Mankiw 6e PowerPoints

advertisement

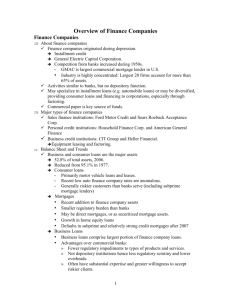

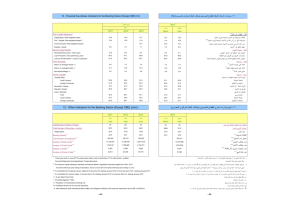

Banking In this section, you will learn: the types of banks about securitization of bank loans the kinds of risks banks face and how they manage these risks what causes bank runs and bank panics how deposit insurance reduces bank runs but increases moral hazard about the regulation of banks Types of banks Commercial banks largest category, about 7000 in U.S. Savings institutions, aka savings and loan associations (S&Ls) Originally, mutual banks (owned by depositors), focused on savings deposits & mortgage loans Over time, became corporations, branched into other types of deposit accounts and loans Types of banks Credit unions nonprofit, owned by their depositors (“members”) each restricts membership to a specific group, e.g. teachers, veterans Finance companies raise funds by issuing bonds and borrowing from banks do not accept deposits, therefore less regulated many specialize in a specific type of loan, e.g. car loans, subprime mortgages Loans and Deposits by Type of Bank, 12/31/2009 9,000 8,000 Billions of dollars 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Commercial banks Deposits Loans Savings institutions Credit unions Finance companies (do not accept deposits) Large vs. small banks Community bank small, < $1 billion in assets operates in a small geographic area they account for 90% of all commercial banks by number, but account for a small portion of total bank assets have a niche in small business lending Large banks capable of making huge loans to corporations enjoy economies of scale Subprime lenders Subprime lenders specialize in high-risk loans, charge (sometimes astronomically) high rates Subprime finance companies introduction of credit scoring fueled rapid growth, esp. subprime mortgages Payday lenders make small short-term loans charge high fees, commonly equivalent to 400-500% APR controversial Subprime lenders Pawnshops Small, short-term loans using borrowers’ property as collateral Loan sharks illegal, organized crime violate usury laws encourage repayment using threats of violence in decline due to competition from payday lenders and pawnshops Securitization Securitization: the process of creating securities backed by pools of loans with similar characteristics Mortgage-backed securities (MBS) the most prevalent type of securitized asset more liquid than the underlying loans MBS backed by subprime mortgages played important role in the recent economic crisis The securitization process Borrowers take out loans from commercial banks or finance companies. The lenders sell their loans to the securitizer, a large financial institution. The securitizer gathers a large pool of similar loans, e.g. $100 million of subprime mortgages. The securitizer issues new securities that entitle their owners to a share of the payments the original borrowers make on the underlying loans. The securities are bought by financial institutions and traded in secondary markets. Fannie and Freddie Federal National Mortgage Association (FNMA, or Fannie Mae), created in 1938 Federal Home Loan Corporation (Freddie Mac), created in 1970 both created to increase supply of mortgage loans, help more people achieve “the American dream” Fannie and Freddie are the largest securitizers of mortgages Fannie and Freddie Fannie and Freddie are government sponsored enterprises (GSEs), private corporations linked to the government. Perceived to have implicit govt backing, therefore can borrow funds at lower cost than other financial institutions can. Suffered huge losses on subprime mortgages in 2007-2008. To prevent bankruptcy, federal government put Fannie and Freddie under conservatorship. NOW YOU TRY: Benefits of securitization List all the parties involved in the securitization of prime mortgages (e.g. by Fannie or Freddie). For each, name at least one benefit they receive. ANSWERS: Benefits of securitization Homebuyers/borrowers Easier to get loans, lower interest rates because securitization increases the pool of funds available for making home loans Banks profit from selling loans for more than they lent, can use proceeds to make more loans achieve geographic diversification: sell loans made in their community, buy MBS backed by loans throughout the country, thus protected from local shocks ANSWERS: Benefits of securitization Securitizers Earn income from securitizing mortgages and selling MBS Buyers of MBS get assets that are (usually) safe and very liquid The subprime mortgage fiasco The housing bubble. House prices… rose 71% during 2002-2006 fell 33% during 2006-2009 Risky lending Subprime lenders lowered standards regarding borrowers income, credit Zero down payment loans, adjustable rate mortgages with low initial “teaser rates” Lenders resold loans, so less concerned with default risk The subprime mortgage fiasco The crash Falling house prices put many homeowners “underwater” – market value of house less than amount owed on mortgage Homeowners couldn’t afford