Two Main Types of Accounting Software

advertisement

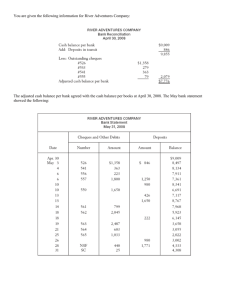

The BANKING Module Slideshow 12 Contents Review of Bank Reconciliation Concepts Account Reconciliation in Sage 50 Accounting Banking 3 Bank Statement 4 Banking Terminology 6 Bank Reconciliation 7 Manual Bank Reconciliation 8 Bank Reconciliation Blueprint 9 To Set Up the Account Reconciliation Journal To Set up LINKED Accounts 14 To Identify Reconciling Items 16 The Account Reconciliation Journal 17 Steps to Complete an Account Reconciliation in Sage 50 Accounting 1. 2. 3. 4. 5. 13 Identify cleared items 19 Reconcile Income 20 Reconcile Expenses 21 Reconcile unresolved items 22 Verify company records 24 Account Reconciliation Reports 25 Slideshow 12 Banking Why do companies use a bank? The reasons are: • Banks provide an effective means of internal control of cash coming in and going out. • Banks are used to clear cheques received. • Payments are easier using cheques and electronic means. Remember, the banking transactions of the company should be separate from the owner(s)’s. (GAAP: Business Entity Concept) Periodically, you will receive a summary of your banking activities in the form of a bank statement. Click for more information on the bank statement. National Bank of Canada 900 McGill Road Kamloops, B.C. V2C 5N3 Account No. 1000-6168 Period May 1, 2014 to May 31, 2014 Enclosures Pages 10 1 Bank Statement The bank statement refers to a particular period (see arrow). Note the codes used. You would usually find a list of codes at the back of the statement. Click. It shows deposits made either through the bank teller (DEP) or through an ATM machine (PTB – Personal Touch Banking). Click. It also shows payments cleared either through cheques, through the Internet (www Payment) or automatic debit (Business PAD). Click. Study the bank charges. For this company’s type of account, the bank charges both for deposits (Crs) and payments (Drs). Notice that charges on electronic transactions are lower than those through the bank tellers. Click to continue. National Bank of Canada 900 McGill Road Kamloops, B.C. V2C 5N3 Account No. 1000-6168 Period May 1, 2014 to May 31, 2014 Enclosures Pages 10 1 Bank Statement (continued) It is very important to note at this point that the bank debits and credits are opposite to the company’s records. For example, when you receive payment from customers, you would debit your company BANK ACCOUNT (see bottom right). National Bank of Canada 900 McGill Road Kamloops, B.C. V2C 5N3 Account No. 1000-6168 Period May 1, 2014 to May 31, 2014 Enclosures Pages 10 1 Click. Notice that when you deposit the cheque from your customer, the bank credits your account (see red arrow on the bank statement). Click. Similarly, your company payment to vendors cleared by the bank are debited in the bank statement, whereas you credit BANK ACCOUNT in your company records. Click to continue. Company Ledger Accounts Payable 69.82 Bank Account 9,878.12 Bank Account 69.82 Accounts Receivable 9,878.12 To record full payment Inv 9321, Brandt Office Supplies via Internet. To record full payment received from Trek Company Inv. 3059. Banking Terminology Before starting work in this chapter, you need to learn some of the terminology related to banking. Click. Study very carefully the terminology shown at the right. Click to continue. Deposit in transit Deposit recorded in the company files that has not been cleared by bank (not shown on the bank statement). Outstanding cheques Cheques written (issued) and recorded by the company that have not been cleared by bank. Adjusted cash balance Reconciled cash balance by which bank and company BANK ACCOUNT show equal balances. NSF (Not Sufficient Funds) cheque Cheque received and deposited by the company that is not cleared by the bank due to insufficient funds in the issuer’s bank account. This could also be a payment cheque or automatic debit issued by the company that can not be cleared because of insufficient funds in the company’s bank account. Overdraft (OD) Your bank account is on OVERDRAFT (OD) if it has a negative balance. Depending on the bank and the type of arrangement you make with them, they will allow you to have a negative balance and will not return cheques due to insufficient funds (NSF) up to a certain amount. This is referred to as OVERDRAFT PROTECTION. Cleared A banking item (e.g., a cheque) is “cleared” when the company’s bank has verified that there are funds that cover the item and that the necessary entry is made on the company’s bank statement. Bank Reconciliation Why do you need to do bank reconciliation? The bank sends a bank statement to the company periodically. You should be able to verify the balance on the statement with the CASH IN BANK account in your General Ledger. However, the balance between the company’s accounting records and the cash balance on the bank statement seldom match. For example, there may be bank charges unknown to the