The Profession of Medical Assisting

advertisement

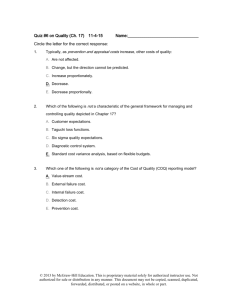

CHAPTER 17 Insurance and Billing © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-2 Learning Outcomes (cont.) 17.1 Define the basic terms used by the insurance industry. 17.2 Compare fee-for-service plans, HMOs, and PPOs. 17.3 Outline the key requirements for coverage by the Medicare, Medicaid, TRICARE and CHAMPVA programs. 17.4 Describe allowed charge, contracted fee, capitation and formula for RBRVS. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-3 Learning Outcomes (cont.) 17.5 Outline the tasks performed to obtain the information required to produce an insurance claim. 17.6 Produce a clean CMS-1500 health insurance claim form. 17.7 Explain the methods used to submit an insurance claim electronically. 17.8 Recall the information found on every payer’s remittance advice. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-4 Introduction • Health care claims – Reimbursement for services – Accuracy = maximum appropriate payment • Medical assistant – Prepare claims – Review insurance coverage – Explain fees – Estimate charges – Understand payment explanation – Calculate the patient’s financial responsibility © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-5 Basic Insurance Terminology • Medical insurance • Benefits • Policy holder • Dependents • Premium • Lifetime maximum benefits © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-6 Basic Insurance Terminology (cont.) • Three participants in an insurance contract: – First party ~ patient – Second party ~ healthcare provider – Third-party payer ~ health plan © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-7 Basic Insurance Terminology (cont.) • Deductible ~ met annually • Coinsurance ~ fixed percentage • Copayment – Managed care plans – Preferred provider • Exclusions • Formulary © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-8 Basic Insurance Terminology (cont.) • Elective procedure • Preauthorization ~ medically necessary • Predetermination © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-9 Apply Your Knowledge What is the difference between first party, second party, and third-party payer? ANSWER: The first party is the patient or owner of the policy; the second party is the physician or facility that provides services, and the third-party payer is the insurance company that agrees to carry the risk of paying for approved services. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-10 Private Health Plans • Insurance companies ~ rules about benefits and procedures • Sources of health plans – Group policies – Individual plans – Government plans • National Provider Identifier (NPI) © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-11 Private Health Plans (cont.) • Healthcare Legislation - 2010 – Extend insurance coverage to all Americans – Ban on • Lifetime limits • Denial of coverage for pre-existing conditions • Policy cancellations for illness – Children on family policy until 26 years old © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-12 Fee-for-Service and Managed Care Plans • Fee-for-service – Policy lists covered medical services – Amount charged for services is controlled by the physician – Amount paid for services is controlled by the insurance carrier © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-13 Fee-for-Service and Managed Care Plans (cont.) • Managed Care Plans (MCOs) – Controls both the financing and delivery of healthcare – Enrolls • Policy holders • Participating physicians – MCOs pay physicians in two ways • Capitation • Contracted fees © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-14 Managed Care Plans (cont.) • Preferred Provider Organization (PPO) – A network of providers to perform services to plan members – Physicians in the plan agree to charge discounted fees • Health Maintenance Organization (HMO) – Physicians are often paid a capitated rate – Patients pay premiums and a copayment for each office visit © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-15 Commercial Payers • Blue Cross Blue Shield • Private Commercial Carriers – Rules and regulations vary – Covered services and fees vary • Liability insurance • Disability insurance © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-16 Apply Your Knowledge Matching: ANSWER: B. Participating physician E nationwide federation of organizations B enroll with managed care plans C. PPO A repay policyholders for healthcare A. Fee-for-Service costs D. HMO G does not cover medical expenses E. BCBS C network of providers who care for F. Liability insurance subscribers G. Disability insurance F covers injuries caused by the insured D subscribers pay premiums and a copayment but no other fees for covered services © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-17 Government Plans • Health care – Retirees – Low-income and disadvantaged – Active or retired military personnel and their families © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-18 Medicare • The largest federal program • Managed by the Centers for Medicare and Medicaid Services (CMS) • Medicare Part A – Hospital insurance – Financed by Federal Insurance Contributions Act (FICA) tax – Covers anyone with Social Security benefits © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-19 Medicare (cont.) • Medicare Part B – Covers outpatient services – Voluntary program – Participants pay a premium • Medicare health insurance card – Medicare number – Indicates eligibility © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-20 Medicare (cont.) • Part C – 1997 – Provides choices in types of plans • Part D – prescription drug plan – Medicare Advantage plans © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-21 Medicare (cont.) • Medicare plan options – Fee-for-Service: The Original Medicare Plan – An annual deductible – After deductible, the patient pays 20 percent – Medigap plan – secondary insurance • Medicare Administrative Contractor (MAC) Jurisdictions © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-22 Medicare (cont.) • Medicare Managed Care Plans • Medicare Preferred Provider