payments, couldn’t borrow more Rising delinquencies and foreclosures Change in U.S. house price index and rate of new foreclosures, 1999-2009 14% 1.4 10% 1.2 8% 1.0 6% 0.8 4% 2% 0.6 0% 0.4 -2% 0.2 -4% -6% 1999 0.0 2001 2003 2005 2007 2009 New foreclosure starts (% of total mortgages) Percent change in house prices (from 4 quarters earlier) 12% US house price index New foreclosures The subprime mortgage fiasco Consequences: huge losses for Subprime lenders investment banks and other institutions holding MBS Contributed to the worst recession in decades The business of banking A bank’s balance sheet summarizes its financial condition at a point in time. It lists assets: what the bank owns, including securities, loans, and reserves reserves: the portion of deposits not lent out liabilities: what the bank owes others, including deposits and borrowings (from other banks or the Federal Reserve) Net worth = assets – liabilities Net worth is also called equity or capital Balance sheet for “Duckworth Bank” Assets (uses of funds) Liabilities and Net Worth (sources of funds) Reserves $ 10 Deposits $ 70 Securities $ 10 Borrowings $ 20 Loans $ 80 Net Worth $ 10 TOTAL $100 TOTAL $100 Measuring bank profits Return on assets (ROA) = profits/assets Return on equity (ROE) = profits/capital Example: Suppose Duckworth Bank’s profits = $2 Recall from Duckworth’s balance sheet: assets = $100, net worth = capital = $10 So, ROA = $2/$100 = 2% and ROE = $2/$10 = 10% ROE is what the stockholders care about Managing liabilities and assets Banks get most of their funds from deposits, which generally cost less than borrowings On the asset side: loans generate income but are not liquid reserves are liquid but generate no income Liquidity management: how banks handle the tradeoff between liquidity and income Federal Funds: short-term interbank loans banks take out when they need extra liquidity Managing credit risk Credit risk (default risk): the risk that borrowers will not repay their loans Banks reduce credit risk by requiring collateral, an asset of the borrower that banks can seize if borrower defaults. Requiring collateral reduces… adverse selection: risky borrowers less likely to take out loans moral hazard: after taking out a loan, borrower has incentive to use the funds responsibly Banks can also reduce credit risk by selling some of their loans Managing interest rate risk Interest rate risk: the uncertainty in bank profits arising from changes in interest rates maturity mismatch between liabilities and assets – depositors can withdraw funds at any time, but many loans don’t mature for years liabilities more rate-sensitive than assets: e.g., an increase in rates increases cost of borrowings more than income from loans Managing interest rate risk To manage interest rate risk, banks can: sell loans to reduce their exposure to rate changes make loans with floating interest rates (also called adjustable rates), so an increase in interest rates increases income as well as costs trade derivatives to hedge against interest rate changes Equity and insolvency risk Insolvency: when assets < liabilities A wave of defaults can cause insolvency. Banks can protect themselves by holding more capital. Equity ratio (ER) = capital/assets ER is related to return on equity: ROE = profit/capital = (profit/assets)/(assets/capital) = ROA/ER NOW YOU TRY: Balance Sheet Analysis a. Fill in the blank spaces on each balance sheet. b. Compute ROA, ROE, and ER for each bank, assuming each bank has $1200 profit. c. Which bank would you rather own, and why? Balance sheet for Apple Bank Assets Reserves Liabilities $2,000 Deposits $10,000 Securities $10,000 Borrowings $6,000 Loans ??? $8,000 Net Worth Balance sheet for Orange Bank Assets Reserves Liabilities $2,000 Deposits $8,000 Securities $10,000 Borrowings ??? Loans $6,000 $8,000 Net Worth ANSWERS: Balance Sheet Analysis Apple & Orange have same ROA = 1200/20000 = 6% Apple ROE = 1200/4000 = 30% Orange ROE = 1200/6000 = 20% Apple ER = 4000/20000 = 20% Orange ER = 6000/20000 = 30% Balance sheet for Apple Bank Reason to choose Apple: Assets Liabilities for • higher ROE, so more profitable owners $2,000 Deposits Reserves $10,000 Securities $10,000 Borrowings $6,000 Reason Loans to choose $8,000 Orange: Net Worth $4,000 • higher ER, so less risk of Balance sheet Orange Banklose insolvency in thefor event assets Assets Liabilities value Reserves $2,000 Deposits $8,000 Securities $10,000 Borrowings $6,000 Loans $6,000 $8,000 Net Worth CASE STUDY The banking crisis of the 1980s Number of failures 350 300 250 S&L failures 200 bank failures 150 100 50 0 1980 1985 1990 1995 CASE STUDY The banking crisis of the 1980s Huge surge in bank, S&L failures during 1980s One cause: rising interest rates Most S&Ls had huge maturity mismatch between rate-sensitive liabilities and long-term loans Most loans made when interest rates were low Interest rates rose sharply during 1970s, 1980s. Treasury Bill rate peaked at 14% in 1981 Result: huge increase in costs without corresponding increase in income