What to Expect from Shoppers in 2014

Presented by:

Rachel McGuire, Senior Analyst

Kate Senzamici, Senior Analyst

Mary Brett Whitfield, Senior Vice President

U.S. Shopper FDM Webinar

February 7, 2014

Copyright © 2014 Kantar Retail. All Rights Reserved.

501 Boylston Street, Suite 6101, Boston, MA 02116

(617) 912- 2828

howard.zimmerman@kantarretail.com

No part of this material may be reproduced or transmitted in any form or by any means, electronic or

mechanical, including photography, recording, or any information storage and retrieval system now known

or to be invented, without the express written permission of Kantar Retail.

The printing of any copies for back up is also strictly prohibited.

Disclaimers

The analyses and conclusions presented in this seminar represent the opinions of Kantar Retail. The views

expressed do not necessarily reflect the views of the management of the retailer(s) under discussion.

This seminar is not endorsed or otherwise supported by the management of any of the companies covered

during the course of the workshop or within the following slides.

© Copyright 2014 Kantar Retail

Agenda: What to Expect from Shoppers in 2014

• Shopping Approaches and Spending Priorities

• Perceptions of Price Leadership

• Loyalty Programs

–Update on Safeway’s “just for U” Program

© Copyright 2014 Kantar Retail

3

Shopping Approaches and Spending Priorities

© Copyright 2014 Kantar Retail

4

Despite Macro-Economic Uncertainty, Spending

Intentions Holding Steady

Retail Spending Intentions in Coming Month Compared with the Same Period Last Year

(three-month moving average)

Spend about

the Same

Spend Much/

Somewhat Less

Spend Much/

Somewhat More

Source: Kantar Retail ShopperScape®. June 2008–December 2013

© Copyright 2014 Kantar Retail

5

Deal Seeking Continue at Top of the List

… but perhaps less top of mind as behaviors ingrained in

routines

Planned Changes in Shopping Behavior for Year Ahead

(among all primary household shoppers)

Behavior Changes

2013

2014

Type of Behavior

Taking advantage of good sales/deals

Buying only things I truly need

Using more coupons

Buying fewer things

Doing more price comparison shopping before purchasing

Shopping less often

Using/keeping items longer before buying replacements

Buying only items needed in the near term

Shopping more at discount and value retailers

Postponing more purchases

Buying less expensive versions of products

Buying more store brands instead of national or high-end brands

Buying fewer luxury items

Shopping online for more things

Shopping online more often

Trading down to less-expensive brands

Using smart phone to compare prices while in stores

Switching some purchasing to "auto-replenishment" programs

49%

45%

41%

34%

29%

29%

25%

25%

24%

19%

19%

18%

18%

14%

13%

12%

7%

1%

47%

45%

41%

38%

29%

31%

25%

26%

24%

21%

20%

18%

19%

15%

15%

12%

7%

1%

Deal-Seeking

Limiting

Deal-Seeking

Limiting

Deal-Seeking

Limiting

Limiting

Limiting

Trading-Down

Limiting

Limiting

Trading-Down

Trading-Down

Moving Online

Moving Online

Trading-Down

Deal-Seeking

Moving Online

Source: Kantar Retail ShopperScape®, October 2012 and October 2013

© Copyright 2014 Kantar Retail

6

Have-Not Shoppers More Likely to Plan More

Changes

Planned Changes in Shopping Behavior for Year Ahead (2014)

(among all primary household shoppers)

Behavior Changes

Taking advantage of good sales/deals

Buying only things I truly need

Using more coupons

Buying fewer things

Doing more price comparison shopping before purchasing

Shopping less often

Using/keeping items longer before buying replacements

Buying only items needed in the near term

Shopping more at discount and value retailers

Postponing more purchases

Buying less expensive versions of products

Buying more store brands instead of national or high-end brands

Buying fewer luxury items

Shopping online for more things

Shopping online more often

Trading down to less-expensive brands

Using smart phone to compare prices while in stores

Switching some purchasing to "auto-replenishment" programs

Have Nots

Haves

46%

48%

42%

39%

30%

34%

27%

29%

27%

23%

25%

21%

19%

14%

14%

14%

6%

1%

48%

39%

40%

35%

26%

27%

24%

23%

19%

19%

13%

13%

18%

16%

17%

8%

10%

1%

Type of Behavior

Deal-Seeking

Limiting

Deal-Seeking

Limiting

Deal-Seeking

Limiting

Limiting

Limiting

Trading-Down

Limiting

Limiting

Trading-Down

Trading-Down

Moving Online

Moving Online

Trading-Down

Deal-Seeking

Moving Online

Note: Have-Not shoppers have annual household income less than $60K’; Have shoppers have annual household income of $60K+

