2008.04.14 In Japan, Keys to Success Same

advertisement

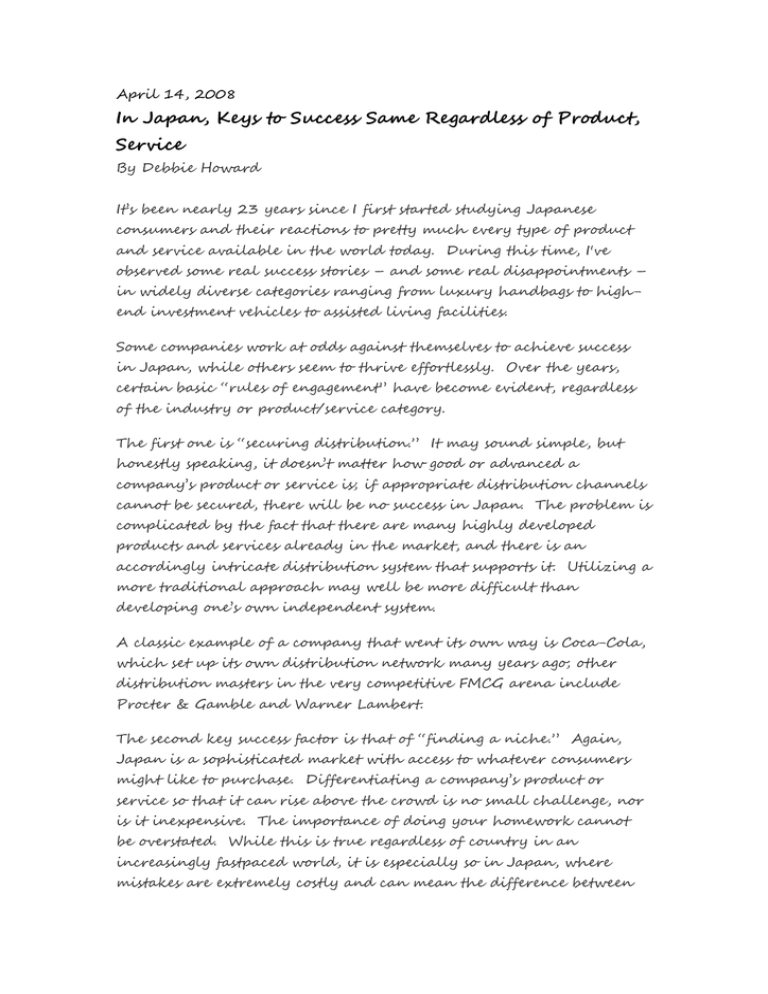

April 14, 2008 In Japan, Keys to Success Same Regardless of Product, Service By Debbie Howard It’s been nearly 23 years since I first started studying Japanese consumers and their reactions to pretty much every type of product and service available in the world today. During this time, I've observed some real success stories – and some real disappointments – in widely diverse categories ranging from luxury handbags to highend investment vehicles to assisted living facilities. Some companies work at odds against themselves to achieve success in Japan, while others seem to thrive effortlessly. Over the years, certain basic “rules of engagement” have become evident, regardless of the industry or product/service category. The first one is “securing distribution.” It may sound simple, but honestly speaking, it doesn’t matter how good or advanced a company’s product or service is; if appropriate distribution channels cannot be secured, there will be no success in Japan. The problem is complicated by the fact that there are many highly developed products and services already in the market, and there is an accordingly intricate distribution system that supports it. Utilizing a more traditional approach may well be more difficult than developing one’s own independent system. A classic example of a company that went its own way is Coca-Cola, which set up its own distribution network many years ago; other distribution masters in the very competitive FMCG arena include Procter & Gamble and Warner Lambert. The second key success factor is that of “finding a niche.” Again, Japan is a sophisticated market with access to whatever consumers might like to purchase. Differentiating a company’s product or service so that it can rise above the crowd is no small challenge, nor is it inexpensive. The importance of doing your homework cannot be overstated. While this is true regardless of country in an increasingly fastpaced world, it is especially so in Japan, where mistakes are extremely costly and can mean the difference between success and failure. “Getting it right” takes on totally new dimensions. Starbucks is a good example of a company that literally created a new niche in Japan, and then was copied not only by foreign competitors who then entered the market – but also by domestic coffee purveyors who updated their concepts to enter the fray. Today, Starbucks continues to innovate and work to “get it right” – and it is a formidable competitor. The third key success factor is that of “making a commitment.” Considering the importance of corporate credibility among Japanese consumers – and the inherent change-averse nature Japan – making a long-term commitment is part and parcel of being successful in Japan. It is often said that those companies who are not fully committed for the long-term will never get a second chance. Certainly, the list of companies that have been successful include many who have been here for well over 30 years or more. An exception is IKEA, which was not successful in entering the Japanese market in the 1980s, but which re-entered in the last several years, and is now leveraging its concept very successfully. Indeed, they are meeting all three of these key success factors this time around, and they are being rewarded with enthusiastic a response from Japanese consumers.