company, or the company could have deposited an NSF cheque from a customer. There could also be some deposits by the company that are not reflected on the bank statement. In other words, there could be a lot of bank-related transactions that are not known by either the bank or the company and should therefore be reconciled in order to come up with an adjusted cash balance. Study the summary at the right. Click to continue. Bank Statement vs. Company may need to make adjustments in the company records due to: • Bank charges/interest charges • Interest earned Company Records Company may need to adjust the calculation of the cash balance on the bank statement to account for: • Outstanding cheques • Deposits in transit • Bank errors • NSF cheques • Company’s bookkeeping errors Company cash account = Adjusted bank balance (Adjusted cash balance) Bank Reconciliation: Manual System It is best to understand the basic concepts of bank reconciliation before completing it in Sage 50 Accounting. First, print a General Ledger Report (Select ALL) for the bank account for the period. National Bank of Canada 900 McGill Road Kamloops, B.C. V2C 5N3 Account No. 1000-6168 Period May 1, 2014 to May 31, 2014 Enclosures Pages 10 1 Click. Identify the items cleared by the bank (blue lines across) as shown on the bank statement and items that need to be reconciled (Bank Charges and Interest charges in this example). The General Ledger Report will also reveal if there are cheques that you have issued but not yet cleared by the bank (outstanding cheques) and deposits that you have made that have not been cleared (deposits in transit). You may also find errors in bookkeeping, such as wrong amounts entered either by you or by the bank. Using these notes, do a manual reconciliation – a spreadsheet is best. Click to continue. Bank charges Interest charges Bank Reconciliation: Blueprint Using the notes that you have made after comparing your G/L BANK account entries with your bank statement, you are ready to do a manual bank reconciliation. Click. Study the blueprint of a bank reconciliation Click to continue. Bank Reconciliation (continued) First, enter the balance per the bank statement and the balance in the company G/L BANK account. Click. Following the blueprint, add or subtract from the balances. For example, outstanding cheques are payments not yet cleared by the bank, so they decrease the bank balance. You would therefore subtract them from the bank statement balance. You would do the opposite with deposits in transit because they increase the bank statement balance. Click. You can then find the adjusted balance for the bank statement and your G/L BANK Account (adjusted cash balance). Click to continue. Per Bank Statement 5,493.12 Less: Outstanding Cheques (620.00) Add: Deposits in Transit 3,230.00 ADJUSTED BALANCE $8,103.12 Per G/L BANK ACCOUNT 8,122.74 Less: Bank Charges (11.45) Less: Bank interest ADJUSTED BALANCE (8.17) $8,103.12 Adjusted Cash Balance = $8,103.12 Bank Reconciliation (continued) Remember, you need to balance your G/L bank account with the reconciled bank balance before you enter any adjustment journal entries. You may not journalize adjustments to the bank records; you may adjust only our company books. At the right are the adjustments you need to make in the company records as per the bank reconciliation blueprint. Click. These are the journal entries you need to make to adjust Bank Charges and the Bank Interest Charge. You credit CASH because both Bank Charges and Interest Expense decrease your cash in the bank. Click to continue. Per G/L BANK ACCOUNT 8,122.74 Less: Bank Charges (11.45) Less: Bank interest ADJUSTED BALANCE (8.17) $8,103.12 Adjustment Journal Entry Bank Charges Interest Expense Cash 11.45 8.17 9.62 Bank Reconciliation (continued) NSF Cheques There may be times that the bank would report an NSF customer cheque in your bank statement. It means that the customer’s cheque that you deposited earlier did not clear your customer’s bank due to lack of funds. Let us assume that the customer originally paid $254.25. Original Journal Entry Cash in Bank Fees Earned 254.25 254.25 To record fees collected Inv #2954 Chq #264. Cash in Bank Fees Earned 254.25 254.25 Click to see the original entry when you received the payment. When an NSF transaction occurs, the amount becomes owing again by the customer, as if it was not paid at all, so you need to record the amount to ACCOUNTS RECEIVABLE. Click and study the appropriate NSF entry. Click and study the effects of the General Journal entries to the balances on the General Ledger. Click to continue. NSF Journal Entry Accounts Receivable Cash in Bank 254.25 254.25 To record NSF Chq #264 (Inv #2954). Cash in Bank 254.25 254.25 Accounts Receivable 254.25 Account Reconciliation in Sage 50 Accounting To set up the Account Reconciliation Journal Bank reconciliation in Sage 50 is done in the Reconciliation & Deposits Journal. Start by clicking the Chart of Accounts