Source: Kantar Retail ShopperScape®, October 2013

© Copyright 2014 Kantar Retail

7

Shoppers Signaling More “Limiting” in 2014

Plus online shopping more likely to be in the mix

Planned Changes in Shopping Behavior: 2014 vs. 2013

2013

2014

– Buying fewer things

34%

38%

– Shopping less often

29%

31%

– Postponing more purchases

19%

21%

(among all primary household shoppers)

Growing participation vs. last year:

• Limiting Behaviors

Note: Yellow shading indicates a significant difference between 2013 and 2014 (90% confidence level)

Source: Kantar Retail ShopperScape®, October 2012 and October 2013

© Copyright 2014 Kantar Retail

8

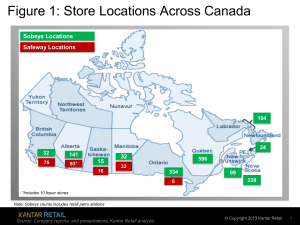

Store Set Contracts in 2013

Average Number of Retailers Shopped in Past Four Weeks*

(among all primary household shoppers)

12.4

12.4

11.1

11.1

11.2

11.2

10.7

*Inclusive of visits to stores and websites; averages are for Q1–Q3 of each year.

Source: Kantar Retail ShopperScape®, January 2007–October 2013

© Copyright 2014 Kantar Retail

9

Evidence that Shoppers Drawing Boundaries

Mounts

• Data points indicate that

“Limiting” is on the agenda

– Fewer retailers shopped for

back-to-school

– Fewer retailers shopped for

holiday gift giving

– Lower rate of category

purchase incidence across

myriad discretionary and nondiscretionary categories in Q4

Source: Kantar Retail ShopperScape®, December 2010–2013

© Copyright 2014 Kantar Retail

10

Categories that Maintained Q4 Purchaser Base

Categories with Flat Category Purchaser Incidence Rate Q4 2013 vs. Q4 2012

(among 80+ categories tracked )

• TVs

• Video game system

• Personal computers

• Tablet computers

• Printers

• Small and major appliances

• Craft/hobby/arts supplies

• Sporting goods

• Key home improvement categories

• Color cosmetics

• Pet food and supplies

• Beer and wine

• Vitamins

Source: Kantar Retail ShopperScape®, October–December 2013

No categories had significantly

higher purchasing rates …

© Copyright 2014 Kantar Retail

11

Staying Healthy and Organized Are Top

Spending Priorities

Spending Priorities

(% of shoppers selecting products as one of top five near-term spending priorities)

% selecting

as

top priority

24%

10%

9%

8%

7%

5%

10%

5%

5%

3%

3%

2%

2%

3%

2%

2%

1%

Source: Kantar Retail ShopperScape®, October 2013

© Copyright 2014 Kantar Retail

12

Varying Priorities by Generation Help Further

Refine Opportunities

Top 5 Spending Priorities by Generation

(as ranked by percentage of shoppers selecting products as one of top five near-term spending priorities)

Gen Y

Gen X

Boomers

Seniors

Better organize/

manage life

Stay healthy

Stay healthy

Stay healthy

Stay healthy

Better organize/manage

life

Better organize/manage

life

Save time on HH

chores

Personalized for

needs/tastes

Save time on HH

chores

Save time on HH

chores

Better organize/manage

life

Hobbies/activities

Stay fit

Hobbies/activities

Stay in home longer

Little indulgences/small

luxuries

Personalized for

needs/tastes

Personalized for

needs/tastes

Stay fit

Source: Kantar Retail ShopperScape®, October 2013

© Copyright 2014 Kantar Retail

13

Minimal Differences by Income

Opportunities across the “good-better-best” spectrum

• Haves and Have Nots have

same top spending priorities …

Key Differences in Spending Priorities:

