Ch 13 Partnership HO

advertisement

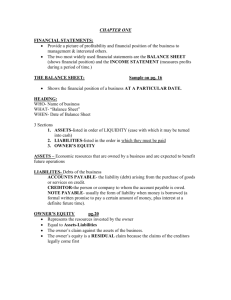

Mrs. O’Donnell BAT4M0 PARTNERSHIPS Partnership Characteristics: Mutual Agency – each partner acts as an agent of the partnership, with the authority to enter into contracts for the purchase and sale of goods and services. Unlimited liability – each partner is personally liable for all the debts of the firm. A new member joining an existing partnership may not assume liability for debts incurred by the firm prior to his/her admission. Limited Life – a partnership may be ended at any time by the death or withdrawal of any member of the firm. Other factors to end a partnership include bankruptcy or incapacity of a partner or expiration of the partnership contract. The admission of a new partner or the retirement of an existing member means an end to the old partnership but usually continues by the formation of a new partnership. Co-ownership of property – any property invested by a partner becomes jointly owned by all partners and no personal rights to the asset are retained. Advantages of a Partnership: Combining skills and resources of two or more individuals Relatively easy and inexpensive to form a partnership, however, should still have a partnership agreement, or contract, in place to summarize the partners’ mutual understanding on points such as: o Names of the partners o The duties and rights of each partner o Amount to be invested by each partner, including the procedure for valuing any noncash assets invested or withdrawn by partners o Methods of sharing net income and net losses o Withdrawals to be allowed each partner o Provision for liquidation, including the method for sharing a deficiency in a partner’s capital account by other partners Freedom from governmental regulations and restrictions (similar to a sole proprietorship) Ease of decision making Disadvantages of a Partnership: Unlimited liability – a partnership is NOT a legal entity nor a taxable entity (i.e. the partnership does not pay taxes). The individual partners' income (or loss) from the partnership is added to their personal income level and they are taxed accordingly. Mutual agency Limited life of a partnership Less effective in raising capital than a corporation Disagreements between partners Mrs. O’Donnell BAT4M0 Types of Partners: General Partner o Has unlimited liability for the debts of the business and the right to make managerial decisions in running the company Limited (Silent) Partner o Has the right to participate in the income of the business, but his/her liability for losses is limited to the amount of his/her investment o Can not actively participate in the management of the business Most partnerships are general partnerships. A Limited Partnership must have at least one general partner. Separate and distinct accounting entity: A partnership especially needs to have an adequate accounting system and an accurate measurement of income since income is divided amoung two or more owners. Investment by a partner: (see pg. 624 of the text for examples) DR Cash or Asset Capital, Partner A When a partner contributes assets other than cash to the business, the partner’s capital account is credit with the current market value at the date the assets are invested in the business. All partners must agree to the assigned current market value. Ordinarily any funds furnished to the firm by a partner a recorded by crediting the partner's capital account. Occasionally, however, a partnership may be in need of funds but the partners do not wish to increase their capital investment in the business. The advance of funds may be designated as a loan from the partner and credited to a liability account (e.g. Accounts Payable or Loan Payable). Statement of Partners’ Equity: Instead of a Statement of Owner’s Equity, a partnership uses a Statement of Partners’ Equity. It explains the changes in each partner’s capital account and in total partnership capital during the year. Blair and Cross Statement of Partners’ Equity For the Year Ended December 31, 20xx Blair Cross Balances, Jan. 1, 20xx $160,000 $160,000 Add: Additional investments 10,000 10,000 Net income for the year 30,000 30,000 Subtotals $200,000 $200,000 Less: Drawings 24,000 16,000 Balances, Dec. 31, 20xx $176,000 $184,000 Total $320,000 20,000 60,000 $400,000 40,000 $360,000 Mrs. O’Donnell BAT4M0 Partnership Balance Sheet: On the Balance Sheet, instead of having an Owner’s equity section, it has a Partner’s equity section where each partner’s capital balance is listed separately. Partners’ Equity: Bennett, Capital Carson, Capital Drake, Capital Total Partners’ Equity $95,000 87,000 98,000 $280,000 Drawing Accounts: Each partner has their own Drawings account and is debited when a partner: Withdraws cash for personal use including payment of a salary Pays personal debts from the business funds Collects accounts receivable belonging to the firm and personally retains them Income Statement: The Income Statement includes a section to show the division of income between partners. The partners will pay personal income tax on their portion of the net income. Income Ratio: Partnership net income (or loss) is shared equally unless the partnership contract specifically indicates otherwise. Other than an equal share other typical ratios are: o A fixed ratio, expressed as a proportion (2:1), a percentage (40% and 60%), or a fraction (2/3 and 1/3) o A ratio based on either capital balances at the beginning of the year or on average capital balances during the year o Salaries to partners, and/or interest on partner’s capital balances, and the remainder in a fixed ratio A partner’s share of net income or net loss is recognized in the accounts through closing entries. The net income earned by partnerships, like those earned by sole proprietorships, compensate the owners for 1) Personal services rendered to the business 2) Capital invested in the business 3) Entrepreneurial risk – risk that investment of money and time may be lost if the business is unsuccessful Mrs. O’Donnell BAT4M0 A partnership is dissolved when a partner withdraws or a new partner is admitted. A new agreement must be created and the partner’s capital accounts must be adjusted. Admission of Partners: 1. Purchase of an existing Partner’s Interest (see pgs 632-633 of text for examples) o total capital of partnership does not change o business “cash” is not affected OR 2. Investment of Assets in the Partnership (see pgs 634-635 of text for examples) o results in a change to both the total net assets and the total partnership capital o business “cash” is affected o when the new partner’s investment differs from the capital equity acquired, the difference is considered a bonus to: i. the existing (old) partners or ii. the new partner Withdrawal of a Partner: (see page 637 of text for examples) 1. Payment from remaining partners’ personal assets OR 2. Payment from partnership assets When all operations of the business are stopped the partnership undergoes liquidation. Liquidation (or termination) of a Partnership: (see pgs 638 - 651 of text for examples) 1. Prepare financial statements and close out the accounts to determine an afterclosing Balance Sheet 2. Sell noncash assets for cash and recognize any gain or loss on realization 3. Allocate any gain or loss on realization to the partners based on their income ratios 4. Pay partnership liabilities in cash 5. Distribute remaining cash to partners based on their capital balances