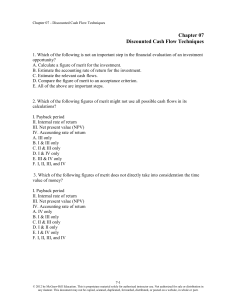

Free sample of Test Bank for Auditing and Assurance

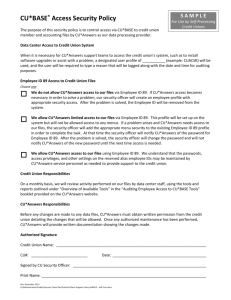

advertisement