Foundations of Strategy Overview

advertisement

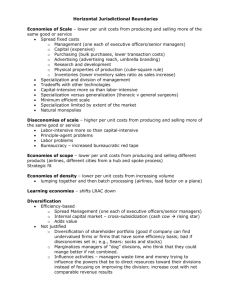

Foundations of Strategy Overview Elizabeth Allen Mike Mullin Michael Johnson Joshua Zamarron James Stariha Chapter 1: The Concept of Strategy The role of strategy in success Strategy today The approach taken in this book The Role of Strategy in Success Goals that are simple, consistent, and long term Single-minded commitment to clear goal Profound understanding of competitive environment Objective appraisal of resources Exploit internal strengths and protect areas of weakness Effective implementation Emergence of organizations and responding to changes in the environment The Role of Strategy in Success Successful Strategy Effective Implementation Profound understanding of Simple, consistent, the competitive environment long-term goals Objective appraisal of resources Strategy Today Strategy Definitions The means by which individuals or organizations achieve their objectives (FS Book) A plan, method, or series of actions designed to achieve a specific goal or effect (Wordsmyth Dictionary) The determination of the long-run goals and objectives of an enterprise and the adoption of courses of action and the allocation of resources necessary for carrying out these goals (Alfred Chandler, Strategy & Structure) The pattern of objectives, purposes, or goals and the major policies and plans for achieving these goals, stated in such a way as to define what business the company is in or is to be in and the kind of company it is or is to be (Kenneth Andrews, The Concept of Corporate Strategy) Strategy Today Corporate strategy Defines the scope of the firm in terms of the industries and markets in which it competes Business strategy Concerned with how the firm competes within a particular industry or market The Approach Taken in this Book Companies operate in the interests of their owners by seeking to maximize profits over the long term by pointing to four key considerations Competition The market for corporate control Convergence of stakeholder interests Simplicity The Approach Taken in this Book Competition Erodes profitability As competition increases, the interests of different stakeholders converge around the goal of survival The Market for Corporate Control Management teams that fail to maximize the profits of their companies will be replaced by teams that do The Approach Taken in this Book Convergence of Stakeholder Interests There is likely to be more community of interests than conflict of interests among different stakeholders Simplicity A key problem of the stakeholder approach is that considering multiple goals and specifying trade-offs between them vastly increases the complexity of decision making. Chapter 3: Resources and capabilities The role of resources and capabilities in strategy formulation Identifying the organization’s resources and capabilities Developing resources and capabilities Resources and Capabilities Firms industry environments have become more unstable, so internal resources and capabilities have become more secure base for formulating strategy It has become increasingly apparent tha competitive advantage rather than industry attractiveness is the primary sources of superior profitability Resources and Capabilities Resources are the productive assets owned by the firm Capabilities are what the firm can do Resources must work together to create organizational capability Capability is the essence of superior performance Identifying Resources Tangible Resources Easiest to identify and evaluate Financial resources, Physical resources Intangible Resources Technology Reputation Culture Human Resources Skills/know-how Capacity for communication and collaboration Motivation Identifying Capabilities Organizational Capability – a firm’s capacity to deploy resources for a desired end result To perform a task, a team of resources must work together. i.e. a brain surgeon with a radiologist, anesthetist, nurses, etc. Distinctive Competence – those things that an organization does particularly well relative to its competitors Developing Resources and Capabilities Having managers with knowledge for capability building Acquiring capabilities through mergers, acquisitions, and alliances Internal development(focus and sequencing): Capability development needs to be systematic and a step by step process of design and implementation through several stages and in order. Chapter 5: Business strategies in different industry and sectoral contexts The industry life cycle Strategy at different stages of the life cycle Scenario planning The Industry Life Cycle Is the supply-side equivalent of the product life cycle, occurs over a much longer time span Comprised of four phases Introduction Growth Maturity Decline Two main factors that are fundamental: Demand growth Production and diffusion of knowledge Demand Growth In the introduction stage, sales are small and the rate of market penetration is low because the industry’s products are little known and customers are few. Customers tend to be innovative oriented and risk-tolerant. The growth stage is characterized by accelerating market penetration as technical improvements and increased efficiency open up the mass market Increasing market saturation causes the onset of the maturity stage. Once saturation is reached, demand is wholly for replacement As the industry becomes challenged by new industries that produce technologically superior substitute products, the industry enters its decline stage Production and Diffusion of Knowledge New knowledge in the form of product innovation is responsible for an industry’s birth Dual processes of knowledge creation and knowledge diffusion exert a major influence on industry evolution Over the course of the industry life cycle people become more knowledgeable about the performance attributes so they are better able to judge value for the price Change focus from product innovation towards process innovation Strategy at Different Stages in the Life Cycle: Introduction Stage The introduction stage typically features a wide variety of product types that reflect the diversity of technologies and designs and the lack of consensus over customer requirments The basis of entry is product innovation Success comes from winning the battle for technological leadership Gross margins can be high, but heavy investments in innovation and market development tend to depress return on investment Strategy at Different Stages in the Life Cycle: Growth Stage One of the key challenges becomes scaling up, as the market expands the firms needs to adapt its product design and manufacturing capabilities to large-scale production More sophisticated financial, administrative, and strategic skills become necessary Need to reduce cost and less need for sophisticated labor as production processes eliminates the need, leads to a shift in production and assembly to newly industrialized countries Strategy at Different Stages in the Life Cycle: Maturity Stage Competitive advantage increasingly becomes a quest for efficiency Key Success factors Cost efficiency through scale economies Low wages and low overheads The number of firms begins to fall as product standardization and excess capacity stimulate price