icon the Home window. Click the CHART OF ACCOUNTS icon. You would select the bank account (CASH IN BANK) to display the General Ledger for the account. Click CASH IN BANK. On the Reconciliations & Deposits page, ensure that the Save Transactions for Account Reconciliation box is checked. When you click the Set Up button, Click the Set Up button now. …the Account Reconciliation Linked Accounts window will appear with the system defaults. You need to change them accordingly. Click to continue. Adjustment The Account Reconciliation Journal: To Set Up Linked Accounts Notice that there are various Income and Expense name boxes, and one Adjustment. You would enter the appropriate names (or accept defaults) and select appropriate accounts in the Account boxes. By doing this, you are virtually creating an input window for each name. Interest Income is the default for Income 1 Name (you can change if necessary). Click. When you click the drop-down arrow for any of the Income Account boxes, the Income accounts in the company’s chart of accounts will display and you can select the appropriate account. You would select 4210 Interest Income. This will allow you to reconcile Interest Income automatically by simply entering the interest amount in the appropriate input window. Click to continue. Adjustment The Account Reconciliation Journal: Linked Accounts (continued) Similarly, you can enter appropriate names and select corresponding accounts for expenses. By entering Bank Charges and selecting 5342 Bank Charges Expense, you will be able to reconcile bank charges automatically by simply entering the amount(s) in the input window. Click. Setting up the Interest Expense name and selecting 5345 Bank Loan Interest will allow you to reconcile bank loan interest automatically. Click. The Adjustment account allows you to select from any Revenue or Expense account. Unresolved amounts will be posted to this account, so they will be easy to analyze for reconciliation. The Reconciliation & Deposits Journal will then be ready to use. Click to continue. Adjustment Account Reconciliation in Sage 50 Accounting: Identify Reconciling Items As in the manual bank reconciliation, you would analyze the bank statement. With the help of your General Ledger report (you will see one later), identify reconciling items that need to be adjusted both in the bank balance and in the company’s General Ledger. Click. Study the manual bank reconciliation below. Click to continue. Account Reconciliation in Sage 50 Accounting: Account Reconciliation Journal Display the Reconciliation & Deposits journal, by clicking the RECONCILE ACCOUNTS icon in the BANKING Home page. Select date for end of the month. Apr. 30, 2014 Click the RECONCILE ACCOUNTS icon. Then select the Cash in Bank account. Click. You would then fill in the top of the window with the start and end dates of the reconciliation, the Opening Balance and the end balance of the latest bank statement. You can also add an appropriate comment. Read the First Reconciliation notation on the TRANSACTION page. Click ADD PRIOR OUTSTANDING. The Add Outstanding Transactions window allows you to add in Resolved and Outstanding transactions in the previous period. If none, you can advance the date in the field Show Resolved Trans. On or After. In this example, you would select the last date of the previous month, April 30. Click to continue. Read Account Reconciliation in Sage 50 Accounting: Account Reconciliation Journal The Reconciliation & Deposits Journal appears showing the current outstanding items. Notice the Unresolved amount at the Summary section at the bottom of the window. Click. Also notice that the Status of the cheques listed are all Outstanding, which is not necessarily correct. Click to continue. Account Reconciliation in Sage 50 Accounting: Step 1: Identify Cleared Items Using the bank statement as your guide, check off the items that the bank had cleared (red lines across) by clicking the item at the STATUS column in the Reconciliation & Deposits journal. As you check off each item shown as cleared on the bank statement, the Status changes from Outstanding to Cleared. Notice the Outstanding items. Click. The Summary section shows an Outstanding item of –194.90 and an Unresolved amount of –1,368.60. Click. Study the Reconciliation & Deposits Journal Entry. The object of the account reconciliation is to reduce the Unresolved amount to zero and update the CASH IN BANK account to the adjusted bank balance of -407.50. Click to continue. Account Reconciliation in Sage 50 Accounting: Step 2: Reconcile Income You would address the Deposit Interest item on the bank statement on the Income page (see below left). Click. Notice that the Interest Income name is automatically filled in the Reconciliation & Deposits journal. It is because you have specified it when you entered the Income Linked Accounts earlier. Click. You would enter Bank Statement as Source No. and the Interest Income amount as