Haves vs. Have Nots

Staying

healthy

Staying

organized

• … but a few differences farther

down the list

Source: Kantar Retail ShopperScape®, October 2013

© Copyright 2014 Kantar Retail

14

Amazon Becomes the Top Holiday Destination

Leapfrogs Target in 2011, Walmart in 2013

Note; Arrows indicate significant decline vs, holiday 2012 (95% confidence level)

Source: Kantar Retail ShopperScape®, December 2011, December 2012 and December 2013

© Copyright 2014 Kantar Retail

15

Holiday Shopping Shifts Online

Proving ground for building online shopping routines

Holidays set stage for

year-round online

shopping

Source: Kantar Retail ShopperScape®, December 2013

Budget shifted more toward

online/Cyber Week than Black Friday

© Copyright 2014 Kantar Retail

16

Online Disrupts Shopping Routines

How Approach to Shopping Has Changed in Past Year

Percent of Shoppers Indicating Statement Describes “Quite Well” or “Somewhat”

Online Disrupts

Shopping Routines

Source: Kantar Retail ShopperScape®, October 2013

© Copyright 2014 Kantar Retail

17

Perceptions of Price Leadership

© Copyright 2014 Kantar Retail

18

Price Remains Paramount in the Value Equation

Which retailers are best positioned to win with price-sensitive

shoppers looking to limit spending in 2014?

Source: Kantar Retail ShopperScape®, January 2013

© Copyright 2014 Kantar Retail

19

Walmart’s EDLP Message Reflected in Shoppers’

Price Perceptions

But how do “core”

shoppers view

these retailers?

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

20

Walmart Perceived Leader for Shelf-Stable Grocery

HEB slips vs. last year, while ALDI gains

Source: Kantar Retail ShopperScape®, November 2011, November 2012, and November 2013

© Copyright 2014 Kantar Retail

21

HEB Dominates in Fresh Grocery

Supermarkets in general the perceived price leaders

Source: Kantar Retail ShopperScape®, November 2011, November 2012, and November 2013

© Copyright 2014 Kantar Retail

22

Walmart Leads in Household Essentials

Many supermarkets see slight gains in price perception

Source: Kantar Retail ShopperScape®, November 2011, November 2012, and November 2013

© Copyright 2014 Kantar Retail

23

Walmart’s Lead in HBC Price Perception Slips

Walgreens and Publix make gains

Source: Kantar Retail ShopperScape®, November 2011, November 2012, and November 2013

© Copyright 2014 Kantar Retail

24

Summary of Price Leadership Winners and

Losers

Retailers Trending Up/Down In Price Leadership Perception Among Monthly Shoppers

Trending Up

Trending Down

Non-perishable grocery

• Publix

• Ahold banners

• Safeway banners

• Walmart

• Sam’s Club

Fresh grocery

•

•

•

•

HEB

Kroger banners

Publix

Safeway banners

• ALDI

• Sam’s Club

HH cleaning and paper

products

• Kroger banners

• Safeway banners

• Publix

• Sam’s Club

HBC

• Walgreens

• Publix

• Walmart

• Family Dollar

Source: Kantar Retail ShopperScape®, November 2011, 2012, and 2013; Kantar Retail analysis

© Copyright 2014 Kantar Retail

25

Two Retailers Improved Across All Categories

from 2012 to 2013

Price Leadership Perception Among Monthly Shoppers of Retailers

Source: Kantar Retail analysis and ShopperScape ®, November 2012 and November 2013

© Copyright 2014 Kantar Retail

26

Price Leadership Perceptions Differ by Key

Demographic Groups

Price Leadership Perception, by Generation and Income

(demographic groups listed significantly more likely vs. all shoppers to name

retailer/channel as price leader)