CASE STUDY The banking crisis of the 1980s Another cause: the commercial real estate bust Early 1980s real estate boom: surge in demand for comm. real estate loans banks relaxed lending standards to cash in on boom Congress allowed S&Ls to make commercial loans, S&Ls made huge loans to real estate developers Recession in early 1980s led to defaults Falling oil prices hurt Texas and Oklahoma Oversupply of commercial real estate led to plummeting property prices, increasing defaults Bank runs Bank run: when depositors lose confidence in a bank and make sudden, large withdrawals Even if the loss in confidence is not justified, the sudden withdrawals overwhelm the bank, deplete its liquid assets To pay withdrawals, the bank must sell assets quickly, often at “fire sale” prices Soon, bank capital is driven below zero Bank panics Bank panic: simultaneous bank runs occurring at many banks 18 bank panics in U.S. during 1873-1933 Early 1930s: bank panics caused 30% of banks to fail, contributing to the Great Depression FDR’s “bank holiday” (March 6, 1933): all banks closed until govt declared them solvent, helped end the bank panic No bank panics in U.S. since 1933 Deposit insurance Deposit insurance: a government program that compensates depositors when a bank fails Federal Deposit Insurance Corporation (FDIC): created in 1933 provides insurance on deposits up to $250,000 (increased from $100,000 in 2008) DISCUSSION QUESTION: Deposit Insurance How can deposit insurance reduce bank runs and bank panics? How does deposit insurance affect the incentives of depositors? banks? Is deposit insurance a good idea? Effects of deposit insurance Reduces bank runs/panics: depositors less likely to withdraw funds since deposits are insured Eliminates depositors’ incentive to monitor banks to insure banks are not taking excessive risks Reduces banks’ incentives to avoid making risky high-interest loans Deposit insurance exacerbates moral hazard in banking, increases chance of future bank failures Bank regulation Charter: a license to operate a bank Each bank applies for a charter from a state agency or from the Office of the Comptroller of the Currency (OCC) Every bank is regulated by one or more of these: Federal Reserve OCC FDIC state agencies Restrictions on balance sheets Assets banks can hold government bonds and safe corporate bonds, not stock or risky corp. bonds no single loan can be “too large” (15% of bank capital for nationally chartered banks) Capital U.S. requires minimum equity ratio = 5% 1988 Basel Accord requires capital equal 8% of “risk adjusted assets,” a weighted average of assets (higher weights for riskier assets) Bank supervision Banks required to report info about finances and activities Bank examinations: regulators visit banks at least annually to examine banks’ records, interview managers, etc. Closing insolvent banks When a bank becomes insolvent, its depositors may not know or care, due to deposit insurance Moral hazard becomes severe for insolvent banks: managers figure they have nothing to lose by making very risky gambles Result: net worth may become more negative before bank closes Thus, regulators try to close insolvent banks quickly to prevent further losses Closing insolvent banks Regulators allowed to close banks when capital = 2% of assets or less They may do so, or may allow bank to operate Forbearance: a regulator’s decision not to close an insolvent bank occurs to avoid the pain and costs of closing the bank a gamble that the bank’s finances will improve exacerbated the S&L crisis because failing banks were allowed to incur further losses SECTION SUMMARY Banks are institutions that accept deposits and make loans. Types include commercial banks, savings institutions, and credit unions. Finance companies make loans but do not accept deposits. Subprime lenders make loans to people with low incomes or bad credit. Many bank loans, especially mortgages, are securitized. Securitization increases the funds available for loans and allows banks to reduce default risk and interest rate risk by selling loans. SECTION SUMMARY A bank’s assets include its loans, reserves, and securities. A bank’s liabilities include its deposits and borrowings. Net worth or bank capital is the difference between assets and liabilities. The balance sheet shows assets on the left and liabilities and net worth on the right. Banks try to reduce credit (default) risk by screening and monitoring borrowers, and by requiring collateral. Banks reduce interest rate risk by selling loans, making adjustable rate loans, and hedging with derivatives. SECTION SUMMARY A bank run occurs when depositors lose confidence and make sudden withdrawals. They can cause otherwise healthy banks to fail. Deposit insurance prevents bank runs by promising to pay off depositors if their bank fails. Deposit insurance increases the moral hazard that banks may take on excessive risks. U.S. banks are regulated by a variety of agencies. Regulators restrict the riskiness of bank assets and require minimum levels of capital.