, all company locations primarily supply Portland grey cement but it is assumed that they can supply white cement as well. Where data is available on the location of sales offices, these are indicated separately. Since the transportation cost is a significant portion of the cost of cement most terminals are located near ports and waterways since transport by waterways is cost efficient. Trucks and rail are used to transport the cement to the customer locations from these terminals. 30 Table 11: Competitors, Terminals and Sales offices White Cement Distribution (from PCA website) Company Distribution terminals State Lehigh White Cement Riverside Buzzi Unichem Distribution terminals State Sales Offices State CA Irving TX Waco TX UnionBridge MD York PA Birmingham AL Glens Falls NY Allentown PA Atlanta GA Elkhart IN Bethlehem PA Knoxville TN Oklahoma OK Chesterfield MO Amarillo TX Fort Wayne IN Stockerton PA Little Rock AR Orange TX Chattanooga TN Bonner Springs KS Independence KS Indianapolis IN Memphis TN Paducah KY Joliet IL Brandon MS Indianapolis IN Bonner Springs KS Burnside LA Pensacola FL Memphis TN Jeffersonville IN Dallas TX Milwaukee WI Natchez MS Cincinnati OH Dawsonville GA Nashville TN New Orleans LA College Park GA St. Louis MO Cape Girardeau MO Maryneal TX Chattanooga TN Oglesby IL Festus MO Pryor OK Greencastle IN Capital Aggregates San Antonio TX Cemex Houston TX Knoxville TN Birmingham AL Fairborn OH Clinchfield GA Milwaukee WI Louisville KY Howell MI Odessa TX Brooksville FL Wampum PA New Braunfels TX ESSROC Cement Corp. Nazareth PA Essexville MI (Italcementi group) Martinsburg WV San Juan PR Bessemer PA Front Royal VA Buzzi Plants 31 Speed IN Frederick MD Middlebranch OH Logansport IN Vancouver BC Upland CA Woodstock ON Jefferson GA Bellwood PA Boca Raton FL Emmaus PA Herndon VA Atlanta GA Lansing MI Harleyville SC Franklin TN Baltimore MD Lee's Summit MO Westborough MA Brookfield WI Chesapeake VA Maumee OH Ravena NY Davenport IA Tulsa OK Valley City ND Calera AL Houston TX Chesapeake VA Long Beach CA Lake Park FL Savannah GA Stockton CA Rinker Materials Corp. West Palm Beach FL St. Lawrence Cement Co. Albany NY Monarch Cement Co Humboldt KS Titan America LLC Norfolk VA Medley FL Federal White Cement LaFarge North America Royal White Cement Table 12 lists names of possible white cement suppliers in U.S.A. based on data pulled from www.alibaba.com. These companies do not engage in production of cement but act as distributors of local or imported white cement. This is not an exhaustive list of suppliers. Their sales data is not available. 32 Table 12: Names of other distributors of white cement (from Alibaba.com) Supplier’s Name AVITTOR INTERNATIONAL CORP MI Bloomfiled Hills FL Fort Lauderdale FL Pembroke Pines NY NY Exquisite Import/Export Trading Company, Inc. - D/B/A - ETC Logistics (USA) OVERSEAS DIRECT IMPORT CO LTD NuMill Industries Shamrock Imports-Exports LLC Alpha Omega International I&E Banah International Group Fama llc Alpha Omega International I&E Mabrouka, Inc ALFRED CEMENT DISTRIBUTION COMPANY Inc. Gbm USA Inc. 33 Appendix. Original The client project requirements. 34