Sample stock problems

advertisement

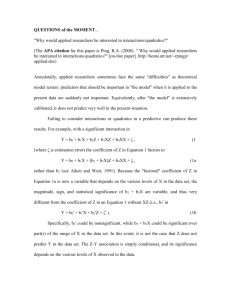

Sample problems Fin 327-Fall 2009 2nd mid-term 1. Quadratics Inc is an applications firm that specializes in multimedia software. Quadratics current earnings are $3.00 per share and expected to grow at 10% each year. Quadratics typically pays out 40% of its earnings as dividends, but is restricted from doing so because of a clause in its bond indenture. This clause states that for the next three years (until the bond matures), Quadratics can only make a dividend payment of $1.00 per share each year. Analysts estimate the required return on Quadratics stock to be 15%. (20 points) (a) Estimate the expected intrinsic value of Quadratics’ stock when the bond matures. Price (3) = 0.4 * 3.00 (1.10)4/(0.15 – 0.10) = 35.14 (b) Use a 2-stage dividend model to estimate the intrinsic value for Quadratics now. Intrinsic value = 1/(1.15) + 1/(1.15)2 + (1+35.14) / (1.15)3 = 25.39 (c) Quadratics trades at a P/E ratio of 11. Based upon your answer in part(b), is Quadratics a good investment? A P/E of 11 implies that the stock trades at 11 times earnings, or $ 33.00. Its intrinsic value is $ 25.39, so it is not a good investment. (d) J. Hochberg, a rising young financial analyst at PruBache argues that the market is pricing Quadratics properly and that a constant dividend growth model is appropriate. In other words, the temporary impact of low dividends (for 3 years) should be ignored. What is the market’s required rate of return if Mr. Hochberg was accurate? Do you think he is accurate? If the market is pricing properly, then the “true” value is really $33. The required rate of return = D1/P0 + g = 1.32/33 + 0.10 = 14%. In other words, if investors are satisfied with a lower rate of return, then they should be willing to pay $33 for the stock. The statement must be interpreted with caution. If you are an investor with a two-year window, then you will only receive the $1 dividend under the current scheme. Therefore, ignoring the impact of the dividends will affect your total return. 2. Provide an assessment of the evidence pertaining to semi-strong form market efficiency, citing at least two situations to make your case. (10 points) See textbook/notes 3. A recent article in the Wall Street Journal stated that every year for the last several, Coca Cola Co. has reported earnings per share that imply a growth rate of 17%. (This is a true story.). In general, what can companies do towards managing their reported earnings growth in the above manner? Do you think this practice is pervasive and why? (10 points) Several corporations frequently attempt to smooth their earnings in order to document steady growth. Among the ways this is done are: Postpone revenue recognition until long after sale (software) Adjust rate of return on pension fund contributions Match unusual gains from asset sales with restructuring charges Gains/losses from currency translation The activity appears to be pervasive especially in larger corporations and is often justified as a process of evolution in accounting practices, especially for newer industries. Recent notifications by the FASB are geared towards promoting transparency in earnings reports. It is not clear how much such practices obscure the transfer of financial information. Investors ought to be able to figure this out. 4. Describe what is meant by market efficiency in the weak form. What does it imply about the role of “technical” analysis? (5 points) Weak form efficiency implies that market prices reflect past price/volume information. Technical analysts typically design trading strategies based on exhaustive examinations of charts, graphs and other indicators. If the information that technical analysis can glean from such strategies is already incorporated in prices (i.e markets are weak form efficient), then these strategies should not result in systematic abnormal profits. 5. Compare the role of business cycle investing with market timing. Are they similar or different? Is one more likely to generate abnormal profits than the other? Be specific in your answer. (5 points) Business cycle investing is similar to market timing in that they both attempt to take advantage of trends. For instance, if the business cycle is near its peak, interest rates will generally be high and a decline in rates can be expected. Therefore, investing in long-maturity and/or low-coupon bonds is the recommended strategy for business cycle investors. Identifying exactly when the cycle peaks is analogous to market timing activity. However, timing the business cycle is equivalent to identifying broad macro-level trends, whereas market timing can also apply to trends in individual stocks as well and motivates trading in the very short-term based upon firm-specific news. In general, abnormal profits are not systematically likely.