Vertical Boundaries of the Firm

advertisement

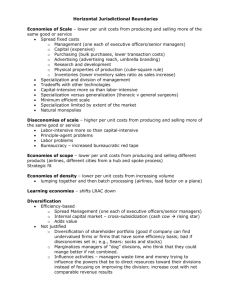

Vertical Boundaries of the Firm David Hennessy Economics Department Flow of Production 1 The production of a good or service often requires a wide range of activities organized in a vertical chain. Production flows from upstream to downstream, e.g., pork, automobiles. Illustration: winemaking (slide). A value chain (graph). 3 The Firm and the Value Chain Which portions of the chain should the firm be involved in? What is it good (bad) at? Where to draw boundaries, and when to change them? Should a firm make or buy? 4 Questionable Assertions A: A firm should buy to avoid the costs associated with making. B: A firm should make in order to capture the profits due to the input producer. C: A firm should make in order to assure supply and avoid fluctuating prices as demand and supply conditions in the input market change. There are many such rules of thumb. Their merit? 5 Some Definitions The value chain: This is the process which begins with the acquisition of raw materials and ends with the distribution and sale of finished goods. Segment value added: This is the revenue associated with that segment of the chain (graph). Upstream (downstream) activities: These are activities occurring early (late) in the value chain. 6 More Definitions Support activities: These are activities not directly associated with the transformation of products in space, form, or time, but still essential to the operation of the business. Transfer price: This is a price used within a firm that is used for pricing goods as they move along segments of the value chain in which the firm operates. (uses in intra-firm make/buy decisions and in tax issues). 7 Make or Buy? Make relates to internal production. Buy relates to use of the marketplace. Reasons to buy: a) economies of scale and scope, b) market discipline. Reasons to make: a) coordination, b) transactions costs, c) information leakage. 8 Reason to Buy: Scale/ Scope Economies If the firm makes, it may not be able to achieve the economies of scale/scope that a market supplier achieves. The market supplier may have critical mass (graph). 9 Critical Mass Key point: AC falls from Q0 to Q* Average Cost AC0 P AC* Q0 Q* 10 Graphic Representation: Scale Economies Suppose your firm needs Q0 widgets, and that many other firms also need widgets. The market firm can sell to many firms, and it sells Q* to make average costs very low (AC* rather than AC0). The market firm can sell a widget at price P with AC0 > P > AC*, and still make a profit. Who benefits from the trade? If all firms that needed Q0 produced Q*, then who would use the surplus? 11 Scope Economies Example: Calculators and watches. Reason: The costs of developing and producing the common liquid crystal display can be spread over more output. Other examples? Sales in Sears vs. specialist stores. Boeing does airplanes and aerospace. Proctor and Gamble. 12 Cost Function and Scope Economies Let the cost of producing Q1 watches and Q2 calculators be function C(Q1, Q2). Produced separately, they cost C(Q1, 0) + C(0, Q2). Produced by the firm, they cost C(Q1, Q2). What if C(Q1, 0) + C(0, Q2) > C(Q1, Q2)? What if the reverse is true? 13 Cost Function and Scope Economies, Cont’d If your firm needs only calculators as an input, then to compete cost-wise with a firm producing both you may have to produce watches too. But you know nothing about the watch business, and don’t want to. Punchline: Buy from the market, and avoid the distraction. 14 Origins of Scale Economies Adam Smith said they came from the division of labor. The pin factory: three tasks to do; a) make the head • b) make the spike / c) solder them together ¡ He found (observation) that it was less efficient to let three people do all three jobs than let each specialize in one of the tasks. Another example: legal specialization (graph). 15 Specialization Among Lawyers AC AC General Practice Lawyers AC Patent Lawyers Specialization not efficient Specialization is efficient Number of Lawyers in the Market 16 Reason to Buy: Market Discipline The market firm may produce only one good, focusing on the costs and quality of that product. If a firm producing other stuff decides to make an input, then it may be for hard-to-explain reasons (to be discussed later). It may then be difficult to ascertain whether the decision to make was wise. Some insights may be obtained from agency theory. 17 The Agency Concept Defn: An agent is an economic entity under formal or informal contract to provide resources, services, or goods to another economic entity (the principal) in return for a (possibly outcome or environment determined) reward. In the firm, the agent is generally the employee, and the principal generally the employer. The employer must guard against slack work, and the abuse of resources for ends other than those of the employer. 18 Agency Costs Defn: Agency costs are costs which accrue to the principal that are associated with insufficient or inappropriate activities by agents, and also the costs of guarding against such activities. Two examples; a) Influence costs, b) Innovation problems. 19 Influence Costs Suppose a firm decides to produce an input because no market firm can be trusted to produce precisely what is needed, e.g. specific software. Now you have employees who know more about this input and its importance to the firm than anyone else in the firm. Later, suppose you want to reassess the decision to make. Who do you turn to? The most knowledgeable employees have an agenda that differs from that of the employer. They can not be relied upon, they may fudge the data. This is the principal-agent problem. Case of unions and operations manuals. 20 Innovation Costs The firm wants to be rewarded for successful innovations/research. Suppose a good scientist innovates and is rewarded with a promotion. If he/she resigned and set up a company to exploit the innovation, the profits might be enormous. The firm will have to pay well to prevent this (agency cost). The scientist could also change jobs, carrying the innovation. The company will have to monitor to prevent such theft (agency cost also). 21 Reason to Make: Coordination To produce a complicated product cheaply, many people have to successfully make interrelated decisions about many resources. It is often easier to coordinate activities when important inputs are made inside a firm. Example: a restauranteur who needs waiters and chefs to coordinate. Best to hire nightly longer-term? 22 Types of Coordination Costs Time: Release movies on time after advertizing, software, microchips, books (on death of celebrity). Size: The space shuttle disaster of 1986 may have been caused by an ill-fitting Oring. Color: Benetton needs the colors it uses to be fashionable at the time. Sequence: Coordinating sequence is vital on assembly lines and in sports. 23 Reason to Make: Transactions Costs There are costs associated with organizing and transacting exchanges between arms-length firms in the marketplace. . Such costs include negotiating, writing, and enforcing contracts. Consumes expensive management time. 24 Reason to Make: Information Leakage Firms usually have sensitive private information concerning innovations, sales, strategies, financial status etc. Employers may be easier to keep quiet than outside firms who might have to be given access to this information to do their job. Examples: Coke and its secret formula; mining firms use their own geologists; Chinese Wall. 25 Assertions T/F? A: A firm should buy to avoid the costs associated with making? Depends on price, quality and other issues. B: A firm should make in order to capture the profits due to the input producer? Depends on cost structure etc. C: A firm should make in order to assure supply and avoid fluctuating prices? Might a production contract or use of futures markets (buying price stability) be less costly?