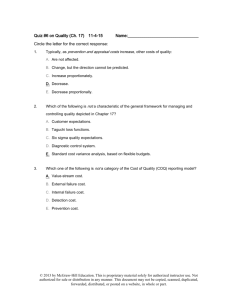

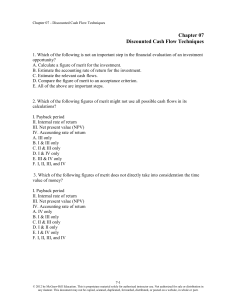

FREE Sample Here - We can offer most test bank and

advertisement