shown on the bank statement. Click. Study the resulting journal entry. Click to continue. Account Reconciliation in Sage 50 Accounting: Step 3: Reconcile Expenses Study the Bank Reconciliation. The items crossed out in blue have been reconciled. Service Charges and Loan Interest are both still unreconciled. Click. On the Expense tab, the linked accounts Expense 1 (Bank Charges) and Expense 3 (Interest Expense) you specified earlier are automatically filled in. Click. You would enter Bank Statement as Source No., and enter the corresponding amounts for BANK CHARGES and INTEREST EXPENSE. Click. Study the Account Reconciliation Journal Entry after reconciling expenses. Notice that the Unresolved amount is equal to the last unresolved item left (NSF cheque). Click to continue. Account Reconciliation in Sage 50 Accounting: Step 4: Reconcile Unresolved Items You have learned how to reconcile all the items on the bank statement, except the NSF cheque. To resolve the NSF cheque, you need to enter a sales invoice in the Sales Journal in the RECEIVABLES module, but you would do that later. First, you would post the entries in the Reconciliation & Deposits Journal. Click. When you post the Reconciliation and Deposit a warning window will appear, which shows an amount equal to the amount of the NSF cheque. Click. The Select Adjustment Account window will appear as you click OK, showing the Bank Rec Unresolved account as the default. Click OK to accept the default. Account Reconciliation in Sage 50 Accounting: Use the original invoice no. adding NS (for NSF) and the cheque no. for easy reference. Step 4: Reconcile Unresolved Items (continued) To clear the Unresolved amount in the company records, you need to record the NSF cheque in a Sales Invoice Journal crediting account 5380 BANK REC UNRESOLVED (Unknown) and not to 1060 CASH IN BANK as you would normally do. This will put back the amount now owing (again) to the ACCOUNTS RECEIVABLE account and to the customer’s subledger. The bank may charge your company for processing NSF cheques. Your company in turn can also charge the client whose cheque has been returned NSF, sometimes with an additional amount for handling. In this example, you are charging the client $45.00 over and above the NSF cheque amount to cover your handling fee. Click. Study the Sales Journal. Click. Study the Invoice Sales Journal Entry. Click to continue. HANDLING FEE is a Revenue-type account (see Chart of Accounts REVENUE Section) Step 5: Verify Company Records You have now completed your (bank) account reconciliation. The last thing you need to do is to verify your company records. The manual bank reconciliation shows an outstanding cheque 627 of $500. Because the bank has not cleared the cheque, you need to ensure that it is carried forward to the next month so it will be in the next month’s account reconciliation record. Click. To check your record, display the Account Reconciliation Detail Report. You will see the outstanding cheque for $500.00. Click to continue. Account Reconciliation Reports: General Ledger Report – CASH IN BANK The best way to verify the company records is to print the General Ledger report . It shows all the entries that were automatically generated by Sage 50 Accounting when you do the account reconciliation using the Reconciliation & Deposits journal. Notice that in Step 1 in the reconciliation process, the cheques your company paid out and were cleared by the bank are automatically credited. Click. The cheques your company received from customers, then deposited and cleared by the bank were debited. Click to continue. Step 1 Account Reconciliation Reports General Ledger Report – CASH IN BANK (continued) The General Ledger report also shows that when you reconciled Income in Step 2, Sage 50 Accounting generated entry J10 and debited INTEREST INCOME. Click to continue. Step 2 Account Reconciliation Reports: General Ledger Report – CASH IN BANK (continued) When you reconciled Expenses in Step 3, Sage 50 Accounting generated entries J11 and J12 and credited SERVICE CHARGES and LOAN INTEREST. Click to continue. Step 3 Account Reconciliation Reports General Ledger Report – CASH IN BANK (continued) The General Ledger report shows that when you completed the account reconciliation, 1060 CASH IN BANK is equal to the Adjusted Cash Balance in the manual Bank Reconciliation. In this case, the cash account is overdrawn by $407.50 Click to continue. Account Reconciliation Reports: General Ledger Report – BANK REC UNRESOLVED The General Ledger report for 5380 BANK REC UNRESOLVED will show a zero balance, since you have reconciled everything in your company records. You therefore have accomplished your objectives for the account reconciliation. Click to continue. More… Go back to your text and proceed from where you have left off. Review this slideshow when you finish the chapter to better prepare yourself for the next chapter. Press ESC now, then click the EXIT button. EXIT