Walmart/Walmart Supercenter

Target/SuperTarget

Warehouse clubs

Drug stores

Dollar stores

Supermarkets

1

NonPerishable

Grocery

Fresh

Grocery

Have Nots1

Gen X

Seniors

Have Nots1

Gen Y

Seniors

Have Nots1

Haves1

HH

Cleaning

and

Paper

HBC

Gen Y

Seniors

Boomers

Gen Y

Seniors

Have Nots1 Have Nots1

Haves1

•

Target more likely to be perceived price leader for non-perishable grocery

among Gen X, but all other categories among Gen Y

•

•

Seniors more likely to view clubs as price leader across all categories

Walmart’s price leadership perception strongest among lower-income shoppers

and Boomers—historically, Walmart’s core shopper base

“Have Nots” are those with an annual household income of <$60k; “Haves” are those with an annual household income of $60k+

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

27

How Well Do Shoppers’ Perceptions Match

Reality?

$42.49

$37.89

$34.05

Total

Basket

Price

$30.81

$28.70

$28.82

Note: Data based on pricing study done by Kantar Retail. Six retailers located within a five-mile radius of each other in the Northeast U.S. were

selected. For each retailer, Kantar Retail assessed the lowest price point available to the shopper in each of 21 categories (trial sizes were

excluded) so that she could minimally meet her purchase requirement. Pricing study performed in September 2013.

Source: Kantar Retail analysis

© Copyright 2014 Kantar Retail

28

How Well Do Shoppers’ Perceptions Match

Reality?

Pretty well, with a few exceptions

Note: Actual price of total basket based on pricing study done by Kantar Retail. For each retailer, Kantar Retail assessed the lowest price point

available to the shopper in each of 21 categories (trial sizes were excluded) so that she could minimally meet her purchase requirement. Pricing

study performed in September 2013.

Source: Kantar Retail analysis and ShopperScape ®, November 2013

© Copyright 2014 Kantar Retail

29

Walmart Goes Head-to-Head on Price

© Copyright 2014 Kantar Retail

30

Shopper Showdown: Walmart vs. Key Competitors

Price Leadership Perception Among Monthly Shoppers of Retailers

(among monthly shoppers of both Walmart AND competitor, % who say Walmart/competitor is the

price leader)

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

31

Changing Price Leadership Perceptions

Key Takeaways

• Though we’ve seen a shift toward other aspects of “value” in

recent years, price is still the paramount consideration

–As more shoppers look to maintain spending levels and adopt some

limiting behaviors in 2014, price is likely to become more important

• Walmart has the strongest price leadership perception overall, but

there are some rocky spots

–Leadership position slipping in non-perishable grocery and HBC

–Loses (often handily) to key competitors in fresh grocery

–Price leadership position strongest among “core” Walmart

demographic groups, but growth will depend on winning with other

shoppers (young, affluent)

• Internalization of deal-seeking mentality reflected in price

leadership perception gains for many supermarkets

© Copyright 2014 Kantar Retail

32

A Look at Loyalty Programs

© Copyright 2014 Kantar Retail

33

Spending Less Most Important to Shoppers

Loyalty cardholders more concerned with value

Convenience vs. Value

Spending as little as possible top factor when shopping

~75% of loyalty card and non-loyalty card shoppers ranked it among top four

Arrows in chart indicate significant difference between column percentages at a 90% confidence level.

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

34

Loyalty Card Participation Mostly Steady Across

Retailers: More Have Cards vs. 2012

Balance Rewards

gaining traction since

September 2012 rollout

Increase in

participation vs.

2012

*Read as: 49% of shoppers surveyed in November 2013 reported having a CVS ExtraCare card.

Arrows indicate significant difference vs. 2012 (90% confidence level)

¹Dillons, Fry’s, King Soopers, Kroger, QFC, Ralphs, Smith’s; ²Dominicks, Randalls, Safeway, Tom Thumb, Vons;

³Giant Foods, Stop & Shop; ⁴Acme, Albertsons, Jewel, Shaw’s/Star Market

Source: Kantar Retail ShopperScape®, November 2012 & November 2013

© Copyright 2014 Kantar Retail

35

CVS ExtraCare Leads in Loyalty

15 year history and penetration give CVS the advantage

• 275 million unique cards,

70 million active users –

Well established among

CVS shoppers

Partnering with

individual suppliers

• Well developed &

need-specific programs

• Leveraging insights to

hone assortments and

drive shoppers to new

categories across the box

Source: Kantar retail analysis & store visits, company reports

Encouraging

collaboration b/t

vendors &

ExtraCare for

solutions

© Copyright 2014 Kantar Retail

36

One Year Later, Where Does

Balance Rewards Stand?

