Accounting I class for the Summer of 2013 July 1-3, 8-11, 15

advertisement

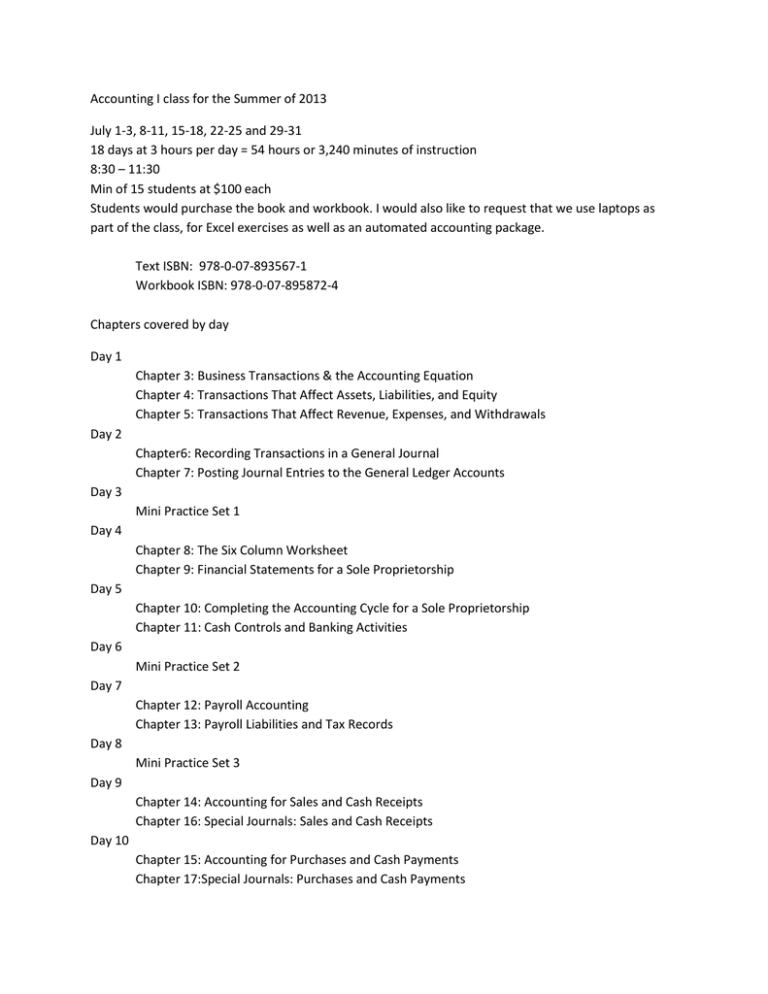

Accounting I class for the Summer of 2013 July 1-3, 8-11, 15-18, 22-25 and 29-31 18 days at 3 hours per day = 54 hours or 3,240 minutes of instruction 8:30 – 11:30 Min of 15 students at $100 each Students would purchase the book and workbook. I would also like to request that we use laptops as part of the class, for Excel exercises as well as an automated accounting package. Text ISBN: 978-0-07-893567-1 Workbook ISBN: 978-0-07-895872-4 Chapters covered by day Day 1 Chapter 3: Business Transactions & the Accounting Equation Chapter 4: Transactions That Affect Assets, Liabilities, and Equity Chapter 5: Transactions That Affect Revenue, Expenses, and Withdrawals Day 2 Chapter6: Recording Transactions in a General Journal Chapter 7: Posting Journal Entries to the General Ledger Accounts Day 3 Mini Practice Set 1 Day 4 Chapter 8: The Six Column Worksheet Chapter 9: Financial Statements for a Sole Proprietorship Day 5 Chapter 10: Completing the Accounting Cycle for a Sole Proprietorship Chapter 11: Cash Controls and Banking Activities Day 6 Mini Practice Set 2 Day 7 Chapter 12: Payroll Accounting Chapter 13: Payroll Liabilities and Tax Records Day 8 Mini Practice Set 3 Day 9 Chapter 14: Accounting for Sales and Cash Receipts Chapter 16: Special Journals: Sales and Cash Receipts Day 10 Chapter 15: Accounting for Purchases and Cash Payments Chapter 17:Special Journals: Purchases and Cash Payments Day 11 Chapter 18: Adjustments and the 10 Column Worksheet Chapter 19: Financial Statements for a Corporation Day 12 Chapter 20: Completing the Accounting Cycle for a Merchandising Corporation Chapter 21: Accounting for Publicly Held Corporations Day 13 Mini Practice Set 4 Day 14 Chapter 22: Cash Funds Chapter 23: Plant Assets and Depreciation Day 15 Chapter 24: Uncollectible Accounts Receivable Chapter 25: Inventories Day 16 Chapter 26: Notes Payable and Receivable Mini Practice Set 5 Day 17 Chapter 27: Introduction to Partnerships Chapter 28: Financial Statements and Liquidation of a Partnership Day 18 Mini Practice Set 6