File

advertisement

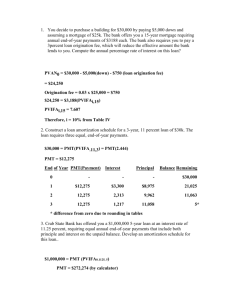

• When ever you take a loan out – the goal is to pay off your debt. • In the first part of a loan, the majority of your repayments are interest. • The way to reduce debt quickly is: • To try to make more payments • Increase the size of your payments • Pay lump sum deposits FORTNIGHTLY PAYMENTS Example • You buy a house for $280,000 and the rate is 5.5% p.a. compounding monthly for 30 years. • What are the size of your monthly repayments. • Change these to fortnightly payments and calculate how long it will take to pay off the loan and show how much you save. • Enter the data into the calculator (use the compound interest window): N= 30 x 12 I% = 5.5 PV = 280000 Pmt = ? FV = 0 P/Y = 12 C/Y = 12 PMT : $1589.81 • Now you need to divide the payment by 2 and change P/Y to 26 – but leave C/Y at 12. N= ? I% = 5.5 N = 646 fortnights PV = 280000 Pmt = -794.91 FV = 24.85 years 0 P/Y = 26 C/Y = 12 This is your original monthly payments You save 5.15 years – so 5.15 x 12 x 1589.81= $98,250.26 Assumptions • • • • • Rates stay the same Inflation is steady Bank fees and charges – may increase pmt’s Tax Dual incomes – so you can pay this amount. Making Larger Repayments This type of question has multiple parts – so you need to work through slowly. On the next slides you will see the calculator screens needed to get to the answer – then also the solution in the book. First you need to calculate PMT Need to calculate how much interest over the whole loan – use AMT Now you have to add $100 to the payment and recalculate N. Notice that we have taken 100 from the original pmt – this is because it is a negative number and we have to make it larger – so we take the 100 off. So it will become -1479.78 We now have to calculate N again So you press F1 This means that it will take 244.7 months to pay off the loan with the new repayment. You need to round this up to the next whole number – so therefore it means that it will take 245 months to pay off the loan. You now need to calculate how much interest you would pay over this time – so once again you need to use the AMT function of the calculator. You will have to alter N to ensure that this works. You then enter PM1 and PM2 with PM2 being equal to the “new” N Now you find the total interest paid. Finally calculate savings in interest: 238936.32 – 187172.57 = $51763.75 • If you can pay a lump sum off your loan at anytime – then you can save money and time on your loan. • Consider the following scenario : – You buy a house for $300,000 and the rate is 5.5% p.a. compounding monthly for 30 years. • After 5 years you pay a lump sum of $10,000 – how much does this save you? 1. Enter the data into the calculator (use the compound interest window): N= 30 x 12 I% = 5.5 PV = 300000 Pmt = ? FV = 0 P/Y = 12 C/Y = 12 PMT : $1703.37 2. Calculate Outstanding Debt • Now we need to calculate the outstanding debt at the 5 years mark – that is how much we need to pay off. • So using the previous question – how much is owed on the loan at the 5 year mark – PM2 = 5x12 PM1 = 1 PM2 = 5x12 N= 360 I% = 5.5 PV = 300000 Then on the bottom menu bar there is BAL (F1) This stands for the balance owing up to this point. Hit that button and it will calculate how much you owe on the loan. Pmt = -1703.37 FV = 0 P/Y = 12 C/Y = 12 $277381.81 3. Now take the lump sum from this and then calculate how long it will take to pay the loan off. N= ? I% = 5.5 N : 277.95 months PV = 277381.81- 10000 Pmt = -1703.37 FV = N : 23 years (approx) 0 P/Y = 12 C/Y = 12 Save approx 2 years – 2 x 12 x 1703.37 = $40880.88