• Finding that though membership is

high, actual usage is low

– Shoppers find the

program confusing

– Not used to the points system

• Now Walgreens is ready to shift

the focus from registering to

rewarding members

Making the reward

clear for shoppers,

putting it into a

measure they

understand

– Working on educating the

shopper, making it easy for

them to optimize the system

Source: ECRM MarketGate, Kantar Retail analysis

© Copyright 2014 Kantar Retail

Kroger Continues to “Capture” Most of Own

Shoppers with Loyalty Card

Balance Rewards gains

traction, while SVU

Rewards loses shoppers

due to store closures

*Read as: 94% of Kroger shoppers have a Kroger loyalty card.

Percentage point figures indicate ppt difference from November 2012.

Source: Kantar Retail ShopperScape®, November 2012 & 2013

© Copyright 2014 Kantar Retail

38

Supermarket Loyalty Cards Still Generate Higher

Satisfaction vs. Drug

Though CVS, Walgreens are improving

Arrows indicate significant difference vs. 2012 (90% confidence level)

¹Dillons, Fry’s, King Soopers, Kroger, QFC, Ralphs, Smith’s; ²Dominicks, Randalls, Safeway, Tom Thumb, Vons;

³Giant Foods, Stop & Shop; ⁴Acme, Albertsons, Jewel, Shaw’s/Star Market

Source: Kantar Retail ShopperScape®, November 2012 & 2013

© Copyright 2014 Kantar Retail

39

But Do Loyalty Cards Really Generate Loyalty?

Capture rates mostly down from 2012

% Loyalty Cardholders Who Spend the Most on Merchandise Group at Retailer

Food / Groceries

Kroger (all banners)

Giant Eagle Advantage Card*

Ahold (all banners)

Safeway (all banners)

Winn Dixie Customer Reward Card

Food Lion MVP Card

HBC

Supervalu (all banners)

CVS ExtraCare card

Walgreens Balance Rewards

Rite Aid Wellness+

2012

2013

ppt difference

46%

44%**

-2.1

46%

43%

-3.1

30%

35%

5.0

39%

35%

-4.4

30%

31%

1.1

31%

29%

-1.9

25%

24%

-1.3

19%

19%

0.5

17%

14%

-2.9

11%

10%

-0.8

*Low sample size (n = 84)

**Read as: 44% of shoppers who have a Kroger loyalty card spend the most on food/groceries at Kroger.

Source: Kantar Retail ShopperScape®, November 2012 & 2013

© Copyright 2014 Kantar Retail

40

Discounts Most Important to Shoppers

While other factors carry pretty equal weight

39%

of Safeway shoppers rate

personalized pricing as a very

important benefit

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

41

Case Study: Safeway’s “just for U”

WHAT: An enhanced loyalty program that provides a more digital and

tailored shopping experience by organizing and personalizing the shopping

experience according to what is most important to each shopper

Personalized Deals

Sale items chosen for shoppers based on

basket history—shoppers get their OWN

price on items they buy often

Digital coupons, personalized shopping lists, weekly Club Card Specials

Kantar Retail Analysis

© Copyright 2014 Kantar Retail

42

JFU Demographics Steady from 2012

With some slight increases

Safeway claims more than

6 million registered just for U users (Q2 2013 conf. call)

Arrow indicates significant difference vs. previous year (90% confidence level)

*The ShopperScape® survey is conducted online and in English only; Hispanics in this sample not representative of the full U.S. Hispanic population.