Organization Plans (PPOs) • Medicare Private Fee-for-Service Plans © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-23 Medicare Plans (cont.) • Recovery Audit Contractor (RAC) Program – Designed to guard the Medicare Trust Fund – Identify improper payments Overpayment Underpayment © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-24 Medicaid • Health cost assistance program not an insurance program • Federal funds for mandated services • States – additional optional services • Accepting assignment • Dual coverage © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-25 Medicaid (cont.) • State guidelines – Verify Medicaid eligibility – Ensure that the physician signs all claims – Preauthorization required except in an emergency – Verify deadlines for claim submissions – Treat Medicaid patients with professionalism and courtesy © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-26 TRICARE and CHAMPVA • TRICARE – Healthcare benefit – Eligibility – enrollment in the Defense Enrollment Eligibility Reporting System (DEERS) • CHAMPVA – Civilian Health and Medical Program of the Veterans Administration – Eligibility determined by the VA © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-27 State Children’s Health Plan (SCHIP) • Enacted in 1997 and reauthorized in 2009 • State-provided health coverage for uninsured children in families that do not qualify for Medicaid © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-28 Workers’ Compensation • Covers employment-related accidents or illnesses • Laws vary by state • Verify with employer before treating and obtain a case number • Records management © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-29 Apply Your Knowledge A 72-year-old disabled patient is being treated at an office that accepts Medicare. The total office visit is $165, but Medicare Part B will only reimburse a set fee of $90. In this situation, what is the most likely solution? ANSWER: a. Bill the patient for the balance due. b. Expect the balance to be paid at the time of service. c. This patient probably has a secondary employer health insurance plan. d. This patient may qualify for the Medi/Medi coverage. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-30 Fee Schedules and Charges • Resource-based relative value scale (RBRVS) • Formula uses: – Nationally uniform relative value unit (RVU) – Geographic adjustment factor (GAF) – Nationally uniform conversion factor (CF) • CMS updates annually © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-31 Payment Methods • Allowed charges – The maximum amount the payer will pay a provider – Equivalent terms – Balance billing – Adjustment © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-32 Payment Methods (cont.) • Contracted fee schedule – fixed fee schedules • Capitation – fixed prepayment • Calculating patient charges – may include – Deductibles – Copayments – Coinsurance – Excluded and over-limit services – Balance billing © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-33 Communication with Patients About Charges • Remind patients of financial obligation • Notify office financial policy – Post – Information packet • Notify of uncovered services © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-34 Apply Your Knowledge What do you need to consider when calculating patient charges? ANSWER: You need to consider whether the patient has met the deductible, if the patient has to pay a copayment or coinsurance, if the service is excluded, or if the patient is over his/her limit for services. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-35 The Claims Process: An Overview • Physician’s office – Obtains patient information – Delivers services and determines diagnosis and fees – Records payments; prepares and submits healthcare claims – Reviews the processing of a claim © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-36 The Claims Process: An Overview (cont.) • Electronic billing programs – Streamlines process • Creating claims • Follow-up • Bills sent to patient – Electronic data exchange (EDI) © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-37 Obtaining Patient Information • • Insurance Basic – – – – Contact information DOB SSN Emergency contact – Employer information – Insurance carrier information • Release signatures – To insurance carrier – Assignment of benefits © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-38 Obtaining Patient Information (cont.) • Eligibility for services – Scan or copy card – Signed release – Check effective date of coverage • Preauthorization – Phone or online – Authorization number © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-39 Obtaining Patient Information (cont.) • Coordination of benefits – Prevents duplication of payment – Primary insurance plan pays first Birthday Rule The insurance plan of the person born first becomes the primary payer. – Secondary plan pays the deductible and copayment © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-40 Delivering Services to the Patient • Physician’s services – Documents visit in medical record – Completes superbill or charge slip • Medical coding – Compare superbill to medical record – Translate procedures on charge slip © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-41 Delivering Services to the Patient (cont.) • Referrals and Authorizations – Obtain authorization number – Enter into billing program • Patient checkout © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-42 Apply Your Knowledge Prior to submitting an insurance claim, what do you need to do? ANSWER: You should have verified eligibility and obtained the patients signature on appropriate releases. You need to be sure you have the correct patient and insurance information to correctly complete the claim form. You should compare the superbill to the medical record. If a charge slip is used, you will need to determine the correct codes © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-43 Preparing and Transmitting the Healthcare Claim • Filing Limits – Vary from company to company – Start with date of service • Electronic Claims transmission – X12 837 Health Care Claim © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-44 Electronic Claim Transmission • Preparing electronic claims – Information entered – data elements – Data must be entered in CAPS in valid fields – No prefixes or special characters allowed – Use only valid data © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-45 Electronic Claim Transmission (cont.) • Data elements – major sections – Provider – taxonomy code – Subscriber (policyholder) – Patient (subscriber or another person) and payer – Claim details – Services • Other standard transactions include – Claim status – Payment status © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-46 Paper Claim Completion • CMS-1500 (CMS-1505) paper form • May be mailed or faxed to the third-party payer • Not widely used • CMS-1505 requires 33 form locators © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-47 Paper Claim Completion (cont.) Block 1 – 13: patient and insurance information Block 14 – 22: provider information Block 1 Block 14 x Block 1a 04 15 20XX Block 15 IN00011123 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-48 Apply Your Knowledge What are the major data element sections required by the X12 837 transaction? ANSWER: They are • • • • • Provider Subscriber Patient and payer Claim details Services © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-49 Transmitting Electronic Claims • Three methods Transmitting claims directly Offices and payers exchange information directly by electronic data interchange (EDI) Using a clearinghouse Using direct data entry Translates nonstandard data into standard format. Clearinghouse cannot create or modify data Internet-based service that loads data elements directly into the health plan’s computer © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-50 Generating Clean Claims • Carefully check claim before submission – Missing or incomplete information – Invalid information • Rejected claims – Provide missing information – Submit new claim © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-51 Claims Security • The HIPAA rules • Common security measures – Access control, passwords, and log files – Backup copies – Security policies © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-52 Apply Your Knowledge What are the three methods for electronic transmission of insurance claims? ANSWER: • Direct transmission to insurance carrier using EDI • Using a clearinghouse that translated information into standard formats and “scrub” claims prior to submission • Direct data entry into the insurance carrier’s system © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-53 Insurer’s Processing and Payment • Claims Register – Created by billing program or clearinghouse – Track submitted claims • Review for medical necessity • Review for allowable benefits © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-54 Payment and Remittance Advice • With payment of a claim – Remittance advice (RA) – Amount billed – Amount allowed – Amount of patient liability – Amount paid – Services not covered © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-55 Reviewing the Insurer’s RA and Payment • Review line by line – If correct, make appropriate entry in claims log – If unpaid or different than records • Trace • Place a query – If rejected ~ review claim for accuracy © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-56 Apply Your Knowledge When reviewing the RA, you note that several claims were rejected and one was not paid. What should you do? ANSWER: You need to review the rejected claims to be sure all information was correct. Either resubmit with corrected information or submit a new claim, depending on the carrier’s policy. You would have to call the insurance company to trace the claim that was not paid. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-57 In Summary 17.1 There are a variety of terms used by insurance companies, knowledgeable medical assistants, medical billers, and coders. 17.2 Fee-for-service plans are traditional plans where the insurance plan pays for a percentage of the charges. HMOs are prepaid plans that pay the providers either by capitation or by contracted fee-for-service A PPO is a managed care plan that establishes a network of providers to perform services for plan members.. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-58 In Summary (cont.) 17.3 Medicare provides health insurance for citizens aged 65 and older as well as certain categories of others. Medicaid is a health benefit plan for low-income and certain others with disabilities. TRICARE is a healthcare benefit for families of uniformed personnel and retirees . CHAMPVA covers the expenses of the families of veterans with total, permanent, service-connected disabilities as well as expenses for survivors of veterans who died in the line of duty or from serviceconnected disabilities © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-59 In Summary (cont.) 17.4 An allowed charge is the maximum dollar amount an insurance carrier will base its reimbursement on. A contracted fee is negotiated between the MCO and the provider. Capitation is a fixed prepayment paid to the PCP. RBRVS stands for resource-based relative value scale. Its formula is RVU X GAF X CF. 17.5 The claims process includes: obtaining patient information; delivering services to the patient and determining the diagnosis and fee; recording charges and codes; documenting payment from the patient; and preparing the healthcare claims. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-60 In Summary (cont.) 17.6 The student should be able to produce a legible, clean, and acceptable CMS-1505 claim form. 17.7 The three methods used to submit claims electronically are: a directly to the payer’s website; the use of a clearinghouse; and the use of direct data entry or DDE. 17.8 Although the format may vary from payer to payer, all RAs (EOBs) contain similar information. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 17-61 End of Chapter 17 I am always doing that which I can not do, in order that I may learn how to do it. ~ Pablo Picasso © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.