competition Often industries go through one or more “shake out” phases during which the rate of failure increases rapidly Further un-skilled labor required, shifts almost entirely to developing countries where the costs are low Strategy at Different Stages in the Life Cycle: Decline Stage Transition can result from technological substitutes, changes in consumer preference, demographic shifts, or foreign competition Key features of decline Excess capacity Lack of technical change Aggressive price competition Declining number of competitors Two determinants of whether or not a declining industry becomes a competitive bloodbath Balance between capacity and output Nature of the demand for the product Scenario Planning Scenario analysis: systematic way of thinking about how the future might unfold that builds on what we know about the current trends an signals Scenarios are stories that describe how the world might look in the future; these stories are used to review and test strategic options Approach is to construct several distinct, internally consistent narratives of how the future may look 5-25 years ahead Scenario Planning Key Steps Define the purpose of the analysis Decide on the time horizon Indentify key trends Identify key uncertainties Create the scenario and check that they are internally consistent Identify indicators that might signal which scenario is unfolding Assessing the strategic implications of each scenario Chapter 6: Technology-based industries and the management of innovation Competitive advantage in technology-intensive industries Strategies to exploit innovation: how & when to enter Creating the conditions for innovation Competitive advantage in technology-intensive industries The innovation process Basic Knowledge Innovation Supply side – Imitation Demand side – Adoption Invention Diffusion The Profitability of Innovation Property rights in Innovation Intellectual property: Patents, Copyrights, Trademarks, and Trade Secrets Codifiable Knowledge “That which can be written down” Coca-Cola, Intel’s Design Lead-Time Lead-Time advantages Microsoft, Intel, and Cisco Systems Complementary Resources Biotech firms ally with large pharmaceutical compaines for clinical testing Strategies to exploit innovation: how & when to enter Alternative Strategies to exploit innovation Licensing, Outsourcing certain functions, Strategic Alliance, Joint Venture, and Internal Commercialization (Risk and Return and Resources requirements) Characteristics of the Innovation Establishment of Property rights critically determines the choice of strategy options. Resources and Capabilities of the Firm Timing Innovation: To Lead or to Follow? Leaders don’t always grab the prize. Risks and cost of pioneering Protection of property rights or lead-time advantage Importance of Complementary resources The potential to establish a standard Creating the conditions for innovation Managing Creativity Creativity is stimulated by human interaction Amgen and Google Organizing for Creativity Quite different from efficiency Google: Engineers have considerable discretion at to which project to join From Invention to Innovation: The Challenge of integration Must be directed and harnessed to create value for both company and society Cross functional development teams, product champions, buying innovation, and open innovation Chapter 7: Corporate Strategy The scope of the firm Key concepts for analyzing firm scope Diversification Scope of The Firm Product Scope– How specialized the firm is in terms of the range of products it supplies. E.g. Coca-Cola, Gap, SAP Vertical Scope– The range of vertically linked activities the firm encompasses. Geographical Scope– The geographical spread of activities for the firm. Key concepts for analyzing firm scope Firm’s extend or reduce their scope because they perceive this to be in the firm’s best interest Economies of scale Reduction in average costs that result from an increase in the output of a single product Economies of scope Cost economies from increasing the output of multiple products Creates potential for multi-business firms to gain cost advantages over more specialized business Key concepts for analyzing firm scope Tangible resources Distribution networks, info technology systems, sales force, labs Offer economies of scope by eliminating duplication between businesses through creating a single shared facility Ex: cable TV companies and telephone companies Shared services organizations Intangible resources Brands, reputation, technology Offer economies of scope from the ability to extend them to additional businesses at low marginal cost Ex: Starbucks Brand extension Diversification The expansion of an existing firm into another product line or field of operation The Benefits and Costs of Diversification: Why do companies strive to diversify? Growth Risk reduction Value creation Our Company Amgen On January 26, 2012 Amgen released a statement about their most recent a successful acquisition, Micromet, for 1.16 Billion dollars. Micromet is a biotechnology company that’s main capability is oncology development This is an example of diversification, due to the expansion of Amgen’s current field of operation into the field of operation of Micromet. Chapter 9: Realizing Strategy The organizational challenge: reconciling specialization with coordination and cooperation Management systems Corporate cultures The Organizational Challenge Reconciling specialization with coordination and cooperation The fundamental source of efficiency in production is specialization through the division of labor into separate tasks. Henry Ford found huge productivity gains with his assembly line. Cutting the time to assemble the Model T from 106 hours to 6 hours in only two years. Costs of specialization More divided the process, the more complex the challenge of integrating the efforts of individual specialists Leads to cooperation problem and coordination problem Management Systems Provide the mechanisms of communication, decision making and control that allow companies to coordinate and integrate activities The Four Management Systems Information Systems: Collect, organize and communicate financial information to top management and other parts of the organization Strategic Planning Systems: important method for achieving coordination within a company. The strategic plan is often made up of the following Statement of goals Set of assumptions or forecasts Qualitative statement Specific action steps Financial projections The Four Management Systems Financial Planning and Control Systems: primary mechanism through which top management seeks to control the company Human Resource Management Systems: an incentive system that promotes the implementation of plans and targets by aligning employee and company goals and ensuring employees have the skills necessary for his or her job Corporate Culture Corporate Culture: refers to the values and ways of thinking that managers wish to encourage in their organization Studies that have been attempted do suggest that organizations with strong corporate cultures do have better long term financial performance than those who do not, although the tests used to find this may not have been totally reliable THANK YOU ANY QUESTIONS?