Source: Kantar Retail ShopperScape®, November 2012 & 2013

© Copyright 2014 Kantar Retail

43

Safeway’s Personalized Pricing Boosts Price

Perception

Important pillar of “just for U” program

+2 ppt

+3 ppt

+9 ppt

+3 ppt

Price perception among JFU members has increased across categories from 2012

Arrows indicate significant difference vs. all Safeway Club Card members (90% confidence level)

*Includes Dominick’s, Randalls, Safeway, Tom Thumb, Vons

Source: Kantar Retail ShopperScape®, November 2012 & 2013

© Copyright 2014 Kantar Retail

44

Program Resonates with Shoppers’ Values

Deals, discounts, and ease

All JFU

Have-nots

members (< $60,000)

Sample size

Spending as little money

as possible

Getting a “good deal”

Stress-free shopping

experience

Haves

($60,000+)

296

149

147

Variety of coupons

77%

85%

70%

Personalized deals offer good prices

76%

80%

72%

Ease of adding coupons to my club card

75%

83%

68%

Personalized deals are relevant

73%

81%

64%

Ease of accessing account information

73%

82%

63%

Ability of JFU site to help plan grocery trips

65%

76%

53%

Satisfaction higher among Have-Not just for U members

Shading indicates significantly greater percentage vs. all just for U members; border indicates significantly lower percentage (90% confidence level)

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

45

Are just for U Members More Loyal?

Fewer shoppers report shopping, spending more since joining

just for U

Shopping

Spending

“…mobile users [are] using the site more frequently, spending more money

than those who are accessing the technology on a desktop computer.”

-Safeway Q3 2013 conf. call

Source: Kantar Retail ShopperScape®, November 2012 & 2013

© Copyright 2014 Kantar Retail

46

just for U App Usage On the Rise

Especially among Have-Not shoppers

Which of the following have you used to access or manage your “just for U” account?

Have Nots

(<$60,000)

Shading indicates significant difference year-to-year

(corresponding shopper segments); 90% confidence level

2012

Sample size 147

just for U Web site on a computer

89%

just for U smartphone app

10%

just for U iPad app

1%

None of these

8%

Source: Kantar Retail ShopperScape®, November 2012 & 2013

2013

149

80%

22%

5%

10%

Haves

($60,000+)

2012

178

84%

27%

5%

6%

2013

147

81%

32%

6%

7%

© Copyright 2014 Kantar Retail

47

Satisfaction Doesn’t Translate Into Trip Driver

just for U more of a convenient bonus—especially among

higher-income members

Arrows indicate significant difference compared with all just for U members (90% confidence level)

Source: Kantar Retail ShopperScape®, November 2013

© Copyright 2014 Kantar Retail

48

Takeaways/Implications

• High participation and satisfaction with rewards

programs still doesn’t guarantee true loyalty

• Shoppers’ needs are pretty simple: They want to spend as little as

possible, get a good deal, and have a frustration-free shopping experience.

Communicating with retailers the importance of keeping it simple will resonate

most with shoppers.

• Personalized pricing is a best in class example of keeping it simple.

Shoppers have almost unlimited options today—help shoppers simplify shopping

routines by customizing their shopping experience for them in the form of

relevant deals.

• Even with the success of personalized pricing, JFU is still not a major trip

driver for Safeway.

© Copyright 2014 Kantar Retail

49

Digital Shopper Forum | February 25–26, 2014 | Chicago, IL

Participate in interactive,

thought-provoking

discussions.

Mention this

webinar to save

$100 off of your

event ticket …

Network with the who's who

of your peers and the experts

in the industry.

*if your company doesn’t

already have a block of prepaid event seats

Learn from Kantar Retail

experts' on the subjects of

digital, shopper, omnichannel, and big data.

For more info on this

event, visit our website

http://www.kantarretail.co

m/digitalshopper2014/

Or, email us

events@kantarretail.com

© Copyright 2014 Kantar Retail

Questions?

Submit questions on Q&A panel on right side of screen

• Shopping Approaches and Spending Priorities

• Perceptions of Price Leadership

• Loyalty Programs

–Update on Safeway’s “just for U” Program

© Copyright 2014 Kantar Retail

51

Contact:

Rachel McGuire

Senior Analyst

rachel.mcguire@kantarretail.com

Mary Brett Whitfield

Senior Vice President

Marybrett.whitfield@kantaretail.com

T:+1 614 355 4036

www.kantarretailiQ.com

T:+1 614 355 4010

www.kantarretailiQ.com

Kate Senzamici

Senior Analyst

kate.senzamici@kantarretail.com

T:+ 1 617 912 2886

www.kantarretailiQ.com

© Copyright 2014 Kantar Retail